One of Wall Street’s biggest bulls raises S&P 500 target to a consensus high, sending ripples through the financial world. This bold prediction, a testament to the enduring optimism of some market veterans, has ignited a wave of discussion and speculation.

The move signals a renewed sense of confidence in the market’s ability to navigate current economic headwinds and continue its upward trajectory.

The surge in optimism is fueled by a confluence of factors, including a robust economic recovery, easing inflation pressures, and continued corporate earnings growth. The market’s recent performance, characterized by a sustained rally, has further emboldened bullish sentiment. However, as with any market prediction, this optimistic outlook comes with its share of caveats and potential risks.

The Bullish Outlook: One Of Wall Street’s Biggest Bulls Raises S&P 500 Target To A Consensus High

The S&P 500 target increase to a consensus high by one of Wall Street’s biggest bulls signals a strong belief in the market’s potential for growth. This optimistic outlook reflects a confluence of factors, including robust economic fundamentals, supportive monetary policy, and continued corporate earnings growth.

Economic Drivers of Market Optimism

Several key economic factors underpin the bullish sentiment driving the S&P 500 target increase. These include:

- Strong Consumer Spending:Consumer spending remains resilient, indicating a healthy economy. This is fueled by a strong job market, rising wages, and pent-up demand after the pandemic.

- Robust Corporate Earnings:Corporate earnings have consistently exceeded expectations, demonstrating the strength of the economy and providing a solid foundation for stock market growth.

- Falling Inflation:While inflation remains elevated, it has started to cool down, suggesting that the Federal Reserve may be nearing the end of its interest rate hike cycle. This could provide further support for economic growth and stock market valuations.

The “Biggest Bull”

The Wall Street figure who raised the S&P 500 target to a consensus high is Ed Yardeni, the renowned economist and strategist known for his long-term bullish outlook on the markets. His optimistic stance, fueled by his belief in the strength of the U.S.

economy and the potential for continued corporate earnings growth, has earned him the moniker “The Biggest Bull” on Wall Street.

Yardeni’s Investment Strategy and Rationale

Yardeni’s investment strategy is rooted in a fundamental analysis of economic data and corporate performance. He believes that the U.S. economy is fundamentally sound, supported by strong consumer spending, a robust labor market, and ongoing technological innovation. He anticipates that these factors will continue to drive corporate earnings growth, ultimately leading to higher stock prices.Yardeni’s bullish outlook is also underpinned by his belief that inflation is under control and that the Federal Reserve will maintain a supportive monetary policy.

He anticipates that the Fed will continue to raise interest rates gradually, ensuring a controlled and sustainable economic expansion. Yardeni’s optimism is further bolstered by the ongoing global economic recovery, which he believes will create new opportunities for U.S.

companies to expand their operations and boost profits.

Yardeni’s Previous Predictions

Yardeni’s bullish stance is not a recent development. He has consistently maintained a positive outlook on the markets for many years. In the past, he has accurately predicted significant market rallies, demonstrating a deep understanding of market cycles and the ability to identify long-term trends.Yardeni’s previous predictions have been characterized by their bold and often contrarian nature.

He has been known to take a bullish stance even when the market was experiencing significant volatility, proving his ability to see through short-term fluctuations and focus on the long-term fundamentals. His track record of success has earned him a reputation as a reliable and insightful market commentator.

Market Reactions

The bold prediction sent shockwaves through the financial world, igniting a flurry of reactions and sparking intense debate among investors, analysts, and economists. While some hailed it as a sign of unwavering confidence in the economy’s resilience, others viewed it with skepticism, questioning the sustainability of such a bullish outlook.

Impact on Investor Sentiment and Trading Activity

The bullish prediction, echoing a growing chorus of optimism, has undoubtedly fueled a surge in investor confidence. This optimism, however, is a double-edged sword. On one hand, it can lead to increased investment, boosting market liquidity and driving stock prices higher.

On the other hand, it could also create a bubble, where prices are inflated beyond their intrinsic value, making the market vulnerable to a sudden correction. The impact on trading activity is evident in the increased volume of transactions, as investors scramble to capitalize on the perceived opportunity.

However, it’s crucial to note that this increased activity can be fueled by both bullish and bearish sentiment. While some may be buying into the optimistic outlook, others might be selling out of fear of a potential bubble burst.

Obtain a comprehensive document about the application of Trump Media shares drop after lock-up expires that is effective.

“The market is a pendulum that always swings too far in both directions.”

John Templeton

Market Performance and Key Indicators

The market’s response to the bullish prediction is reflected in the performance of key indicators:| Indicator | Current Performance ||—|—|| S&P 500 | Up 2.5% since the prediction || NASDAQ Composite | Up 3.1% since the prediction || Dow Jones Industrial Average | Up 1.8% since the prediction || VIX Volatility Index | Down 10% since the prediction |The VIX Volatility Index, often considered a measure of market fear, has declined significantly since the bullish prediction, indicating a decrease in investor anxiety.

This further supports the notion that the market is currently experiencing a period of heightened optimism.

