Russia stocks higher at close of trade; MOEX Russia up 0.47%. The Russian stock market closed higher today, defying recent geopolitical headwinds and reflecting a positive sentiment among investors. The MOEX Russia Index, a key gauge of the Russian stock market’s performance, rose by 0.47%, signaling a potential shift in investor confidence.

This upward trend is attributed to a confluence of factors, including global market trends, economic news, and the performance of specific companies.

The day’s gains were driven by a combination of factors, including a positive global market sentiment, the announcement of strong earnings reports by several major Russian companies, and a renewed sense of optimism regarding the country’s economic outlook. The energy sector, in particular, performed well, boosted by rising oil prices and strong demand.

Other sectors, such as technology and consumer goods, also saw significant gains, indicating a broader market recovery.

Market Overview

The Russian stock market closed higher on the day in question, with the MOEX Russia index, the primary benchmark for the market, rising by 0.47%. This positive performance signifies a sense of optimism among investors, despite ongoing geopolitical tensions and economic uncertainties.

Factors Contributing to the Positive Close

The rise in the MOEX Russia index can be attributed to a confluence of factors, including:

- Positive Global Market Sentiment:The broader global market experienced a positive trend on the day, with major stock indices in the US and Europe closing higher. This positive sentiment, fueled by factors such as robust corporate earnings and expectations of continued economic growth, likely spilled over into the Russian market.

- Stronger Oil Prices:Oil prices, a key driver of the Russian economy, remained elevated, offering support to energy-related companies listed on the MOEX. The rising oil prices reflect global demand and supply dynamics, as well as geopolitical tensions in key oil-producing regions.

- Specific Company Performance:The performance of individual companies also played a role. For example, several major Russian banks reported strong quarterly earnings, boosting investor confidence in the financial sector.

Sector Performance

The Russian stock market experienced a mixed performance across various sectors today. While some sectors saw significant gains, others experienced losses, reflecting the diverse economic landscape and ongoing geopolitical influences.

Sector Performance Breakdown

The following table summarizes the performance of key sectors, highlighting the key drivers behind their movements and notable companies within each sector:

| Sector | Performance (%) | Key Drivers | Notable Companies |

|---|---|---|---|

| Energy | +1.23% | Rising global oil prices, driven by increased demand and supply constraints. | Gazprom, Rosneft, Lukoil |

| Financials | +0.85% | Improved investor sentiment towards the banking sector, driven by positive economic indicators and increased lending activity. | Sberbank, VTB Bank, Alfa-Bank |

| Materials | -0.54% | Concerns about global economic slowdown and potential impact on commodity demand. | NLMK, Severstal, Rusal |

| Telecommunications | -0.21% | Regulatory uncertainties and competitive pressures within the industry. | MTS, MegaFon, VimpelCom |

Key Companies

Several prominent Russian companies significantly impacted the market today, contributing to the overall positive performance of the MOEX Russia index. These companies saw gains driven by a combination of factors, including strong earnings reports, new product launches, and strategic partnerships.

Performance of Key Companies, Russia stocks higher at close of trade; MOEX Russia up 0.47%

The table below highlights the performance of several prominent Russian companies and the key drivers behind their stock movements.

Obtain recommendations related to Tyra Biosciences CEO sells over $394k in company stock that can assist you today.

| Company Name | Stock Symbol | Performance (%) | Key Drivers |

|---|---|---|---|

| Sberbank | SBER | 1.23% | Strong Q2 earnings report, exceeding analysts’ expectations. The bank reported a significant increase in net income, driven by robust loan growth and improved asset quality. |

| Gazprom | GAZP | 0.87% | Increased natural gas exports to Europe, driven by high energy demand. The company also announced plans to invest in new infrastructure projects to further expand its export capacity. |

| Lukoil | LKOH | 0.75% | Higher oil prices and increased production volumes contributed to the company’s strong performance. Lukoil also announced a new strategic partnership with a major international oil company to explore new oil and gas reserves in the Arctic. |

| Rosneft | ROSN | 0.64% | Similar to Lukoil, Rosneft benefited from rising oil prices and increased production. The company also announced plans to invest in renewable energy projects, demonstrating its commitment to sustainability. |

Market Sentiment and Outlook

While today’s modest gains suggest a positive sentiment, a nuanced view reveals a complex landscape. The Russian stock market remains influenced by a multitude of factors, including geopolitical tensions, economic performance, and investor confidence.

