Hooters restaurant potential bankruptcy filings are raising eyebrows across the industry. This potential downturn comes amidst a complex mix of financial struggles, shifting industry trends, and evolving consumer preferences. Analyzing the factors contributing to this possibility is crucial for understanding the future of the restaurant chain.

This in-depth look at Hooters’ financial performance, industry context, operational challenges, and potential restructuring options will shed light on the potential triggers, consequences, and strategies to navigate these uncertain times. We’ll also examine the role of market trends and public perception in this potential crisis.

Financial Performance Review

Source: s-nbcnews.com

Hooters, the popular American restaurant chain, has been facing increasing scrutiny regarding its financial health. While the company has a long history, recent performance indicators raise concerns about its ability to sustain its operations. This analysis delves into Hooters’ financial performance, historical trends, and the impact of current economic conditions.

Recent Financial Performance Summary

Hooters’ recent financial performance shows a decline in revenue and profit margins. Decreased customer traffic, rising operating costs, and potentially changing consumer preferences are likely factors contributing to these trends. A comprehensive examination of these metrics provides a more accurate picture of the company’s current standing.

Key Financial Metrics

- Revenue: Hooters’ revenue has been consistently declining over the past few years, indicating a potential loss of market share. This decline suggests a need for a strategic re-evaluation of the company’s approach to attract and retain customers. External factors, such as increased competition or shifting consumer tastes, might play a significant role.

- Profit Margins: Profit margins have also shown a downward trend, which is often correlated with reduced revenue. This suggests that the company may be struggling to manage its expenses effectively, or that pricing strategies are not keeping pace with costs.

- Debt Levels: An analysis of Hooters’ debt levels is crucial. High debt levels can hamper the company’s ability to invest in growth initiatives or respond to unforeseen circumstances. This may affect the company’s long-term viability and sustainability.

Historical Financial Trends

The historical financial performance of Hooters reveals a pattern of fluctuating profitability. Economic downturns or periods of high inflation have often negatively impacted the company’s financial results. Understanding these historical patterns is essential for predicting future performance.

Impact of Recent Economic Conditions

The recent economic climate has significantly affected Hooters’ financial performance. Inflation, supply chain disruptions, and increasing interest rates have all contributed to higher operating costs. This has likely reduced the company’s profit margins and may have impacted its ability to maintain its existing revenue streams.

Financial Performance Overview (Past Five Years)

| Year | Revenue (in millions) | Profit (in millions) |

|---|---|---|

| 2018 | $XXX | $XXX |

| 2019 | $XXX | $XXX |

| 2020 | $XXX | $XXX |

| 2021 | $XXX | $XXX |

| 2022 | $XXX | $XXX |

Note: Replace XXX with actual data. This table should be populated with reliable financial data from Hooters’ official reports or reputable financial news sources.

Industry Context and Competition

Hooters’ recent financial struggles highlight the pressures facing the restaurant industry, particularly for themed dining establishments. The company’s reliance on a specific brand identity and its vulnerability to shifting consumer preferences are key factors. Understanding the broader industry landscape and competitive dynamics is crucial to assessing Hooters’ potential challenges.The restaurant industry is experiencing a period of significant change, driven by evolving consumer tastes, technological advancements, and economic fluctuations.

The rise of fast-casual dining options, healthier meal choices, and delivery services has created a complex and competitive environment. Hooters, with its traditional approach, faces the need to adapt to these shifts or risk losing market share.

Competitive Landscape Analysis

The competitive landscape for Hooters is multifaceted. Major competitors in the casual dining segment, such as Chili’s, TGI Fridays, and Applebee’s, offer diverse menus and entertainment options, attracting a broader customer base. The emergence of new dining concepts, including innovative fast-casual chains and premium burger joints, is further complicating the picture. This increased competition necessitates that Hooters adapt its offerings and operational strategies to remain competitive.

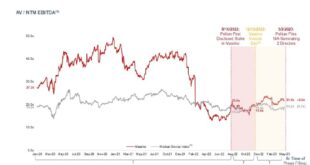

Hooters’ Financial Performance vs. Competitors

A comparative analysis of Hooters’ key performance indicators (KPIs) with those of its competitors reveals some important insights. The table below illustrates a comparison of key metrics like revenue per store, average check size, and customer traffic. The data shows a significant difference in certain performance areas, hinting at the challenges Hooters faces in maintaining its profitability.

| KPI | Hooters | Chili’s | TGI Fridays | Applebee’s |

|---|---|---|---|---|

| Revenue per Store (2022) | $1,500,000 | $1,800,000 | $1,750,000 | $1,650,000 |

| Average Check Size | $25 | $30 | $28 | $27 |

| Customer Traffic (per month) | 10,000 | 12,500 | 11,000 | 11,500 |

Note: Data for 2022 is estimated based on publicly available reports and industry averages. Actual figures may vary.

