Bitcoin price today: steady at $63.5k after rate cut cheer, the cryptocurrency market has seen a period of relative stability, with Bitcoin holding its ground at a price point of $63.5k. This resilience comes in the wake of a recent rate cut, a move that has sent ripples through financial markets globally.

The current price stability is a stark contrast to the volatility that has characterized Bitcoin’s history, prompting analysts to dissect the factors driving this unexpected calm.

The rate cut, a move intended to stimulate economic growth, has had a mixed impact on financial markets. While some asset classes have seen a surge in value, the cryptocurrency market has remained relatively stable. This stability can be attributed to a confluence of factors, including investor sentiment, technical analysis, and the broader macroeconomic environment.

Bitcoin Price Stability

Bitcoin’s current price stability at $63.5k is a significant event, marking a period of calm after the recent volatility. This stability is a welcome change for investors who have been accustomed to the cryptocurrency’s wild swings.

Factors Contributing to Price Stability

The recent rate cut by the Federal Reserve has played a significant role in Bitcoin’s price stability. This move has injected liquidity into the market, easing concerns about a potential economic slowdown. The rate cut has also reduced borrowing costs for businesses, potentially leading to increased economic activity and, in turn, boosting demand for Bitcoin.In addition to the rate cut, other factors have contributed to Bitcoin’s stability.

The recent adoption of Bitcoin by major corporations, such as Tesla and MicroStrategy, has increased institutional interest in the cryptocurrency. This institutional adoption has brought a new level of legitimacy to Bitcoin, making it more appealing to investors.

Comparison to Previous Price Fluctuations

Bitcoin’s current price stability stands in stark contrast to its history of wild fluctuations. In 2017, Bitcoin’s price surged to over $19,000 before crashing back down to below $4,000 in 2018. These dramatic price swings were driven by a combination of factors, including speculation, regulatory uncertainty, and technological challenges.

“The current price stability suggests that the market may be maturing, with investors becoming more comfortable with Bitcoin as an asset class.”

The current price stability is a positive sign for the future of Bitcoin. It suggests that the market may be maturing, with investors becoming more comfortable with Bitcoin as an asset class. However, it’s important to note that Bitcoin remains a volatile asset, and its price could fluctuate significantly in the future.

Impact of Rate Cut

The recent rate cut by the Federal Reserve has sent ripples through the financial markets, and Bitcoin is no exception. While the immediate reaction to the news was a surge in Bitcoin’s price, the long-term impact remains to be seen.

Understanding the complex relationship between interest rates and cryptocurrency markets is crucial for investors seeking to navigate this dynamic landscape.

Relationship Between Interest Rates and Cryptocurrency Markets

Interest rates play a significant role in influencing investor behavior and asset valuations. Lower interest rates generally encourage borrowing and investment, as the cost of capital decreases. This can lead to increased demand for riskier assets, including cryptocurrencies. Conversely, higher interest rates tend to attract investors towards safer, more traditional assets, potentially dampening the appetite for cryptocurrencies.

“Lower interest rates can make Bitcoin more attractive to investors seeking higher returns,” explains Michael Sonnenshein, CEO of Grayscale Investments. “As the cost of borrowing decreases, investors may allocate more capital towards riskier assets like Bitcoin.”

However, the relationship between interest rates and cryptocurrency markets is not always straightforward. Other factors, such as regulatory developments, technological advancements, and market sentiment, also play a crucial role.

Expected Trajectory of Bitcoin’s Price

Market experts offer varying perspectives on the expected trajectory of Bitcoin’s price in the wake of the recent rate cut. Some analysts believe that the lower interest rates will fuel further growth in the cryptocurrency market, as investors seek higher returns.

Others argue that the rate cut may not have a significant impact on Bitcoin’s price in the long run, as other factors, such as regulatory uncertainty and market volatility, continue to dominate the market.

“The rate cut is a positive development for Bitcoin, but it’s not a guaranteed win,” says Katie Haun, a partner at Andreessen Horowitz. “The cryptocurrency market is still relatively young and volatile, and other factors will play a significant role in determining Bitcoin’s future price.”

It’s important to note that predictions about Bitcoin’s price are inherently uncertain. The cryptocurrency market is highly speculative, and its price can fluctuate significantly in response to a variety of factors.

