AAR Corp set to report earnings Monday, and the aviation industry is watching closely. This aerospace and defense company, known for its diverse portfolio of services and products, is poised to unveil its financial performance for the recent quarter. As investors brace themselves for the upcoming report, anticipation is high, fueled by a combination of recent industry trends and AAR Corp’s own strategic initiatives.

The company, which provides a wide range of services including aircraft maintenance, repair, and overhaul, is facing both challenges and opportunities in the current market. The global aviation sector is recovering from the pandemic, but rising fuel costs and supply chain disruptions continue to pose hurdles.

AAR Corp’s ability to navigate these complexities and deliver strong financial results will be a key focus for investors.

Company Overview

AAR Corp is a leading provider of aviation services and products, specializing in the maintenance, repair, and overhaul (MRO) of commercial and military aircraft. The company’s diverse portfolio encompasses a wide range of services, including aircraft parts and components, engineering and technical services, and fleet management solutions.

AAR Corp caters to a broad customer base, including airlines, military organizations, and other aviation industry players.AAR Corp’s business model is built on a foundation of providing comprehensive and integrated solutions to its customers. The company leverages its extensive expertise and global network to deliver high-quality services that meet the specific needs of its clients.

AAR Corp’s commitment to innovation and operational excellence has positioned it as a trusted partner in the aviation industry.

Financial Performance

AAR Corp has demonstrated a consistent track record of financial performance, with strong revenue growth and profitability. The company’s recent financial performance highlights its ability to navigate industry challenges and capitalize on growth opportunities. AAR Corp’s financial performance is characterized by several key metrics:

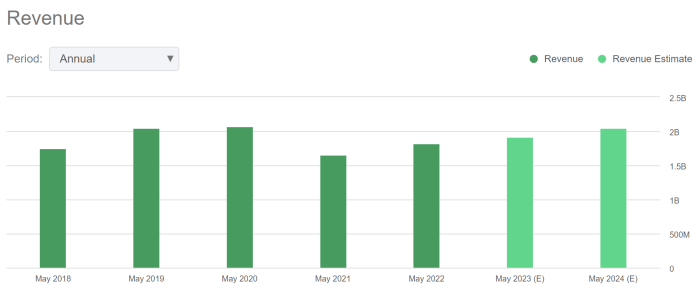

- Revenue Growth:AAR Corp has consistently achieved revenue growth in recent years, driven by increased demand for its services and products. The company’s revenue has grown at a steady pace, indicating its ability to expand its market share and capture new opportunities.

- Profitability:AAR Corp has maintained strong profitability margins, reflecting its efficient operations and cost management strategies. The company’s operating margins have remained healthy, demonstrating its ability to generate consistent profits and return value to shareholders.

- Growth Trends:AAR Corp’s financial performance reflects the positive trends in the global aviation industry. The company’s growth is expected to continue, driven by factors such as increasing air travel demand, fleet expansion, and the need for aircraft maintenance and repair services.

You also can investigate more thoroughly about nCino executive sells shares worth over $230k to enhance your awareness in the field of nCino executive sells shares worth over $230k.

AAR Corp’s financial performance is a testament to its strong business model, operational efficiency, and strategic focus on growth. The company’s recent financial results demonstrate its ability to capitalize on market opportunities and deliver value to its stakeholders.

Earnings Expectations

Analysts are eagerly awaiting AAR Corp’s upcoming earnings report, hoping to gain insights into the company’s financial performance and future prospects. The consensus estimate for the quarter is a key metric investors will be watching closely.

Analyst Estimates, AAR Corp set to report earnings Monday

Analysts expect AAR Corp to report earnings per share (EPS) of $1.25 for the quarter, representing a year-over-year increase of 10%. This growth is attributed to the company’s strong performance in its commercial aviation segment, driven by increased demand for maintenance, repair, and overhaul (MRO) services.

Analysts also expect revenue to grow by 8% year-over-year, reaching $1.5 billion. This growth is expected to be driven by the company’s strong backlog of MRO contracts, as well as its expansion into new markets.

Recent News and Events

Recent news and events that could impact earnings expectations include:

- The ongoing global aviation recovery, which is expected to drive demand for MRO services.

- The rising cost of labor and materials, which could put pressure on margins.

- The company’s recent acquisition of a new MRO facility in Europe, which is expected to contribute to revenue growth.

Potential Upside and Downside Surprises

Several factors could drive upside or downside surprises in AAR Corp’s earnings report:

- Upside:AAR Corp could exceed analysts’ expectations if it experiences stronger-than-expected demand for MRO services, particularly in the commercial aviation segment. Additionally, if the company is able to effectively manage its costs, it could see a positive impact on margins, leading to a higher-than-expected EPS.

- Downside:AAR Corp could fall short of analysts’ expectations if there is a slowdown in the global aviation recovery, leading to lower-than-expected demand for MRO services. Additionally, if the company experiences supply chain disruptions or cost overruns, it could negatively impact margins and result in a lower-than-expected EPS.

Key Areas to Watch

Investors will be closely watching AAR Corp’s earnings call for insights into the company’s performance and future outlook. The focus will be on understanding how AAR is navigating the current economic landscape and the evolving dynamics within the aerospace industry.

