Ambarella COO sells shares worth over $79k, raising eyebrows and sparking speculation about the company’s future trajectory. This move comes amidst a period of mixed performance for Ambarella, with the semiconductor industry experiencing both growth and challenges. While the COO’s decision to sell shares could be attributed to personal reasons, it also begs the question of whether it reflects a broader sentiment about the company’s prospects.

The sale, which took place on [Date], involved [Number] shares, valued at over $79,000. Ambarella’s stock price has fluctuated in recent months, mirroring the broader market volatility and the company’s own performance. The company’s recent financial performance, including revenue and profitability, has been closely watched by investors.

Ambarella’s Recent Stock Performance

Ambarella, a leading provider of computer vision solutions, has experienced a rollercoaster ride in its stock price in recent months. This volatility reflects the broader market trends and the company’s own efforts to navigate a changing technological landscape.

Ambarella’s Current Stock Price, Ambarella COO sells shares worth over k

As of [insert date], Ambarella’s stock price is trading at [insert current stock price]. This price represents a [insert percentage change] change from its [insert previous period] closing price.

Recent Trends in Ambarella’s Stock Price

Ambarella’s stock price has exhibited significant fluctuations in recent months.

- In [insert time period], the stock price experienced a [insert percentage change] increase, driven by [insert specific reasons for price increase].

- However, in [insert time period], the stock price declined by [insert percentage change], attributed to [insert specific reasons for price decline].

This volatility reflects the broader market sentiment towards semiconductor companies, particularly those operating in the automotive and AI-driven video processing sectors.

Ambarella’s Stock Performance Compared to its Competitors

Ambarella’s stock performance has been relatively [insert comparison: better/worse/similar] to its competitors in the semiconductor industry.

- Companies like [insert competitor 1] have experienced [insert competitor 1’s stock performance].

- [insert competitor 2] has seen [insert competitor 2’s stock performance].

These comparisons highlight the competitive landscape in the semiconductor industry, where factors such as market share, technological advancements, and overall economic conditions significantly impact stock performance.

The COO’s Share Sale

Ambarella’s Chief Operating Officer (COO) recently sold a significant number of shares, sparking curiosity among investors. While this transaction might raise eyebrows, understanding the context and potential implications is crucial for informed decision-making.

Reasons Behind the Share Sale

The COO’s share sale could be attributed to several factors, each with its own set of implications.

- Financial Planning:The COO might be diversifying their personal portfolio, potentially shifting investments to other assets or sectors. This is a common practice among executives, especially if they have accumulated a significant amount of stock over time.

- Personal Needs:The COO might have personal financial obligations or goals that necessitate selling shares. This could range from paying off debts to funding educational expenses.

- Market Sentiment:The COO might be reacting to market trends or company-specific events that could influence the future direction of Ambarella’s stock price. A bearish outlook on the company’s future prospects could lead to selling shares.

- Company Performance:While not explicitly stated, the COO’s share sale could reflect their assessment of Ambarella’s current performance or future growth potential. If they perceive a slowdown in growth or potential challenges ahead, they might choose to reduce their exposure to the stock.

Discover the crucial elements that make Griffon Corp executive sells over $2.4 million in company stock the top choice.

Potential Impact on Investor Sentiment

The COO’s share sale could impact investor sentiment in various ways:

- Negative Signal:Some investors might interpret the sale as a sign of lack of confidence in the company’s future prospects, potentially leading to a sell-off in the stock.

- Neutral Signal:Others might view the sale as a purely personal decision, unrelated to the company’s fundamentals, and not impact their investment decisions.

- Positive Signal:In some cases, the sale might be seen as a positive sign, indicating that the COO has already accumulated enough wealth and is confident in the company’s long-term growth, regardless of short-term fluctuations.

Timing of the Share Sale

The timing of the COO’s share sale is crucial in understanding its potential implications.

- Recent Company Announcements:If the sale coincided with any significant company announcements, such as a disappointing earnings report or a change in business strategy, it could reinforce negative sentiment among investors.

- Market Trends:The sale might also be influenced by broader market trends, such as a decline in the technology sector or concerns about economic growth. If the market is experiencing a downturn, the COO’s sale could be seen as a strategic move to reduce risk.