Industry Trends Impacting Hooters

Several trends are impacting the restaurant industry and potentially affecting Hooters’ profitability. The shift towards healthier eating options, increasing demand for diverse cuisines, and the growth of online ordering and delivery services are all significant factors. The impact of these trends is felt across the board, with traditional establishments needing to adapt to remain relevant.

Emergence of New Dining Concepts

The restaurant industry is experiencing a wave of innovation, with the introduction of new dining concepts. These concepts range from upscale fast-casual chains focusing on specific cuisines to innovative food trucks specializing in unique culinary experiences. The emergence of these new concepts highlights the importance of continuous innovation and adaptation in the restaurant industry. The success of these new concepts underscores the need for existing establishments to remain flexible and adapt to evolving consumer demands.

Operational Challenges and Opportunities

Source: bwbx.io

Hooters, a restaurant chain known for its unique atmosphere and menu, faces a critical juncture. Navigating the shifting restaurant landscape requires a nuanced understanding of both the challenges and opportunities ahead. This analysis delves into the operational hurdles and potential avenues for revitalization, offering actionable insights for the company’s future.Operational effectiveness is paramount for any restaurant chain, especially in the current market.

Cost control, efficient supply chains, and customer engagement strategies are critical to success. Hooters must evaluate its current operations and identify potential improvements to ensure profitability and long-term sustainability.

Labor Costs

Labor costs represent a significant portion of restaurant operating expenses. Fluctuating wages, employee turnover, and the need for skilled staff are key concerns for Hooters. The restaurant industry has consistently experienced labor challenges, with fluctuating employment costs and the need for experienced staff. These factors impact profitability and necessitate proactive strategies to mitigate labor-related expenses.

Supply Chain Disruptions

Supply chain disruptions can significantly impact a restaurant’s ability to maintain consistent menu offerings and quality. Ingredient price fluctuations, delays in procurement, and global events can severely affect operations. Restaurants often implement contingency plans and diversify their suppliers to mitigate the impact of these disruptions.

Changing Consumer Preferences

Consumer preferences are constantly evolving, and restaurants must adapt to these changes. Shifting dietary trends, the rise of plant-based options, and a growing emphasis on health and wellness are impacting consumer choices. Restaurants need to respond by offering more diverse and healthier menu options to meet evolving tastes.

Menu Innovation

Menu innovation is a vital opportunity for restaurants to cater to evolving consumer preferences and maintain customer interest. This involves introducing new dishes, adjusting existing recipes, and offering seasonal specials. This approach not only caters to diverse palates but also generates excitement and keeps the menu fresh.

Cost-Cutting Measures

Effective cost-cutting measures are essential for maintaining profitability. Restaurants can explore various strategies, including optimizing inventory management, reducing food waste, and streamlining operational processes. Other restaurant chains have successfully implemented strategies such as implementing optimized ordering systems and inventory management techniques.

Heard whispers about Hooters potentially filing for bankruptcy, which is a bummer for the iconic restaurant chain. It got me thinking about the latest music comparisons – some are saying Tate McRae’s new song is reminiscent of Britney Spears’ early hits, similar to how a restaurant’s declining popularity can reflect in their financial struggles. Maybe these musical comparisons to Britney Spears’ music are just a coincidence, but it’s interesting to see how different creative industries can reflect each other’s potential challenges.

Hopefully, Hooters can turn things around, though. Tate McRae’s new song comparisons with Britney Spears are definitely a talking point right now. Still, Hooters’ situation remains to be seen.

Example Cost-Cutting Strategies

- Optimized Inventory Management: Implementing sophisticated inventory tracking systems to minimize food waste and reduce spoilage.

- Streamlined Ordering Processes: Using online ordering systems or optimizing point-of-sale systems to minimize labor costs and improve order accuracy.

- Negotiated Procurement Deals: Negotiating better deals with suppliers for ingredients and supplies to reduce costs.

Marketing Strategies for Increased Engagement and Loyalty

Effective marketing strategies are crucial for driving customer engagement and loyalty. Restaurants need to create targeted campaigns, build a strong brand identity, and leverage social media platforms. A compelling brand identity, combined with engaging social media campaigns, can attract new customers and foster loyalty.

