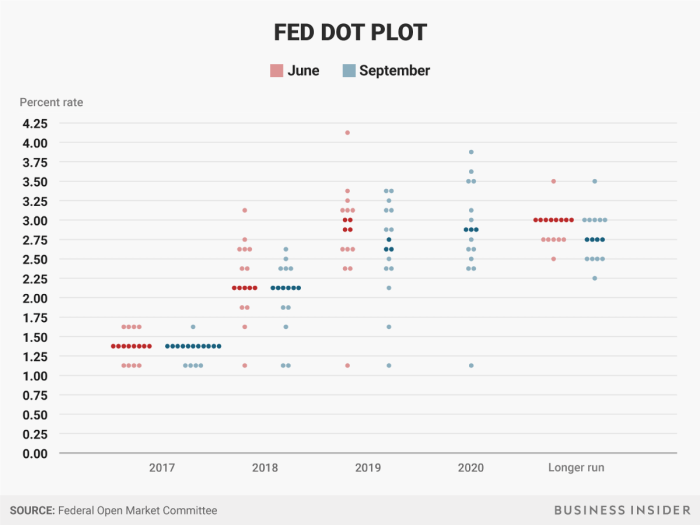

Fed’s ‘dot plot’ signals no rush for another 50bps cut, but jobs data hold sway. The Federal Reserve’s latest “dot plot” – a visual representation of individual policymakers’ interest rate projections – suggests a pause in aggressive rate cuts.

However, the strength of the labor market, as reflected in recent jobs data, might hold the key to the Fed’s future decisions. This delicate balancing act between inflation concerns and economic growth is at the heart of the Fed’s ongoing monetary policy deliberations.

The “dot plot” offers a glimpse into the Fed’s collective thinking, indicating that policymakers are currently not leaning towards another significant rate reduction. This stance reflects their cautious approach to navigating the complex economic landscape, where inflation remains a concern, but the robust job market provides a buffer against recessionary pressures.

The Fed’s ‘Dot Plot’ and Interest Rates

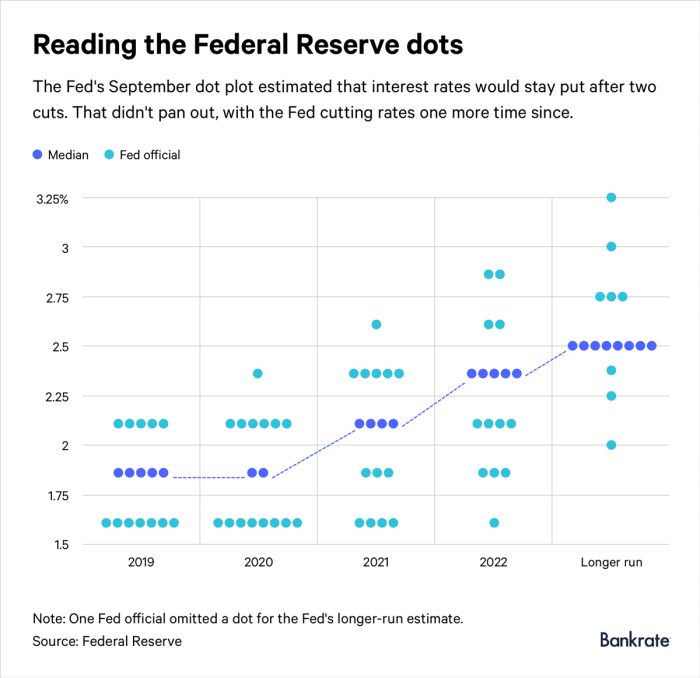

The Fed’s ‘dot plot’ is a powerful tool for understanding the central bank’s thinking on interest rates. This visual representation of individual Federal Open Market Committee (FOMC) members’ projections for the federal funds rate offers a glimpse into the collective wisdom of the Fed.

