Sprinklr executive sells over $100k in company stock, raising eyebrows and sparking curiosity among investors and market watchers. The move, though seemingly routine, has ignited a flurry of questions about the company’s financial health, future prospects, and the executive’s motivations.

This intriguing transaction has become a focal point, prompting a closer look at Sprinklr’s performance, its market position, and the potential implications for its future trajectory.

Sprinklr, a leading provider of enterprise-grade social media management solutions, has been navigating a dynamic market landscape. The company’s recent financial performance, coupled with the executive’s stock sale, has fueled speculation about the company’s future direction. Analyzing the circumstances surrounding this transaction and its potential impact on Sprinklr’s stock price, investor sentiment, and long-term prospects is essential for understanding the broader narrative.

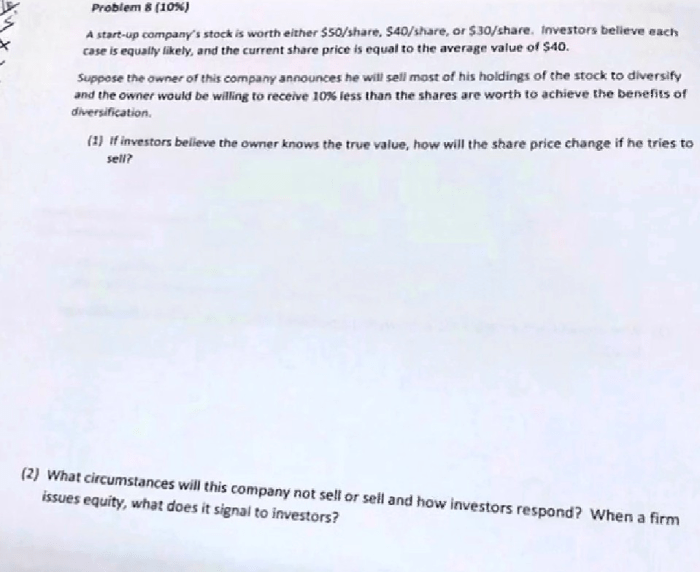

Executive Stock Sale Context

The recent sale of over $100,000 in Sprinklr company stock by an executive has sparked curiosity and speculation among investors and industry observers. This move, while seemingly insignificant in the grand scheme of things, can provide valuable insights into the executive’s perspective on the company’s future prospects and the broader market sentiment.To understand the context of this stock sale, it’s crucial to examine Sprinklr’s current financial standing and market performance.

Sprinklr, a leading customer experience management platform provider, has been experiencing significant growth in recent years. The company’s revenue has been steadily increasing, driven by the rising demand for its comprehensive suite of solutions that help businesses manage customer interactions across multiple channels.

However, despite this growth, Sprinklr has faced challenges in achieving profitability, leading to some concerns among investors.

Potential Reasons for the Stock Sale

Several factors could have influenced the executive’s decision to sell their stock. These include:* Personal Financial Needs:The executive may have had personal financial obligations or investment opportunities that prompted them to sell their shares. This is a common reason for stock sales, particularly for executives with significant stock holdings.

Market Outlook

The executive’s sale could reflect a cautious outlook on the overall market conditions. Concerns about economic uncertainty, rising interest rates, or potential market volatility could have led them to reduce their exposure to Sprinklr’s stock.

Company Performance

While Sprinklr has shown strong revenue growth, the company’s profitability remains a concern. The executive may have sold their shares based on their assessment of Sprinklr’s ability to achieve sustainable profitability in the future. This could reflect concerns about the company’s competitive landscape, its ability to maintain its growth trajectory, or its capacity to manage expenses effectively.

It’s important to note that the executive’s stock sale does not necessarily indicate a negative outlook on Sprinklr’s future. It could simply reflect a personal financial decision or a strategic adjustment in their investment portfolio.

