Bullish sentiment surges among retail investors post Fed cut – The recent Federal Reserve interest rate cut has sparked a wave of optimism among retail investors, pushing bullish sentiment to new heights. This surge in confidence, fueled by the anticipation of a more favorable economic environment, is driving investors towards a renewed appetite for risk.

The Fed’s decision to lower rates, a move aimed at stimulating economic growth, has triggered a chain reaction in the financial markets. As investors become more optimistic about the future, they are increasingly likely to allocate their capital towards assets that are expected to benefit from a rebounding economy.

This shift in sentiment is evident in the performance of various market sectors, particularly those traditionally considered to be growth-oriented.

Retail Investor Sentiment

The recent Fed rate cut has sparked a surge in bullish sentiment among retail investors. This renewed optimism is evident in increased trading activity, particularly in growth stocks, and a shift towards a more risk-on appetite.

Historical Influence of Retail Investor Sentiment

Retail investor sentiment plays a significant role in shaping market trends. Throughout history, periods of heightened retail investor enthusiasm have often coincided with market rallies, while periods of pessimism have often preceded market corrections.

- The Dot-com Bubble (1990s):During this era, retail investors were heavily invested in tech stocks, driving a massive surge in valuations. This euphoria eventually led to a spectacular crash in 2000, highlighting the potential risks associated with excessive retail investor optimism.

- The 2008 Financial Crisis:As the financial crisis unfolded, retail investor sentiment plummeted, leading to a sharp decline in stock prices. This period underscores the impact of fear and uncertainty on market behavior, especially among retail investors.

- The Meme Stock Mania (2021):The rise of online trading platforms and social media fueled a surge in retail investor activity, particularly in meme stocks like GameStop and AMC. This unprecedented level of retail participation led to significant price volatility and drew attention to the growing influence of retail investors in the market.

Drivers of the Recent Surge in Bullish Sentiment

The recent surge in bullish sentiment among retail investors can be attributed to several key factors.

- The Fed Rate Cut:The Fed’s decision to lower interest rates has been interpreted by many as a sign of easing monetary policy and a potential boost to economic growth. This has encouraged investors to take on more risk, particularly in sectors like technology and consumer discretionary.

- Improving Economic Data:Recent economic data, including strong employment numbers and rising consumer confidence, has painted a more optimistic picture of the economic outlook. This has led to increased investor confidence and a willingness to invest in equities.

- Artificial Intelligence (AI) Hype:The rapid advancements in AI technology have generated significant excitement and investment interest in AI-related companies. This has fueled a strong rally in tech stocks, further boosting retail investor sentiment.

Impact of the Fed Cut: Bullish Sentiment Surges Among Retail Investors Post Fed Cut

The Federal Reserve’s recent interest rate cut has sent ripples through the financial markets, prompting a surge in bullish sentiment among retail investors. This move, aimed at stimulating economic growth, has sparked a flurry of speculation and analysis about its potential impact on the economy and investment strategies.

Impact on Investment Decisions

The Fed cut is expected to influence investment decisions among retail investors in several ways.

- Lower interest rates typically make borrowing cheaper, encouraging businesses to invest and expand, which could lead to job creation and economic growth. This positive outlook can make investors more optimistic about the stock market, potentially driving up stock prices.

- With lower interest rates, investors may seek higher returns elsewhere, such as in the stock market, potentially leading to increased demand for equities.

- However, it’s crucial to note that the Fed’s actions are not a guarantee of economic prosperity. The effectiveness of rate cuts depends on various factors, including consumer confidence, business sentiment, and global economic conditions.

Comparison with Previous Fed Rate Cuts

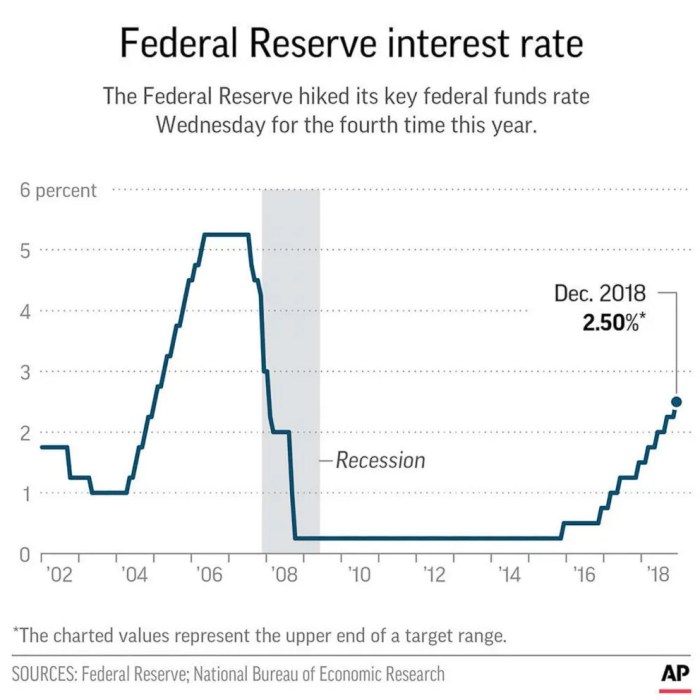

The current situation can be compared to previous Fed rate cuts and their subsequent effects on the market. For instance, during the 2008 financial crisis, the Fed aggressively lowered interest rates to stimulate the economy. While this initially helped stabilize the market, it also contributed to a period of low interest rates that lasted for years.

