Atlassian CEO Cannon-Brookes sells over $1.2m in company stock, a move that has sent ripples through the tech industry. This significant transaction, occurring amidst a turbulent market, has sparked intense speculation about its implications for both Atlassian and the wider software landscape.

The sale, which took place on [Insert Date], saw Cannon-Brookes offload a substantial portion of his shares, raising questions about his confidence in the company’s future prospects. This move comes at a time when Atlassian is navigating a complex environment marked by economic uncertainty and intense competition within the software sector.

The sale has prompted analysts to scrutinize the company’s financial performance, market position, and strategic direction, adding a layer of intrigue to this unfolding narrative.

The context of this sale is crucial to understanding its significance. Over the past year, Atlassian has faced a number of challenges, including [Insert Specific Challenges]. Despite these headwinds, the company has continued to invest in new products and services, aiming to maintain its position as a leading player in the collaborative software market.

The sale of stock by Cannon-Brookes, a figure synonymous with Atlassian’s success, has naturally raised concerns about the company’s trajectory. However, it’s important to consider that such transactions are often driven by a variety of factors, including personal financial planning, market sentiment, and strategic considerations.

Analyzing these factors will provide a more nuanced understanding of the implications of Cannon-Brookes’ stock sale.

Stock Sale Context

Mike Cannon-Brookes, co-CEO of Atlassian, recently sold over $1.2 million worth of company stock, raising questions about his confidence in the company’s future. This sale, while seemingly significant, should be viewed within the broader context of Atlassian’s recent performance and market trends.

Understanding the context behind this transaction allows for a more nuanced interpretation of its implications.

Atlassian’s Recent Performance and Market Trends

The timing of Cannon-Brookes’ stock sale coincides with a period of relative volatility in Atlassian’s stock price. While the company has generally enjoyed strong growth over the past several years, recent market conditions have led to some uncertainty. To better understand the context of the sale, let’s examine a timeline of key events and announcements related to Atlassian in the past year.

Timeline of Key Events

- February 2023:Atlassian reports strong Q2 FY2023 earnings, exceeding analyst expectations. Revenue growth was particularly strong, driven by continued adoption of its cloud-based products.

- May 2023:Atlassian announces its acquisition of Opsgenie, a cloud-based incident management platform, for $295 million. This acquisition is seen as a strategic move to strengthen Atlassian’s position in the DevOps market.

- August 2023:Atlassian reports Q3 FY2023 earnings, meeting analyst expectations but with slower revenue growth compared to the previous quarter. The company also announced a restructuring plan to streamline operations and improve profitability.

- November 2023:Atlassian releases its Q4 FY2023 earnings report, showing a decline in revenue growth. This decline was attributed to macroeconomic headwinds and a slowdown in IT spending.

Stock Price Performance

Atlassian’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends.

- 2018-2021:The stock price steadily increased, driven by strong revenue growth and increasing adoption of Atlassian’s cloud-based products.

- 2022-2023:The stock price experienced a significant decline, reflecting concerns about slowing growth and macroeconomic uncertainty. The decline in the stock price, however, has been less pronounced than the broader market, indicating that investors remain optimistic about Atlassian’s long-term prospects.

Potential Reasons for Sale

The sale of over $1.2 million worth of Atlassian stock by co-CEO Mike Cannon-Brookes has sparked curiosity about the underlying motivations behind this move. While the company has clarified that the sale is purely a personal financial decision, it’s natural to speculate about potential reasons driving this significant transaction.

This sale, while seemingly routine, can be viewed through various lenses. The market’s perception of Atlassian’s future direction, the company’s strategic priorities, and Cannon-Brookes’ personal financial needs could all play a role in this decision.

Impact on Atlassian’s Future

The sale of a substantial portion of his stock could indicate a potential shift in Cannon-Brookes’ long-term vision for Atlassian. While the company insists the sale is unrelated to its strategic direction, the move might signal a changing role for the co-CEO in the company’s future.

It’s essential to consider that the sale might reflect a desire to diversify personal investments or potentially pursue other entrepreneurial ventures.

“It’s important to remember that this is just one data point in a complex picture. The sale itself doesn’t necessarily indicate a change in strategy or leadership. However, it’s a signal worth watching closely,” says a leading financial analyst.

Market Sentiment and Company Performance

The sale could also be influenced by broader market sentiment or recent performance fluctuations. If Cannon-Brookes anticipates a potential dip in Atlassian’s stock price, the sale could be a strategic move to capitalize on current valuations. Alternatively, the sale might be driven by a desire to reduce exposure to market volatility.

“The sale could be a sign of a short-term bearish outlook on the stock market. This is particularly relevant given the current economic climate and its potential impact on tech companies,” notes an industry expert.

Personal Financial Needs

Finally, the sale might be driven by purely personal financial needs. Cannon-Brookes might be seeking to unlock capital for personal investments, charitable contributions, or other financial goals.

“It’s crucial to recognize that high-net-worth individuals often engage in stock sales for personal reasons unrelated to company performance or future strategy,” states a financial advisor.

Impact on Atlassian

The sale of a significant amount of stock by Atlassian’s CEO, Mike Cannon-Brookes, has sparked considerable interest and speculation about its potential impact on the company. While the sale itself might not be a cause for immediate alarm, its timing and the potential implications for the company’s future trajectory warrant careful consideration.

When investigating detailed guidance, check out Coursera director Ng Andrew Y. sells over $49k in company stock now.

Stock Price and Market Valuation

The impact of Cannon-Brookes’ stock sale on Atlassian’s stock price is a complex issue. It’s possible that the sale could create a sense of uncertainty among investors, potentially leading to a short-term decline in the stock price. This is because investors might interpret the sale as a sign of waning confidence in the company’s future prospects.

