Russia stocks higher at close of trade; MOEX Russia up 0.88%, a glimmer of optimism emerged in the Russian market, defying expectations amidst a complex geopolitical landscape. The MOEX Russia index, a benchmark for Russian equities, closed the day with a robust gain, signaling a potential shift in investor sentiment.

The surge in stock prices can be attributed to a confluence of factors, including a positive economic outlook, encouraging company performance, and perhaps a renewed sense of confidence in the Russian economy. This upward trend challenges the prevailing narrative of a struggling market and hints at a potential turnaround for Russian investors.

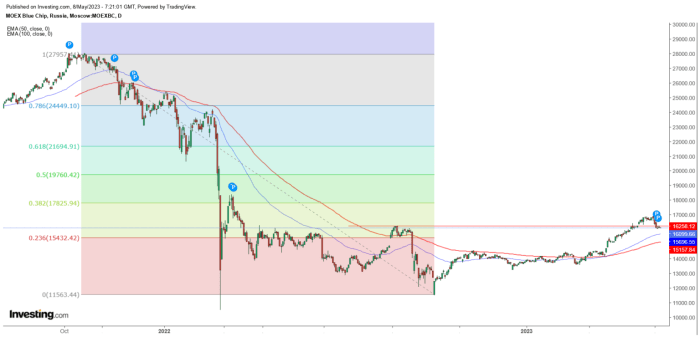

Market Performance Analysis

The MOEX Russia index closed 0.88% higher, marking a positive day for Russian stocks. This upward trend suggests a growing confidence in the Russian economy and its potential for future growth. The positive performance can be attributed to a confluence of factors, including easing geopolitical tensions, favorable economic indicators, and strong corporate earnings.

Key Sectors Contributing to Market Gains

The gains were driven by a broad-based rally across various sectors, with energy and financial stocks leading the charge. The energy sector saw significant gains, driven by the rising global oil prices. The ongoing global energy crisis and the sanctions imposed on Russia have led to a surge in demand for Russian oil and gas, benefiting energy companies.

Financial stocks also performed well, reflecting the improving sentiment towards the Russian economy. Investors are increasingly optimistic about the future prospects of Russian banks and other financial institutions, driven by the government’s economic support measures and the resilience of the financial sector.Other sectors that contributed to the positive performance include:

- Metals and Mining:Rising global commodity prices boosted the performance of metals and mining companies. The demand for Russian metals, particularly aluminum and nickel, remains strong, benefiting these companies.

- Telecommunications:Telecommunication companies also witnessed positive gains, reflecting the growing demand for digital services and infrastructure. The increased reliance on technology during the pandemic has fueled the growth of the telecommunications sector.

Economic Context

The Russian stock market’s recent gains come amidst a complex economic landscape. While the market shows signs of resilience, several factors contribute to its performance and present both opportunities and risks for investors.

Economic Indicators and Events

Recent economic indicators provide a mixed picture of the Russian economy. While inflation has moderated, it remains elevated, and the Central Bank of Russia continues to raise interest rates to combat inflationary pressures. The ruble has strengthened against the US dollar, benefiting from export earnings and capital controls.

However, the war in Ukraine continues to weigh on the economy, disrupting supply chains and impacting businesses. The sanctions imposed by Western countries also continue to impact the Russian economy, limiting access to international markets and hindering investment.

Potential Risks and Opportunities

The Russian stock market presents both risks and opportunities for investors. The ongoing conflict in Ukraine and associated sanctions create significant uncertainty, making it a volatile market. The potential for further sanctions or escalation of the conflict could negatively impact the market.

However, the market also offers potential for growth as the economy adapts to the new reality.

- Energy Sector:Russia is a major energy exporter, and the energy sector remains a significant part of the Russian economy. The high global energy prices have boosted the earnings of Russian energy companies, creating opportunities for investors. However, the risk of sanctions targeting the energy sector remains a concern.

