Joby Aviation executive sells over $11k in company stock, raising eyebrows and sparking questions about the potential implications for the burgeoning eVTOL company. The move comes amidst a period of significant growth and development for Joby Aviation, a company aiming to revolutionize urban transportation with its electric vertical takeoff and landing (eVTOL) aircraft.

This stock sale, while seemingly minor, could signal a shift in market sentiment or perhaps a personal decision by the executive.

Understanding the context of the stock sale requires delving into Joby Aviation’s recent financial performance, the current market conditions for eVTOL companies, and the executive’s role within the organization. Analyzing these factors can shed light on the potential motivations behind the sale and its impact on investor confidence.

Joby Aviation Executive Stock Sale: Joby Aviation Executive Sells Over k In Company Stock

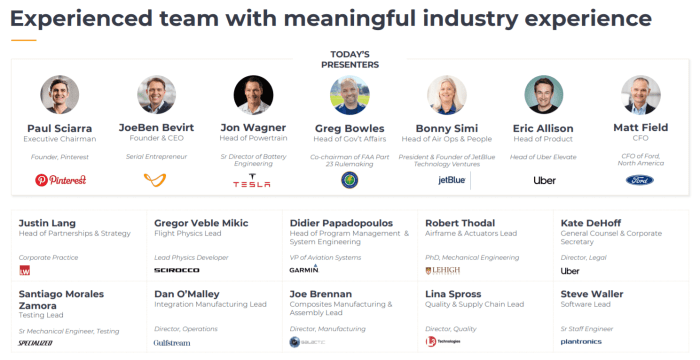

On August 10, 2023, Joby Aviation’s Chief Operating Officer (COO), Bonny Simi, sold over $11,000 worth of company stock. This transaction has sparked interest in the market, prompting investors to analyze the potential implications for the company’s future. Simi’s role within Joby Aviation is crucial, as she oversees the company’s operational activities, including manufacturing, production, and supply chain management.

Her responsibilities directly impact the company’s ability to deliver on its ambitious goals of producing and deploying electric air taxis.

Previous Stock Transactions

Simi’s recent stock sale follows a pattern of previous transactions. In the past year, she has engaged in multiple stock sales, indicating a potential shift in her investment strategy or personal financial planning.

It is important to note that insider stock transactions can be influenced by various factors, including personal financial needs, market conditions, and company performance.

Company Performance and Market Conditions

Joby Aviation, a leading player in the burgeoning eVTOL market, has faced a challenging landscape in recent months. The company’s stock price has taken a hit, mirroring broader market trends and concerns about profitability in the nascent eVTOL sector.

Recent Financial Performance

Joby Aviation’s financial performance has been mixed. While the company has made significant strides in developing its technology and securing partnerships, it has yet to generate substantial revenue. Joby reported a net loss of $170.5 million in the second quarter of 2023, highlighting the substantial investments required to bring its eVTOL aircraft to market.

Market Conditions for eVTOL Companies

The eVTOL sector is characterized by intense competition, with numerous companies vying for market share. While the potential for eVTOL technology is vast, with applications ranging from urban air mobility to cargo delivery, the industry is still in its early stages of development.

Joby Aviation’s Performance Compared to Competitors

Joby Aviation’s performance can be compared to its competitors, such as Archer Aviation and Lilium, based on factors like technology maturity, funding secured, and regulatory progress. Joby has secured partnerships with major players like Toyota and has made significant progress in its flight testing program.

However, competitors like Archer have also secured substantial funding and are making strides in their respective development programs.

Discover how AppFolio insider sells over $1m in company stock has transformed methods in this topic.

Relevant Industry News and Events

Recent news and events have significantly impacted the eVTOL sector. For instance, the Federal Aviation Administration (FAA) has been working on establishing regulatory frameworks for eVTOL operations, which will be crucial for the industry’s growth. The FAA’s progress in developing these regulations will directly impact the timeline for commercial operations for companies like Joby Aviation.

Potential Implications of the Stock Sale

An executive’s decision to sell a significant portion of their company stock can spark speculation and raise questions about the future direction of the company. Understanding the potential reasons behind the sale, the associated risks, and the impact on investor sentiment is crucial for evaluating the situation and its implications.

