Sumitomo Mitsui buys $551.8 million worth of Jefferies Group stock, marking a significant move in the financial services landscape. This investment, a strategic maneuver by the Japanese financial giant, signals a potential shift in market dynamics and raises questions about the future of both companies.

This acquisition isn’t just about numbers; it’s about strategic positioning. Sumitomo Mitsui, a leading financial institution known for its global reach and expertise in investment banking, has made a calculated bet on Jefferies Group, a renowned investment bank with a strong presence in various sectors.

This move suggests a desire to capitalize on Jefferies Group’s market position and potentially expand its own reach in key areas.

The Investment

Sumitomo Mitsui Financial Group’s (SMFG) acquisition of a significant stake in Jefferies Group, a global investment bank, represents a strategic move with far-reaching implications for both companies. This investment, totaling $551.8 million, signifies SMFG’s commitment to expanding its global footprint and strengthening its position in the investment banking sector.

Strategic Positioning and Market Trends

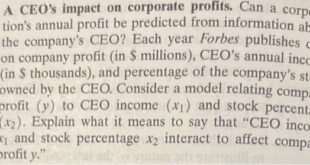

SMFG’s investment in Jefferies Group is a strategic move aimed at enhancing its presence in the global financial markets. This investment allows SMFG to leverage Jefferies Group’s expertise in investment banking, capital markets, and advisory services, particularly in the United States.

The investment also aligns with SMFG’s expansion strategy, as it seeks to diversify its revenue streams and gain access to new markets. The global investment banking landscape is undergoing significant changes, driven by factors such as regulatory reforms, technological advancements, and the increasing demand for specialized financial services.

SMFG’s investment in Jefferies Group reflects its recognition of these trends and its desire to position itself for future growth.

Potential Impact on Sumitomo Mitsui and Jefferies Group

This investment is expected to benefit both SMFG and Jefferies Group. For SMFG, the investment provides access to Jefferies Group’s network of clients, expertise in specific market segments, and a platform for expanding its global reach. This could lead to increased revenue generation and market share for SMFG.

For Jefferies Group, the investment provides access to SMFG’s resources, including its strong capital base and global network. This could enhance Jefferies Group’s ability to compete in the global investment banking market, particularly in areas such as mergers and acquisitions, debt financing, and equity underwriting.

Additionally, the investment could help Jefferies Group expand its operations in Asia, leveraging SMFG’s strong presence in the region.

Jefferies Group’s Business

Jefferies Group is a global investment bank that provides a wide range of financial services to corporations, governments, and institutions. The firm is known for its expertise in capital markets, investment banking, and asset management. Jefferies Group’s core business operations are structured around several key areas of expertise, including:

Investment Banking

Jefferies Group’s Investment Banking division provides advisory and capital-raising services to clients across a wide range of industries. The firm’s expertise in mergers and acquisitions (M&A), debt and equity capital markets, and restructuring has made it a leading player in the investment banking space.

The division’s recent performance has been strong, with a significant increase in M&A advisory fees and a robust pipeline of new deals.

Capital Markets, Sumitomo Mitsui buys 1.8 million worth of Jefferies Group stock

Jefferies Group’s Capital Markets division provides trading and brokerage services to institutional clients. The firm is a leading market maker in a wide range of asset classes, including equities, fixed income, and derivatives. Jefferies Group’s capital markets business has benefited from strong trading volumes and increased volatility in recent years.

The firm’s expertise in navigating complex market conditions has attracted a growing number of institutional clients.

Asset Management

Jefferies Group’s Asset Management division manages a wide range of investment products for institutional and individual investors. The firm’s investment strategies include equity, fixed income, and alternative investments. Jefferies Group’s asset management business has grown significantly in recent years, driven by strong performance and a focus on providing innovative investment solutions.

Recent Performance

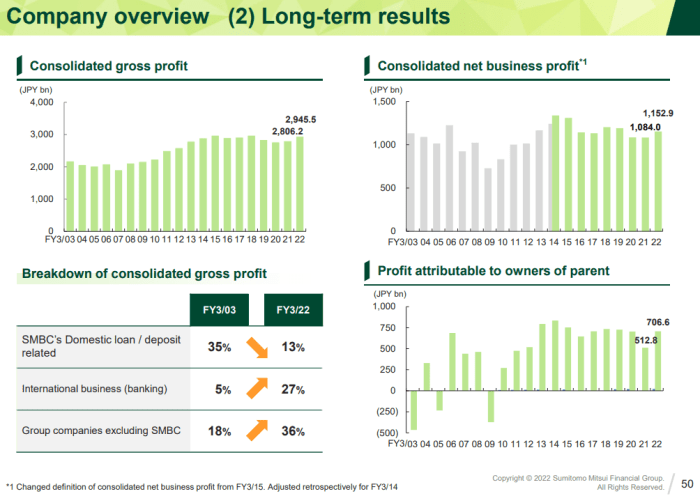

Jefferies Group has consistently delivered strong financial performance in recent years. The firm’s revenue and earnings have grown steadily, driven by growth in its core businesses. Jefferies Group’s recent financial performance is highlighted by the following key metrics:

- Revenue: Jefferies Group’s revenue has increased steadily in recent years, reaching $7.2 billion in 2022.