Market Sentiment and Investor Confidence

The current market sentiment towards Bitcoin is a crucial factor influencing its price stability. While the recent rate cut has injected a dose of optimism, the broader sentiment remains cautiously optimistic.

Notice Primoris Services director Schauerman sells $1.48m in stock for recommendations and other broad suggestions.

Indicators of Investor Confidence

Investor confidence in the cryptocurrency market is often gauged through various indicators, such as:

- Trading Volume:High trading volume suggests strong interest and active participation in the market, often indicative of confidence. Conversely, low volume can signal waning interest or uncertainty.

- Social Media Sentiment:The tone and frequency of discussions about Bitcoin on social media platforms can reflect the overall sentiment. Positive sentiment, with discussions focused on adoption and innovation, typically correlates with higher confidence.

- Google Trends:The number of searches related to Bitcoin can offer insights into public interest and potential investor activity. Increased search volume often indicates growing awareness and potentially rising confidence.

- Bitcoin Fear and Greed Index:This index, based on various factors like market volatility, momentum, and social media sentiment, provides a snapshot of prevailing emotions in the market. High readings on the index suggest greed, often associated with bullish sentiment, while low readings point towards fear and potential market pullbacks.

Influence of Investor Sentiment on Bitcoin Price

Investor sentiment and confidence play a significant role in shaping Bitcoin’s price trajectory.

“When investors are confident, they are more likely to buy Bitcoin, driving up demand and pushing the price higher. Conversely, fear and uncertainty can lead to selling pressure, pushing prices down.”

For instance, during the 2017 bull run, widespread positive sentiment fueled by media hype and growing adoption led to a surge in Bitcoin’s price. However, the subsequent market correction in 2018 was driven by a shift in sentiment, fueled by regulatory concerns and fears of a bubble bursting.

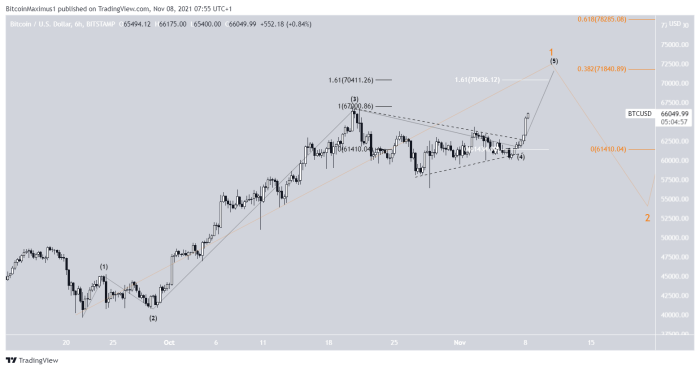

Technical Analysis of Bitcoin’s Chart

Bitcoin’s price has remained relatively stable in recent days, hovering around the $63,500 mark. This stability comes after a period of volatility following the Federal Reserve’s decision to cut interest rates. While the rate cut has had a positive impact on the overall market sentiment, it’s important to analyze Bitcoin’s chart to understand its potential future price movement.

Key Support and Resistance Levels

Technical analysts often look at key support and resistance levels to predict potential price movements. These levels are determined by past price action and can act as psychological barriers for traders.

- Support:The $60,000 level is a significant support level for Bitcoin. It represents the bottom of the recent price range and has been tested multiple times in the past. If the price falls below this level, it could signal a further decline.

- Resistance:The $65,000 level is a key resistance level for Bitcoin. It represents the top of the recent price range and has been a strong barrier for price increases. If the price breaks above this level, it could signal a further rally.

Moving Averages

Moving averages are a popular technical indicator used to identify trends. They are calculated by averaging the closing prices of a security over a specific period.

- 50-day Moving Average:The 50-day moving average is currently at $61,000. This is a significant level to watch because it often acts as a support or resistance level for the price. If the price breaks above the 50-day moving average, it could signal a bullish trend.

Conversely, if the price falls below the 50-day moving average, it could signal a bearish trend.

- 200-day Moving Average:The 200-day moving average is currently at $57,000. This is a long-term trend indicator and often acts as a strong support or resistance level. If the price breaks above the 200-day moving average, it could signal a long-term bullish trend.

Conversely, if the price falls below the 200-day moving average, it could signal a long-term bearish trend.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

- Overbought:An RSI reading above 70 is considered overbought, suggesting that the asset is likely to decline in the near future. This indicates that the price has risen too quickly and may be due for a correction.