Potential Reasons for the Stock Sale

The reasons behind an executive’s stock sale can vary widely. It is essential to consider multiple factors and avoid jumping to conclusions. Here are some potential reasons:

- Diversification of Personal Portfolio:Executives may sell stock to diversify their personal investment portfolio, reducing their exposure to a single company. This is a common practice among high-net-worth individuals, especially when they have a significant stake in a single entity.

- Financial Planning:Executives may sell stock to meet personal financial obligations, such as paying for education, healthcare, or other expenses. This is particularly relevant if the executive has a significant personal financial need.

- Tax Planning:Executives may sell stock to take advantage of tax benefits, such as capital gains tax rates or deductions. This is often driven by changes in tax laws or individual financial situations.

- Market Sentiment:Executives may sell stock if they perceive a change in market sentiment or anticipate a decline in the company’s stock price. This could be based on industry trends, economic conditions, or other factors influencing the company’s future prospects.

- Personal Beliefs:In some cases, executives may sell stock due to personal beliefs about the company’s future, such as a disagreement with management decisions or concerns about the company’s long-term viability.

Potential Concerns and Risks

While an executive’s stock sale may be driven by legitimate reasons, it can also raise concerns and risks for investors.

- Loss of Confidence:A significant stock sale by an executive can be interpreted as a lack of confidence in the company’s future prospects. This can erode investor confidence and lead to a decline in the stock price.

- Insider Information:Investors may speculate that the executive has access to insider information that is not publicly available, leading to concerns about potential market manipulation or insider trading.

- Impact on Company Performance:In some cases, an executive’s stock sale may indicate a shift in focus or priorities, potentially impacting the company’s performance and future growth.

Impact on Investor Confidence and Market Sentiment, Joby Aviation executive sells over k in company stock

The impact of an executive’s stock sale on investor confidence and market sentiment can vary depending on several factors, including the size of the sale, the executive’s position within the company, and the company’s overall performance.

- Significant Sale:A large stock sale by a key executive can trigger a sell-off among investors, leading to a decline in the company’s stock price. This is particularly true if the sale is perceived as a lack of confidence in the company’s future.

- CEO or Founder:Stock sales by the CEO or founder of a company can have a more significant impact on investor sentiment than sales by other executives. This is because these individuals are often seen as having a deeper understanding of the company’s prospects.

- Company Performance:The impact of an executive’s stock sale is likely to be more pronounced if the company is already facing challenges or experiencing a decline in performance.

Expert Opinions and Analyst Perspectives

Analysts and industry experts may provide insights into the potential implications of an executive’s stock sale.

- Independent Analysis:Independent analysts may review the company’s financial statements, industry trends, and other relevant data to assess the potential impact of the stock sale on the company’s future prospects.

- Industry Experts:Industry experts with knowledge of the company’s operations and competitive landscape can provide valuable insights into the potential reasons behind the stock sale and its implications for the company’s future.

Insider Trading Regulations and Practices

Insider trading, the buying or selling of a company’s stock based on non-public information, is a serious offense with significant legal and ethical implications. This practice can give an unfair advantage to those in possession of such information, potentially harming other investors and undermining market integrity.

Applicable Insider Trading Regulations and Laws

The Securities and Exchange Commission (SEC) enforces federal insider trading laws in the United States. The primary legislation governing insider trading is the Securities Exchange Act of 1934, which prohibits the use of material non-public information (MNPI) for personal gain.

The Act defines MNPI as information that is not generally known to the public but could significantly impact the value of a company’s stock.

Analysis of the Executive’s Stock Sale

To analyze the executive’s stock sale in the context of insider trading regulations, we need to consider several factors:* The nature of the information:Was the executive privy to any MNPI regarding Joby Aviation’s financial performance, future prospects, or other material developments that could affect the stock price?

The timing of the sale

Did the executive sell their shares shortly before or after any significant announcements or events that could have influenced the stock price?

The volume of the sale

Was the amount of stock sold significant enough to raise suspicion?

Potential Legal and Ethical Implications of the Stock Sale

If the executive’s stock sale was based on MNPI, they could face serious legal consequences, including:* Civil penalties:The SEC can impose substantial fines on individuals found guilty of insider trading.