- Net Income: Jefferies Group’s net income has also grown steadily in recent years, reaching $1.5 billion in 2022.

- Return on Equity: Jefferies Group’s return on equity has consistently been above the industry average, reflecting the firm’s strong profitability.

Business Model Comparison

Jefferies Group’s business model is distinct from other major investment banks in several ways:

- Focus on niche markets: Jefferies Group has a strong focus on niche markets, such as healthcare, technology, and energy, where it has developed deep expertise.

- Client-centric approach: Jefferies Group is known for its client-centric approach, providing personalized service and tailored solutions.

- Independent ownership: Jefferies Group is a publicly traded company, but it is not owned by a large financial conglomerate, which allows it to maintain a more independent and entrepreneurial culture.

Sumitomo Mitsui’s Investment Strategy

Sumitomo Mitsui Financial Group (SMFG), Japan’s largest financial conglomerate, has a long history of strategic investments and partnerships. The company’s investment strategy is driven by a focus on long-term growth and value creation, with a keen eye on global market trends and opportunities.

Historical Approach to Strategic Acquisitions and Partnerships

SMFG’s investment strategy is characterized by a history of strategic acquisitions and partnerships, aimed at expanding its global reach and diversifying its business portfolio. This approach has been a key driver of its growth and success.

- Acquisitions:SMFG has made numerous strategic acquisitions over the years, including the acquisition of the U.S. investment bank, Donaldson, Lufkin & Jenrette (DLJ), in 2000. This acquisition significantly expanded SMFG’s presence in the global investment banking market and provided access to new markets and clients.

- Partnerships:SMFG has also formed strategic partnerships with other financial institutions around the world, such as its joint venture with Goldman Sachs in Japan. These partnerships have enabled SMFG to leverage the expertise and resources of other leading institutions, enhancing its ability to compete in the global financial services market.

Overall Investment Portfolio and Focus on Specific Industries or Sectors

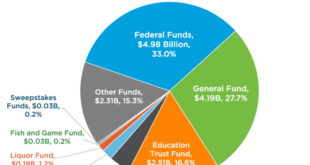

SMFG’s investment portfolio is diverse, spanning a range of industries and sectors. The company’s investment decisions are driven by a careful assessment of risk and return, with a focus on long-term value creation.

- Financial Services:SMFG has a strong presence in the financial services sector, with a particular focus on banking, investment banking, and asset management. The company’s investment in Jefferies Group reflects its commitment to expanding its investment banking capabilities in the global market.

- Technology:SMFG is also investing in the technology sector, recognizing the transformative potential of technology in the financial services industry. This includes investments in fintech companies and initiatives to develop innovative digital financial services.

- Infrastructure:SMFG invests in infrastructure projects, recognizing their long-term economic and social impact. These investments can include projects in transportation, energy, and telecommunications.

Potential Impact of the Jefferies Group Investment on SMFG’s Broader Investment Strategy

SMFG’s investment in Jefferies Group is a strategic move that aligns with its broader investment strategy. This investment is expected to:

- Expand SMFG’s Global Reach:By acquiring a significant stake in Jefferies Group, SMFG gains access to Jefferies’ global network of clients and markets, further expanding its international presence and reach.

- Enhance Investment Banking Capabilities:Jefferies Group is a leading investment bank with a strong presence in the U.S. and global markets. This investment will enhance SMFG’s investment banking capabilities, providing it with a wider range of products and services to offer clients.

- Strengthen Position in Key Sectors:Jefferies Group has a strong presence in key sectors such as energy, healthcare, and technology. This investment will provide SMFG with deeper expertise and insights into these sectors, enabling it to better serve its clients.

Market Impact

Sumitomo Mitsui’s significant investment in Jefferies Group has the potential to reshape the landscape of the financial services market, particularly within the investment banking industry. This strategic move could spark a wave of changes, affecting competition, opportunities, and challenges for other market players.

Impact on Competition

This investment could intensify competition within the investment banking industry. Sumitomo Mitsui’s global reach and resources, combined with Jefferies’ expertise in specific market segments, could create a formidable competitor. This could lead to:

- Increased pressure on other investment banks to expand their global footprint and expertise in niche markets.

- A potential shift in market share as Sumitomo Mitsui-Jefferies gains traction with clients seeking a broader range of services.

- More aggressive pricing strategies and competitive bidding for deals as firms strive to maintain their market position.

Opportunities and Challenges

This investment presents both opportunities and challenges for other market players.

In this topic, you find that Mara Holdings CEO sells shares worth over $430k is very useful.

- Opportunities:Other investment banks may find opportunities to collaborate with Sumitomo Mitsui-Jefferies on specific deals or projects, leveraging each other’s strengths. This could lead to cross-border partnerships and joint ventures, expanding their reach and expertise.

