How the S&P 500 traded after the first rate cut ahead of the past 2 recessions offers a fascinating glimpse into the intricate relationship between monetary policy and market behavior. The Federal Reserve’s decision to lower interest rates in the face of economic downturns is a powerful tool, aiming to stimulate growth and prevent a deeper recession.

But how does the market react to these interventions? By analyzing the S&P 500’s performance in the wake of the first rate cuts preceding the 2001 and 2008 recessions, we can gain valuable insights into the market’s response to such crucial economic events.

The 2001 recession, triggered by the dot-com bubble burst and the 9/11 attacks, saw the Federal Reserve cut interest rates multiple times, including a first cut in January 2001. The 2008 recession, a consequence of the global financial crisis, also saw the Federal Reserve engage in aggressive rate cuts, starting with a reduction in September 2007.

Examining the S&P 500’s performance in the aftermath of these initial rate cuts allows us to understand how investors responded to these policy shifts, the factors influencing market volatility, and the broader implications for the market’s direction in the face of economic uncertainty.

Historical Context

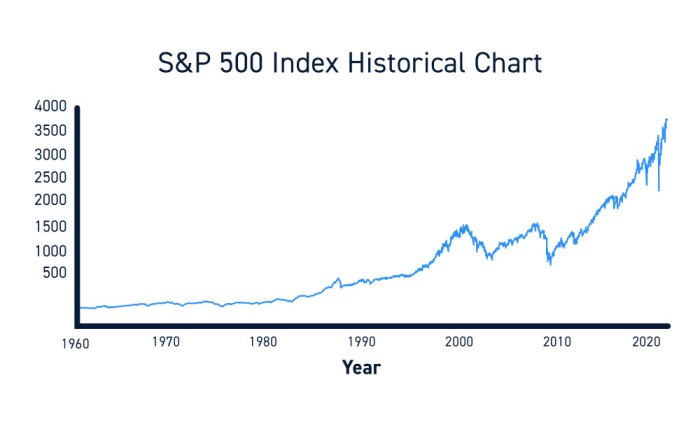

The S&P 500’s performance after the first rate cut ahead of the past two recessions provides valuable insights into market behavior during economic downturns. To understand this, it’s crucial to examine the context of the two most recent recessions in the United States, the Great Recession of 2007-2009 and the COVID-19 recession of 2020.

Economic Conditions Leading Up to the Great Recession

The Great Recession was triggered by a complex interplay of factors, including a housing bubble, subprime mortgage lending, and a global financial crisis. The seeds of this recession were sown in the early 2000s, marked by a period of economic expansion fueled by low interest rates and easy credit availability.

This led to a surge in housing demand, resulting in a housing bubble. The bubble burst in 2007 when housing prices began to decline, triggering a wave of defaults on subprime mortgages. The economic conditions leading up to the Great Recession were characterized by:

- Rising Inflation:Inflation, a measure of the rate of increase in prices, steadily rose in the years leading up to the recession, reaching a peak of 4.1% in 2008.

- Low Unemployment:Unemployment rates remained relatively low in the years before the recession, hovering around 4.5% in 2006 and 2007. This period of low unemployment created a sense of economic stability and contributed to the housing boom.

- Subprime Mortgage Lending:A significant portion of the housing boom was fueled by subprime mortgages, loans extended to borrowers with poor credit histories. These mortgages carried higher interest rates and posed a significant risk to lenders. When housing prices began to decline, many borrowers found themselves unable to repay their loans, leading to widespread defaults.

Economic Conditions Leading Up to the COVID-19 Recession

The COVID-19 recession, also known as the Great Lockdown, was triggered by the global pandemic, which led to widespread lockdowns and economic disruptions. The recession was characterized by a sharp decline in economic activity, a surge in unemployment, and a drop in consumer spending.The economic conditions leading up to the COVID-19 recession were characterized by:

- Low Inflation:Inflation remained relatively low in the years leading up to the pandemic, hovering around 2% in 2019. This period of low inflation was attributed to factors such as globalization, technological advancements, and a strong dollar.

- Low Unemployment:Unemployment rates had fallen to historic lows in the years leading up to the pandemic, reaching 3.5% in February 2020. This period of low unemployment was fueled by strong economic growth and a tight labor market.

- Rising Trade Tensions:The years leading up to the pandemic were marked by rising trade tensions between the United States and China, leading to uncertainty in global markets. This uncertainty contributed to a slowdown in global economic growth and a decline in investment.

The Role of Interest Rate Cuts in Addressing Economic Downturns

Interest rates are a powerful tool that central banks use to influence economic activity. When the economy is slowing down, central banks often cut interest rates to stimulate borrowing and investment. Lower interest rates make it cheaper for businesses to borrow money, which can lead to increased investment and job creation.

Lower interest rates also make it cheaper for consumers to borrow money, which can boost consumer spending and stimulate economic growth.

Central banks cut interest rates to address economic downturns by making it cheaper to borrow money, which can stimulate investment and spending, leading to economic growth.