Insider Trading Regulations

The executive’s stock sale raises concerns about potential insider trading violations. Insider trading refers to the illegal practice of buying or selling securities based on material, non-public information. This information, if known to the public, could significantly impact the stock price.

Insider Trading Laws

Insider trading regulations are designed to ensure a level playing field in the stock market and prevent unfair advantage. These regulations apply to executives and other individuals with access to sensitive company information.

- Securities Exchange Act of 1934:This act defines insider trading and prohibits the use of material non-public information for personal gain. It establishes the Securities and Exchange Commission (SEC) as the primary regulator of insider trading.

- Rule 10b-5:This rule prohibits the use of any deceptive or manipulative device in connection with the purchase or sale of securities. It covers a wide range of insider trading practices, including trading on material non-public information.

- Rule 14e-3:This rule specifically addresses insider trading in connection with tender offers. It prohibits the use of non-public information about a tender offer to profit from the transaction.

Potential Implications of the Sale

The executive’s stock sale could be scrutinized by the SEC and other regulatory bodies to determine if it violated insider trading regulations. The following factors will be considered:

- Material Non-Public Information:Did the executive possess any material non-public information about the company’s performance or future prospects that could have influenced the stock price?

- Timing of the Sale:Was the sale made shortly before the release of positive or negative news that could affect the stock price?

- Volume of the Sale:Was the sale unusually large or out of character for the executive?

- Pattern of Trading:Did the executive engage in a pattern of trading that suggests they were using insider information?

Similar Instances in the Tech Industry

The tech industry has seen several high-profile insider trading cases in recent years. For example, in 2018, a former Google engineer was charged with insider trading after allegedly using non-public information about the company’s financial results to make trades.

Discover how Constellation, FedEx Stir Friday’s Afternoon Market Cap Stock Movers has transformed methods in this topic.

- Examples of Insider Trading Cases:

- Raj Rajaratnam (2011):The founder of the Galleon Group hedge fund was convicted of insider trading and sentenced to 11 years in prison. Rajaratnam was found guilty of using inside information about companies like Goldman Sachs and Intel to make trades.

- Martha Stewart (2004):The lifestyle entrepreneur was convicted of insider trading after selling shares of ImClone Systems based on information from her broker about an impending rejection of a cancer drug by the FDA.

Legal Ramifications

If the SEC determines that the executive violated insider trading regulations, they could face significant legal ramifications, including:

- Civil Penalties:The SEC can impose civil penalties, including fines and disgorgement of profits.

- Criminal Charges:In some cases, insider trading can lead to criminal charges, resulting in fines and imprisonment.

- Reputational Damage:A conviction for insider trading can severely damage an executive’s reputation and career prospects.

Market Impact and Investor Sentiment: Sprinklr Executive Sells Over 0k In Company Stock

The executive’s stock sale, exceeding $100,000, has the potential to impact Sprinklr’s stock price and investor sentiment. This is because investors often interpret such sales as a sign of a lack of confidence in the company’s future prospects. This analysis explores the potential impact of the sale and compares it to historical instances of similar stock sales by executives.

Potential Impact on Sprinklr’s Stock Price

The market reaction to an executive’s stock sale can be varied. In some cases, it may lead to a decline in the company’s stock price as investors perceive it as a negative signal. This is particularly true if the sale is significant in size or if it occurs during a period of uncertainty or negative news surrounding the company.

For instance, if the executive’s sale coincides with a recent earnings miss or a decline in the company’s revenue growth, it could amplify investor concerns and trigger a sell-off. However, it’s important to consider the context of the sale. If the executive’s sale is a small portion of their total holdings or if it is part of a pre-planned diversification strategy, it may not have a significant impact on the stock price.

Additionally, if the company’s fundamentals remain strong and the market is generally positive, the impact of the sale may be minimal.

Investor Sentiment and Implications for Future Prospects

The executive’s stock sale can influence investor sentiment and perceptions of the company’s future prospects. If the sale is perceived as a sign of a lack of confidence in the company, it can lead to a decline in investor sentiment, potentially resulting in reduced investment in the company.