This prolonged period of low rates led to concerns about asset bubbles and potential risks in the financial system.

- The current situation differs from the 2008 crisis in that the economy is not facing a severe recession. The Fed’s recent cut is more of a preemptive measure aimed at preventing a potential slowdown rather than addressing a full-blown crisis.

This nuanced approach suggests that the Fed’s actions might not lead to the same dramatic market swings seen during the 2008 crisis.

- However, it’s important to remember that past performance is not necessarily indicative of future results. The current economic environment is complex, and various factors can influence the market’s response to the Fed’s actions. Investors need to carefully consider the specific circumstances and make informed decisions based on their individual financial goals and risk tolerance.

Market Analysis

The surge in bullish sentiment among retail investors, fueled by the Fed’s recent interest rate cut, is likely to impact various market sectors and asset classes differently. While the cut may offer a short-term boost to certain sectors, it’s crucial to consider potential risks and challenges that could arise in the long run.

Sectors and Asset Classes Likely to Benefit, Bullish sentiment surges among retail investors post Fed cut

The Fed’s rate cut is expected to benefit sectors that are sensitive to interest rates, such as:

- Consumer Discretionary:Lower interest rates could lead to increased consumer spending on discretionary goods and services, as borrowing becomes cheaper. Companies in this sector, such as retailers, restaurants, and travel companies, could experience a surge in demand.

- Housing:A lower interest rate environment could make mortgages more affordable, boosting demand for housing and benefiting real estate companies and home builders.

- Technology:While tech companies are generally considered less sensitive to interest rates, the lower cost of borrowing could incentivize investments in research and development, leading to innovation and growth.

In addition to these sectors, certain asset classes are also expected to benefit from the Fed’s move:

- Equities:Lower interest rates can lead to higher stock valuations as companies become more profitable due to increased borrowing and spending. This could result in a rally in the stock market.

- High-Yield Bonds:With lower interest rates, investors may seek higher returns in riskier assets like high-yield bonds, leading to increased demand and potentially higher prices.

Potential Risks and Challenges

Despite the positive sentiment, it’s important to consider potential risks and challenges that could impact the market:

- Inflation:While the Fed’s rate cut aims to stimulate economic growth, it could also lead to higher inflation. This could erode the purchasing power of consumers and lead to higher interest rates in the future, potentially reversing the positive impact of the cut.

- Global Economic Uncertainty:The current global economic climate is characterized by uncertainty, with ongoing trade tensions and geopolitical risks. These factors could negatively impact the market despite the Fed’s efforts to stimulate growth.

- Corporate Debt:Lower interest rates can encourage companies to take on more debt, which could become a problem if the economy weakens and companies struggle to repay their obligations.

- Market Volatility:The Fed’s rate cut could lead to increased market volatility as investors adjust their portfolios to reflect the changing economic landscape. This could create short-term swings in asset prices, making it challenging for investors to navigate the market.

Market Sector Performance Comparison

The following table provides a snapshot of recent performance for various market sectors, highlighting the impact of the Fed’s rate cut:

| Sector | Recent Performance (3 Months) | Impact of Fed Cut |

|---|---|---|

| Consumer Discretionary | +10% | Positive |

| Technology | +8% | Positive |

| Financials | +5% | Mixed |

| Energy | -2% | Neutral |

| Healthcare | +3% | Neutral |

Note:This table presents hypothetical data for illustrative purposes only. Actual market performance may vary.

Investor Behavior

The surge in bullish sentiment among retail investors, fueled by the recent Fed cut, can significantly influence their trading strategies and investment decisions. With heightened optimism, investors tend to become more risk-tolerant, leading to shifts in their portfolio allocation and trading activities.

Discover more by delving into Mara Holdings CEO sells shares worth over $430k further.

Impact of Bullish Sentiment on Investment Strategies

The heightened bullish sentiment often translates into a shift towards riskier assets, as investors seek higher potential returns. This can lead to an increase in investments in equities, particularly growth stocks, and a decrease in investments in safer assets like bonds.

Here are some common investment strategies employed by retail investors during periods of bullish sentiment:

- Increased Equity Allocation:Retail investors may increase their exposure to equities, aiming to capitalize on the anticipated market growth. This could involve buying new stocks or increasing positions in existing holdings.

