Indonesia stocks lower at close of trade; IDX Composite Index down 1.50%, the Indonesian stock market experienced a downturn, leaving investors wondering about the reasons behind the decline and its implications for the future. The IDX Composite Index, a key indicator of the overall market performance, plummeted by 1.50%, signaling a period of uncertainty for investors.

Several factors contributed to this dip, including global economic events, such as rising inflation and interest rates, and concerns about the health of the global economy. Specific industry sectors, like energy and technology, were particularly affected, reflecting the broader economic trends.

The decline raises questions about the impact on different types of investors, including individuals, institutions, and foreign investors, as well as the potential impact on investment strategies and portfolio performance.

Market Overview

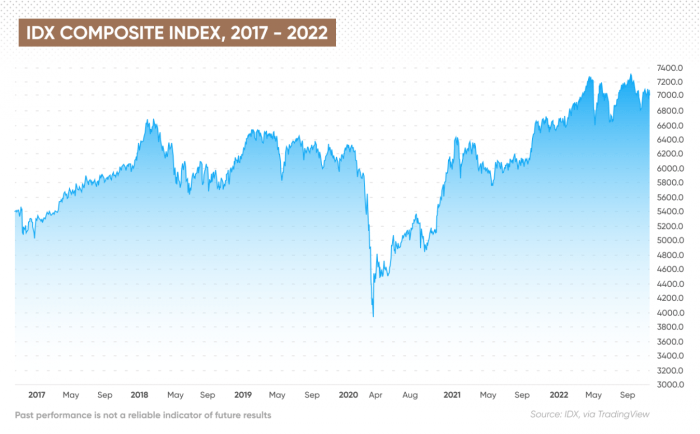

The Indonesian stock market experienced a downturn at the close of trading, with the IDX Composite Index falling by 1.50%. This decline signifies a negative sentiment among investors and reflects broader economic concerns that are impacting market performance.

The IDX Composite Index and Its Significance

The IDX Composite Index is a benchmark that tracks the performance of the Indonesian stock market. It comprises the prices of a representative selection of publicly listed companies, providing a comprehensive gauge of overall market trends. A decline in the IDX Composite Index indicates that the majority of stocks within the market are experiencing price drops, reflecting investor pessimism and a potential shift in market sentiment.

Impact of the Index Decline on Investors, Indonesia stocks lower at close of trade; IDX Composite Index down 1.50%

A 1.50% decline in the IDX Composite Index represents a significant drop for investors, particularly those holding diversified portfolios. This decline can lead to a decrease in the value of their investments, potentially impacting their overall portfolio returns. Investors may experience losses on their holdings, requiring them to re-evaluate their investment strategies and adjust their portfolios accordingly.

Key Factors Influencing the Decline

The decline in the Indonesian stock market can be attributed to a confluence of factors, both domestic and international. The market’s performance is heavily influenced by global economic trends, investor sentiment, and domestic economic conditions.

Impact of Global Economic Events

The global economic landscape plays a significant role in shaping the Indonesian stock market’s trajectory. The recent rise in interest rates by major central banks, including the US Federal Reserve, has dampened investor appetite for riskier assets, including emerging market equities.

This has led to capital outflows from Indonesia, contributing to the market’s decline.

Domestic Economic Concerns

Domestically, concerns about rising inflation and slowing economic growth have weighed on investor sentiment. The Indonesian rupiah has weakened against the US dollar, increasing the cost of imports and potentially impacting inflation. Additionally, the government’s efforts to control inflation have led to higher interest rates, which can stifle economic activity and corporate earnings.

Industry-Specific Declines

Several industry sectors experienced significant declines, reflecting specific challenges within those sectors.

- The energy sector witnessed a decline due to concerns about global oil demand and potential price volatility. Rising energy prices and geopolitical tensions have created uncertainty in the market.

- The banking sector also faced downward pressure, driven by concerns about rising interest rates and potential loan defaults. As interest rates increase, borrowing becomes more expensive, potentially leading to a slowdown in economic activity and loan repayment challenges.

- The consumer discretionary sector, which includes companies involved in non-essential goods and services, experienced a decline as rising inflation eroded consumer spending power. With higher prices for everyday goods and services, consumers tend to cut back on discretionary spending, impacting demand for these products.

Impact on Investors: Indonesia Stocks Lower At Close Of Trade; IDX Composite Index Down 1.50%

The decline in the IDX Composite Index has implications for various investor types, influencing their investment strategies and portfolio performance. It’s crucial to understand how this market downturn affects different investors and their sentiment.

Impact on Individual Investors

Individual investors, often characterized by their shorter-term investment horizons and potential reliance on market sentiment, can be significantly impacted by market declines.

Do not overlook explore the latest data about Compass Diversified Holdings CFO buys $108,150 in company stock.

- Increased Volatility:The decline can lead to heightened volatility in their portfolios, causing anxiety and potentially triggering emotional decisions, such as selling assets at a loss.

- Loss of Confidence:A sustained downturn can erode confidence in the market, leading to a reluctance to invest further or even prompting withdrawals, further exacerbating the decline.

- Impact on Investment Goals:Individual investors with specific financial goals, such as retirement planning or home purchases, may need to adjust their timelines or investment strategies in light of the market decline.