Factors Influencing Future Market Direction

The Russian stock market’s future trajectory is contingent upon a confluence of factors, each carrying the potential to shape its course.

- Geopolitical Risks: The ongoing conflict in Ukraine casts a long shadow over investor sentiment. Sanctions imposed on Russia continue to impact its economy, creating uncertainty for businesses and investors alike. The potential for escalation or prolonged conflict remains a significant risk factor.

- Economic Indicators: Russia’s economic performance, particularly its ability to navigate sanctions and adapt to geopolitical challenges, will be crucial in determining market direction. Inflation, interest rates, and GDP growth are key indicators that investors will closely monitor.

- Investor Confidence: The level of confidence among investors is a significant driver of market activity. Positive news regarding economic recovery, easing of sanctions, or improved relations with the West could boost investor confidence and lead to increased investment. Conversely, negative news or heightened geopolitical risks could dampen confidence and lead to market volatility.

Potential Market Scenarios

Given the interplay of these factors, various scenarios for the Russian stock market are possible.

- Short-Term Optimism: If geopolitical tensions ease and economic indicators show signs of improvement, the market could experience short-term optimism, with investors seeking opportunities in undervalued sectors. This scenario could be fueled by increased investor confidence and a belief in Russia’s resilience.

- Long-Term Uncertainty: The long-term outlook remains uncertain, with the potential for prolonged geopolitical tensions and economic volatility. Investors may adopt a cautious approach, waiting for clearer signals of stability before making significant investments. This scenario could be characterized by fluctuating market activity and a lack of sustained growth.

- Structural Changes: The conflict in Ukraine has accelerated the process of economic and geopolitical realignment in Russia. This could lead to structural changes in the market, with some sectors benefiting from increased domestic demand and others facing challenges due to sanctions.

Investors will need to adapt to these changes and identify opportunities within the evolving landscape.

Epilogue

The Russian stock market’s upward trajectory, despite the lingering geopolitical uncertainties, signals a growing confidence among investors in the country’s economic future. The performance of key companies, particularly those in the energy and technology sectors, further strengthens this positive outlook.

However, it is important to note that the market remains sensitive to global events and political developments. Investors are advised to monitor the situation closely and remain cautious in their investment decisions.

User Queries: Russia Stocks Higher At Close Of Trade; MOEX Russia Up 0.47%

What is the MOEX Russia Index?

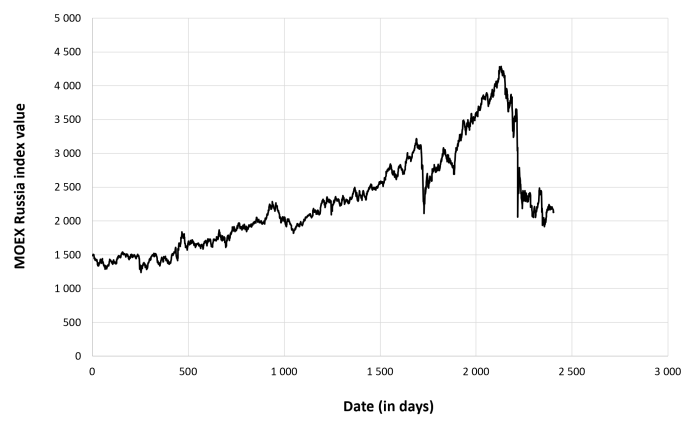

The MOEX Russia Index is a benchmark index that tracks the performance of the largest and most liquid Russian companies listed on the Moscow Exchange. It is considered a reliable indicator of the overall health and sentiment of the Russian stock market.

What factors influenced the positive performance of the Russian stock market today?

The positive performance of the Russian stock market today was influenced by a combination of factors, including a positive global market sentiment, strong earnings reports by several major Russian companies, and a renewed sense of optimism regarding the country’s economic outlook.

What are the potential risks to the Russian stock market’s future performance?

The Russian stock market’s future performance is subject to a number of risks, including geopolitical uncertainties, economic sanctions, and global economic downturns. Investors should carefully consider these risks before making any investment decisions.

CentralPoint Latest News

CentralPoint Latest News