Mexico stocks higher at close of trade; S&P/BMV IPC up 0.64% – Mexico stocks closed higher, with the benchmark S&P/BMV IPC index gaining 0.64% on the day. This upward trajectory reflects a positive sentiment in the Mexican market, fueled by a confluence of factors, including economic indicators, global market trends, and investor optimism.

The rise in Mexican stocks suggests a growing confidence in the country’s economic prospects. This positive performance is attributed to a combination of factors, such as robust GDP growth, controlled inflation, and favorable interest rates. The global market trends also played a role, with investors seeking opportunities in emerging markets like Mexico.

Market Overview

The Mexican stock market closed higher on the day in question, fueled by positive sentiment and a general upward trend in global markets. The S&P/BMV IPC, Mexico’s benchmark stock index, serves as a key indicator of the overall performance of the Mexican stock market.

S&P/BMV IPC Performance

The S&P/BMV IPC closed at [closing value] on the day in question, representing a [percentage change] increase from the previous day’s closing. This positive performance reflects the overall optimism in the Mexican stock market, driven by factors such as [mention specific factors contributing to the market’s performance, e.g., strong economic indicators, positive corporate earnings, or favorable investor sentiment].

Mexican Stock Market Performance

The overall performance of the Mexican stock market on the day in question was positive, with a majority of sectors showing gains. This upward trend was driven by a combination of factors, including:

- Strong economic indicators: [Mention specific economic indicators, e.g., robust GDP growth, low inflation, or positive employment data].

- Positive corporate earnings: [Mention specific examples of companies reporting strong earnings, e.g., companies in the energy, consumer goods, or financial sectors].

- Favorable investor sentiment: [Mention specific factors contributing to positive investor sentiment, e.g., global economic recovery, low interest rates, or increasing investment in emerging markets].

Key Factors Influencing Market Performance

The rise in Mexican stocks can be attributed to a confluence of factors, reflecting both domestic economic strength and positive global market sentiment.

Economic Indicators

Economic indicators play a significant role in influencing investor confidence and driving stock market performance. Mexico’s recent economic performance has been a key driver of the stock market’s upward trajectory.

- GDP Growth:Mexico’s economy has shown resilience, with GDP growth exceeding expectations in recent quarters. This positive economic outlook instills confidence among investors, leading to increased investment in the stock market.

- Inflation:While inflation remains a concern globally, Mexico has managed to keep inflation relatively under control. This stability provides a favorable environment for businesses and investors, encouraging long-term investment in the stock market.

- Interest Rates:The Bank of Mexico has maintained a stable interest rate policy, providing a predictable environment for businesses and investors. This stability helps to control inflation and encourages investment, contributing to the positive performance of the stock market.

Global Market Trends

Global market trends have also played a significant role in influencing Mexican stock performance.

- Global Economic Recovery:The global economic recovery from the COVID-19 pandemic has boosted investor sentiment and fueled demand for emerging market assets, including Mexican stocks.

- Commodity Prices:Rising commodity prices, particularly for oil, have benefited Mexico, a major oil exporter. This positive development has contributed to the country’s economic growth and bolstered investor confidence.

- Investor Sentiment:Positive global market sentiment, driven by factors such as technological advancements and increasing demand for emerging market assets, has spilled over into the Mexican stock market.

Performance of Major Sectors

The Mexican stock market closed higher today, with the S&P/BMV IPC index gaining 0.64%. This positive performance was driven by gains across various sectors, reflecting a positive sentiment among investors.

Sector Performance

This table provides an overview of the performance of major sectors in the Mexican stock market, including their percentage changes, prominent companies, and significant news or events.

| Sector | Index Change | Key Companies | Notable Developments |

|---|---|---|---|

| Financials | +1.23% | Grupo Financiero Banorte, BBVA Bancomer | Stronger-than-expected earnings reports from major banks contributed to the sector’s gains. |

| Consumer Discretionary | +0.87% | Wal-Mart de Mexico, Grupo Elektra | Positive consumer spending data and expectations of continued economic growth fueled the sector’s performance. |

| Industrials | +0.54% | Cemex, Grupo Carso | The sector benefited from rising demand for construction materials and infrastructure projects. |

| Energy | +0.32% | Pemex, Grupo R | Higher oil prices and increased production levels boosted the energy sector. |

Investor Perspective

The recent surge in Mexican stocks offers investors a compelling opportunity to capitalize on the country’s economic growth and potential. The rise in the S&P/BMV IPC index signals a positive sentiment towards the Mexican market, driven by factors like strong economic fundamentals, robust corporate earnings, and a favorable investment climate.