The Significance of the Fed’s ‘Dot Plot’

The ‘dot plot’ is a valuable tool for investors and economists alike, as it provides a clear picture of the Fed’s intended path for interest rates. Each dot on the plot represents the median projection for the federal funds rate at the end of each year, with the distribution of dots showing the range of views among FOMC members.

This information is crucial for understanding the Fed’s policy stance and anticipating potential future rate adjustments.

The Implications of the ‘Dot Plot’ Signaling No Immediate Need for Another 50bps Rate Cut

The recent ‘dot plot’ released by the Fed indicated that most FOMC members do not anticipate the need for another 50 basis points (bps) rate cut in the near future. This suggests that the Fed is comfortable with the current interest rate level and believes that the economy is on a path toward sustainable growth.

This stance could provide stability and confidence in the financial markets, potentially leading to lower borrowing costs for businesses and consumers.

Factors That Could Influence the Fed’s Future Decisions on Interest Rates

The Fed’s future decisions on interest rates will depend on a multitude of factors, including:

- Inflation:The Fed’s primary mandate is to maintain price stability. If inflation rises above the target rate of 2%, the Fed may need to raise interest rates to cool down the economy. Conversely, if inflation remains below target, the Fed may consider further rate cuts to stimulate economic activity.

- Economic Growth:The Fed closely monitors economic growth indicators, such as GDP growth, unemployment rate, and consumer spending. If the economy shows signs of weakness, the Fed may lower interest rates to boost growth. Conversely, if the economy is overheating, the Fed may raise rates to prevent inflation.

- Labor Market Conditions:The strength of the labor market is a key indicator of economic health. If unemployment is low and wages are rising, the Fed may consider raising rates to prevent inflationary pressures. Conversely, if unemployment is high and wages are stagnant, the Fed may lower rates to stimulate job creation.

- Global Economic Conditions:The Fed also considers global economic conditions, as they can impact the U.S. economy. For example, a slowdown in the global economy could lead the Fed to lower interest rates to support U.S. exports and growth.

The Impact of Jobs Data

The latest jobs data, particularly the strong employment figures, has become a crucial factor in the Federal Reserve’s deliberations regarding interest rate adjustments. The Fed closely monitors employment data as a key indicator of the overall health of the economy.

Strong Job Market Indicators and the Fed’s Stance

A robust job market, characterized by low unemployment rates and strong job growth, generally signals a healthy economy. This can lead the Fed to adopt a more hawkish stance, potentially indicating a less aggressive approach to interest rate cuts or even a potential rate hike.

Strong job market indicators suggest that the economy is resilient and can withstand higher interest rates, reducing the need for further monetary easing.

The Influence of Economic Indicators on the Fed’s Decision-Making

The Fed considers a wide range of economic indicators when making decisions about interest rates. The relative importance of each indicator can vary depending on the economic context and the Fed’s assessment of the risks to the economy. Here’s a breakdown of some key indicators and their influence:

- Inflation: The Fed’s primary mandate is to maintain price stability. High inflation typically leads to interest rate hikes to cool down the economy and curb price increases. Conversely, low inflation might encourage rate cuts to stimulate economic growth.

- Gross Domestic Product (GDP) Growth: Strong GDP growth indicates a healthy economy and might prompt the Fed to consider raising interest rates to prevent overheating. Weak GDP growth, however, could lead to rate cuts to stimulate economic activity.

- Consumer Spending: Consumer spending is a significant driver of economic growth. Strong consumer spending might suggest the Fed should maintain or even increase interest rates to manage potential inflationary pressures. Conversely, weak consumer spending could indicate a need for rate cuts to boost economic activity.

The Fed’s Balancing Act

The Federal Reserve (Fed) faces a complex balancing act in navigating the current economic landscape. The Fed’s primary objectives are to maintain price stability and foster maximum employment. However, these goals often conflict, forcing the Fed to make difficult choices about interest rate policy.

Key Economic Indicators

The Fed closely monitors a range of economic indicators to guide its monetary policy decisions. These indicators provide insights into the health of the economy, inflation trends, and consumer confidence. The most crucial indicators include:

- Inflation Rate:The Fed targets an inflation rate of 2%. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are key measures of inflation.

