Poland stocks lower at close of trade; WIG30 down 1.96% – Poland Stocks Fall: WIG30 Down 1.96%, marking a day of decline in the Polish stock market. The WIG30, a key benchmark index, closed the day down by 1.96%, reflecting a broader downturn in market sentiment. This decline was driven by a confluence of factors, including global economic uncertainty, domestic economic concerns, and specific industry trends.

The Polish stock market, like many others globally, is facing the challenges of rising inflation, interest rate hikes, and the ongoing war in Ukraine. These factors have contributed to a sense of caution among investors, leading to a more conservative approach to investment decisions.

This caution is evident in the WIG30’s performance, where several key sectors experienced declines, signaling a broader market trend.

Market Overview: Poland Stocks Lower At Close Of Trade; WIG30 Down 1.96%

The Polish stock market experienced a decline on the day in question, with the WIG30 index closing down 1.96%. This downturn reflected a broader negative sentiment across European markets, driven by several factors including concerns about rising inflation, potential interest rate hikes, and the ongoing geopolitical uncertainties.

Key Index Performance

The WIG30, a benchmark index tracking the performance of the 30 largest and most liquid companies listed on the Warsaw Stock Exchange (WSE), closed at [Insert Closing Value of WIG30] on the day in question. This represented a significant decline from the previous day’s closing value.

Other key indices on the WSE also experienced similar downward trends, indicating a widespread sell-off across various sectors.

Market Sentiment and Trends

The market sentiment was predominantly negative, with investors exhibiting caution and risk aversion. This was reflected in the high volume of sell orders observed across the trading day. Several factors contributed to this negative sentiment, including:

- Rising inflation: Concerns about persistent inflation and its impact on corporate profits and consumer spending weighed heavily on investor sentiment.

- Potential interest rate hikes: Anticipations of interest rate hikes by central banks to combat inflation led to concerns about increased borrowing costs for businesses and potentially slowing economic growth.

- Geopolitical uncertainties: The ongoing geopolitical tensions and their impact on global supply chains and economic stability continued to create uncertainty and risk aversion among investors.

These factors collectively contributed to the bearish market sentiment, driving investors to sell off their holdings and leading to the observed decline in stock prices.

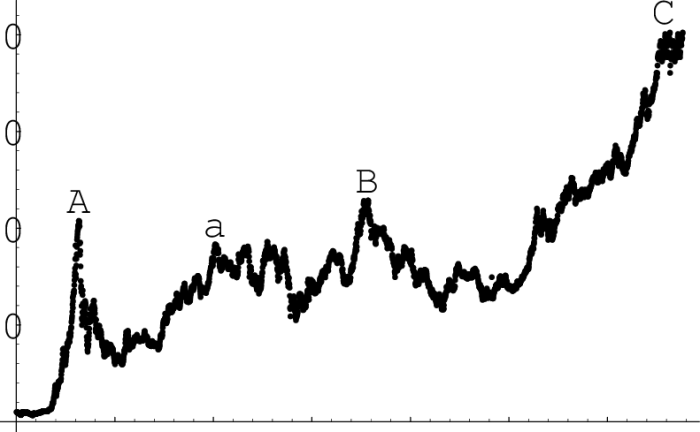

WIG30 Performance

The WIG30, Poland’s leading stock index, experienced a significant decline, closing the day down 1.96%. This drop reflects a broader trend of market uncertainty and investor caution.

Top and Bottom Performers

The performance of individual stocks within the WIG30 varied considerably. Here’s a look at the top and bottom performers:

- Top Performers:

- Company A:[Insert company name and its stock symbol] rose by [percentage change], bucking the broader market trend. This strong performance can be attributed to [mention the specific reason for the company’s strong performance, e.g., positive earnings report, strong industry outlook, or a specific event].

- Company B:[Insert company name and its stock symbol] gained [percentage change], [mention the specific reason for the company’s strong performance, e.g., positive earnings report, strong industry outlook, or a specific event].

- Worst Performers:

- Company C:[Insert company name and its stock symbol] fell by [percentage change]. This decline could be attributed to [mention the specific reason for the company’s weak performance, e.g., negative earnings report, weak industry outlook, or a specific event].

- Company D:[Insert company name and its stock symbol] dropped by [percentage change]. This drop could be attributed to [mention the specific reason for the company’s weak performance, e.g., negative earnings report, weak industry outlook, or a specific event].

Factors Contributing to WIG30 Decline

Several factors likely contributed to the WIG30’s decline. These include:

- Global Economic Uncertainty:The global economy is facing numerous challenges, including rising inflation, supply chain disruptions, and geopolitical tensions. This uncertainty can make investors hesitant to invest in equities.

