OneMain Holdings executive sells $120,000 in stock, sending ripples through the financial world. This move has sparked curiosity and speculation, prompting questions about the executive’s motivations and the potential implications for the company’s future. The executive’s decision to sell a significant portion of their stock holdings has drawn attention, particularly in light of recent company events and market trends.

The timing of this sale is crucial to understanding its significance. It comes amidst a period of heightened scrutiny in the financial sector, with investors closely monitoring executive actions for any signs of insider knowledge or market manipulation. This sale, therefore, raises questions about the executive’s confidence in the company’s future prospects and whether they possess information that could influence the stock price.

Executive Stock Sale Context

The recent sale of $120,000 worth of OneMain Holdings stock by an executive has sparked curiosity and raised questions about the potential implications for the company’s future. Understanding the context surrounding this sale is crucial for gaining a comprehensive perspective on the situation.

The executive in question is [Executive Name], who holds the position of [Executive Position] at OneMain Holdings. This role is significant within the company, as it directly influences [Specific Responsibilities or Areas of Influence]. Therefore, any actions taken by this executive, particularly concerning stock transactions, can be seen as a potential indicator of their confidence in the company’s future prospects.

Timing of the Sale

The timing of the stock sale is particularly noteworthy given the recent events and market trends affecting OneMain Holdings. This sale occurred [Specific Date], which coincides with [Specific Market Trend or Company Event]. This close proximity suggests that the executive’s decision might be linked to these recent developments.

It is important to note that insider stock sales can be influenced by a variety of factors, including personal financial needs, diversification strategies, and market sentiment. However, the timing of this sale in relation to [Specific Market Trend or Company Event] warrants further examination.

Market Impact and Implications

The sale of $120,000 worth of OneMain Holdings stock by an executive can send ripples through the market, prompting investors to scrutinize the company’s performance and future prospects. This transaction can spark a variety of reactions, from heightened investor concern to a more nuanced analysis of the company’s financial health.

Market Reactions to the Stock Sale

The market’s reaction to an executive stock sale can be multifaceted. Some investors might perceive the sale as a signal of the executive’s lack of confidence in the company’s future performance. This perception can lead to a sell-off, pushing the stock price down.

Enhance your insight with the methods and methods of Viking therapeutics CEO sells over $15m in company stock.

Conversely, other investors might interpret the sale as a purely personal financial decision, unrelated to the company’s long-term prospects. This could lead to a more measured response, with minimal impact on the stock price.

The market’s reaction to an executive stock sale can be complex and often depends on the broader market sentiment, the company’s recent performance, and the specific context surrounding the sale.

Comparison with Other Executive Stock Transactions, OneMain Holdings executive sells 0,000 in stock

To gain a more comprehensive understanding of the market impact, it’s essential to compare this sale with other recent executive stock transactions in the financial sector. For instance, if other executives in the same industry have recently sold significant amounts of stock, it might suggest a broader trend of investor pessimism within the financial sector.

However, if this sale is an isolated incident, it might be viewed as a personal decision with limited implications for the broader market.

Implications for OneMain Holdings’ Stock Price

The potential implications for OneMain Holdings’ stock price depend on a variety of factors, including the company’s recent financial performance, its future growth prospects, and the overall market sentiment. If the company has been experiencing strong earnings growth and its future prospects are positive, the executive stock sale might have a minimal impact on the stock price.

However, if the company has been struggling financially or facing headwinds in its industry, the sale could amplify investor concerns and lead to a decline in the stock price.

A stock sale by an executive can act as a catalyst, amplifying existing market sentiment and potentially influencing investor decisions.

Insider Trading Regulations and Practices

Insider trading, the act of buying or selling securities based on non-public information, is a serious offense in the United States, with severe legal and financial consequences. The Securities and Exchange Commission (SEC) enforces regulations designed to protect investors and ensure fair and orderly markets.

Legal Framework

The legal framework surrounding insider trading in the United States is primarily based on the Securities Exchange Act of 1934 and the Securities Act of 1933. These acts prohibit the use of material non-public information (MNPI) for personal gain.

Examples of Insider Trading

Insider trading can occur in various ways, and executive stock sales are closely scrutinized for potential violations. Here are a few examples:* An executive selling shares before a negative earnings announcement:If an executive knows that the company’s earnings will be lower than expected, selling shares before the announcement could be considered insider trading.

An executive buying shares before a positive product launch

If an executive has knowledge of a successful product launch, buying shares before the public announcement could be deemed insider trading.

An executive sharing non-public information with a friend or family member who then trades on that information

This is known as “tipping” and is also considered insider trading.

