Earnings call: FedEx outlines strategic responses to demand challenges – FedEx Tackles Demand Challenges: Strategic Responses Unveiled – In a world of fluctuating demand, FedEx, a global logistics giant, found itself navigating choppy waters. The company’s recent earnings call shed light on the strategic responses it’s employing to adapt to this dynamic landscape.

Facing headwinds from economic uncertainties and shifting global trade patterns, FedEx has Artikeld a roadmap to weather the storm and maintain its competitive edge.

The call delved into the complexities of FedEx’s current business environment, highlighting the impact of global economic trends on its operations. The company acknowledged the challenges posed by fluctuating demand and Artikeld its strategies for navigating these turbulent waters.

From adapting its network and operations to embracing innovative technology solutions, FedEx is demonstrating its commitment to staying ahead of the curve.

FedEx’s Current Business Environment

FedEx operates in a dynamic and complex global business environment, navigating a confluence of economic, geopolitical, and technological forces that shape its performance. The company’s ability to adapt and respond effectively to these evolving conditions is paramount to its continued success.

The current economic landscape presents a mix of opportunities and challenges for FedEx. While global economic growth is expected to moderate in the coming quarters, the company continues to benefit from the ongoing recovery in consumer spending and business investment.

However, persistent inflationary pressures, rising interest rates, and geopolitical uncertainties create a backdrop of volatility and uncertainty.

Global Trade Trends

Global trade flows are a key driver of FedEx’s business, and recent trends have had a significant impact on its operations. While trade volumes have shown signs of recovery following the pandemic-induced disruptions, they remain below pre-pandemic levels. The war in Ukraine, ongoing supply chain bottlenecks, and rising protectionist sentiment have contributed to a slowdown in global trade growth.

FedEx is actively navigating these challenges by diversifying its customer base, expanding its presence in emerging markets, and investing in new technologies to enhance efficiency and optimize its network. The company is also closely monitoring geopolitical developments and adapting its operations to mitigate potential risks.

Demand Fluctuations

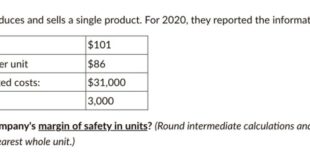

FedEx faces significant challenges in managing demand fluctuations, particularly in the context of global economic uncertainty and evolving consumer behavior. The company’s business model is heavily reliant on the movement of goods, and changes in demand patterns can lead to fluctuations in shipping volumes, impacting its profitability.

FedEx is employing a range of strategies to mitigate the impact of demand fluctuations, including optimizing its network capacity, adjusting pricing strategies, and investing in technology to enhance its forecasting capabilities. The company is also focusing on developing new services and solutions to meet the evolving needs of its customers.

Key Strategic Responses

FedEx is proactively addressing the evolving demand landscape by implementing strategic initiatives aimed at optimizing its operations and enhancing its service offerings. These measures are designed to ensure the company’s resilience and adaptability in a dynamic market environment.The company’s strategic responses are underpinned by a focus on driving operational efficiency, enhancing customer experience, and expanding its service portfolio.

This approach is driven by a deep understanding of the evolving needs of FedEx’s diverse customer base and a commitment to delivering value through innovative solutions.

Optimizing Network Efficiency

The company’s efforts to optimize network efficiency are driven by a desire to enhance its operational performance and streamline its delivery processes. FedEx is focusing on optimizing its network infrastructure, leveraging technology, and implementing process improvements to achieve greater efficiency and cost-effectiveness.

“We’re taking a number of steps to right-size our network, including adjusting our capacity and footprint, as well as optimizing our delivery routes and schedules.”

- Network optimization:FedEx is streamlining its network by adjusting capacity and footprint, optimizing delivery routes and schedules, and leveraging technology to improve efficiency.

- Capacity management:The company is closely monitoring demand patterns and adjusting its capacity to ensure alignment with market needs. This includes optimizing aircraft utilization, adjusting staffing levels, and strategically managing its fleet.

- Technology investments:FedEx is investing in advanced technologies such as artificial intelligence (AI) and machine learning to enhance route optimization, automate processes, and improve real-time decision-making.

Impact on Operations and Networks

FedEx is actively adjusting its network and operations to navigate the evolving demand landscape. The company is implementing strategic changes to enhance efficiency, optimize resource allocation, and ensure continued service quality while adapting to the current economic climate.

Network Optimization and Capacity Management

FedEx is employing a multifaceted approach to network optimization, encompassing adjustments to flight schedules, route planning, and facility utilization. These initiatives aim to streamline operations, reduce costs, and enhance service reliability. For instance, FedEx is consolidating certain routes and adjusting flight schedules to align with demand patterns.

Additionally, the company is leveraging data analytics to optimize facility utilization, ensuring that resources are deployed effectively across its network.

Service Offerings and Pricing Strategies

FedEx is adapting its service offerings and pricing strategies to cater to the evolving needs of its customers. The company is introducing new services, such as expedited delivery options for time-sensitive shipments, and adjusting pricing models to reflect the changing market dynamics.