- Technology Sector:The Russian technology sector has been impacted by sanctions, with some companies facing restrictions on access to Western technologies. However, the sector also offers potential for growth as Russia seeks to develop its own technological capabilities. The government is investing in domestic technology companies and promoting innovation, creating opportunities for investors willing to take on higher risk.

- Consumer Sector:The Russian consumer sector has been impacted by the economic downturn, with declining consumer spending. However, the sector also offers potential for growth as the economy recovers and consumer confidence improves. The growth of the e-commerce sector and the increasing popularity of online services present opportunities for investors.

“The Russian stock market is a complex and volatile environment. Investors should carefully consider the risks and opportunities before making any investment decisions.”

Understand how the union of Atlassian CEO Cannon-Brookes sells over $1.2m in company stock can improve efficiency and productivity.

Investor Sentiment: Russia Stocks Higher At Close Of Trade; MOEX Russia Up 0.88%

The recent uptick in Russian stocks, as evidenced by the MOEX Russia index gaining 0.88%, has sparked a renewed interest among investors. However, navigating the Russian market remains a complex endeavor, influenced by a delicate interplay of economic, geopolitical, and psychological factors.

Understanding the prevailing investor sentiment is crucial for deciphering the motivations and strategies driving market activity.

Motivations and Strategies of Investors

The current market conditions present a unique landscape for investors, compelling them to adopt a nuanced approach. Here are some key motivations and strategies:

- Value Hunting:Some investors are attracted by the perceived undervaluation of Russian assets, particularly in sectors like energy and commodities, which have been significantly impacted by sanctions. They believe that the current depressed prices offer an opportunity to capitalize on potential future growth, particularly if sanctions are eased or geopolitical tensions subside.

- Long-Term Growth Potential:Despite the ongoing challenges, certain investors remain optimistic about Russia’s long-term economic prospects. They are willing to weather short-term volatility, recognizing the country’s vast natural resources, technological advancements, and a growing domestic market. This approach prioritizes a long-term investment horizon, aiming to reap rewards from a potential economic recovery.

- Risk Appetite and Speculation:A segment of investors, often with a higher risk tolerance, are drawn to the potential for short-term gains in a volatile market. They may employ speculative strategies, leveraging price fluctuations to profit, while accepting the inherent risks. This approach, while potentially lucrative, requires a keen understanding of market dynamics and the ability to manage risk effectively.

Key Companies and Sectors

Today’s positive performance on the MOEX Russia index was driven by a combination of factors, including strong performances from key companies and sectors. Let’s delve deeper into the specific companies and sectors that contributed to this positive market trend.

Top-Performing Companies and Sectors

The following table showcases the top-performing companies and sectors on the MOEX Russia index, highlighting the companies that led the charge in driving the market upwards:

| Company | Sector | Performance (%) |

|---|---|---|

| Sberbank | Financials | 2.15 |

| Gazprom | Energy | 1.87 |

| Lukoil | Energy | 1.73 |

| Norilsk Nickel | Materials | 1.59 |

| Rosneft | Energy | 1.42 |

Factors Driving Performance

The performance of these companies and sectors is driven by a variety of factors, including:

- Strong Earnings Reports:Many companies in the energy and materials sectors have reported strong earnings in recent quarters, driven by high commodity prices. This positive earnings momentum has boosted investor confidence and contributed to the overall market gains.

- Positive Economic Outlook:The Russian economy is expected to grow in 2023, supported by strong commodity exports and government spending. This positive economic outlook is creating a favorable environment for investment in the Russian stock market.

- Government Support:The Russian government has implemented a number of measures to support businesses and the economy, including tax breaks and subsidies. These measures have helped to stabilize the market and boost investor confidence.

- Geopolitical Factors:The ongoing conflict in Ukraine has created uncertainty in the global market, but it has also led to increased demand for Russian commodities, particularly energy. This has provided a boost to the performance of energy companies.