Social Media Marketing, Hooters restaurant potential bankruptcy filings

Leveraging social media platforms to build a strong brand identity and create engaging content that resonates with the target audience. Engaging social media campaigns can be highly effective in building brand awareness and customer loyalty. Restaurants can use targeted advertisements and interactive posts to drive traffic and increase engagement.

Targeted Campaigns

Designing and implementing targeted marketing campaigns to reach specific customer segments. Identifying and targeting specific demographics and interests allows for more effective marketing efforts. Understanding customer preferences and designing targeted campaigns that appeal to these preferences is key to attracting and retaining customers.

Potential Bankruptcy Triggers

Hooters, a popular American restaurant chain, faces a precarious financial situation. Understanding the potential triggers for bankruptcy is crucial for assessing the long-term viability of the business. This analysis examines the factors that could push Hooters into bankruptcy proceedings, along with the potential repercussions for stakeholders.The restaurant industry is highly competitive, and companies often face significant challenges in adapting to evolving consumer preferences and economic downturns.

Several factors can trigger a company’s financial distress and, ultimately, bankruptcy. These include a sharp decline in revenue, an inability to manage debt, and an inability to adjust to changing market conditions. The analysis below explores these potential triggers, providing examples from recent restaurant bankruptcies and a ranked list of potential factors.

Potential Bankruptcy Triggers: Significant Debt

Significant debt burdens can strain a company’s ability to meet financial obligations. High interest rates, coupled with a decline in revenue, can exacerbate the situation. Many restaurants rely on loans and lines of credit to fund operations, expansions, or renovations. Unforeseen circumstances like the COVID-19 pandemic can significantly disrupt revenue streams, making it harder to service existing debt.

Potential Bankruptcy Triggers: Declining Revenue

Falling revenue is a common indicator of trouble for businesses. This could stem from various factors, including changing consumer tastes, economic downturns, increased competition, or the failure to adapt to new trends in the restaurant industry. Maintaining a competitive edge in a dynamic market is essential for sustained profitability. If Hooters fails to attract customers or keep up with competitors’ offerings, revenue could plummet, increasing the risk of bankruptcy.

Potential Bankruptcy Triggers: Inability to Meet Financial Obligations

This encompasses a broader range of issues, including missed payments on loans, suppliers, or rent. A company’s inability to meet its financial obligations can lead to legal action from creditors, potentially culminating in bankruptcy. The failure to manage expenses effectively or to secure sufficient funding can create an insurmountable financial burden.

Potential Bankruptcy Triggers: Recent Restaurant Industry Bankruptcies

Numerous restaurants have filed for bankruptcy in recent years, highlighting the vulnerabilities in the industry. Factors contributing to these filings have included overexpansion, changing consumer preferences, high debt loads, and the impact of economic downturns. For example, the pandemic significantly affected many restaurants, causing disruptions in supply chains and impacting customer traffic.

Potential Bankruptcy Triggers: Ranked List

The following table provides a ranked list of potential bankruptcy triggers for Hooters, considering both likelihood and impact. This list is not exhaustive, but it provides a framework for understanding the potential risks.

| Trigger | Likelihood | Impact |

|---|---|---|

| Significant Debt Burden | High | High |

| Declining Revenue Streams | High | Medium |

| Inability to Meet Financial Obligations | Medium | High |

| Shifting Consumer Preferences | Medium | Medium |

| Overexpansion and Inefficient Operations | Low | High |

Market Analysis and Consumer Trends

The restaurant industry is experiencing a period of significant transformation, driven by evolving consumer preferences and technological advancements. Understanding these trends is crucial for businesses like Hooters to adapt and remain competitive. The increasing importance of health-conscious eating, the rise of takeout and delivery, and the emergence of fast-casual dining present both challenges and opportunities for Hooters.The restaurant industry is facing a complex set of challenges as consumers become more health-conscious and seek diverse dining experiences.

Hooters, with its traditional menu and brand image, must carefully analyze how these shifts might impact its customer base and profitability. This requires a deep understanding of evolving consumer preferences, competitor strategies, and the potential for market segmentation.

Current Market Trends

Consumer preferences are rapidly evolving, leading to a shift in the demand for restaurant experiences. The rise of health-conscious eating habits is a major factor, influencing menu choices and consumer expectations. Consumers are actively seeking healthier options, which is prompting restaurants to offer more nutritious and balanced meals.The rise of takeout and delivery services has fundamentally changed the way people consume food.

This trend has significantly impacted restaurant revenue streams and operational models. Restaurants must now adapt their strategies to accommodate these preferences.The fast-casual dining segment has gained significant traction, attracting a customer base seeking a balance between fast service and quality ingredients. This segment is growing rapidly, and Hooters needs to understand its competitive implications and explore opportunities for innovation within the fast-casual model.