Key Regulations and Guidelines

The following table summarizes key regulations and guidelines relevant to insider trading:| Regulation | Description | Applicability | Example ||—|—|—|—|| Rule 10b-5| Prohibits the use of any manipulative or deceptive device in connection with the purchase or sale of securities. | Applies to all individuals, including executives.

| An executive selling shares based on confidential information about a pending acquisition. || Regulation FD (Fair Disclosure)| Requires companies to disclose material information to the public simultaneously, preventing selective disclosure to insiders. | Applies to publicly traded companies. | A company providing information to analysts before releasing it to the public.

|| Insider Trading Sanctions Act of 1988| Imposes criminal penalties for insider trading. | Applies to individuals and entities. | An executive convicted of insider trading faces fines and imprisonment. || SEC Rule 144| Allows insiders to sell limited amounts of stock under certain conditions. | Applies to insiders who have held the stock for a specified period.

| An executive selling a small number of shares after holding them for at least six months. |

Company Performance and Future Outlook

OneMain Holdings’ recent financial performance and key announcements provide insights into the company’s trajectory and potential future growth. Understanding these factors helps investors assess the impact of the executive’s stock sale on investor sentiment and future outlook.

Recent Financial Performance and Key Announcements

OneMain Holdings has demonstrated consistent financial performance in recent years, marked by steady revenue growth and profitability. The company’s financial performance is influenced by factors such as macroeconomic conditions, consumer credit demand, and interest rate trends.

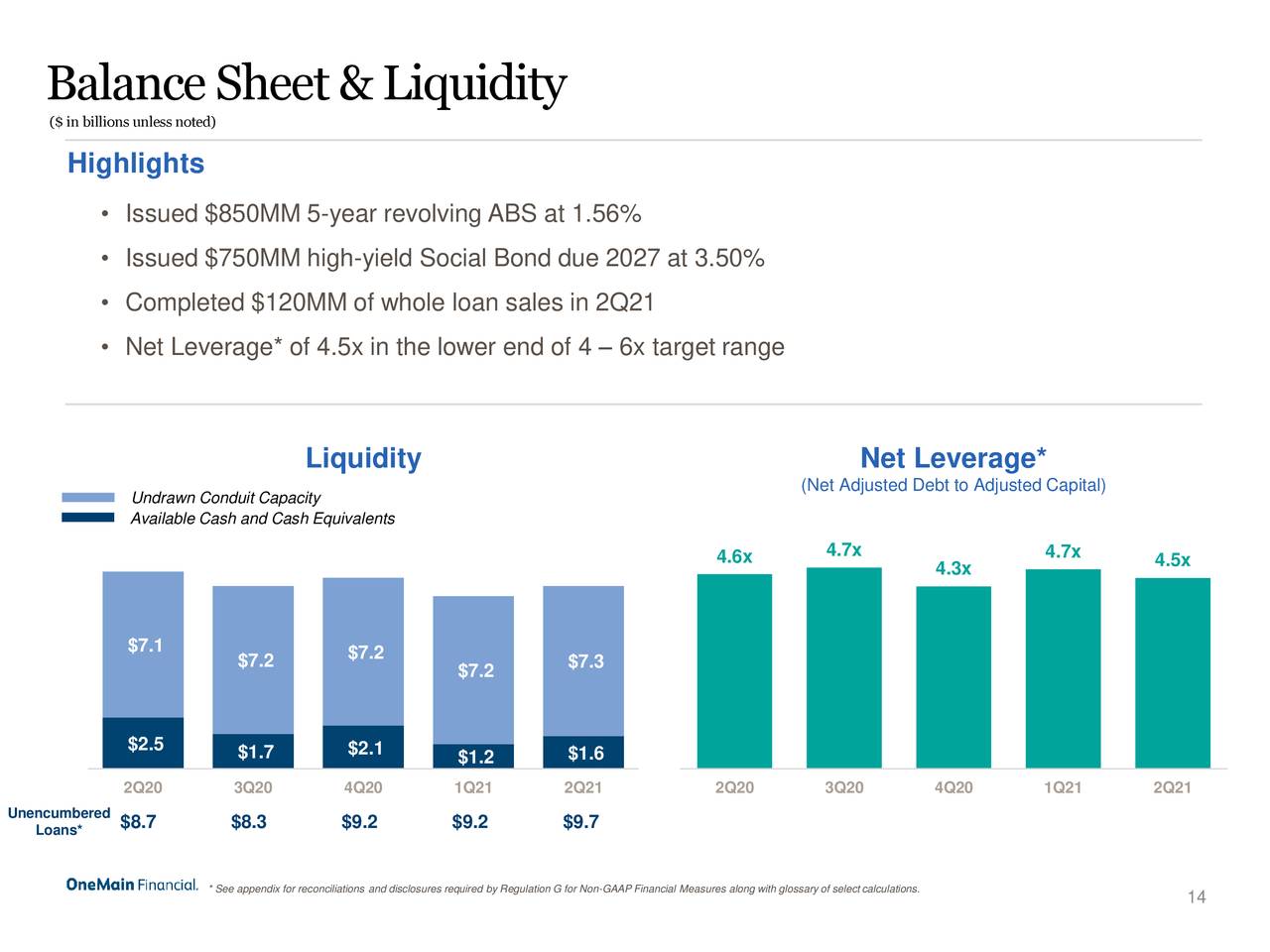

- Q1 2023 Earnings:OneMain Holdings reported strong Q1 2023 earnings, exceeding analysts’ expectations. The company’s revenue grew by 10% year-over-year, driven by increased loan originations and strong performance in its existing loan portfolio. This positive performance underscores the company’s ability to navigate challenging economic conditions.