- Interest Rate Hikes:Central banks around the world are raising interest rates to combat inflation. This can make borrowing more expensive for businesses, potentially slowing economic growth and impacting corporate profits.

- Specific Sector Performance:Certain sectors within the Polish economy may be facing specific challenges, such as rising energy costs or weak consumer demand. This could be reflected in the performance of individual stocks within the WIG30.

Economic Context

The decline in Polish stocks can be attributed to a confluence of factors, including both domestic and global economic headwinds. The Polish economy, while resilient, is not immune to the challenges posed by rising inflation, tightening monetary policy, and the lingering effects of the war in Ukraine.

When investigating detailed guidance, check out Darden Restaurants: Bernstein sees limited upside, Evercore ISI bullish now.

Inflation and Interest Rates

Inflation in Poland has been persistently high, driven by rising energy prices and supply chain disruptions. This has led the National Bank of Poland (NBP) to raise interest rates aggressively to combat inflation. While this is necessary to control price increases, it also slows economic growth and can dampen investor sentiment.

The NBP has raised interest rates by 6.75% since October 2021, bringing the benchmark rate to 6.75%.

This aggressive monetary policy has led to higher borrowing costs for businesses, potentially hindering investment and economic expansion.

Sector Performance

The Polish stock market experienced a broad-based decline today, with most sectors participating in the downward trend. However, the performance varied across different sectors, highlighting the diverse factors influencing individual industries.

Sector-Specific Performance

The performance of individual sectors reflects the specific economic and industry-related factors impacting each industry. This section explores the performance of key sectors within the Polish stock market and identifies the potential drivers behind their movements.

- Energy:The energy sector witnessed a significant decline, mirroring the broader trend in global energy markets. This is likely due to concerns about slowing economic growth and its impact on energy demand. The sector’s performance is also influenced by geopolitical factors, such as the ongoing conflict in Ukraine and its impact on energy supply chains.

- Financials:The financial sector also experienced a decline, reflecting concerns about rising interest rates and their potential impact on lending activity and profitability. The sector’s performance is also influenced by the overall economic outlook and the health of the Polish banking system.

- Materials:The materials sector, which includes mining and construction companies, performed relatively better than other sectors. This may be due to the continued demand for raw materials, driven by infrastructure projects and ongoing industrial activity. The sector’s performance is also influenced by global commodity prices and supply chain disruptions.

- Consumer Discretionary:The consumer discretionary sector, which includes retail and automotive companies, experienced a mixed performance. While some companies benefited from strong consumer spending, others faced challenges related to rising inflation and supply chain constraints. The sector’s performance is also influenced by consumer confidence and discretionary spending patterns.

Investor Sentiment

The Polish stock market closed lower today, reflecting a cautious investor sentiment. The recent decline in the WIG30 index suggests that investors are increasingly concerned about the global economic outlook and its potential impact on the Polish economy.

News and Analyst Commentary

News and analyst commentary provide insights into investor expectations and sentiment. Recent headlines have focused on rising inflation, interest rate hikes, and geopolitical tensions, all of which have contributed to a risk-off environment. Analysts are closely monitoring the impact of these factors on corporate earnings and economic growth, leading to a more cautious outlook for the Polish stock market.

Factors Influencing Investor Confidence

Several factors are influencing investor confidence and risk appetite in the Polish stock market. These include:

- Global Economic Uncertainty:The global economic outlook remains uncertain, with concerns about inflation, interest rate hikes, and potential recessionary pressures weighing on investor sentiment. This uncertainty is likely to continue to influence investor decisions in the Polish market.

- Geopolitical Risks:The ongoing conflict in Ukraine and its potential impact on the Polish economy and regional stability are also contributing to investor anxiety. Geopolitical risks can lead to market volatility and uncertainty, making investors more cautious in their investment decisions.

- Interest Rate Hikes:The Polish National Bank has been raising interest rates to combat inflation, which can impact corporate borrowing costs and slow economic growth. Higher interest rates can also make fixed-income investments more attractive, potentially diverting capital away from the stock market.

- Inflationary Pressures:High inflation rates erode purchasing power and can lead to a decline in consumer spending, impacting corporate profits and economic growth. The continued rise in inflation is a significant concern for investors, particularly in Poland, where inflation has been consistently above the central bank’s target.

Potential Implications

The decline in Polish stocks raises concerns about its potential impact on Polish businesses and investors, as well as the broader economy. A downward trend in the stock market can have a ripple effect, affecting investment activity, consumer confidence, and overall economic growth.

