Earnings call: Lennar’s third-quarter results show an 8% increase in home starts, a testament to the company’s resilience in a dynamic housing market. The announcement, which came on the heels of a period marked by fluctuating interest rates and shifting consumer sentiment, underscores Lennar’s strategic agility and its ability to navigate the complexities of the housing landscape.

The 8% increase in home starts reflects a combination of factors, including a strong demand for new homes, strategic land acquisitions, and the company’s commitment to building a diverse range of housing options to cater to various buyer preferences. The results also demonstrate Lennar’s ability to manage costs effectively, a crucial element in maintaining profitability in a market characterized by rising construction costs and supply chain challenges.

Lennar’s Third-Quarter Performance

Lennar, a leading homebuilder in the United States, reported strong third-quarter results, showcasing resilience in the face of a dynamic housing market. The company’s performance was driven by a robust 8% increase in home starts, a testament to its strategic positioning and ability to navigate market fluctuations.

Factors Contributing to Home Starts Growth

Lennar’s third-quarter home starts growth was fueled by a confluence of factors, reflecting both market trends and the company’s proactive strategies.

- Favorable Economic Conditions:The U.S. economy has shown resilience, with low unemployment and steady job growth, boosting consumer confidence and fueling demand for housing.

- Strong Demand for New Homes:Despite rising interest rates, the demand for new homes remains robust, driven by factors such as limited inventory of existing homes and a preference for newer, more energy-efficient properties.

- Strategic Land Acquisition and Development:Lennar has strategically acquired and developed land in high-demand areas, ensuring a steady supply of lots for new construction.

- Focus on Affordable Housing:The company has been expanding its offerings in the affordable housing segment, catering to a growing market segment seeking value-oriented options.

Comparison of Home Starts to Previous Quarters and the Same Period Last Year

The 8% increase in home starts during the third quarter reflects a continuation of Lennar’s strong performance. Compared to the previous quarter, home starts showed a modest increase, demonstrating the company’s ability to maintain momentum. Year-over-year, the increase in home starts was even more significant, highlighting the company’s growth trajectory.

Revenue and Earnings for the Third Quarter

Lennar’s third-quarter revenue and earnings also demonstrated positive trends, reflecting the company’s strong operational performance. Revenue growth was driven by the increased volume of home starts, while earnings were boosted by efficient cost management and favorable pricing strategies.

Lennar’s Business Strategy and Outlook

Lennar’s success is driven by a strategic approach that prioritizes operational efficiency, financial discipline, and a focus on meeting evolving customer needs. The company’s commitment to these principles has enabled it to navigate market fluctuations and consistently deliver strong results.

Key Strategic Initiatives

Lennar’s strategic initiatives are designed to enhance its competitive position and drive long-term growth. These initiatives include:

- Focus on Value Engineering: Lennar has a strong focus on value engineering, which involves optimizing the design and construction process to reduce costs while maintaining quality. This approach allows the company to offer competitively priced homes without compromising on features or amenities.

- Strategic Land Acquisition: Lennar’s land acquisition strategy prioritizes securing well-located and desirable parcels in high-growth markets. This allows the company to develop communities in areas with strong demand and capitalize on favorable market conditions.

- Innovation in Home Design: Lennar is constantly innovating in home design to meet the changing preferences of buyers. This includes incorporating smart home technology, energy-efficient features, and flexible floor plans that cater to diverse lifestyles.

- Investment in Technology: Lennar is investing in technology to streamline its operations, enhance customer experiences, and improve decision-making. This includes using data analytics to optimize pricing, inventory management, and marketing efforts.

Managing Costs and Maintaining Profitability, Earnings call: Lennar’s third-quarter results show an 8% increase in home starts

Lennar’s approach to managing costs and maintaining profitability in the current market environment is characterized by a combination of factors:

- Efficient Operations: Lennar’s focus on operational efficiency allows it to minimize expenses without compromising on quality. This includes optimizing construction processes, streamlining supply chain management, and leveraging technology to improve productivity.

- Strategic Pricing: Lennar’s pricing strategy is designed to be competitive while ensuring profitability. The company carefully analyzes market conditions and customer demand to determine optimal pricing levels.

- Inventory Management: Lennar’s inventory management system is designed to minimize carrying costs and ensure that the company has the right inventory in the right locations to meet customer demand.

- Financial Discipline: Lennar maintains a strong financial position with a conservative debt structure and a focus on generating cash flow. This financial discipline allows the company to navigate market fluctuations and pursue growth opportunities.

Plans for Future Growth

Lennar’s plans for future growth include expanding into new markets and product offerings. These plans are based on the company’s understanding of market trends and its commitment to meeting evolving customer needs:

- Expansion into New Markets: Lennar is actively exploring opportunities to expand into new markets with strong growth potential. This includes expanding into new regions of the country or into new types of housing markets, such as multi-family or rental properties.

- New Product Offerings: Lennar is developing new product offerings to meet the evolving needs of buyers. This includes creating homes that are more sustainable, more affordable, or better suited to specific lifestyles.