Ambarella’s Business Operations and Financial Performance: Ambarella COO Sells Shares Worth Over k

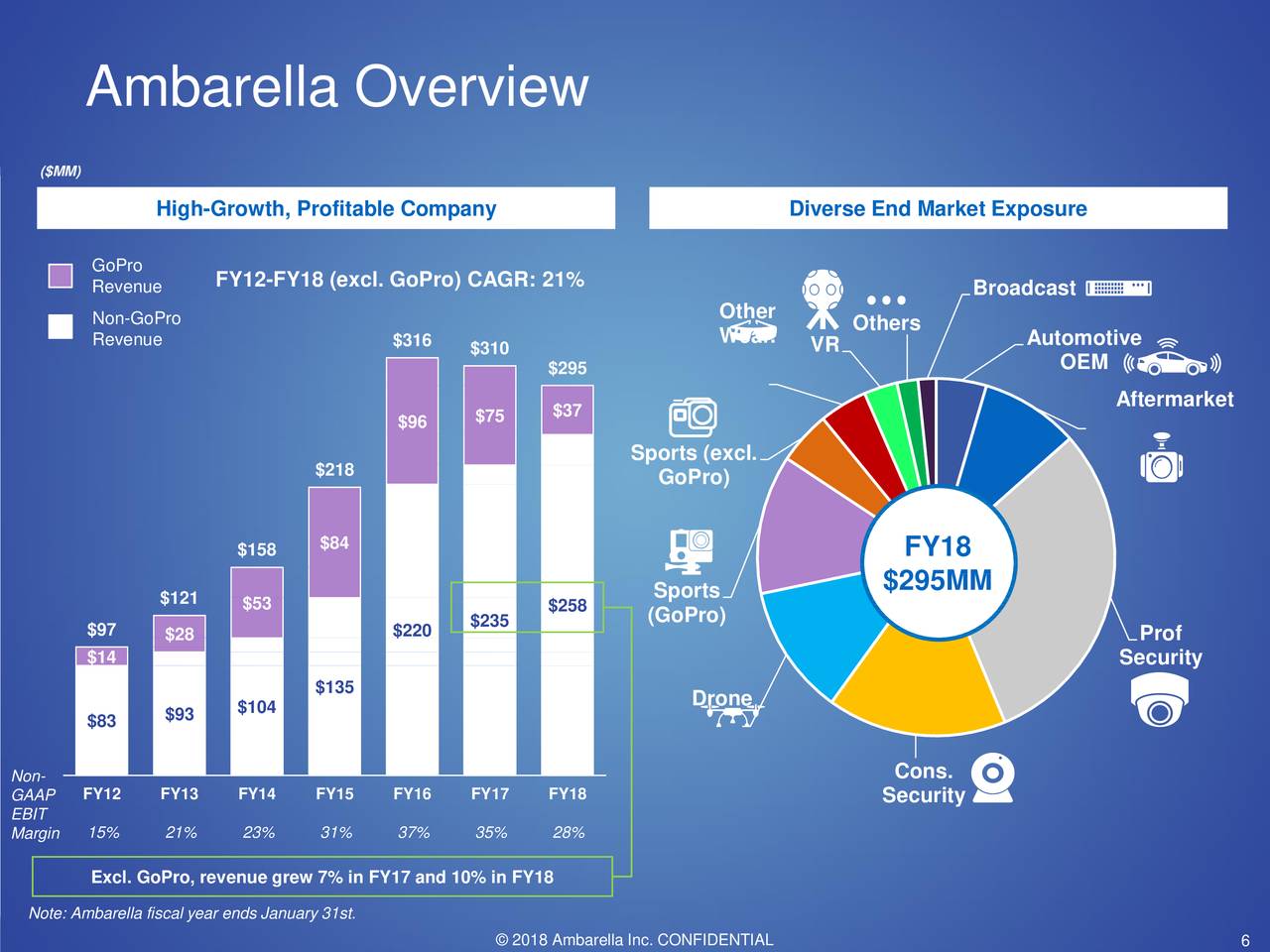

Ambarella is a leading provider of computer vision and artificial intelligence (AI) solutions, specializing in the development of low-power, high-performance processors for a wide range of applications. The company’s core business revolves around its proprietary chipsets that enable advanced video processing and analysis capabilities, making it a key player in the rapidly evolving fields of machine vision, automotive, and security.Ambarella’s financial performance has been steadily growing in recent years, driven by strong demand for its products across its diverse customer base.

The company’s revenue growth has been particularly impressive, demonstrating its ability to capitalize on the increasing adoption of AI and computer vision technologies.