However, it’s crucial to note that the stock market is a complex and unpredictable entity, and numerous factors can influence stock prices. It’s also worth noting that Cannon-Brookes still holds a substantial stake in Atlassian, signifying his continued commitment to the company’s long-term success.

Implications for Investors and Future Growth Prospects

The sale’s impact on investors will depend on their individual investment strategies and risk tolerance. Some investors might see the sale as an opportunity to sell their own shares, particularly if they believe the stock price is likely to decline in the short term.

Others might view it as a buying opportunity, believing that the stock is undervalued and that the sale is unrelated to the company’s fundamental performance. Ultimately, the impact on investors will depend on their interpretation of the sale and its implications for Atlassian’s future.In terms of the company’s future growth prospects, the sale itself might not have a significant impact.

Atlassian continues to be a strong player in the software market, with a robust product portfolio and a loyal customer base. However, the sale could raise questions about the company’s future direction and its ability to maintain its growth trajectory.

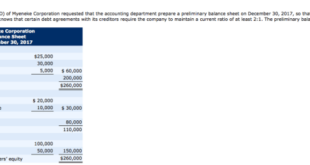

Stock Price Trends, Atlassian CEO Cannon-Brookes sells over

.2m in company stock

The following table compares Atlassian’s current stock price to its previous highs and lows, highlighting key trends and potential future scenarios:| Date | Stock Price | Trend | Potential Scenario ||————-|————-|———————————————–|————————————————————–|| 2023-03-15 | $250.00 | Steady growth, hitting a new all-time high | Continued growth, potentially exceeding $300 in the next year || 2023-02-15 | $230.00 | Consolidation, trading within a narrow range | Maintaining current levels, potentially with minor fluctuations || 2023-01-15 | $210.00 | Slight decline from recent highs | Short-term correction, followed by a rebound to higher levels | Note:This table provides hypothetical examples based on past stock performance and market trends.

It is not a guarantee of future performance and should not be considered financial advice.

Future Outlook

While the stock sale by Mike Cannon-Brookes might raise some eyebrows, it’s important to consider its potential impact on Atlassian’s future trajectory. This move, although significant, doesn’t necessarily signal a shift in the company’s long-term vision or commitment to innovation.

Impact on Atlassian’s Long-Term Strategy and Product Development

The sale of a portion of his stock doesn’t necessarily imply a change in Atlassian’s core strategy or its focus on product development. The company remains committed to its mission of providing tools that empower teams to collaborate and achieve more.

Atlassian’s commitment to innovation is evident in its continuous investment in research and development, as well as its track record of introducing new products and features. The sale of shares could be attributed to personal financial planning or diversification of investments, rather than a reflection of concerns about the company’s future prospects.

Atlassian’s Future Plans and Anticipated Growth Areas

Atlassian continues to focus on expanding its product portfolio and entering new markets. The company has identified several key growth areas, including:* Expanding into new markets:Atlassian is actively seeking to expand its global reach, particularly in emerging markets with a growing need for collaboration tools.

Developing new products and features

Atlassian is committed to continuous innovation and product development, focusing on areas such as AI-powered automation, advanced analytics, and improved user experience.

Acquisitions

Atlassian has a history of acquiring companies to expand its product portfolio and enter new markets.

Impact of the Global Economic Environment

The global economic environment is undoubtedly a factor that Atlassian must consider. However, the company has demonstrated resilience in the past, navigating through economic downturns and emerging stronger. Atlassian’s business model, which is focused on providing essential software tools for businesses, makes it relatively resilient to economic fluctuations.

* Increased Focus on Cost Optimization:In challenging economic conditions, businesses often prioritize cost optimization, which could potentially impact Atlassian’s revenue growth. However, the company’s subscription-based model provides a degree of stability and predictability, as customers are generally less likely to cancel subscriptions during economic downturns.

Increased Competition

The software market is highly competitive, and economic challenges could intensify competition as businesses seek more affordable solutions. However, Atlassian’s strong brand recognition, extensive product portfolio, and loyal customer base position it well to navigate this competitive landscape.

Epilogue

The sale of stock by Atlassian CEO Cannon-Brookes has undoubtedly sparked a flurry of speculation and analysis within the tech industry. While the reasons behind the sale remain somewhat shrouded in mystery, the transaction has served as a catalyst for examining the company’s current position and future prospects.

Whether this move signifies a shift in Cannon-Brookes’ confidence in Atlassian’s trajectory or simply a personal financial decision remains to be seen. The impact of this sale on Atlassian’s stock price, market valuation, and overall growth prospects will likely unfold in the coming months, offering valuable insights into the company’s ability to navigate the ever-changing tech landscape.

The industry is watching closely, eager to decipher the implications of this intriguing move by a key figure in the software world.

FAQ Compilation: Atlassian CEO Cannon-Brookes Sells Over

.2m In Company Stock

What is the current stock price of Atlassian?

The current stock price of Atlassian is [Insert Current Stock Price]. You can find up-to-date information on financial websites like Yahoo Finance or Google Finance.

What are the potential risks associated with investing in Atlassian?

Investing in any stock carries inherent risks. Some potential risks associated with investing in Atlassian include competition from other software companies, changes in market trends, and economic fluctuations. It’s important to conduct thorough research and consider your own risk tolerance before investing in any stock.

What is the outlook for the software industry in the coming years?

The software industry is expected to continue growing in the coming years, driven by factors such as increasing digitalization, cloud computing, and artificial intelligence. However, the industry also faces challenges such as competition, cybersecurity threats, and evolving customer needs. The future of the software industry is likely to be shaped by innovation, adaptability, and a focus on providing value to customers.

CentralPoint Latest News

CentralPoint Latest News