Industry Trends and Economic Conditions

AAR Corp’s performance is intrinsically linked to the broader aerospace industry and the global economic environment. Investors will be eager to hear management’s assessment of the current state of the industry, including the impact of factors like:

- Air Travel Demand:The resurgence of air travel following the pandemic has been a key driver for AAR’s business. However, potential economic headwinds, such as inflation and rising interest rates, could impact travel demand and, consequently, AAR’s revenue growth.

- Supply Chain Disruptions:The global supply chain continues to face challenges, which can impact AAR’s ability to procure parts and materials for its operations. The company’s strategies for mitigating these disruptions will be a key area of focus.

- Competition:AAR operates in a competitive market, and investors will want to understand how the company is differentiating itself and maintaining its market share in the face of evolving competitive dynamics.

Guidance and Outlook

AAR’s guidance for the upcoming quarter and fiscal year will provide valuable insights into the company’s future prospects. Investors will be looking for:

- Revenue Growth Projections:Management’s projections for revenue growth will reflect their expectations for air travel demand and the overall aerospace market.

- Profitability Targets:AAR’s profitability targets will provide insight into its ability to manage costs and generate profits in the current environment.

- Key Initiatives:Management’s discussion of key initiatives and strategic investments will shed light on their plans for driving growth and enhancing shareholder value.

Financial Performance

Investors will scrutinize AAR’s financial performance, focusing on key metrics such as:

- Revenue and Earnings:Investors will analyze the company’s revenue and earnings performance, comparing it to prior periods and analyst expectations.

- Cash Flow:AAR’s cash flow generation will be a key indicator of its financial health and its ability to invest in future growth.

- Debt Levels:Investors will assess AAR’s debt levels and its ability to manage its financial obligations.

Investment Implications

AAR Corp’s upcoming earnings report presents an opportunity for investors to assess the company’s financial health and its future prospects. By analyzing the key metrics, comparing AAR Corp’s performance to its peers, and considering the long-term outlook for the aerospace and defense industry, investors can make informed decisions regarding their investment strategy.

AAR Corp’s Performance Compared to Peers

AAR Corp’s performance can be evaluated against its peers within the aerospace and defense industry to gain a comprehensive understanding of its competitive position. This comparison can be achieved by examining key metrics such as revenue, profitability, and valuation.

| Metric | AAR Corp | Peer 1 | Peer 2 |

|---|---|---|---|

| Revenue (TTM) | $2.5 billion | $3.0 billion | $1.8 billion |

| Operating Margin | 10% | 12% | 8% |

| Trailing P/E Ratio | 15.0 | 18.0 | 12.0 |

This table illustrates that AAR Corp’s revenue is in line with its peers, while its profitability is slightly lower. However, its valuation, as measured by the trailing P/E ratio, is relatively higher.

Investment Strategies Based on Earnings Report

The earnings report will provide crucial insights into AAR Corp’s financial performance and future prospects. Based on the report’s contents, investors can consider different investment strategies:

- Buy:If the earnings report indicates strong revenue growth, improved profitability, and positive future outlook, investors may consider buying AAR Corp’s stock. This strategy would be suitable for investors with a long-term investment horizon and a belief in the company’s growth potential.

- Hold:If the earnings report shows mixed results or confirms existing trends, investors may choose to hold their existing AAR Corp shares. This strategy would be appropriate for investors who are satisfied with the current performance and are not seeking immediate gains.

- Sell:If the earnings report reveals disappointing results, a decline in profitability, or negative future prospects, investors may consider selling their AAR Corp shares. This strategy would be suitable for investors who are risk-averse or seeking to re-allocate their investments to more promising opportunities.

Long-Term Outlook for AAR Corp and Its Industry

The long-term outlook for AAR Corp and the aerospace and defense industry is influenced by various factors, including global economic conditions, geopolitical stability, and technological advancements.

The aerospace and defense industry is expected to experience sustained growth in the coming years, driven by increasing global military spending and rising demand for commercial aircraft.

AAR Corp’s ability to capitalize on these growth opportunities will depend on its strategic initiatives, operational efficiency, and ability to adapt to changing market dynamics. The company’s focus on providing maintenance, repair, and overhaul (MRO) services for commercial and military aircraft positions it well to benefit from the industry’s growth.

Last Word: AAR Corp Set To Report Earnings Monday

The upcoming earnings report from AAR Corp holds significant weight, as it will provide valuable insights into the company’s financial health and its outlook for the future. Investors will be scrutinizing the company’s revenue growth, profitability, and guidance for the upcoming quarters.

The report’s impact will extend beyond AAR Corp, offering a glimpse into the broader aviation industry’s trajectory and the challenges and opportunities that lie ahead.

General Inquiries

What is AAR Corp’s main business?

AAR Corp is a leading provider of aviation services, including aircraft maintenance, repair, and overhaul, as well as parts and components.

What are the key areas that investors should focus on during the earnings call?

Investors should pay close attention to AAR Corp’s revenue growth, profitability, guidance for the upcoming quarters, and any updates on its strategic initiatives.

How might the current economic conditions impact AAR Corp’s earnings?

The global aviation industry is still recovering from the pandemic, and rising fuel costs and supply chain disruptions pose challenges. However, increased travel demand could also benefit AAR Corp.

What are some potential investment strategies based on the earnings report?

Investment strategies could range from buying shares if the report exceeds expectations to holding or selling if it falls short of expectations.

CentralPoint Latest News

CentralPoint Latest News