- Unemployment Rate:The unemployment rate is a measure of the percentage of the labor force that is unemployed. A low unemployment rate indicates a strong economy, while a high unemployment rate suggests weakness.

- Gross Domestic Product (GDP):GDP is the total value of goods and services produced in a country. GDP growth is a measure of the economy’s overall performance.

- Interest Rates:Interest rates are a key tool of monetary policy. The Fed can influence interest rates by adjusting the federal funds rate, the rate at which banks lend to each other.

- Consumer Confidence:Consumer confidence is a measure of how optimistic consumers are about the economy. High consumer confidence can lead to increased spending and economic growth.

Market Reactions and Outlook

The Fed’s ‘dot plot’ signaling no immediate rate cuts sent ripples through the financial markets, prompting a mixed reaction across asset classes. While some investors welcomed the signal of a potential pause in tightening, others remained cautious, anticipating the potential impact on various investment strategies.

Impact on Asset Classes

The Fed’s stance on interest rates has a significant influence on the performance of various asset classes. Here’s how the markets reacted:

- Stocks: The stock market initially experienced a dip, reflecting concerns about the potential for continued economic headwinds. However, the decline was relatively modest, suggesting that investors remain optimistic about the long-term growth prospects of the US economy.

- Bonds: Bond yields rose in response to the Fed’s signaling of no immediate rate cuts, indicating a potential for higher borrowing costs in the future. This rise in yields is likely to put pressure on bond prices, particularly for longer-term bonds.

Discover how Primoris Services director Schauerman sells $1.48m in stock has transformed methods in this topic.

- Currencies: The US dollar strengthened against other major currencies, reflecting the perceived strength of the US economy and the potential for higher interest rates. This strengthening of the dollar could impact US exports and potentially lead to higher inflation.

Outlook for the US Economy, Fed’s ‘dot plot’ signals no rush for another 50bps cut, but jobs data hold sway

The Fed’s monetary policy decisions have a profound impact on the overall health of the US economy. The current stance suggests that the Fed is closely monitoring economic data and is prepared to adjust its policy as needed. The outlook for the US economy remains uncertain, with several factors at play.

The ongoing global economic slowdown, the potential for further inflation, and the ongoing geopolitical tensions are all contributing to the volatility in the markets. Despite these challenges, the US economy is expected to continue growing, albeit at a slower pace.

The strong labor market and robust consumer spending provide some support for continued economic expansion. However, the Fed’s commitment to fighting inflation and the potential for a recession remain key risks to the outlook.

Closure: Fed’s ‘dot Plot’ Signals No Rush For Another 50bps Cut, But Jobs Data Hold Sway

The Fed’s “dot plot” provides a valuable insight into their current thinking, but it’s not a crystal ball. The strength of the job market will be a critical factor in shaping the Fed’s future decisions on interest rates. Whether the Fed chooses to hold steady or make adjustments, the impact on the economy will be felt across various asset classes, influencing the direction of markets and investor sentiment.

The ongoing dance between inflation, economic growth, and the job market will continue to drive the Fed’s policy decisions, and it’s a story that will continue to unfold in the coming months.

Top FAQs

What is the “dot plot” and why is it important?

The “dot plot” is a visual representation of individual Federal Reserve policymakers’ projections for future interest rates. It offers a glimpse into the Fed’s collective thinking and helps investors understand the potential direction of monetary policy.

How does strong job market data influence the Fed’s decisions?

Strong job market data indicates a healthy economy, which can give the Fed more flexibility to focus on controlling inflation. However, if inflation remains high, the Fed might still consider raising rates to cool the economy, even with a strong job market.

What are the potential risks and benefits of different interest rate scenarios?

Higher interest rates can slow down economic growth by making borrowing more expensive. However, they can also help control inflation. Lower interest rates can stimulate economic growth but can also lead to higher inflation.

CentralPoint Latest News

CentralPoint Latest News