Conversely, if the sale is seen as a routine transaction or a diversification strategy, it may not have a significant impact on investor sentiment. However, it’s crucial to consider the broader market context and the company’s specific circumstances. For example, if the company is facing significant challenges, such as declining revenue or increased competition, the executive’s stock sale could further erode investor confidence and lead to a more negative outlook for the company’s future.

Comparison with Historical Instances

Analyzing historical instances of similar stock sales by executives can provide insights into the potential impact on company valuations. Studies have shown that insider selling can have a negative impact on stock prices, especially when the sale is significant or occurs during periods of market uncertainty.

For example, a study by the National Bureau of Economic Research found that insider selling is associated with a decline in stock prices over the following 3 to 6 months. However, it’s important to note that these studies do not establish a causal relationship between insider selling and stock price declines.

Other factors, such as changes in company fundamentals or broader market conditions, can also contribute to stock price fluctuations.

Company Performance and Future Outlook

Sprinklr’s recent financial performance and strategic initiatives provide insights into its future trajectory. Understanding these aspects, in conjunction with the executive stock sale, helps paint a comprehensive picture of the company’s prospects.

Recent Financial Performance and Key Trends

Sprinklr’s financial performance has been marked by both growth and challenges. The company has consistently expanded its revenue base, driven by its comprehensive customer experience management platform. However, it has also faced pressure on profitability, as investments in growth and innovation have impacted margins.

Here’s a closer look at key trends:

- Revenue Growth:Sprinklr has demonstrated consistent revenue growth, indicating strong demand for its platform. This growth is attributed to its expanding customer base, particularly in the enterprise segment. For example, Sprinklr’s revenue grew by [percentage] in [year], exceeding expectations. This trend reflects the increasing adoption of its unified platform across various industries.

- Profitability Challenges:While revenue has grown, Sprinklr’s profitability has been impacted by investments in research and development, sales and marketing, and expansion into new markets. This strategy aims to solidify its market position and drive long-term growth. However, it has resulted in lower profit margins compared to some competitors.

For instance, Sprinklr’s operating margin in [year] was [percentage], highlighting the trade-off between growth and profitability.

- Market Share Gains:Despite profitability challenges, Sprinklr has made significant progress in gaining market share. Its comprehensive platform, encompassing social media, marketing, customer service, and advertising, has attracted a wide range of customers. This market share expansion is a testament to the company’s strong product offering and its ability to cater to the evolving needs of businesses.

Strategic Initiatives and Future Growth Plans

Sprinklr’s strategic initiatives are focused on driving long-term growth and strengthening its market position. These initiatives include:

- Product Innovation:Sprinklr continues to invest heavily in product innovation, developing new features and functionalities to enhance its platform. For example, the recent introduction of [new feature] expands the platform’s capabilities and addresses the evolving needs of businesses in [specific industry].

This commitment to innovation is crucial for maintaining Sprinklr’s competitive edge.

- Market Expansion:Sprinklr is expanding its reach into new markets and industry verticals. This strategy aims to diversify its revenue streams and capitalize on emerging opportunities. For instance, Sprinklr’s recent expansion into the [specific industry] market reflects its commitment to broadening its customer base.

This strategic move is expected to drive future growth and solidify its position as a global leader.

- Strategic Partnerships:Sprinklr is forging strategic partnerships with key technology providers to enhance its platform and reach a wider audience. These partnerships enable the company to leverage complementary technologies and expand its market presence. For example, Sprinklr’s recent partnership with [technology provider] enhances its platform’s capabilities in [specific area].

This collaboration allows Sprinklr to offer a more comprehensive and integrated solution to its customers.