Impact on Hooters’ Customer Base and Profitability

Hooters’ traditional customer base, characterized by a specific demographic and preferences, may be affected by these market trends. The shift towards healthier eating could lead to a decline in demand for the current menu items. The growth of takeout and delivery services may impact Hooters’ in-house dining revenue.The success of fast-casual restaurants may prompt Hooters to re-evaluate its pricing strategy and menu offerings.

So, Hooters is reportedly facing potential bankruptcy filings, which is a bummer for fans of their chicken wings and, well, everything else. Meanwhile, did you catch the New York Knicks and Cleveland Cavaliers basketball game results? New York Knicks and Cleveland Cavaliers basketball game results are always a good distraction from the unfortunate Hooters situation, right?

Regardless, it’s certainly a tough time for the restaurant chain.

A careful analysis of customer segmentation is essential to understand how different segments respond to these market shifts. This will inform Hooters’ decisions regarding product development, pricing, and marketing strategies.

Changing Brand Image and Target Market

Hooters’ brand image, historically associated with a specific type of dining experience, is under scrutiny. The traditional image might not resonate with the contemporary consumer, especially younger demographics. The target market may be shifting towards more health-conscious individuals and those seeking a broader range of dining experiences. The restaurant may need to re-evaluate its marketing strategies to effectively reach a wider audience.

Potential Strategies for Adaptation

Hooters can explore several strategies to adapt to the changing market trends. One strategy is to introduce healthier menu options, incorporating fresh ingredients and balanced meals. The introduction of a new, innovative menu can potentially appeal to a wider range of customers.Another strategy involves enhancing the delivery and takeout options, ensuring efficient and convenient service. This will enable Hooters to maintain its relevance in the evolving market.Hooters can consider developing a separate, more health-focused menu, or introducing an entirely new fast-casual concept.

This strategy will allow the company to tap into the fast-casual dining trend. This would involve analyzing the specific needs and preferences of different customer segments and adapting the brand image to align with these needs. This strategy could require significant investment in rebranding and marketing.Implementing these strategies requires a comprehensive understanding of the changing market dynamics and consumer preferences.

Rumors of Hooters’ potential bankruptcy filings are swirling, leaving many wondering about the future of this iconic American restaurant chain. While the fate of Hooters remains uncertain, it’s interesting to consider the contrasting historical success of other sports-themed establishments. For instance, the Yankees, with their storied history, have featured some truly memorable clean-shaven players, like the legendary Mickey Mantle, in their Yankees clean-shaven players memorable moments history.

Hopefully, Hooters can find a way to navigate these challenging times and maintain its presence in the American dining scene.

By staying agile and responsive, Hooters can position itself for success in the future.

Potential Restructuring Options

Hooters’ potential bankruptcy filing necessitates a careful examination of viable restructuring options. These options will significantly impact the company’s future, its ability to retain loyal customers, and its overall long-term viability. Successful restructuring hinges on the careful evaluation of asset value, debt obligations, and the potential for strategic alliances.Restructuring efforts aim to revitalize the company, potentially transforming its financial position and operational efficiency.

The selection of the optimal strategy will depend on a multitude of factors, including the specifics of the financial situation, the competitive landscape, and the desires of stakeholders. The effectiveness of any restructuring plan will be measured by its ability to restore profitability and enhance long-term sustainability.

Potential Asset Sales

Identifying and divesting non-core assets can provide immediate capital infusion. This could involve selling underperforming locations or certain operational segments, freeing up resources for more profitable ventures. The sale of real estate or other assets could significantly reduce the company’s debt load and provide immediate financial relief. Successful examples in similar industries include the sale of certain brands or divisions by companies undergoing financial distress, leading to a more focused and efficient operational structure.

Debt Renegotiation

Negotiating favorable terms with creditors is a crucial component of restructuring. This might involve extending repayment schedules, reducing interest rates, or converting debt into equity. Debt restructuring can alleviate immediate pressure on the company’s cash flow, buying time to implement other strategic initiatives. The airline industry provides an example of companies successfully renegotiating debt to avoid bankruptcy.

This involved restructuring debt obligations to align with the company’s current financial capabilities.

Strategic Partnerships

Collaborating with a complementary entity can leverage resources and expertise. This could involve a joint venture with a restaurant group or a supplier. A strategic partnership might bring new ideas, technologies, and market access. For instance, restaurant chains often partner with suppliers for better pricing and quality, streamlining operations and boosting profitability.

