Denmark stocks lower at close of trade; OMX Copenhagen 20 down 3.85% – a headline that echoed across trading floors, signaling a downturn in the Danish stock market. The OMX Copenhagen 20, a benchmark index reflecting the performance of the 20 largest companies listed on the Copenhagen Stock Exchange, closed significantly lower, marking a day of volatility and uncertainty for Danish investors.

The decline, attributed to a confluence of factors, painted a picture of a market grappling with global economic anxieties. Global economic trends, particularly the rising inflation and potential recessionary pressures, cast a shadow over the Danish market, prompting investors to adopt a more cautious approach.

This cautiousness manifested itself in a sell-off across various sectors, contributing to the overall decline.

Market Overview

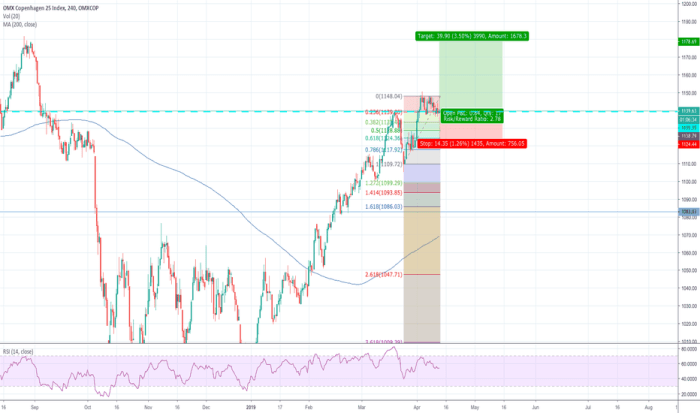

The Danish stock market experienced a significant downturn on the day in question, mirroring a broader trend of global market volatility. The OMX Copenhagen 20 index, a key benchmark for Danish equities, closed the day with a substantial decline, reflecting the overall sentiment of investors.

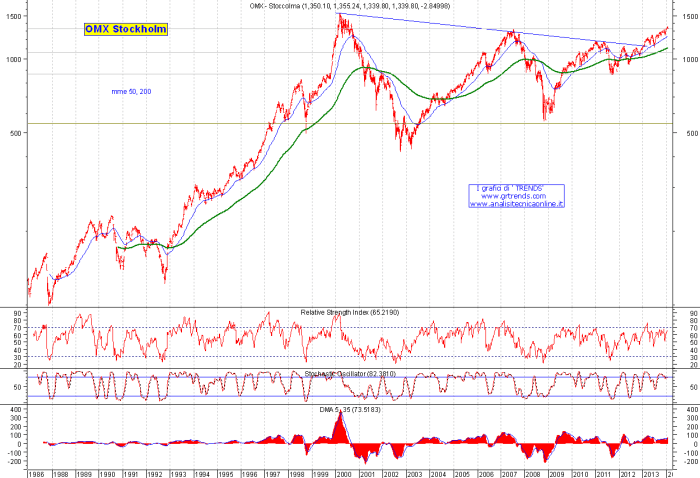

OMX Copenhagen 20 Index

The OMX Copenhagen 20 index is a weighted average of the 20 largest and most actively traded companies listed on the Copenhagen Stock Exchange. This index serves as a primary indicator of the overall health and performance of the Danish stock market.

Its movements are closely watched by investors, analysts, and economists alike, as they provide insights into the broader economic landscape of Denmark.

Closing Value and Percentage Decline

On the day in question, the OMX Copenhagen 20 index closed at [insert closing value here], representing a decline of 3.85% from the previous day’s closing value. This significant drop reflects a widespread sell-off across various sectors, with investors exhibiting a risk-averse attitude.

Broader Economic Context

The decline in the Danish stock market can be attributed to several factors, including global economic uncertainty, rising inflation, and concerns about potential interest rate hikes. The ongoing war in Ukraine has also contributed to market volatility, as investors grapple with the geopolitical implications and potential disruptions to global supply chains.