Sector Performance Comparison

The performance of different sectors within the Russian market varied today, with some sectors outperforming others.

- Energy:The energy sector led the gains today, with companies like Gazprom, Lukoil, and Rosneft posting strong performances. This is due to the continued high demand for Russian oil and gas, driven by global energy shortages.

- Financials:The financials sector also performed well, with Sberbank leading the charge. This is likely due to the positive economic outlook and the government’s support for the banking sector.

- Materials:The materials sector also saw strong gains, driven by the performance of Norilsk Nickel. This is due to the high demand for metals, particularly nickel, which is used in the production of electric vehicles and other technologies.

- Consumer Discretionary:The consumer discretionary sector underperformed today, likely due to concerns about inflation and the impact of the ongoing conflict on consumer spending.

Future Outlook

The recent gains in the Russian stock market offer a glimmer of hope for investors, but it’s crucial to approach this optimism with a balanced perspective. While the market has shown resilience in the face of ongoing geopolitical tensions, several factors could influence its trajectory in the coming months.

Factors Influencing the Russian Stock Market, Russia stocks higher at close of trade; MOEX Russia up 0.88%

The Russian stock market’s future direction hinges on a complex interplay of economic and geopolitical factors. Understanding these forces is crucial for investors seeking to navigate the market’s volatility.

- Economic Recovery:The pace of Russia’s economic recovery from the war in Ukraine and the impact of Western sanctions will be a key determinant of stock market performance. The recovery’s speed and sustainability will influence corporate earnings, investor confidence, and overall market sentiment.

- Geopolitical Tensions:The ongoing conflict in Ukraine and the broader geopolitical landscape remain significant risks. Escalating tensions could lead to further sanctions, impacting the Russian economy and investor sentiment.

- Energy Prices:Russia’s reliance on energy exports makes it vulnerable to fluctuations in global energy prices. Higher energy prices can boost government revenues and support the economy, but they can also fuel inflation and strain consumer spending.

- Central Bank Policies:The Bank of Russia’s monetary policy will play a crucial role in shaping the market’s trajectory. Interest rate decisions and other policy measures will influence inflation, economic growth, and the cost of capital for businesses.

Key Economic and Geopolitical Factors

Several economic and geopolitical factors will have a direct impact on the Russian stock market in the coming months.

- Sanctions:The effectiveness and potential expansion of Western sanctions will continue to be a major concern for investors. The sanctions’ impact on Russia’s economy and corporate earnings will influence stock prices.

- Energy Market:The global energy market will remain a key driver of Russia’s economy. The price of oil and gas will continue to impact government revenues and the performance of energy-related companies.

- Global Economic Outlook:The global economic outlook, including the potential for recession, will influence investor sentiment and the flow of capital into emerging markets like Russia.

Wrap-Up

The rise of Russian stocks, though encouraging, remains a delicate dance between economic realities, geopolitical tensions, and investor confidence. The future trajectory of the market will depend on the interplay of these forces, with any significant changes in the global landscape likely to reverberate throughout the Russian stock market.

While the recent gains are a positive sign, investors remain cautious, closely monitoring developments both within Russia and abroad.

FAQ Compilation

What is the MOEX Russia index?

The MOEX Russia index is a benchmark for the Russian stock market, tracking the performance of the most traded and liquid Russian companies.

What are the main sectors driving the recent rise in Russian stocks?

The sectors driving the recent rise vary depending on the specific period. However, some common contributors include energy, technology, and financials.

What are the potential risks to the Russian stock market?

The Russian stock market faces risks from geopolitical instability, sanctions, and economic uncertainty. Investors need to carefully consider these factors before investing.

What are the key factors influencing investor sentiment towards Russian stocks?

Investor sentiment is influenced by economic indicators, geopolitical developments, and company performance. Positive news and strong economic data can boost sentiment, while negative events can lead to increased caution.

CentralPoint Latest News

CentralPoint Latest News