For example, FedEx is offering discounts for certain types of shipments, such as those with lower density, to incentivize customers and optimize capacity utilization.

Impact on Efficiency and Profitability

The network and operational adjustments implemented by FedEx are expected to enhance efficiency and improve profitability. Streamlined operations, optimized resource allocation, and adjusted pricing strategies are expected to lead to cost savings and improved margins. However, the success of these initiatives hinges on the company’s ability to adapt quickly to evolving market conditions and effectively manage the transition process.

Technology and Innovation

FedEx is actively leveraging technology to enhance efficiency and customer service, positioning itself as a leader in the evolving logistics landscape. This strategy is critical for navigating the current demand challenges and driving future growth.

Technology’s Role in Efficiency and Customer Service

Technology is playing a pivotal role in streamlining FedEx’s operations and enhancing the customer experience. This is achieved through a multifaceted approach encompassing:

- Advanced analytics: FedEx is utilizing advanced analytics to optimize route planning, improve package sorting, and predict potential disruptions. This data-driven approach helps minimize delivery times, reduce fuel consumption, and enhance overall operational efficiency.

- Automated sorting systems: FedEx has invested in automated sorting systems at its hubs, which significantly speed up package handling and reduce manual labor. These systems leverage robotics and artificial intelligence (AI) to efficiently sort packages based on destination, ensuring faster and more accurate delivery.

- Digital platforms: FedEx has developed user-friendly digital platforms for customers to track shipments, manage accounts, and access real-time delivery information. These platforms empower customers with greater control and transparency, enhancing their overall experience.

- Mobile apps: FedEx offers mobile apps that enable customers to track packages, schedule pickups, and access other services on the go. These apps provide a convenient and personalized experience, enhancing customer satisfaction.

Innovative Solutions, Earnings call: FedEx outlines strategic responses to demand challenges

FedEx is continuously exploring and implementing innovative solutions to address the dynamic demands of the logistics industry. Some notable examples include:

- Autonomous vehicle technology: FedEx is actively testing and integrating autonomous vehicle technology into its fleet. This technology has the potential to revolutionize delivery operations, offering greater efficiency, safety, and sustainability. For example, FedEx is collaborating with companies like Ford and Waymo to explore the use of self-driving trucks and delivery vehicles in specific routes and environments.

- Drone delivery: FedEx is exploring the use of drones for package delivery in select locations. Drone delivery offers the potential to reduce delivery times, reach remote areas, and provide more flexible delivery options. FedEx has partnered with drone technology companies and is working with regulators to ensure the safe and efficient integration of drones into its delivery network.

When investigating detailed guidance, check out Griffon Corp executive sells over $2.4 million in company stock now.

- Internet of Things (IoT): FedEx is leveraging IoT technology to track packages in real-time and optimize delivery routes. Sensors and data analytics provide valuable insights into package location, temperature, and other critical factors, enabling proactive monitoring and timely interventions.

Technology’s Role in Addressing Demand Challenges

Technology is playing a crucial role in helping FedEx address the current demand challenges. This includes:

- Increased automation: Automation through robotics and AI is enabling FedEx to handle increased package volumes with greater efficiency and accuracy. This reduces manual labor requirements, minimizes human error, and ensures faster processing times.

- Optimized network capacity: Advanced analytics and data-driven insights allow FedEx to optimize its network capacity by predicting demand fluctuations and adjusting resources accordingly. This ensures efficient utilization of assets and minimizes disruptions in service.

- Enhanced customer service: Digital platforms and mobile apps empower customers with greater control and transparency, enabling them to manage shipments and access real-time information. This improves customer satisfaction and reduces the burden on customer service teams.

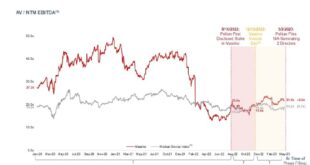

Financial Performance and Outlook

FedEx’s recent financial performance reflects the ongoing challenges of a dynamic global economy. While the company navigates a complex landscape, it’s essential to analyze the key financial metrics that reveal the effectiveness of its strategic responses.

Financial Performance Review

The recent quarter showcased FedEx’s resilience amidst a challenging economic environment. Revenue growth remained stable, demonstrating the company’s ability to maintain its market position. However, operating income faced pressure due to rising fuel costs and ongoing labor market dynamics.

Guidance for Future Earnings and Revenue

FedEx’s outlook for future earnings and revenue reflects a cautious optimism. The company anticipates continued growth in revenue, driven by its global network and expanding e-commerce market. However, it acknowledges the persistent impact of inflationary pressures and supply chain disruptions.

Key Financial Metrics

Several key financial metrics provide insights into the effectiveness of FedEx’s strategic responses. These include:

- Operating Margin:This metric reflects the profitability of FedEx’s core operations. While operating margin experienced some pressure in the recent quarter, the company expects improvements in the coming periods as strategic initiatives take effect.

- Cash Flow:FedEx’s strong cash flow generation demonstrates its ability to manage working capital effectively and invest in growth opportunities. This financial strength positions the company favorably for navigating economic fluctuations.