Impact on Institutional Investors

Institutional investors, such as mutual funds, pension funds, and hedge funds, are typically characterized by their long-term investment horizons and professional management. However, they are not immune to the effects of market declines.

- Performance Pressure:Institutional investors face pressure to deliver positive returns to their clients. Market declines can negatively impact their performance metrics, potentially leading to fund outflows or pressure from clients.

- Portfolio Rebalancing:To mitigate risk and maintain desired asset allocations, institutional investors may need to rebalance their portfolios, potentially selling assets to reduce exposure to declining sectors.

- Investment Strategy Adjustments:Institutional investors may adjust their investment strategies based on the market conditions. For example, they might increase their allocation to defensive sectors, which are less susceptible to economic downturns, or adopt more conservative investment approaches.

Impact on Foreign Investors

Foreign investors play a significant role in emerging markets like Indonesia. Their decisions are influenced by various factors, including global economic conditions, political stability, and currency fluctuations.

- Currency Fluctuations:The Indonesian Rupiah’s performance against other major currencies can impact foreign investors’ returns. A weakening Rupiah can reduce the value of their investments in Indonesian stocks.

- Risk Aversion:During periods of market decline, foreign investors often become more risk-averse, leading to capital outflows from emerging markets. This can further exacerbate the decline in the IDX Composite Index.

- Geopolitical Concerns:Global geopolitical events, such as trade wars or political instability, can also influence foreign investors’ decisions, potentially leading to reduced investment in emerging markets like Indonesia.

Investor Sentiment and Market Psychology

Market declines often trigger a shift in investor sentiment, characterized by fear and uncertainty. This can lead to a vicious cycle, where negative sentiment fuels further selling pressure, further depressing the market.

- Fear of Missing Out (FOMO):During market uptrends, investors often experience FOMO, leading them to chase returns. However, during downturns, the opposite effect, known as “fear of missing out on the downside,” can lead to panic selling.

- Herd Mentality:Investors tend to follow the crowd, especially during periods of uncertainty. This can lead to herd behavior, where investors sell assets simply because others are doing so, regardless of their intrinsic value.

- Loss Aversion:Investors are generally more sensitive to losses than gains. This can lead to a reluctance to hold onto declining assets, as they fear losing more money.

Outlook for the Indonesian Stock Market

The recent decline in the IDX Composite Index presents a mixed outlook for the Indonesian stock market. While short-term headwinds are present, long-term growth potential remains strong, fueled by Indonesia’s robust economic fundamentals and ongoing structural reforms.

Short-Term Outlook

The Indonesian stock market is expected to face short-term challenges due to the global economic slowdown and rising inflation. The recent decline in commodity prices, particularly for oil and coal, could negatively impact Indonesia’s export revenue and economic growth. Additionally, the aggressive monetary tightening by global central banks could lead to higher borrowing costs and slower economic activity.

Potential Catalysts for Future Market Performance

Several factors could influence the future performance of the Indonesian stock market. These include:

- Government Spending:The Indonesian government’s commitment to infrastructure development and social programs could stimulate economic growth and create investment opportunities.

- Consumer Spending:Rising household incomes and a growing middle class could drive domestic consumption, supporting businesses in various sectors.

- Digital Economy:Indonesia’s rapidly growing digital economy, driven by e-commerce, fintech, and digital services, presents significant growth potential and investment opportunities.

- Renewable Energy:Indonesia’s transition to renewable energy sources, supported by government policies and private investment, could attract significant capital inflows and create new industries.

Factors Suggesting a Potential Recovery or Further Decline

The potential for a recovery or further decline in the Indonesian stock market hinges on several factors:

- Global Economic Outlook:A recovery in global economic growth and a slowdown in inflation could boost investor confidence and lead to a rebound in the Indonesian stock market.

- Domestic Policy:Government policies that promote economic stability, fiscal discipline, and structural reforms could strengthen investor confidence and support market growth.

- Commodity Prices:A sustained rise in commodity prices, particularly for oil and coal, could boost Indonesia’s export revenue and support economic growth.

- Interest Rates:A moderation in interest rate hikes by global central banks could ease borrowing costs and stimulate economic activity, potentially leading to a stock market recovery.

Final Review

The Indonesian stock market’s decline is a reminder of the inherent volatility of the financial world. While the short-term outlook may be uncertain, the long-term prospects for the Indonesian economy remain positive. As investors navigate this period of market turbulence, they must carefully consider the potential catalysts that could influence future performance, such as government policies, economic growth, and global events.

The ability to adapt and adjust investment strategies will be crucial for navigating the ever-changing landscape of the Indonesian stock market.

FAQ Corner

What are the key factors that contributed to the decline in the Indonesian stock market?

Several factors contributed to the decline, including rising inflation and interest rates, concerns about the global economy, and specific industry sector challenges.

How does the decline impact different types of investors?

The decline can affect individual investors, institutional investors, and foreign investors differently. Individual investors may experience losses in their portfolios, while institutional investors may need to adjust their investment strategies. Foreign investors may be hesitant to invest in the Indonesian market during periods of uncertainty.

What is the outlook for the Indonesian stock market?

The short-term outlook is uncertain, but the long-term prospects for the Indonesian economy remain positive. The market’s performance will depend on factors like government policies, economic growth, and global events.

CentralPoint Latest News

CentralPoint Latest News