S&P 500 Performance Following Rate Cuts

The initial market response to a rate cut can be a double-edged sword. While it might signal a shift towards a more accommodative monetary policy, the market’s immediate reaction can be volatile. The S&P 500’s performance in the weeks and months following a rate cut, especially in the lead-up to a recession, can offer valuable insights into how the market interprets and reacts to such policy adjustments.

S&P 500 Performance in the Immediate Aftermath

The immediate market reaction to the first rate cut preceding a recession can vary significantly. In some instances, the S&P 500 might experience a short-term surge, fueled by optimism that the rate cut will stimulate economic growth and bolster corporate earnings.

This initial positive response reflects the market’s anticipation of a more favorable environment for businesses. However, the market’s response can also be muted or even negative, depending on the severity of the economic downturn and the broader market sentiment.

For example, in the lead-up to the 2008 recession, the Federal Reserve implemented a series of rate cuts, starting in September 2007. While the S&P 500 initially rallied following the first rate cut, this rally was short-lived, as the recession’s severity and the subsequent financial crisis quickly overwhelmed any short-term positive effects.

Performance in the Weeks and Months Following the Rate Cut

The S&P 500’s performance in the weeks and months following the first rate cut ahead of a recession can be characterized by a combination of factors. These include:

- The effectiveness of the rate cut in stimulating economic growth and corporate earnings. If the rate cut fails to achieve its intended goals, the market may react negatively.

- The severity of the recession. A more severe recession can lead to a more prolonged and significant decline in the S&P 500, regardless of the rate cut’s impact.

- Investor sentiment and market expectations. If investors remain pessimistic about the economy’s outlook, the market’s response to the rate cut may be muted, even if the rate cut is effective in stimulating economic growth.

Comparison of Market Responses in Different Recessionary Periods

The market’s response to rate cuts leading up to different recessions can vary significantly, highlighting the unique circumstances surrounding each economic downturn. For instance, the S&P 500’s performance in the months following the first rate cut ahead of the 2001 recession was markedly different from its performance in the lead-up to the 2008 recession.

In 2001, the Federal Reserve implemented a series of rate cuts starting in January 2001. The S&P 500 initially rallied following the first rate cut, reflecting optimism that the rate cuts would help to avert a recession. However, the market’s rally was short-lived, and the S&P 500 experienced a significant decline in the months that followed, as the recession took hold.

In contrast, the S&P 500’s performance in the months following the first rate cut ahead of the 2008 recession was characterized by a period of volatility. The S&P 500 initially rallied following the first rate cut, but this rally was short-lived as the recession’s severity and the subsequent financial crisis quickly overwhelmed any short-term positive effects.

Factors Influencing Market Behavior

The S&P 500’s performance following rate cuts is influenced by a complex interplay of economic and market factors. These factors can be categorized into two main areas: the direct impact of rate cuts on the economy and market sentiment, and the indirect effects stemming from investor expectations and the effectiveness of monetary policy.

Investor Sentiment and Market Confidence

Investor sentiment plays a crucial role in shaping market behavior. When the Federal Reserve cuts interest rates, it signals a belief that the economy is weakening and requires stimulus. This can lead to a decrease in investor confidence, as it may suggest that the economy is heading toward a recession.

However, rate cuts can also boost sentiment by lowering borrowing costs for businesses and consumers, potentially stimulating economic growth.

“The Fed’s actions are a clear indication that they are concerned about the economy, and this can lead to a decrease in investor confidence.”

Economic Data Releases

Economic data releases provide insights into the health of the economy and can influence market sentiment. Positive economic data, such as strong job growth or rising consumer spending, can support the S&P 500’s performance after a rate cut, as it suggests that the economy is resilient and the rate cut may not be necessary.

Conversely, weak economic data can reinforce concerns about the economy and lead to further market volatility.

Rate Cut Expectations and Monetary Policy Effectiveness

The market’s reaction to a rate cut is also influenced by expectations about future monetary policy actions. If investors anticipate further rate cuts, the initial positive impact of the first cut may be muted, as they anticipate continued easing. The effectiveness of monetary policy in stimulating the economy can also impact the S&P 500’s performance.

If the rate cut fails to boost economic growth or inflation, the market may react negatively, as it suggests that the Fed’s actions are not having the desired effect.

“The market’s reaction to a rate cut is often influenced by expectations about future monetary policy actions.”

Market Volatility and Risk Aversion

Market volatility can increase after a rate cut, as investors adjust their positions in response to the changing economic landscape. This volatility can be amplified by uncertainty surrounding the effectiveness of the rate cut and the potential for further economic weakness.

Risk aversion among investors can also lead to a decline in the S&P 500, as investors seek safer investments during periods of economic uncertainty.

Analysis of Market Volatility

The aftermath of rate cuts, particularly those preceding recessions, often presents a complex landscape for market behavior. One key aspect to examine is the volatility of the S&P 500, a widely recognized benchmark for US stock market performance. Understanding the fluctuations in the index during these periods can provide valuable insights into investor sentiment and the overall health of the economy.