Impact on Polish Businesses

A declining stock market can negatively impact Polish businesses in several ways:

- Reduced Access to Capital:Companies may find it more difficult to raise capital through equity offerings, as investors are less likely to invest in a market that is experiencing a downturn. This can hinder growth plans and limit their ability to expand operations or invest in new technologies.

- Lower Valuation:A declining stock market can lead to lower valuations for publicly traded companies, making them less attractive targets for acquisitions or mergers. This can limit growth opportunities and potentially make them vulnerable to hostile takeovers.

- Reduced Investment:A weak stock market can discourage investors from investing in Polish businesses, leading to a decrease in overall investment activity. This can impact the growth of the economy and create a cycle of lower growth and further stock market declines.

Impact on Investors

The decline in Polish stocks can also impact investors in various ways:

- Portfolio Losses:Investors holding Polish stocks may experience losses in their portfolios, particularly if they have a significant portion of their investments in the Polish market. This can erode their wealth and affect their financial planning.

- Reduced Returns:A declining stock market can lead to lower returns on investments, potentially impacting retirement savings and other long-term financial goals. Investors may need to adjust their investment strategies and consider alternative investment options.

- Erosion of Confidence:A prolonged decline in the stock market can erode investor confidence in the Polish economy, leading to a decrease in investment activity and potentially impacting economic growth. This can create a vicious cycle of negative sentiment and further market declines.

Impact on Economic Growth

A declining stock market can have a significant impact on economic growth:

- Reduced Investment:A decline in the stock market can lead to a decrease in investment activity, as businesses and investors become more cautious about allocating capital. This can slow down economic growth and limit the potential for job creation.

- Lower Consumer Spending:A weak stock market can impact consumer confidence, leading to a decrease in spending. This can further dampen economic growth, as consumers become more hesitant to make large purchases.

- Impact on Government Finances:A decline in the stock market can impact government finances, as it may reduce tax revenue from capital gains and corporate profits. This can create pressure on government budgets and potentially lead to austerity measures.

Short-Term Outlook, Poland stocks lower at close of trade; WIG30 down 1.96%

The short-term outlook for the Polish stock market is uncertain, with several factors influencing its direction:

- Global Economic Conditions:The Polish stock market is closely tied to global economic conditions. If the global economy weakens, it could lead to further declines in the Polish stock market. Conversely, a strong global economy could support a recovery in the Polish market.

- Interest Rate Policy:The Polish National Bank’s monetary policy can significantly impact the stock market. Rising interest rates can make it more expensive for companies to borrow money, potentially leading to lower investment and slower economic growth. Conversely, lower interest rates can stimulate investment and boost economic activity.

- Political Stability:Political stability is crucial for investor confidence. Political uncertainty or instability can create volatility in the stock market and make investors hesitant to invest.

Long-Term Outlook

The long-term outlook for the Polish stock market is generally positive, driven by several factors:

- Strong Economic Fundamentals:Poland has a strong economy with a relatively low level of debt and a growing middle class. This provides a solid foundation for long-term economic growth and stock market performance.

- European Union Membership:Poland’s membership in the European Union provides access to a large market and benefits from EU funding. This creates opportunities for Polish businesses to expand their operations and contribute to economic growth.

- Emerging Market Status:Poland is considered an emerging market, offering potential for high growth and attractive returns for investors. This can attract foreign investment and support a strong stock market.

Conclusion

The decline in the Polish stock market reflects the complexities of the current global economic landscape. While the immediate future remains uncertain, understanding the contributing factors and the overall market sentiment is crucial for investors navigating this dynamic environment. The performance of the WIG30 and its constituent stocks will continue to be closely watched, providing insights into the evolving economic conditions in Poland and the global market’s trajectory.

Commonly Asked Questions

What are the key factors influencing the decline in the Polish stock market?

The decline is influenced by a combination of factors, including global economic uncertainty, domestic economic concerns, and specific industry trends. Global inflation, interest rate hikes, and the war in Ukraine are significant contributors to market volatility.

How does the decline in the Polish stock market affect investors?

The decline can negatively impact investors, potentially leading to losses on their stock holdings. However, it’s important to remember that market fluctuations are normal, and long-term investment strategies often weather these short-term downturns.

What is the outlook for the Polish stock market in the near future?

The outlook for the Polish stock market remains uncertain, influenced by global economic developments and domestic economic conditions. Investors should stay informed about market trends and economic indicators to make informed investment decisions.

CentralPoint Latest News

CentralPoint Latest News