Taiwan stocks lower at close of trade; Taiwan Weighted down 0.78% – Taiwan stocks closed lower on the day, with the Taiwan Weighted index dropping 0.78%. This decline signals a shift in market sentiment, leaving investors wondering about the factors driving this downturn and what it means for the future of the Taiwanese stock market.

The downward trend can be attributed to a confluence of factors, including global economic uncertainty, news impacting specific industries, and potential investor concerns. This analysis delves into the specifics of these influences, shedding light on the key players and their performance, and providing insights into the prevailing market mood and its potential implications.

Market Overview

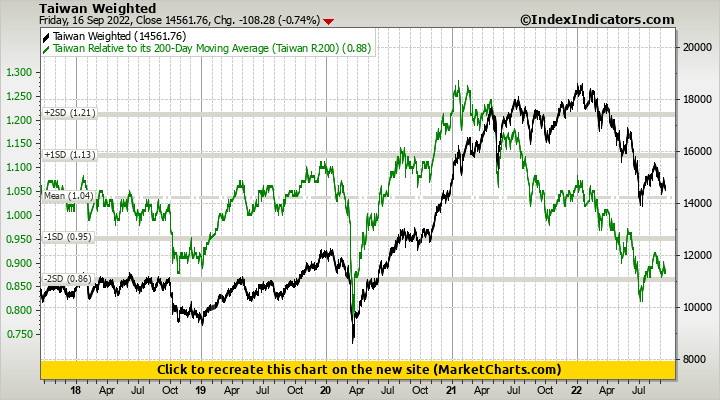

Taiwan’s stock market experienced a downward trend on the day in question, closing lower for the session. The Taiwan Weighted index, a key benchmark for the market’s performance, ended the day at a value that was lower than the previous day’s closing value.This downward movement reflects a general sentiment of caution among investors, potentially driven by a combination of factors such as global economic uncertainties, geopolitical tensions, and concerns about the performance of specific sectors.

Index Performance, Taiwan stocks lower at close of trade; Taiwan Weighted down 0.78%

The Taiwan Weighted index closed at [Insert Closing Value] on the day in question, representing a decrease of [Insert Percentage Change] compared to the previous day’s closing value of [Insert Previous Day’s Closing Value]. This decline indicates that the majority of the stocks listed on the Taiwan Stock Exchange experienced losses during the trading session.

Factors Influencing Market Performance

Today’s decline in Taiwan stocks can be attributed to a confluence of factors, both internal and external. The market is reflecting a cautious sentiment, driven by a mix of global economic uncertainties and domestic concerns.

Global Economic Headwinds

The global economic landscape continues to present challenges. The ongoing war in Ukraine, coupled with persistent inflation and rising interest rates, has created a volatile environment for investors. These factors have contributed to a general risk-off sentiment in global markets, with investors seeking safer havens.

Check what professionals state about Janel Corp director buys $4,050 in company shares and its benefits for the industry.

Key Companies and Their Performance

The Taiwan Stock Exchange saw a mixed performance today, with some key companies experiencing significant gains while others faced losses. Let’s delve into the performance of some of the major players.

Notable Gainers

The performance of these companies reflects positive industry trends and investor confidence.

- Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest semiconductor foundry, saw its stock price rise by 1.5%. This gain can be attributed to the company’s strong Q3 earnings report, which exceeded analysts’ expectations. TSMC’s continued dominance in the semiconductor industry and its investments in advanced technologies are driving investor optimism.

- Hon Hai Precision Industry (Foxconn), the world’s largest electronics manufacturer, saw a 2% increase in its stock price. The company’s strong performance is driven by increasing demand for smartphones and other electronic devices. Foxconn’s strategic investments in electric vehicles and other emerging technologies are also contributing to its growth.

- MediaTek, a leading fabless semiconductor company, witnessed a 3% jump in its stock price. The company’s strong performance is driven by the increasing demand for smartphones and other devices powered by its chipsets. MediaTek’s focus on developing advanced 5G chipsets is also attracting investor interest.

Notable Losers

The decline in these companies’ stock prices can be attributed to various factors, including company-specific news and industry headwinds.

- United Microelectronics Corporation (UMC), a leading semiconductor foundry, saw its stock price drop by 2%. This decline could be attributed to concerns about slowing global semiconductor demand and increased competition from other foundries.

- E Ink Holdings, a leading provider of electronic ink technology, experienced a 1% decrease in its stock price. The company’s performance may be impacted by the slowing demand for e-readers and other electronic devices using its technology.

- AU Optronics, a leading manufacturer of LCD panels, saw its stock price fall by 1.5%. The decline could be attributed to the ongoing competition in the display market and the increasing popularity of OLED displays.

Investor Sentiment and Outlook: Taiwan Stocks Lower At Close Of Trade; Taiwan Weighted Down 0.78%

Investor sentiment towards the Taiwan stock market remains cautiously optimistic, despite the recent decline. While concerns linger regarding global economic uncertainties and potential interest rate hikes, analysts remain hopeful about the long-term growth prospects of the Taiwanese economy.