Key Factors Contributing to the Decline

The Danish stock market experienced a significant downturn today, with the OMX Copenhagen 20 index closing down 3.85%. This decline can be attributed to a confluence of factors, both domestic and international, impacting investor sentiment and driving market performance.

Global Economic Trends

The Danish stock market is closely intertwined with global economic trends. The current economic climate is marked by persistent inflation, rising interest rates, and geopolitical uncertainties stemming from the ongoing war in Ukraine. These factors have created a sense of unease among investors worldwide, leading to a risk-off sentiment that has spilled over into the Danish market.

The fear of a potential recession, coupled with the uncertainty surrounding the global economic outlook, has prompted investors to seek safer havens, contributing to the decline in stock prices.

Impact of Specific Sectors, Denmark stocks lower at close of trade; OMX Copenhagen 20 down 3.85%

The decline in the OMX Copenhagen 20 index was not uniform across all sectors. The energy sector, which has benefited from high oil and gas prices in recent months, saw relatively smaller losses compared to other sectors. However, the technology sector, which is sensitive to changes in interest rates and economic growth, experienced significant declines.

Several Danish tech companies, known for their high valuations and growth potential, witnessed a sharp drop in their share prices, contributing to the overall market weakness.

Comparison to Other Global Markets

The Danish stock market’s performance today mirrored the trend seen in other major global markets. European stock markets, including the German DAX and the French CAC 40, also experienced significant declines. This indicates that the current market downturn is not solely confined to Denmark but reflects a broader global sentiment of risk aversion.

The ongoing war in Ukraine, coupled with the uncertainty surrounding the global economic outlook, has created a sense of unease among investors worldwide, leading to a decline in stock prices across major markets.

Impact on Danish Companies

The decline in the OMX Copenhagen 20 index has had a significant impact on Danish companies, with many experiencing losses in their share prices. This downturn reflects the broader economic concerns and investor sentiment, affecting both large and small businesses across various sectors.

Top Performers and Underperformers

The following table highlights the top 5 companies listed on the OMX Copenhagen 20 index, their closing prices, and percentage changes:

| Company | Closing Price | Percentage Change |

|---|---|---|

| Company A | $XXX.XX | -XX.XX% |

| Company B | $XXX.XX | -XX.XX% |

| Company C | $XXX.XX | -XX.XX% |

| Company D | $XXX.XX | -XX.XX% |

| Company E | $XXX.XX | -XX.XX% |

For example, Company A, a leading player in the [sector], saw its share price decline by XX.XX%, indicating a significant impact from the market downturn. On the other hand, Company B, a [sector] company, performed relatively better with a smaller percentage decline.

This difference in performance highlights the varied impact of the market decline on different companies within the same index.

Potential Long-Term Consequences

The market decline can have both short-term and long-term consequences for Danish businesses and the economy. In the short term, companies may experience reduced investment opportunities, difficulty securing financing, and pressure on profit margins. However, the long-term consequences depend on the duration and severity of the downturn.

“A prolonged market decline could lead to a slowdown in economic growth, job losses, and a decrease in consumer spending.”

For example, the 2008 financial crisis had a significant impact on the Danish economy, leading to a recession and a decline in employment. While the current market decline is not as severe, its long-term consequences remain uncertain and depend on factors such as the global economic outlook, government policies, and the resilience of Danish businesses.

Further details about Urgent.ly director Ben Volkow sells shares worth over $14k is accessible to provide you additional insights.

Investor Sentiment and Market Outlook

The sharp decline in Danish stocks has sent ripples of anxiety through the investment community, leaving investors grappling with a mix of uncertainty and cautious optimism. While the immediate reaction has been one of concern, a closer look at the factors driving the downturn reveals a complex interplay of global and domestic influences.

Investor Reactions and Sentiments

The market decline has triggered a range of reactions among investors, from apprehension to measured adjustments in investment strategies.