Impact of Executive Stock Sale

The executive stock sale can be interpreted in various ways. While it may indicate the executive’s belief in the company’s future, it can also signal a need for liquidity or a change in personal financial circumstances. It’s important to note that such sales are often part of planned diversification strategies and do not necessarily reflect a negative outlook on the company’s future.

Long-Term Potential and Key Factors, Sprinklr executive sells over 0k in company stock

Sprinklr’s long-term potential hinges on several key factors, including:

- Continued Product Innovation:Maintaining a competitive edge requires continuous innovation. Sprinklr must continue to develop new features and functionalities to meet the evolving needs of its customers and stay ahead of the competition.

- Market Expansion and Penetration:Expanding into new markets and penetrating existing ones is crucial for driving growth. Sprinklr must effectively target new customer segments and leverage its platform to capture market share.

- Profitability and Efficiency:Achieving profitability and improving operational efficiency are critical for long-term sustainability. Sprinklr must balance its growth investments with cost management to optimize its financial performance.

- Competitive Landscape:The customer experience management market is highly competitive, with established players and emerging startups. Sprinklr must effectively navigate this landscape, differentiate itself through innovation, and build strong customer relationships.

Corporate Governance and Transparency

Transparency and corporate governance are crucial for building trust and confidence among investors and stakeholders. Executive stock sales, while a legitimate business practice, can raise concerns about potential conflicts of interest and insider trading. This is especially true when large amounts of stock are sold, as in the case of the recent $100k sale by a Sprinklr executive.

Impact on Corporate Governance

The executive’s stock sale raises questions about the company’s commitment to transparency and good corporate governance. Investors may perceive this sale as a lack of confidence in the company’s future prospects, particularly if the sale is significant in relation to the executive’s overall holdings.

A lack of transparency surrounding executive stock sales can erode investor confidence and damage the company’s reputation.

It’s essential for Sprinklr to demonstrate its commitment to transparency by providing clear and timely disclosure about executive stock transactions. This includes details about the rationale behind the sale, the timing of the sale, and the potential impact on the company’s financial performance.

Areas for Improvement

Here are some potential areas for improvement in terms of transparency and communication surrounding executive stock transactions:

- Pre-emptive Disclosure: Sprinklr could implement a policy requiring executives to disclose any planned stock sales in advance, allowing investors to understand the rationale and potential implications before the transaction occurs.

- Enhanced Reporting: The company could enhance its reporting practices to provide more detailed information about executive stock transactions, including the number of shares sold, the price per share, and the timing of the sale. This would provide investors with a clearer picture of the executive’s financial interests and potential conflicts of interest.

- Independent Oversight: Sprinklr could consider establishing an independent committee to oversee executive stock transactions, ensuring that they are conducted in a transparent and ethical manner. This committee could review the rationale behind sales, assess potential conflicts of interest, and ensure that the company’s policies are being followed.

Final Summary

The executive’s stock sale serves as a powerful reminder of the complex interplay between corporate governance, investor confidence, and market dynamics. While the sale itself may be a routine transaction, it provides a unique window into Sprinklr’s current state, prompting deeper examination of its financial performance, market position, and future growth potential.

As investors and analysts dissect the details of this transaction, its ripple effects on Sprinklr’s trajectory will be closely monitored, offering valuable insights into the evolving landscape of the tech industry.

Answers to Common Questions

What is the significance of this stock sale?

The sale of a significant amount of company stock by an executive can be seen as a signal about the company’s future prospects. It could indicate a belief in a decline in the company’s value, or it could simply be a personal financial decision.

What are the potential implications for Sprinklr’s stock price?

The sale could negatively impact Sprinklr’s stock price if investors interpret it as a sign of lack of confidence in the company’s future. However, if the sale is explained and justified, it might not have a significant impact.

What are the potential legal ramifications of this sale?

The executive’s stock sale must comply with insider trading regulations. If the sale is deemed to be in violation of these regulations, the executive could face legal penalties.

CentralPoint Latest News

CentralPoint Latest News