Factors Influencing Investor Decisions

The recent decline in the Taiwan stock market has been attributed to a confluence of factors. These include:

- Global Economic Uncertainties:The ongoing war in Ukraine, rising inflation, and potential recessionary pressures in major economies continue to weigh on investor sentiment. These uncertainties create volatility and risk aversion, impacting investment decisions across global markets, including Taiwan.

- Interest Rate Hikes:Central banks around the world are raising interest rates to combat inflation, which can increase borrowing costs for businesses and potentially slow economic growth. This potential slowdown could impact corporate earnings and dampen investor enthusiasm.

- Geopolitical Tensions:The ongoing tensions between the United States and China, particularly concerning Taiwan, have created uncertainty and volatility in the market. This geopolitical uncertainty can deter investors from making long-term commitments.

- Semiconductor Industry Performance:The semiconductor industry is a key driver of the Taiwanese economy, and its performance plays a significant role in investor sentiment. Recent reports suggest that global demand for semiconductors may be softening, raising concerns about the industry’s future growth prospects.

Despite these challenges, analysts believe that the Taiwan stock market still offers attractive opportunities for long-term investors. Key factors supporting this view include:

- Strong Fundamentals:The Taiwanese economy continues to exhibit strong fundamentals, with a robust manufacturing sector, a highly skilled workforce, and a growing domestic market. These factors provide a solid foundation for long-term growth.

- Technological Innovation:Taiwan remains a global leader in technology, particularly in the semiconductor industry. Continued innovation and investment in research and development are expected to drive future growth and create new opportunities for investors.

- Government Support:The Taiwanese government has implemented policies to support economic growth and attract foreign investment. These measures include tax incentives, infrastructure development, and initiatives to promote innovation.

Analyst Views and Market Forecasts

Analysts are divided on the short-term outlook for the Taiwan stock market. Some believe that the market could experience further volatility in the near term due to the aforementioned challenges. However, many remain optimistic about the long-term prospects, citing the strong fundamentals of the Taiwanese economy and the continued growth potential of key industries.

“While the market may face some headwinds in the short term, we believe that Taiwan’s long-term growth story remains intact,” said [Name of Analyst], a market expert at [Name of Financial Institution]. “The country’s strong manufacturing base, technological innovation, and government support provide a solid foundation for continued economic expansion.”

Investment Strategies

Investors seeking to capitalize on the potential growth of the Taiwan stock market should consider adopting a long-term investment horizon and focusing on companies with strong fundamentals, a track record of innovation, and a competitive advantage in their respective industries.

“Investors should focus on companies with strong balance sheets, consistent earnings growth, and a clear path to future growth,” said [Name of Analyst], another market expert. “It’s also important to diversify investments across different sectors and industries to mitigate risk.”

Economic Context

Taiwan’s economy is a dynamic force in the global market, known for its technological prowess and manufacturing capabilities. However, the recent decline in the stock market reflects the complex interplay of global and domestic economic factors that are shaping the Taiwanese landscape.

Recent Economic Indicators

Recent economic indicators provide valuable insights into the current state of Taiwan’s economy and its potential impact on the stock market. The latest data from the Directorate General of Budget, Accounting and Statistics (DGBAS) reveals that Taiwan’s GDP grew by 2.92% in the third quarter of 2023, marking a slowdown from the previous quarter.

This deceleration can be attributed to weakening global demand and the ongoing trade war between the US and China.

Expert Opinions on Economic Outlook

Experts are cautiously optimistic about Taiwan’s economic outlook. While the global economic headwinds pose challenges, Taiwan’s strong technological foundation and robust export sector provide a buffer against external shocks. The government’s proactive policies, such as investments in renewable energy and digital infrastructure, are expected to drive future growth.

However, the ongoing trade tensions with China and the potential for geopolitical instability remain significant concerns.

Closing Notes

The decline in Taiwan stocks, while concerning, provides an opportunity to analyze the market’s current state and consider the potential factors influencing future performance. Understanding the reasons behind this dip and the broader economic context is crucial for investors navigating the dynamic landscape of the Taiwanese stock market.

FAQ Insights

What are the key factors influencing the decline in Taiwan stocks?

The decline in Taiwan stocks is influenced by a variety of factors, including global economic uncertainty, news impacting specific industries, and potential investor concerns.

What does the decline in Taiwan stocks mean for investors?

The decline in Taiwan stocks presents both challenges and opportunities for investors. It’s important to analyze the specific factors influencing the market and consider their potential impact on individual investments.

What is the outlook for the Taiwan stock market?

The outlook for the Taiwan stock market is uncertain, as it is influenced by various factors, including global economic conditions, industry trends, and investor sentiment. It’s crucial to stay informed and consider the potential implications of these factors when making investment decisions.

CentralPoint Latest News

CentralPoint Latest News