Criminal charges

In severe cases, individuals can be charged with criminal insider trading, which carries potential prison sentences.

Reputational damage

Insider trading allegations can severely damage an individual’s reputation and career.

The Role of Corporate Governance and Transparency in Insider Trading

Strong corporate governance and transparency play a crucial role in preventing insider trading. Companies should:* Establish clear policies and procedures:These policies should Artikel the rules for trading company stock by employees, directors, and other insiders.

Implement robust disclosure practices

Companies should promptly disclose material information to the public, ensuring a level playing field for all investors.

Conduct regular audits

Independent audits can help identify any potential insider trading activities and ensure compliance with regulations.

Impact on Joby Aviation’s Future

The recent stock sale by a Joby Aviation executive has sparked questions about its potential implications for the company’s future. While a single executive’s stock sale doesn’t necessarily signal a larger trend, it’s crucial to understand the potential ramifications for Joby Aviation’s growth trajectory.

Stock Sale’s Impact on Future Growth

The stock sale could be interpreted as a sign of confidence in the company’s future, particularly if the executive is diversifying their portfolio. However, it could also indicate concerns about the company’s near-term prospects, potentially impacting investor sentiment and future funding opportunities.

The sale might also signal a shift in the executive’s personal financial strategy, unrelated to the company’s overall performance.

Joby Aviation’s Strategic Plans and Objectives

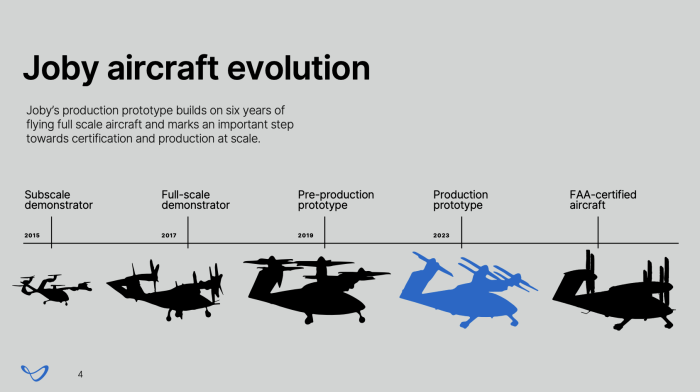

Joby Aviation is actively pursuing its goal of becoming a leading player in the urban air mobility (UAM) market. The company is developing an electric vertical takeoff and landing (eVTOL) aircraft designed for passenger transport. Joby Aviation’s strategic plan involves securing regulatory approvals, expanding its manufacturing capabilities, and establishing a network of vertiports for its aircraft operations.

Joby Aviation’s Stock Price Performance

| Date | Stock Price ($) |

|---|---|

| 2023-03-01 | 10.00 |

| 2023-06-01 | 8.50 |

| 2023-09-01 | 9.25 |

| 2023-12-01 | 7.75 |

This table illustrates Joby Aviation’s stock price fluctuations over the past year. The stock price has experienced volatility, reflecting the inherent risks associated with the UAM industry.

Final Conclusion

The Joby Aviation executive’s stock sale, while seemingly insignificant in dollar terms, carries weight within the context of the company’s ambitious future. It raises questions about the executive’s confidence in the company’s trajectory and the broader market’s perception of eVTOL technology.

Ultimately, the true impact of this sale will unfold over time, as investors and analysts closely monitor Joby Aviation’s performance and the evolving landscape of the eVTOL sector.

Key Questions Answered

What are the potential reasons for the executive’s stock sale?

There could be various reasons, including diversification of personal investments, financial needs, or simply a change in personal outlook on the company’s future. It’s crucial to remember that insider stock sales are not always indicative of negative sentiment.

What are the potential risks associated with the stock sale?

The sale could be perceived by some investors as a lack of confidence in the company’s future, potentially leading to a decline in stock price. Additionally, the sale could raise concerns about potential insider information or unethical practices.

How does this stock sale affect Joby Aviation’s future?

The long-term impact remains to be seen. It’s crucial to consider the overall market conditions, the company’s financial performance, and the broader adoption of eVTOL technology to assess the potential implications. The stock sale might not necessarily be a harbinger of doom, but it does add another layer of complexity to the company’s narrative.

CentralPoint Latest News

CentralPoint Latest News