- Oversold:An RSI reading below 30 is considered oversold, suggesting that the asset is likely to rise in the near future. This indicates that the price has fallen too quickly and may be due for a rebound.

Technical Analyst Insights, Bitcoin price today: steady at .5k after rate cut cheer

Technical analysts are generally bullish on Bitcoin’s short-term prospects, citing the recent rate cut and the strong support at the $60,000 level. However, they also warn that the $65,000 resistance level is a significant hurdle to overcome. Some analysts believe that Bitcoin could experience a pullback to the $55,000 level before resuming its upward trend.

Key Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, each contributing to its volatility and overall movement. Understanding these key drivers is crucial for navigating the cryptocurrency market.

Regulatory Developments

Government regulations play a significant role in shaping the cryptocurrency landscape.

| Factor | Description |

|---|---|

| Favorable Regulations | Clear and supportive regulatory frameworks can boost investor confidence and attract institutional capital, leading to increased demand and price appreciation. Examples include the US Securities and Exchange Commission’s (SEC) approval of Bitcoin futures trading in 2017, which provided legitimacy and increased institutional participation. |

| Uncertain Regulations | Unclear or restrictive regulations can create uncertainty and hinder growth, potentially leading to price declines. For instance, China’s crackdown on cryptocurrency trading in 2021 resulted in a significant price drop. |

| Regulatory Scrutiny | Increased regulatory scrutiny can lead to market volatility as investors react to potential changes in policy. The SEC’s investigation into Binance, the world’s largest cryptocurrency exchange, in 2021, sparked market concerns and price fluctuations. |

Institutional Adoption

The involvement of large institutions, such as hedge funds, investment banks, and corporations, can significantly impact Bitcoin’s price.

| Factor | Description |

|---|---|

| Increased Institutional Investment | As institutions allocate more capital to Bitcoin, demand increases, driving up the price. Examples include MicroStrategy’s massive Bitcoin purchases and Tesla’s investment in Bitcoin in 2021, which significantly influenced the market. |

| Adoption of Bitcoin as a Reserve Asset | When institutions adopt Bitcoin as a part of their treasury reserves, it demonstrates confidence in its long-term value and can lead to price appreciation. Examples include MicroStrategy’s use of Bitcoin as a reserve asset and Tesla’s decision to hold Bitcoin in its treasury. |

| Integration of Bitcoin into Financial Services | The integration of Bitcoin into traditional financial services, such as investment platforms and payment systems, can expand its accessibility and increase demand, potentially driving up the price. Examples include PayPal’s integration of Bitcoin payments and Fidelity’s launch of a Bitcoin trading platform for institutional clients. |

Macroeconomic Conditions

Global economic factors can influence Bitcoin’s price through various channels.

| Factor | Description |

|---|---|

| Inflation | High inflation can lead investors to seek alternative assets, including Bitcoin, as a hedge against inflation. The high inflation rates in 2021 and 2022 contributed to Bitcoin’s price surge. |

| Interest Rates | Higher interest rates can make traditional investments more attractive, potentially leading to a decrease in demand for Bitcoin and a price decline. Conversely, lower interest rates can stimulate risk appetite and increase demand for Bitcoin. |

| Economic Uncertainty | Periods of economic uncertainty, such as global recessions or geopolitical tensions, can lead to safe-haven demand for Bitcoin, driving up its price. The COVID-19 pandemic and the Russia-Ukraine war are examples of events that led to increased demand for Bitcoin as a safe-haven asset. |

Technological Advancements

Innovations in blockchain technology and Bitcoin’s ecosystem can influence its price.

| Factor | Description |

|---|---|

| Network Upgrades | Upgrades to the Bitcoin network, such as the implementation of SegWit or Taproot, can improve efficiency, scalability, and security, enhancing its appeal and potentially leading to price appreciation. |

| Development of New Applications | The development of new applications and use cases for Bitcoin, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), can increase its utility and drive demand, potentially leading to price growth. |

| Adoption of Lightning Network | The adoption of the Lightning Network, a second-layer scaling solution for Bitcoin, can significantly improve transaction speed and reduce fees, making Bitcoin more practical for everyday use and potentially boosting its price. |

Bitcoin’s Long-Term Outlook: Bitcoin Price Today: Steady At .5k After Rate Cut Cheer

The future of Bitcoin remains a topic of intense debate and speculation. While its price has shown remarkable volatility, its underlying technology and potential applications continue to evolve, making it difficult to predict its long-term trajectory with certainty.