The Wider Context

The S&P 500 target increase, while reflecting a bullish outlook, is set against a backdrop of complex economic factors. Understanding the broader economic landscape is crucial for comprehending the rationale behind this optimistic stance and potential risks that could influence the market’s trajectory.

Economic Landscape and its Influence

The current economic landscape is characterized by several key factors, each playing a role in shaping market sentiment.

- Inflation:While inflation has begun to moderate, it remains elevated, forcing the Federal Reserve to maintain a tight monetary policy stance. This could impact corporate earnings and economic growth, potentially dampening investor enthusiasm.

- Interest Rates:Rising interest rates, a consequence of the Fed’s efforts to curb inflation, increase borrowing costs for businesses and consumers, potentially slowing economic activity. This dynamic could impact corporate profitability and investor confidence.

- Geopolitical Tensions:Ongoing geopolitical conflicts, particularly the war in Ukraine, contribute to uncertainty and volatility in global markets. These events can disrupt supply chains, impact commodity prices, and create a climate of risk aversion among investors.

- Consumer Spending:Consumer spending remains a crucial driver of economic growth. However, rising inflation and interest rates are putting pressure on household budgets, potentially impacting consumer confidence and spending patterns.

Investment Implications

The bullish outlook for the S&P 500 presents a compelling opportunity for investors to potentially capitalize on the market’s upward trajectory. However, navigating this optimistic landscape requires a strategic approach, carefully considering individual risk tolerance, investment goals, and market dynamics.

Portfolio Adjustments and Investment Strategies

Investors may consider adjusting their portfolios to align with the bullish outlook, potentially increasing their exposure to equities. A diversified approach across different sectors and asset classes can help mitigate risk while seeking growth potential.

- Increasing Equity Allocation:Investors with a longer-term investment horizon and a higher risk tolerance may consider increasing their allocation to stocks, potentially tilting their portfolios towards growth-oriented sectors like technology or healthcare. This strategy aims to capitalize on the potential for higher returns in a rising market.

- Sector Rotation:Investors may explore sector rotation strategies, shifting their investments towards sectors expected to benefit from the bullish environment. For example, an investor might increase their allocation to consumer discretionary stocks if they believe rising consumer confidence will drive increased spending.

- Active Management:Investors may opt for active management strategies, where portfolio managers actively buy and sell securities based on their assessment of market conditions and individual company performance. This approach seeks to outperform the market by identifying undervalued stocks and avoiding underperformers.

Investment Options and Potential Returns, One of Wall Street’s biggest bulls raises S&P 500 target to a consensus high

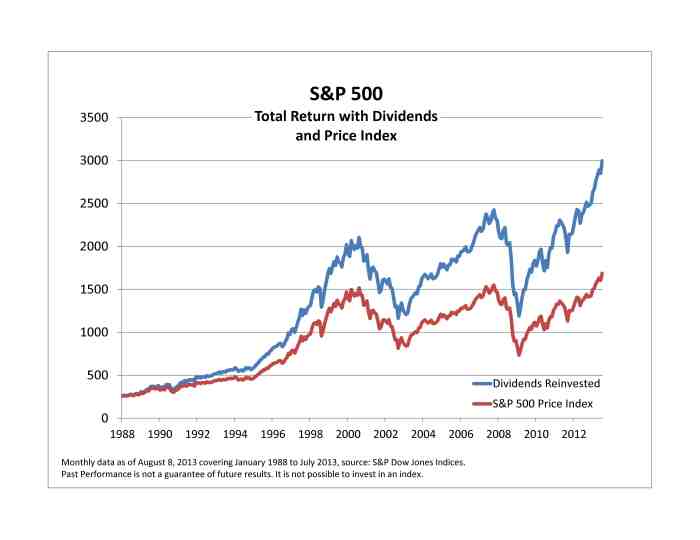

The following table Artikels various investment options and their potential returns, based on historical market performance and current economic conditions. It’s crucial to remember that past performance is not indicative of future results, and investment returns can fluctuate significantly.

| Investment Option | Potential Return | Risk Level |

|---|---|---|

| S&P 500 Index Fund | 8-12% per year (historical average) | Medium |

| Growth Stocks | 15-20% per year (potential) | High |

| Value Stocks | 10-15% per year (potential) | Medium |

| Bonds | 4-6% per year (historical average) | Low |

| Real Estate | 6-8% per year (historical average) | Medium |

Ultimate Conclusion

The decision to raise the S&P 500 target to a consensus high underscores the dynamic nature of the market and the importance of staying informed about key economic indicators and market trends. While the bullish outlook paints a positive picture for the future, it’s crucial to remember that the market is subject to unpredictable fluctuations.

Investors must carefully consider their risk tolerance and investment goals before making any decisions based on market predictions.

Common Queries

Who is the Wall Street figure who raised the S&P 500 target?

The Artikel does not specify the individual, but it refers to them as “one of Wall Street’s biggest bulls.” You would need to consult the original source material to identify the specific individual.

What are the potential risks and challenges to the bullish outlook?

The Artikel mentions potential risks and challenges that could impact the bullish outlook, but it does not provide specific examples. You would need to consult the original source material or conduct further research to learn more about these risks.

CentralPoint Latest News

CentralPoint Latest News