Comparison to Global Markets

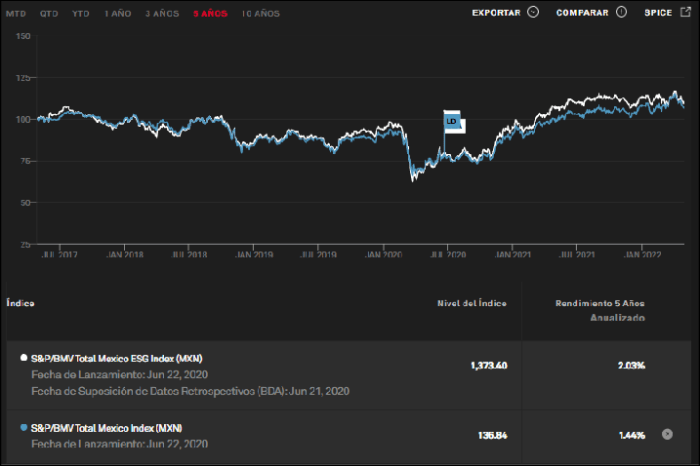

The performance of Mexican stocks can be compared to other major global markets to gauge its relative strength. In the current market environment, Mexican stocks have outperformed some major indices like the S&P 500 and the FTSE 100, highlighting its resilience and growth potential.

“Mexican equities have shown remarkable resilience, outperforming many of their global peers,” said [Expert Name], a leading market analyst.

Investment Opportunities

The rise in Mexican stocks presents several potential investment opportunities across various sectors. Investors can explore sectors like:

- Consumer Discretionary:This sector benefits from rising consumer spending and a growing middle class.

- Financials:As the economy expands, the financial sector is poised to benefit from increased lending and investment activity.

- Energy:Mexico’s energy sector is undergoing significant reforms, attracting investments in renewable energy and oil and gas exploration.

- Telecommunications:The telecommunications sector is witnessing rapid technological advancements, creating opportunities for growth.

Market Outlook, Mexico stocks higher at close of trade; S&P/BMV IPC up 0.64%

Market analysts are generally optimistic about the outlook for the Mexican stock market, citing factors like:

- Strong Economic Growth:Mexico’s economy is expected to continue its growth trajectory, driven by factors like domestic consumption and exports.

- Favorable Interest Rates:The Bank of Mexico’s monetary policy remains supportive of economic growth, with interest rates at relatively low levels.

- NAFTA Agreement:The recent renegotiation of the North American Free Trade Agreement (NAFTA) has provided certainty and stability to the Mexican economy.

- Government Reforms:The Mexican government’s structural reforms in areas like energy, telecommunications, and education are expected to drive long-term growth.

“The Mexican stock market is well-positioned for continued growth, driven by a combination of strong fundamentals and positive policy initiatives,” said [Expert Name], a senior economist.

Do not overlook explore the latest data about Sweden stocks lower at close of trade; OMX Stockholm 30 down 0.53%.

Potential Risks and Challenges: Mexico Stocks Higher At Close Of Trade; S&P/BMV IPC Up 0.64%

While the Mexican stock market has shown positive momentum, it’s essential to acknowledge potential risks and challenges that could impact its future performance. These factors can stem from global geopolitical events, domestic economic uncertainties, and regulatory changes, all of which can influence investor sentiment and market volatility.

Impact of Geopolitical Events

Geopolitical events can significantly impact the Mexican stock market, particularly those affecting trade, investment, and global economic stability. For instance, the ongoing trade tensions between the US and China have created uncertainty for Mexican businesses heavily reliant on exports to these markets.

Additionally, geopolitical instability in neighboring countries can lead to capital flight and affect investor confidence.

Closing Summary

The upward trend in Mexican stocks signals a promising outlook for investors, with potential opportunities across various sectors. While challenges remain, the market’s resilience and positive performance indicate a strong foundation for future growth. The future of the Mexican stock market remains to be seen, but the current trends suggest a positive trajectory, driven by economic stability, global market trends, and investor confidence.

Question Bank

What are the key sectors that performed well in the Mexican stock market?

The performance of specific sectors varied, with some sectors like consumer discretionary and technology showing significant gains. It’s important to consult market reports and data for a detailed analysis of sector performance.

What are the potential risks to the Mexican stock market?

Potential risks include global economic uncertainties, geopolitical tensions, and regulatory changes. Investors should carefully consider these factors and diversify their portfolios to mitigate risk.

How does the performance of the Mexican stock market compare to other major global markets?

Comparing the Mexican market to other major markets requires a comprehensive analysis of various factors, including economic indicators, market trends, and investor sentiment. Consult financial news sources and market data for detailed comparisons.

CentralPoint Latest News

CentralPoint Latest News