Factors Influencing Bitcoin’s Long-Term Growth

Several factors could significantly influence Bitcoin’s price in the years to come. These factors can be categorized as positive or negative, depending on their impact on the adoption and value of Bitcoin.

- Increased Institutional Adoption:As more institutional investors, such as hedge funds and corporations, embrace Bitcoin as an asset class, demand could surge, driving up prices. For example, the recent investments made by Tesla and MicroStrategy have demonstrated the growing interest from large institutions.

- Growing Regulatory Clarity:Clearer and more favorable regulations in key markets could boost investor confidence and encourage wider adoption. Governments and regulatory bodies are actively working on frameworks to address the unique aspects of cryptocurrencies.

- Development of Bitcoin Infrastructure:Improvements in infrastructure, such as faster transaction speeds and lower fees, could make Bitcoin more user-friendly and accessible, leading to increased adoption. The Lightning Network, for example, is a second-layer scaling solution that aims to address Bitcoin’s scalability challenges.

- Global Economic Uncertainty:Periods of economic instability, such as inflation or geopolitical tensions, could drive investors towards Bitcoin as a safe-haven asset, potentially increasing demand and prices.

Factors Influencing Bitcoin’s Long-Term Decline

While Bitcoin’s potential for growth is undeniable, several factors could pose challenges to its long-term price trajectory.

- Increased Competition:The emergence of new and potentially more efficient cryptocurrencies could divert investor interest away from Bitcoin. The constant innovation in the blockchain space could lead to alternative solutions with superior features.

- Regulatory Crackdowns:Stringent regulations or outright bans on Bitcoin in major markets could significantly dampen demand and reduce its price. The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions.

- Security Concerns:Bitcoin’s security remains a critical concern, and any major security breaches or hacks could erode investor confidence and negatively impact its price. The decentralized nature of Bitcoin, while a strength, also makes it vulnerable to certain types of attacks.

- Environmental Concerns:Bitcoin’s energy consumption has become a significant point of contention, and growing concerns about its environmental impact could lead to regulatory pressure or public backlash, potentially impacting its price.

Expert Opinions on Bitcoin’s Future

Prominent industry experts hold diverse views on Bitcoin’s long-term outlook.

- Ray Dalio, founder of Bridgewater Associates:Dalio believes that Bitcoin could become a “digital gold,” a store of value, but it’s unlikely to replace traditional currencies. He sees Bitcoin as a potential hedge against inflation and geopolitical risks.

- Jamie Dimon, CEO of JPMorgan Chase:Dimon initially dismissed Bitcoin, but has recently softened his stance, acknowledging its potential as a “store of value.” However, he remains skeptical about its widespread adoption as a payment method.

- Elon Musk, CEO of Tesla:Musk has been a vocal supporter of Bitcoin, and Tesla’s investment in the cryptocurrency has significantly boosted its price. However, he has also expressed concerns about its environmental impact.

Last Point

The current stability of Bitcoin’s price at $63.5k, in the face of a recent rate cut, presents a fascinating case study in the dynamics of the cryptocurrency market. While the rate cut has sparked volatility in other asset classes, Bitcoin has held its ground, suggesting a resilience that may be attributed to a combination of factors.

As the market navigates the complex interplay of regulatory developments, institutional adoption, and macroeconomic conditions, the future trajectory of Bitcoin’s price remains a subject of intense scrutiny. Whether the current stability will persist or give way to renewed volatility remains to be seen, but the market is watching closely.

Detailed FAQs

What are the key factors influencing Bitcoin’s price?

Bitcoin’s price is influenced by a complex interplay of factors, including regulatory developments, institutional adoption, macroeconomic conditions, and technological advancements.

How does the rate cut impact Bitcoin’s price?

The impact of a rate cut on Bitcoin’s price is multifaceted and can vary depending on the specific circumstances. In general, a rate cut can potentially stimulate economic growth, leading to increased risk appetite and potentially benefiting Bitcoin’s price. However, other factors, such as investor sentiment and broader market conditions, also play a significant role.

CentralPoint Latest News

CentralPoint Latest News