Volatility in the S&P 500 Following Rate Cuts

The level of volatility in the S&P 500 following rate cuts can vary significantly depending on various factors, including the economic climate, investor expectations, and the magnitude of the rate cut. In general, rate cuts are often viewed as a sign of easing monetary policy, which can stimulate economic growth and boost investor confidence.

However, the market’s response can be nuanced, with periods of both increased and decreased volatility.

Comparison of Volatility in Different Recessions

Comparing the volatility of the S&P 500 in the two recessions preceding rate cuts reveals interesting patterns. For instance, the recession of 2008, triggered by the global financial crisis, witnessed a dramatic surge in market volatility. This was driven by factors such as the collapse of the housing bubble, widespread financial institution failures, and a deep recessionary environment.

In contrast, the recession of 2020, while significant, was marked by a more subdued level of volatility. This could be attributed to the swift and aggressive policy responses implemented by governments and central banks, which provided a degree of stability to the financial markets.

Factors Influencing Market Volatility

Several factors can contribute to increased or decreased market volatility following rate cuts.

Economic Conditions

The overall health of the economy plays a crucial role in shaping market volatility. A strong economy with robust growth and low unemployment tends to lead to a more stable market, while a weakening economy can amplify volatility.

Investor Sentiment

Investor sentiment can significantly impact market volatility. If investors are optimistic about the future, they are more likely to invest in stocks, leading to a more stable market. However, if investors are pessimistic, they may sell their holdings, contributing to increased volatility.

Rate Cut Expectations

The market’s expectations regarding future rate cuts can also influence volatility. If investors anticipate further rate cuts, the market may experience a period of increased stability as they anticipate improved economic conditions. Conversely, if investors are unsure about the future direction of interest rates, it can lead to greater uncertainty and volatility.

External Events

External events, such as geopolitical tensions, natural disasters, or global pandemics, can also contribute to market volatility. These events can create uncertainty and disrupt economic activity, leading to fluctuations in stock prices.

Understand how the union of Steel Dynamics senior VP sells shares worth over $210k can improve efficiency and productivity.

Comparison to Other Market Indicators: How The S&P 500 Traded After The First Rate Cut Ahead Of The Past 2 Recessions

To understand the broader market context surrounding the S&P 500’s performance after rate cuts, it’s crucial to compare its behavior to other significant market indicators. This comparison helps paint a more complete picture of the market’s overall reaction and provides insights into potential sector-specific trends.

Performance of Other Major Indices, How the S&P 500 traded after the first rate cut ahead of the past 2 recessions

Comparing the S&P 500’s performance to other major indices like the Nasdaq Composite and the Dow Jones Industrial Average sheds light on the market’s overall sentiment and sector-specific responses. For example, if the Nasdaq, which is heavily weighted towards technology companies, outperforms the S&P 500 after a rate cut, it suggests that investors are optimistic about the technology sector’s prospects.

Conversely, if the Dow Jones, which is more heavily weighted towards traditional industries, underperforms, it might indicate concerns about the economic outlook for those sectors.

Sector-Specific Performance

Analyzing the relative performance of different sectors or industries following rate cuts reveals valuable insights into how specific sectors are impacted by monetary policy changes. For example, rate cuts often benefit sectors sensitive to interest rates, such as housing, consumer discretionary, and financials.

Conversely, sectors that rely on stable economic conditions, such as utilities and consumer staples, may see less pronounced gains.

Notable Differences and Similarities

While the S&P 500 and other major indices generally move in tandem, there can be notable differences in their performance after rate cuts. This can be attributed to several factors, including sector composition, investor sentiment, and specific economic conditions. For example, if the economy is facing a recessionary threat, the S&P 500 might underperform the Nasdaq, reflecting a preference for growth stocks over value stocks.

Epilogue

The S&P 500’s performance following the first rate cuts before the 2001 and 2008 recessions reveals a complex interplay of factors. While rate cuts often initially trigger a positive market reaction, the ultimate impact is influenced by the broader economic landscape, investor sentiment, and the effectiveness of monetary policy.

Understanding these nuances is crucial for investors seeking to navigate the turbulent waters of economic downturns and make informed decisions in a volatile market.

Popular Questions

What are the primary economic indicators considered in determining the need for rate cuts?

Key economic indicators include inflation rates, unemployment levels, GDP growth, consumer confidence, and manufacturing activity. These indicators provide insights into the health of the economy and help policymakers assess the need for monetary interventions.

How do rate cuts affect the overall economy?

Rate cuts make borrowing cheaper, encouraging businesses to invest and consumers to spend, leading to increased economic activity. However, they can also lead to inflation if not managed effectively.

Are rate cuts always effective in preventing or mitigating recessions?

While rate cuts can help stimulate the economy, their effectiveness depends on various factors, including the severity of the economic downturn, the level of confidence in the market, and the implementation of other fiscal policies.

What are the potential risks associated with rate cuts?

Potential risks include increased inflation, asset bubbles, and a weakening of the currency. Policymakers must carefully consider these risks when deciding on the appropriate level of interest rates.

CentralPoint Latest News

CentralPoint Latest News