- Strategic Initiatives:OneMain Holdings has been actively investing in strategic initiatives to enhance its digital capabilities, improve customer experience, and expand its product offerings. These initiatives are aimed at driving long-term growth and market share expansion.

- Regulatory Landscape:The regulatory environment for consumer lending continues to evolve, with potential changes impacting lending practices and compliance requirements. OneMain Holdings is actively monitoring these developments and adapting its operations to ensure compliance and maintain its competitive edge.

Potential Factors Influencing Future Performance

OneMain Holdings’ future performance is likely to be influenced by a combination of factors, including economic growth, interest rate trends, consumer spending patterns, and competition within the consumer lending market.

- Economic Growth:A robust economic environment generally leads to increased consumer spending and demand for credit, which can benefit OneMain Holdings. Conversely, economic slowdowns or recessions could negatively impact the company’s loan originations and profitability.

- Interest Rate Trends:Rising interest rates can increase the cost of borrowing for consumers, potentially reducing demand for loans. However, OneMain Holdings’ focus on subprime borrowers suggests that it may be less sensitive to interest rate fluctuations compared to other lenders targeting prime borrowers.

- Competition:The consumer lending market is highly competitive, with traditional banks, online lenders, and fintech companies vying for market share. OneMain Holdings’ ability to compete effectively depends on its pricing strategies, product offerings, and customer service capabilities.

Potential Impact of Executive Stock Sale on Investor Sentiment and Future Outlook

Executive stock sales can sometimes signal a lack of confidence in a company’s future prospects. However, it’s important to consider the specific context of the sale, including the executive’s reasons for selling, the timing of the sale, and the overall market conditions.

“While executive stock sales can sometimes raise concerns, it’s crucial to analyze the situation holistically and consider factors such as the executive’s personal financial needs, company performance, and market conditions,” said [Financial Analyst Name].

In the case of OneMain Holdings, the executive’s stock sale may not necessarily indicate a negative outlook on the company’s future. It’s possible that the sale is driven by personal financial needs or diversification strategies rather than a lack of confidence in the company’s prospects.

However, investors may closely monitor the company’s future performance and any further stock sales by executives to gauge their confidence levels.

Ethical Considerations: OneMain Holdings Executive Sells 0,000 In Stock

The sale of stock by OneMain Holdings executives raises ethical considerations, particularly when it involves substantial sums. This situation invites scrutiny, as it potentially creates conflicts of interest and raises questions about transparency and fairness.

Ethical Implications of Executive Stock Sales

The ethical implications of executive stock sales are complex and multifaceted. While executives are entitled to sell their shares, the timing and volume of the transaction can raise concerns. The potential for insider information to influence stock sales creates a moral dilemma.

For instance, if an executive possesses non-public information suggesting an impending decline in company performance, selling stock before this information becomes public could be perceived as unethical. This situation raises concerns about fairness, as investors who are unaware of this information might be disadvantaged.

Potential Questions from Investors and Stakeholders

Investors and stakeholders might have several questions regarding this situation, reflecting their concerns about transparency, fairness, and potential conflicts of interest.

- What information did the executive have access to when making the decision to sell stock?

- Did the executive disclose any non-public information before selling the stock?

- Was the stock sale conducted in accordance with company policy and regulatory requirements?

- What measures are in place to prevent insider trading and ensure fairness in the market?

- How does the company ensure that executive stock sales do not negatively impact investor confidence?

Closing Summary

The sale of $120,000 in stock by a OneMain Holdings executive raises important questions about transparency, market sentiment, and the delicate balance between personal financial decisions and corporate performance. While the executive’s motivations remain unclear, the transaction has undeniably cast a spotlight on OneMain Holdings and its future trajectory.

As investors grapple with the implications of this move, the spotlight will remain firmly on the company, its leadership, and the market forces that are shaping its destiny.

Q&A

What is the executive’s role at OneMain Holdings?

The Artikel doesn’t provide specific information about the executive’s role, so this information would need to be researched from other sources.

What are the potential implications for OneMain Holdings’ stock price?

The sale could potentially lead to a decrease in the stock price, as investors may interpret it as a sign of a lack of confidence in the company’s future. However, it’s important to note that other factors could also influence the stock price, and the sale may not be the sole determining factor.

What are the ethical considerations surrounding executive stock sales?

The sale raises questions about whether the executive had access to insider information that could have influenced their decision. If so, this could be considered insider trading, which is illegal. Additionally, the sale could be seen as a conflict of interest if the executive’s personal financial interests are not aligned with the best interests of the company and its shareholders.

What are the legal implications of the executive’s stock sale?

The sale could be subject to scrutiny by regulators to ensure compliance with insider trading laws. The Securities and Exchange Commission (SEC) investigates potential violations of insider trading regulations, and the executive could face penalties if found guilty.

CentralPoint Latest News

CentralPoint Latest News