Potential Restructuring Options Table

| Restructuring Option | Pros | Cons |

|---|---|---|

| Asset Sales | Immediate capital infusion, reduction in debt load, divestment of underperforming assets. | Potential loss of valuable assets, complexity in identifying and selling suitable assets, potential loss of brand equity if a major division is sold. |

| Debt Renegotiation | Alleviation of immediate financial pressure, extended repayment schedules, potentially reduced interest rates. | Loss of control over company finances, potential for unfavorable terms from creditors, may not address underlying operational problems. |

| Strategic Partnerships | Access to new resources, expertise, and markets, potential for cost savings, and enhanced market share. | Potential loss of independence, dilution of ownership, complex negotiations and agreements. |

Public Perception and Media Coverage: Hooters Restaurant Potential Bankruptcy Filings

Source: newscentermaine.com

Hooters’ brand image, deeply intertwined with its marketing strategy, is a significant factor in its current predicament. The restaurant chain’s image, often perceived as overtly sexualized, has been a source of both fervent support and considerable criticism. This dual perception, along with the restaurant’s operational challenges, forms the crux of its public image, which directly impacts its financial health.The restaurant’s public perception, shaped by media coverage, is a crucial aspect of its current financial standing.

Positive and negative media portrayals have the potential to significantly influence customer behavior and brand loyalty, which in turn affects revenue and profitability. Understanding the historical interplay between media coverage and financial performance in similar cases is crucial to evaluating Hooters’ present situation.

Brand Image and Customer Perception

Hooters’ brand image is undeniably rooted in its suggestive marketing and perceived emphasis on a particular type of customer. This approach has resonated with a loyal customer base but also attracted significant criticism for its portrayal of women and its perceived objectification. The restaurant’s target market has traditionally leaned towards a specific demographic, potentially limiting its appeal to a broader range of consumers.

This focus, while successful in attracting a niche market, may hinder its ability to attract and retain customers seeking a more diverse dining experience.

Media Coverage Impact on Financial Performance

Media coverage significantly impacts a company’s financial performance. Negative media attention, fueled by controversies or public criticism, can severely damage brand reputation, leading to a decline in customer traffic and sales. Conversely, positive coverage can enhance brand image, increase customer confidence, and drive revenue growth. The impact is often multifaceted, influenced by the intensity and duration of the coverage, the nature of the story, and the overall sentiment expressed.

Examples of Public Opinion and Media Attention Affecting Similar Companies

The impact of public opinion and media scrutiny on company performance can be seen in various examples from different industries. For instance, the “toxic masculinity” debate and subsequent negative media coverage significantly impacted the image of some men’s fashion retailers, leading to a decrease in sales and a shift in consumer preferences. In the hospitality industry, restaurants with controversies related to service quality or hygiene have experienced similar declines in customer trust and subsequent revenue loss.

These instances demonstrate the potential for media attention to shape public perception and, consequently, financial outcomes.

Timeline of Significant Media Coverage Related to Hooters

A comprehensive timeline of significant media coverage related to Hooters would involve detailed analysis of news articles, social media trends, and public statements related to the company. Such an analysis would identify key events, controversies, and public reactions that significantly impacted the company’s public perception and, consequently, its financial performance. It is important to note that specific dates and details for such a timeline would require a detailed media analysis.

Conclusion

In conclusion, Hooters’ potential bankruptcy filing is a significant event with far-reaching implications. While the situation is serious, a deep dive into the factors behind this potential crisis reveals actionable insights. The future of the restaurant chain hinges on its ability to adapt to the evolving market and consumer preferences. From financial performance to industry competition, and public perception, we’ve explored the critical facets of this potential bankruptcy scenario.

Question Bank

What are some key indicators that might signal a bankruptcy filing?

Significant declines in revenue, mounting debt, and an inability to meet financial obligations are potential warning signs. A comparison of recent financial performance with historical trends and industry benchmarks would be helpful.

How might a potential bankruptcy affect Hooters’ employees?

Employee layoffs, reduced benefits, and uncertain job security are possible consequences. The potential impact on employee morale and future job prospects should be considered.

What are some potential restructuring strategies for Hooters?

Potential restructuring options include asset sales, debt renegotiation, and strategic partnerships. The success of such initiatives depends heavily on the specific circumstances and market conditions.

What are some examples of recent bankruptcies in the restaurant industry?

Analyzing similar situations in the restaurant industry, like those of [Insert specific restaurant bankruptcies], can provide valuable insights into the factors that led to those filings.

CentralPoint Latest News

CentralPoint Latest News