- Challenges:Smaller investment banks may face increased pressure to compete with the combined resources and scale of Sumitomo Mitsui-Jefferies. This could necessitate strategic alliances, mergers, or acquisitions to remain competitive in a rapidly evolving landscape.

Future Prospects

This strategic investment opens a new chapter for both Sumitomo Mitsui and Jefferies Group, promising a future brimming with opportunities and potential. By analyzing the timeline, potential scenarios, and market impact, we can gain a clearer picture of the transformative journey ahead.

Timeline of Key Milestones

This investment signifies a pivotal moment in the history of both institutions, setting the stage for a series of exciting developments. Here’s a timeline outlining potential milestones:

- Short Term (1-2 years):

- Increased collaboration on cross-border deals and transactions, leveraging each other’s expertise in their respective markets.

- Jointly developing new products and services catering to a wider client base.

- Expansion of Jefferies’ presence in the Asian market, particularly in Japan, with support from Sumitomo Mitsui’s extensive network.

- Medium Term (3-5 years):

- Potential for Sumitomo Mitsui to acquire a controlling stake in Jefferies Group, deepening their strategic partnership.

- Jefferies Group becoming a major player in the Japanese financial market, attracting a larger share of the local investment banking and capital markets business.

- Joint ventures and strategic alliances with other financial institutions, expanding their global reach and service offerings.

- Long Term (5+ years):

- Jefferies Group becoming a leading global investment bank, rivaling established players like Goldman Sachs and Morgan Stanley.

- Sumitomo Mitsui becoming a global financial powerhouse, with a significant presence in key markets worldwide.

- The combined entity potentially setting new industry standards in terms of innovation, client service, and financial performance.

Potential Scenarios

This investment presents a multitude of possibilities for both companies, with varying degrees of success and impact. The following table Artikels potential scenarios and their implications:

| Scenario | Sumitomo Mitsui | Jefferies Group |

|---|---|---|

| Highly Successful Integration | Enhanced global reach, increased market share, strengthened financial position, leading innovator in the financial services industry. | Rapid expansion in Asia, particularly Japan, increased market share, improved financial performance, strong brand recognition worldwide. |

| Moderate Success | Steady growth, increased presence in key markets, improved financial performance, enhanced reputation in the global financial landscape. | Significant expansion in Asia, improved financial performance, increased brand awareness, moderate success in expanding global reach. |

| Limited Success | Minimal impact on overall business, limited expansion in new markets, moderate financial performance, unchanged position in the global financial landscape. | Limited expansion in Asia, moderate financial performance, unchanged brand recognition, struggles to compete with established players. |

Shaping the Future

This strategic investment has the potential to reshape the future of both Sumitomo Mitsui and Jefferies Group, as well as the financial services industry as a whole. By combining their strengths and expertise, they can:

- Drive innovation:Jointly develop new products and services that cater to the evolving needs of clients in a rapidly changing financial landscape. For example, they could create innovative solutions for cross-border transactions, leveraging technology to enhance efficiency and reduce costs.

- Expand global reach:Sumitomo Mitsui’s extensive network in Asia, particularly Japan, can provide Jefferies Group with a platform to expand its operations and reach new clients in this key market. This could potentially lead to a more diversified and resilient business model, reducing reliance on any single region.

- Enhance competitiveness:By combining resources and expertise, they can create a more formidable competitor in the global financial services industry. This could lead to increased market share, improved profitability, and greater influence in shaping industry trends.

- Set new standards:The partnership can potentially set new standards for client service, financial performance, and innovation in the industry. This could lead to a more competitive and dynamic landscape, benefiting both clients and investors.

Wrap-Up

The impact of this investment will be felt across the financial services industry, potentially reshaping the competitive landscape. As Sumitomo Mitsui integrates Jefferies Group’s operations into its own, the world will watch to see how this alliance unfolds. This investment represents a significant move for both companies, and its implications for the future of the financial services industry remain to be seen.

The coming months will be crucial in determining how this strategic alliance will shape the future of both companies and the financial services industry as a whole.

Essential Questionnaire: Sumitomo Mitsui Buys 1.8 Million Worth Of Jefferies Group Stock

Why did Sumitomo Mitsui invest in Jefferies Group?

Sumitomo Mitsui likely invested in Jefferies Group to expand its reach in key markets, gain access to new expertise, and potentially leverage Jefferies Group’s existing client base. This move could also be a strategic response to changing market dynamics and the increasing competition in the financial services industry.

What is the potential impact of this investment on the financial services industry?

This investment could lead to increased competition in the investment banking sector, potentially affecting pricing, service offerings, and market share. It could also drive innovation and lead to new financial products and services.

What are the future prospects for Sumitomo Mitsui and Jefferies Group?

The future prospects for both companies will depend on how effectively they integrate their operations and leverage each other’s strengths. This investment has the potential to create a powerful financial force, but it will require careful planning and execution to ensure success.

CentralPoint Latest News

CentralPoint Latest News