ACV Auctions executive sells $1.5 million in company stock, a move that has sparked widespread curiosity and speculation within the automotive industry. This significant transaction has sent ripples through the market, raising questions about the executive’s motivations, the potential impact on the company’s future, and the implications for investors.

The sale, which involved a substantial portion of the executive’s holdings in ACV Auctions, has ignited discussions about the company’s financial health and its position within the competitive automotive marketplace. Analysts are scrutinizing the transaction, seeking clues about the executive’s confidence in the company’s long-term prospects and the potential influence of the sale on investor sentiment.

Executive Stock Sale

An ACV Auctions executive recently sold $1.5 million worth of company stock, sparking discussions about the potential implications for the company’s financial health and future prospects. This move has raised questions about the executive’s motivations and whether any potential conflicts of interest or insider trading concerns exist.

Executive’s Motivations

The executive’s decision to sell such a significant amount of stock could be driven by various factors.

- Financial Planning:The executive might be diversifying their portfolio or meeting personal financial obligations, such as paying for education or retirement.

- Market Outlook:The executive may have a less optimistic view of the company’s future performance than the market, prompting them to sell their shares.

- Personal Circumstances:Unforeseen personal circumstances, such as a family emergency or a need for immediate liquidity, could also motivate the stock sale.

ACV Auctions Market Position

ACV Auctions has established itself as a leading player in the rapidly evolving automotive wholesale marketplace. The company leverages technology to streamline the auction process, providing a transparent and efficient platform for buying and selling used vehicles.

Competitive Landscape

ACV Auctions operates in a competitive landscape with several established players and emerging disruptors. Key competitors include:

- Manheim Auctions:A long-standing leader in the wholesale vehicle auction industry, Manheim offers a vast network of physical auction locations and online platforms.

- ADESA:Another major player in the wholesale vehicle auction market, ADESA provides a similar range of services as Manheim, including physical auctions and online platforms.

- KAR Auction Services:A diversified automotive services company, KAR operates multiple auction brands, including ADESA and Impact Auctions , catering to different segments of the market.

- eBay Motors:A prominent online marketplace for buying and selling vehicles, eBay Motors offers a wide selection of used vehicles and attracts a diverse range of buyers and sellers.

- Online Auction Platforms:Several emerging online auction platforms, such as Copart and IAAI , are gaining traction by offering a more digital-centric approach to vehicle auctions.

Recent Performance and Financial Trends

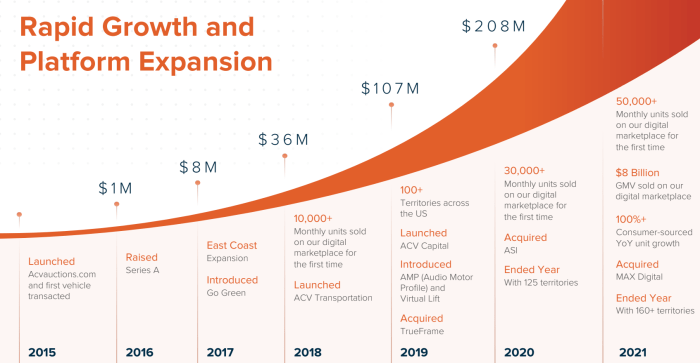

ACV Auctions has demonstrated strong financial performance in recent years, reflecting the growing demand for its digital auction platform. The company’s revenue has consistently increased, driven by the expansion of its customer base and the adoption of its technology-driven approach.

ACV Auctions’ revenue grew by over 100% in 2021, demonstrating the company’s strong market position and growth potential.

Growth Strategy and Future Plans

ACV Auctions is focused on expanding its market share and strengthening its position as a leading provider of digital wholesale vehicle auction solutions. The company’s growth strategy includes:

- Expanding its customer base:ACV Auctions is actively targeting new customers in the automotive industry, including dealerships, fleet operators, and independent buyers and sellers.

- Developing innovative technology solutions:The company is investing in research and development to enhance its platform and introduce new features that improve the auction experience for buyers and sellers.

- Expanding its geographic reach:ACV Auctions is exploring opportunities to expand its operations into new markets both domestically and internationally.

Impact on Investor Sentiment: ACV Auctions Executive Sells

.5 Million In Company Stock

The executive stock sale of $1.5 million in ACV Auctions stock has the potential to impact investor sentiment, as it might be perceived as a lack of confidence in the company’s future prospects by some investors. It’s crucial to analyze the context of the sale and compare it to other recent events affecting the company’s share price to understand its potential impact.

Stock Sale in Context

The stock sale needs to be evaluated within the broader context of the company’s performance, market conditions, and the executive’s personal financial situation. For instance, if the sale is a part of a pre-planned diversification strategy or is prompted by personal reasons, it may not necessarily indicate a lack of faith in the company’s future.

However, if the sale occurs amidst a period of declining share prices or negative financial news, it could amplify investor concerns.

Comparison with Recent Events

To understand the potential impact of the executive stock sale, it’s essential to compare it with other recent events affecting ACV Auctions’ share price. For example, if the company recently announced a positive earnings report or a strategic partnership, the impact of the stock sale might be less pronounced.

However, if the sale coincides with a period of negative news, such as a missed earnings target or a regulatory investigation, it could exacerbate investor anxiety.

Short-Term and Long-Term Market Fluctuations

The executive stock sale could lead to short-term market fluctuations as investors react to the news. The sale could trigger a sell-off, particularly if it’s perceived as a sign of insider selling or a lack of confidence in the company’s future.

However, if the sale is well-explained and the company continues to perform well, the impact on the share price could be short-lived. In the long term, the sale’s impact will depend on the company’s overall performance and the broader market conditions.