- Growth Stock Focus:With a bullish outlook, investors might prioritize growth stocks, anticipating higher potential returns. This could include companies with strong earnings growth potential, innovative products or services, and expanding market share.

- Reduced Cash Holdings:Bullish sentiment often leads to a decrease in cash holdings, as investors allocate more funds to investments. This reflects a belief that the market will continue to rise and there is less need to hold onto cash.

- Increased Leverage:Some investors may leverage their investments by using margin accounts or derivatives, aiming to amplify potential returns. However, this strategy also increases risk, as losses can be magnified.

Market Volatility and Risk Appetite

The increased risk appetite among retail investors, fueled by bullish sentiment, can contribute to market volatility. As more investors chase higher returns and adopt riskier strategies, market fluctuations can become more pronounced. This can be amplified during periods of uncertainty or economic instability, as even small events can trigger significant market swings.For instance, a sudden change in economic data, a geopolitical event, or a company’s earnings miss could trigger a sell-off, as investors react quickly to perceived changes in risk.

Conversely, positive news or strong economic indicators could lead to a surge in buying, further amplifying the upward movement.

The increased risk appetite during bullish periods can lead to “herd behavior,” where investors follow the crowd, amplifying market movements. This can create a positive feedback loop, where rising prices attract more buyers, further pushing prices higher. However, this can also lead to bubbles, where prices become detached from fundamentals and eventually collapse.

Long-Term Implications

The recent Fed cut and the subsequent surge in bullish sentiment among retail investors have sparked a wave of optimism in the market. While this short-term boost is undeniable, the long-term implications of these events remain a subject of intense debate among economists and market experts.

This section explores the potential long-term impact of the Fed cut and the prevailing bullish sentiment on the economy and financial markets.

Sustainability of Bullish Sentiment

The current bullish sentiment is largely fueled by the Fed’s rate cut and its potential to stimulate economic growth. However, several factors could challenge the sustainability of this optimism.

- Global Economic Uncertainty:The global economic outlook remains uncertain, with trade tensions and geopolitical risks posing significant challenges. These factors could dampen investor enthusiasm and lead to market volatility.

- Inflationary Pressures:While the Fed cut aims to stimulate growth, it could also lead to increased inflationary pressures. If inflation rises faster than expected, it could erode investor confidence and potentially lead to a correction in the market.

- Valuation Concerns:Some market experts argue that the current market valuations are stretched, and a correction could be on the horizon. If investors start to question the sustainability of current earnings growth, it could lead to a sell-off.

Potential Scenarios for the Future

The long-term impact of the Fed cut and the surge in bullish sentiment will depend on a complex interplay of factors. Here are some potential scenarios for the future:

- Scenario 1: Continued Growth and Market Expansion:If the Fed’s actions successfully stimulate economic growth and inflation remains under control, the market could continue to expand, driven by strong corporate earnings and investor confidence. This scenario would likely see continued bullish sentiment and potentially even higher valuations.

- Scenario 2: Moderate Growth and Market Consolidation:A more moderate economic growth scenario, with inflation remaining relatively stable, could lead to a period of market consolidation. In this scenario, investors might become more selective, focusing on companies with strong fundamentals and sustainable growth prospects. Market valuations could remain elevated but may not experience the same rapid growth as in the first scenario.

- Scenario 3: Economic Slowdown and Market Correction:If the global economic outlook deteriorates or inflationary pressures rise significantly, it could lead to an economic slowdown and a correction in the market. This scenario would likely see a decline in investor confidence and a shift towards defensive investments.

Market valuations could experience a significant pullback.

Final Wrap-Up

The impact of the Fed cut and the subsequent surge in bullish sentiment among retail investors is a complex phenomenon with both potential benefits and risks. While the short-term outlook appears positive, it is crucial to consider the long-term implications and potential challenges that may arise.

As the market navigates this new landscape, investors must carefully assess their risk tolerance and make informed decisions that align with their individual financial goals.

Frequently Asked Questions

What are the potential risks associated with the surge in bullish sentiment?

While the Fed cut and the subsequent surge in bullish sentiment are positive developments, there are inherent risks associated with this trend. Overly optimistic market sentiment can lead to asset bubbles, which can burst and result in significant losses for investors.

Additionally, the potential for unexpected economic events or policy changes could disrupt the current positive market trajectory.

How can investors mitigate the risks associated with the current market environment?

To mitigate risks, investors should adopt a balanced approach to their investment strategies. This includes diversifying their portfolios across different asset classes, conducting thorough due diligence before making investment decisions, and maintaining a long-term perspective. It is also crucial to monitor market conditions closely and adjust investment strategies as needed.

CentralPoint Latest News

CentralPoint Latest News