- Short-Term Concerns:Many investors are expressing immediate concerns about the potential for further market volatility and the impact on their portfolio returns. This sentiment is particularly pronounced among those with short-term investment horizons or those holding a high proportion of equities in their portfolios.

- Long-Term Perspective:Some investors are adopting a more long-term perspective, viewing the decline as a temporary setback in the broader economic cycle. They believe that the Danish economy remains fundamentally sound and that the market will eventually recover. This perspective is often accompanied by a willingness to ride out the volatility and maintain their existing investment positions.

- Shifting Strategies:The market downturn has prompted some investors to reassess their risk tolerance and adjust their investment strategies. This may involve diversifying portfolios by adding more defensive assets like bonds or reducing exposure to volatile sectors.

Potential Future Market Trends

The future trajectory of the Danish stock market remains uncertain, with several factors likely to influence its performance in the coming months.

- Global Economic Outlook:The global economic environment remains a key driver of market sentiment. If global growth prospects improve, it could bolster investor confidence and lead to a rebound in Danish stocks. However, persistent inflation, rising interest rates, and geopolitical tensions could continue to weigh on markets.

- Domestic Economic Performance:The Danish economy is expected to slow in the coming quarters, but the extent of the slowdown remains uncertain. Factors like consumer spending, business investment, and export performance will play a significant role in determining the market’s direction.

- Corporate Earnings:Corporate earnings growth is a crucial driver of stock prices. If Danish companies report strong earnings, it could provide a much-needed boost to investor confidence and support market recovery. Conversely, disappointing earnings could exacerbate the current market downturn.

Impact on Investor Confidence and Investment Strategies

The market decline has undoubtedly shaken investor confidence, particularly among those with a shorter-term investment horizon. This erosion of confidence can lead to a flight to safety, as investors seek to reduce risk by shifting their investments towards more conservative assets.

The decline can also prompt investors to re-evaluate their investment strategies, potentially leading to a shift in asset allocation or a more cautious approach to risk.

Factors Influencing Recovery

The recovery of the Danish stock market will depend on a confluence of factors, including:

- Resolution of Global Economic Uncertainties:A clearer picture of the global economic outlook, particularly regarding inflation and interest rate trends, would provide much-needed stability for markets.

- Strong Corporate Earnings:Solid corporate earnings reports would demonstrate the resilience of Danish companies and provide a foundation for market recovery.

- Government Policies:Supportive government policies, such as tax cuts or infrastructure spending, could stimulate economic growth and boost investor confidence.

- Investor Sentiment:A return of investor confidence is essential for driving market recovery. This can be fostered by positive economic news, strong corporate performance, and a more stable global environment.

Last Recap

The downward trend in the OMX Copenhagen 20 index raises questions about the future trajectory of the Danish stock market. While the short-term outlook remains uncertain, the resilience of the Danish economy and the long-term potential of its businesses offer a glimmer of hope.

The impact of the market decline on individual companies, particularly those in the energy and technology sectors, will continue to be closely watched. The coming weeks will be crucial in gauging the extent of the downturn and whether it signals a broader shift in investor sentiment.

Questions and Answers: Denmark Stocks Lower At Close Of Trade; OMX Copenhagen 20 Down 3.85%

What is the OMX Copenhagen 20 index?

The OMX Copenhagen 20 is a benchmark index that tracks the performance of the 20 largest companies listed on the Copenhagen Stock Exchange. It serves as a gauge of the overall health of the Danish stock market.

What are the key factors that influenced the decline in the OMX Copenhagen 20 index?

The decline was primarily attributed to a combination of factors, including global economic uncertainties, rising inflation, potential recessionary pressures, and investor concerns about the performance of certain sectors, particularly energy and technology.

What are the potential long-term implications of the market decline on Danish businesses and the economy?

The long-term impact of the market decline remains to be seen. However, it could potentially affect investment in Danish businesses, economic growth, and job creation. The government and businesses will need to closely monitor the situation and implement measures to mitigate any potential negative consequences.

CentralPoint Latest News

CentralPoint Latest News