- Debt-to-Equity Ratio:FedEx maintains a healthy debt-to-equity ratio, indicating a conservative approach to leverage. This financial discipline allows the company to weather economic storms and pursue strategic investments.

Industry Comparisons and Competitive Landscape: Earnings Call: FedEx Outlines Strategic Responses To Demand Challenges

FedEx’s strategic responses to the current market challenges are not unique. The entire logistics industry is grappling with similar issues, and competitors are deploying a variety of strategies to adapt. This section delves into how FedEx’s actions compare to those of its key rivals, analyzes the competitive landscape, and explores the potential long-term implications of these strategies on FedEx’s market position.

Competitive Landscape and FedEx’s Position

The global logistics industry is a fiercely competitive landscape, with players vying for market share in a rapidly evolving environment. Key players include:

- UPS:FedEx’s primary competitor, UPS operates a similar global network, focusing on both domestic and international shipping. Their strategies often mirror FedEx’s, with an emphasis on efficiency, technology, and customer service.

- Amazon:While primarily an e-commerce giant, Amazon’s logistics arm, Amazon Logistics, is rapidly expanding, offering competitive delivery services and posing a significant threat to traditional players like FedEx.

- DHL:A leading international logistics provider, DHL has a strong presence in Europe and Asia, offering a wide range of services including express shipping, freight forwarding, and supply chain management.

- Smaller Regional Players:Numerous regional carriers and niche logistics providers also compete in specific markets, catering to specialized needs or offering cost-effective solutions.

FedEx’s position within this competitive landscape is defined by its extensive global network, strong brand recognition, and commitment to innovation. However, the company faces significant challenges from both established players and emerging competitors.

Strategic Response Comparisons

To understand FedEx’s strategic responses in the context of its competitors, it’s crucial to compare their actions across key areas:

Efficiency and Cost Optimization

- FedEx:Focusing on automation, network optimization, and streamlining operations to reduce costs and improve efficiency. Examples include investments in automated sorting systems, optimizing delivery routes, and exploring drone technology.

- UPS:Implementing similar strategies, including automation investments, network optimization, and exploring alternative delivery methods like electric vehicles.

- Amazon:Leverages its vast infrastructure and data analytics to optimize delivery routes, utilize smaller delivery vehicles, and implement a network of delivery hubs.

Technology and Innovation

- FedEx:Investing heavily in technology, including AI-powered solutions for route optimization, predictive analytics for demand forecasting, and digital platforms for customer interactions.

- UPS:Similar focus on technology, with investments in AI, machine learning, and data analytics for operational efficiency and customer experience enhancement.

- Amazon:Pioneering in the use of robotics and automation in warehouses, deploying drones for delivery, and leveraging data analytics for personalized customer experiences.

Customer Service and Experience

- FedEx:Emphasizing customer-centricity, offering a wide range of services, and investing in technology to improve customer experience, such as online tracking and personalized communication.

- UPS:Prioritizing customer satisfaction, offering a range of services, and investing in technology to enhance the customer experience, such as online tracking and personalized communication.

- Amazon:Leveraging its customer data to offer personalized delivery options, flexible scheduling, and a seamless online experience, setting a high bar for customer service.

Long-Term Implications

The competitive landscape in logistics is constantly evolving, and the long-term implications of FedEx’s strategic responses are multifaceted:

- Maintaining Market Position:FedEx’s investments in technology, efficiency, and customer experience are crucial to maintain its market position against established competitors and emerging players like Amazon.

- Adapting to Disruption:The rise of e-commerce and the increasing demand for faster and more flexible delivery options require FedEx to adapt its business model and embrace new technologies to remain competitive.

- Differentiation and Value Proposition:FedEx needs to differentiate itself from competitors by offering unique value propositions, such as specialized services, niche market focus, or innovative solutions, to attract and retain customers.

Ending Remarks

FedEx’s earnings call painted a picture of resilience and strategic adaptation in the face of ongoing market volatility. The company’s proactive approach to addressing demand challenges, coupled with its commitment to innovation, signals its determination to remain a dominant force in the logistics industry.

By leveraging technology, optimizing its network, and adapting its service offerings, FedEx is poised to navigate the complexities of the global marketplace and emerge stronger than ever.

Questions Often Asked

What were the key challenges FedEx highlighted in its earnings call?

FedEx cited fluctuating demand, economic uncertainties, and shifting global trade patterns as key challenges impacting its business.

How is FedEx using technology to address these challenges?

FedEx is leveraging technology to improve efficiency, enhance customer service, and optimize its network. The earnings call discussed specific examples of innovative solutions, such as automated sorting systems and data-driven route optimization.

What impact did these strategic responses have on FedEx’s financial performance?

The earnings call provided insights into FedEx’s recent financial performance, including revenue and earnings guidance. Key financial metrics were analyzed to assess the effectiveness of the company’s strategic responses to demand challenges.

CentralPoint Latest News

CentralPoint Latest News