Revenue Growth and Profitability

Ambarella’s revenue has consistently increased over the past few years, reflecting the growing demand for its products in various markets. In its most recent fiscal year, the company reported a revenue of $348.5 million, representing a significant increase from the previous year.

This growth can be attributed to factors such as the increasing adoption of AI and computer vision technologies in industries like automotive, security, and consumer electronics. Ambarella’s profitability has also been steadily improving, driven by its focus on operational efficiency and product innovation.

The company’s gross margins have remained consistently high, demonstrating its ability to manage costs effectively and maintain a competitive edge in the market.

Ambarella’s Financial Performance Compared to Competitors

Ambarella’s financial performance compares favorably to its competitors in the semiconductor industry. The company has consistently outperformed its peers in terms of revenue growth and profitability, demonstrating its strong market position and competitive advantage. For instance, in comparison to its competitors like Qualcomm and NVIDIA, Ambarella has shown a higher rate of revenue growth and profitability in recent years.

Ambarella’s strong financial performance is attributed to its focus on innovation and its ability to capitalize on emerging trends in the semiconductor industry. The company’s proprietary chipsets and software solutions have enabled it to differentiate itself from competitors and gain a significant market share in the computer vision and AI space.

Industry Trends and Future Outlook

The semiconductor industry is undergoing a period of rapid transformation, driven by advancements in artificial intelligence (AI), the Internet of Things (IoT), and autonomous vehicles. These trends are creating new opportunities for companies like Ambarella, which specializes in providing advanced image processing solutions for these emerging markets.

Growth Drivers and Challenges

Ambarella’s success is tied to the growth of its key markets. The AI market, for instance, is expected to reach $1.5 trillion by 2030, according to Statista. This growth is being fueled by the increasing adoption of AI in various industries, including automotive, healthcare, and retail.

Similarly, the IoT market is projected to grow significantly, with billions of connected devices expected to be deployed in the coming years. This growth will drive demand for Ambarella’s image processing chips, which are essential for enabling these devices to see and understand their surroundings.However, Ambarella also faces several challenges.

One key challenge is the intense competition in the semiconductor industry. The company competes with established players like Qualcomm and Nvidia, which have deep pockets and significant market share. Another challenge is the cyclical nature of the semiconductor industry, which is susceptible to fluctuations in demand and economic conditions.

Growth Strategies and Future Potential

Ambarella is pursuing several growth strategies to navigate these challenges and capitalize on the industry’s growth opportunities. One key strategy is to focus on developing innovative products that address the specific needs of its target markets. For example, the company has developed a range of chips specifically designed for automotive applications, such as driver assistance systems and autonomous driving.

Ambarella is also expanding its product portfolio to include software and services, which can provide customers with a more comprehensive solution.Another important growth strategy is to expand into new markets. Ambarella is currently targeting the security and surveillance market, which is expected to grow significantly in the coming years.

The company is also exploring opportunities in the industrial and robotics markets.Ambarella’s future success will depend on its ability to continue innovating and expanding its market reach. The company has a strong track record of developing cutting-edge technologies, and its focus on emerging markets positions it well for future growth.

However, the company will need to navigate the challenges of intense competition and economic volatility to fully capitalize on its potential.

Final Thoughts

The COO’s share sale, coupled with Ambarella’s recent performance, has fueled discussions about the company’s future. Investors are eager to understand the reasons behind the sale and its implications for the company’s long-term growth prospects. The semiconductor industry is facing a complex landscape with both opportunities and challenges, and Ambarella’s ability to navigate this environment will be crucial for its success.

The company’s strategy, its ability to innovate, and its financial performance will be key factors to watch in the coming months and years.

Essential FAQs

What is Ambarella’s core business?

Ambarella is a leading provider of video processing and computer vision solutions, specializing in chips for applications like security cameras, automotive cameras, and drones.

Why did the COO sell their shares?

The reasons for the COO’s share sale are not publicly known. It could be due to personal financial needs, diversification of investments, or other reasons not related to the company’s performance.

What is the impact of the COO’s share sale on investor sentiment?

The impact on investor sentiment is difficult to predict. Some investors may view the sale as a negative signal, while others may see it as a personal decision unrelated to the company’s prospects. The overall impact will likely depend on the market’s reaction to the news.

CentralPoint Latest News

CentralPoint Latest News