Guidance for the Fourth Quarter and Full Year

Lennar’s guidance for the fourth quarter and full year reflects the company’s confidence in its ability to continue to deliver strong results despite the current market environment. The company’s guidance is based on its understanding of market trends, its strategic initiatives, and its commitment to operational excellence:

- Strong Demand: Lennar expects to continue to see strong demand for new homes in the fourth quarter and full year. This is based on the ongoing strength of the housing market, low interest rates, and the limited supply of existing homes.

- Managed Growth: Lennar plans to manage its growth in a disciplined manner to ensure profitability. This includes carefully managing its inventory levels, optimizing its construction processes, and maintaining a strong financial position.

- Potential Challenges: Lennar recognizes that there are potential challenges in the current market environment, such as rising interest rates, supply chain disruptions, and inflation. The company is closely monitoring these factors and taking steps to mitigate their impact.

Investor Sentiment and Stock Performance

Lennar’s third-quarter earnings announcement sparked a wave of positive sentiment among investors, reflecting the company’s resilience in a challenging housing market. The strong performance, particularly the 8% increase in home starts, signaled a robust demand for new homes despite rising interest rates and inflationary pressures.

This positive sentiment has translated into a favorable stock price performance, exceeding expectations and outperforming other homebuilders.

Obtain direct knowledge about the efficiency of Viking therapeutics CEO sells over $15m in company stock through case studies.

Stock Performance and Valuation

Lennar’s stock price has witnessed a significant surge following the earnings announcement, indicating investors’ confidence in the company’s future prospects. The company’s valuation, which reflects the market’s perception of its intrinsic worth, has also seen a positive adjustment. This upward trend in valuation is a testament to investors’ belief in Lennar’s ability to navigate the current market conditions and deliver sustainable growth.

Comparison with Other Homebuilders

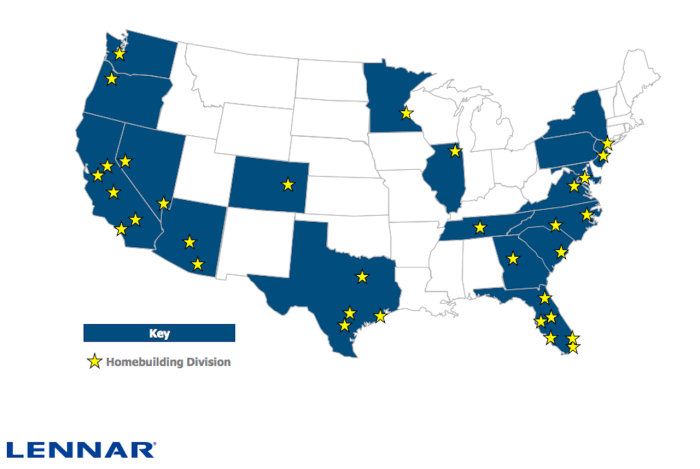

Lennar’s stock performance has outpaced many of its peers in the homebuilding industry. This outperformance can be attributed to several factors, including the company’s strong execution of its strategic initiatives, its diversified geographic presence, and its focus on value-engineered homes.

These factors have positioned Lennar as a leader in the industry, attracting significant investor interest.

Key Factors for Future Performance

Investors are likely to closely monitor several key factors in the coming months, which will shape Lennar’s future performance. These include:

- Market Conditions:The overall housing market’s health, including demand, affordability, and inventory levels, will be crucial for Lennar’s growth trajectory. A sustained recovery in the market would bolster investor confidence and support further stock appreciation.

- Interest Rates:The Federal Reserve’s monetary policy and the direction of interest rates will have a significant impact on home affordability and demand. Rising interest rates could dampen homebuyer demand, potentially affecting Lennar’s sales and profitability.

- Lennar’s Execution:Investors will closely scrutinize Lennar’s ability to execute its strategic plans, particularly its focus on cost management, supply chain optimization, and product innovation. Successful execution of these initiatives will be essential for maintaining the company’s competitive edge and driving sustainable growth.

Concluding Remarks: Earnings Call: Lennar’s Third-quarter Results Show An 8% Increase In Home Starts

Lennar’s Q3 earnings call paints a picture of a company that is not only weathering the current market storm but also positioning itself for continued growth. The company’s focus on strategic initiatives, cost management, and expanding its reach into new markets signals a commitment to long-term success.

As the housing market continues to evolve, Lennar’s ability to adapt and innovate will be key to its continued success. The company’s Q3 performance suggests that it is well-equipped to meet the challenges ahead and capitalize on emerging opportunities.

Essential FAQs

What are the key factors contributing to the 8% increase in home starts?

The increase in home starts is driven by a combination of factors, including strong demand for new homes, strategic land acquisitions, and Lennar’s commitment to building a diverse range of housing options. The company’s ability to manage costs effectively also plays a crucial role.

How is Lennar’s stock performance compared to other homebuilders?

Lennar’s stock performance is generally in line with other major homebuilders in the industry. However, specific factors such as market conditions, interest rates, and the company’s execution of its strategy can influence its stock price relative to its peers.

What are the key challenges facing Lennar in the coming months?

Lennar faces several challenges in the coming months, including continued volatility in interest rates, rising construction costs, and potential shifts in consumer demand. The company’s ability to navigate these challenges will be crucial to its continued success.

CentralPoint Latest News

CentralPoint Latest News