If ACV Auctions continues to deliver strong financial results and demonstrate sustainable growth, the stock sale is unlikely to have a significant long-term impact.

Implications for Fundraising Efforts and Future Stock Performance

The executive stock sale could potentially impact the company’s fundraising efforts. If investors perceive the sale as a negative sign, it could make it more challenging for the company to raise capital in the future. Additionally, the sale could affect the company’s future stock performance.

Further details about Cooper Companies CEO sells over $12 million in stock is accessible to provide you additional insights.

If the stock price declines due to the sale, it could make it more difficult for the company to attract new investors and potentially hurt its valuation.

Corporate Governance and Transparency

The recent sale of $1.5 million in company stock by ACV Auctions’ executives has raised questions about the company’s corporate governance practices and the level of transparency surrounding the transaction. This section examines the company’s governance framework, the information disclosed about the sale, and potential areas for improvement in both areas.

Corporate Governance Practices

ACV Auctions’ corporate governance practices are guided by the principles Artikeld in the company’s Corporate Governance Guidelines, which emphasize ethical conduct, transparency, and accountability. The company’s board of directors plays a key role in overseeing these practices, with independent directors comprising a majority of the board.

The board is responsible for approving executive compensation, setting strategic direction, and ensuring the company operates in compliance with applicable laws and regulations.

Transparency Regarding the Executive Stock Sale

ACV Auctions disclosed the executive stock sale through a Form 4 filing with the Securities and Exchange Commission (SEC), which provides details about the sale, including the date, number of shares sold, and the price per share. While the company adhered to the SEC’s disclosure requirements, the information provided in the filing was limited to the bare minimum, leaving investors with unanswered questions about the reasons behind the sale.

Areas for Improvement in Corporate Governance and Disclosure

ACV Auctions could enhance its corporate governance practices and disclosure by:

- Providing more context about the executive stock sale.While the SEC filing disclosed the basic details of the transaction, investors would benefit from additional information about the rationale behind the sale, the timing of the sale, and the potential impact on the company’s future performance. This could include a statement from the company’s management explaining the reasons for the sale and any potential implications for investors.

- Implementing a policy regarding insider trading.A clear policy on insider trading can help ensure that executives are not engaging in activities that could harm investors’ confidence. Such a policy should include specific guidelines for insider trading activities, penalties for violations, and a process for reporting suspected violations.

- Enhancing the independence of the board of directors.While the board of directors currently has a majority of independent directors, the company could further enhance the independence of the board by ensuring that directors have no material financial ties to the company and that they have the necessary expertise to oversee the company’s operations.

Comparison to Industry Standards and Best Practices, ACV auctions executive sells

.5 million in company stock

ACV Auctions’ corporate governance practices and disclosure practices generally align with industry standards and best practices. However, the company could benefit from adopting some of the best practices implemented by other companies in the industry. For instance, some companies provide more detailed information about executive stock sales in their SEC filings, including a statement from management explaining the rationale behind the sale and its potential impact on the company’s future performance.

Additionally, some companies have adopted policies that prohibit executives from selling stock during certain periods, such as during the company’s earnings blackout period.

Implications for Industry Trends

The executive stock sale, while a significant event, must be analyzed within the broader context of the automotive industry’s evolving landscape. The sale’s impact on the perception of the automotive auction market and its potential influence on future investment decisions deserve careful consideration.

Impact on the Perception of the Automotive Auction Market

The executive stock sale reflects a positive sentiment towards ACV Auctions’ future prospects. This transaction underscores the company’s strong financial position and its ability to attract investment. It also serves as a signal of confidence in the long-term growth potential of the online automotive auction market.

This positive perception can encourage other investors to enter the market, leading to increased competition and innovation.

Potential Implications for the Future of Online Auctions and Digital Marketplaces

The growth of online auctions and digital marketplaces in the automotive industry is undeniable. The recent executive stock sale reinforces this trend. It suggests that investors are recognizing the efficiency, transparency, and accessibility offered by these platforms. This shift towards digital solutions is likely to continue, leading to further consolidation in the industry and the emergence of new players.

Influence on Future Investment Decisions

The executive stock sale provides valuable insights for future investment decisions in the automotive sector. It demonstrates the attractiveness of online auction platforms and the potential for strong returns. Investors may now be more inclined to allocate capital to companies operating in this space, further driving growth and innovation.

However, it is crucial to consider the competitive landscape and the potential for market saturation as online auctions become increasingly popular.

End of Discussion

The executive’s stock sale serves as a focal point for examining the intricate interplay of corporate governance, market dynamics, and investor confidence within the automotive industry. As the ripple effects of this transaction continue to unfold, the industry will be watching closely to see how ACV Auctions navigates the challenges and opportunities that lie ahead.

The sale has undoubtedly brought the company’s financial health and future prospects under intense scrutiny, leaving investors and analysts alike eager to decipher the implications of this pivotal event.

Commonly Asked Questions

What is ACV Auctions?

ACV Auctions is a leading online marketplace for wholesale used vehicles, connecting dealers and buyers across the United States.

Why did the executive sell their stock?

The executive’s reasons for selling their stock are not publicly disclosed. It could be due to personal financial planning, diversification, or other factors.

What is the impact of the stock sale on ACV Auctions’ share price?

The impact of the stock sale on ACV Auctions’ share price is difficult to predict. It depends on various factors, including the market’s overall sentiment and the company’s future performance.

Is the stock sale a sign of insider trading?

The stock sale does not necessarily indicate insider trading. The executive may have sold their shares for legitimate reasons, and the transaction is likely subject to regulatory scrutiny.

CentralPoint Latest News

CentralPoint Latest News