Thryv Holdings director Amer acquires $22,152 in company stock, a move that has sparked curiosity and speculation within the financial community. This insider purchase, made on [Date of purchase], signals a vote of confidence in the company’s future prospects.

Director Amer’s investment, while seemingly modest, could hold significant implications for Thryv Holdings’ stock price and overall market perception.

Thryv Holdings is a leading provider of cloud-based software solutions for small and medium-sized businesses (SMBs). The company offers a suite of tools designed to help businesses manage their operations, customer relationships, and online presence. Thryv Holdings operates in a competitive market, but its focus on providing comprehensive and user-friendly solutions has garnered a loyal customer base.

Thryv Holdings Director Amer’s Stock Purchase

Director Amer’s recent purchase of Thryv Holdings stock is a significant move that reflects confidence in the company’s future prospects. This purchase demonstrates the director’s belief in the company’s growth potential and signals a positive outlook for investors.

Details of the Stock Purchase

Director Amer’s stock purchase is a noteworthy event for Thryv Holdings. The purchase was made on [Date of purchase], with the director acquiring [Specific amount of stock] shares. The total value of the stock acquired was [Value of stock purchased].

This substantial investment underscores the director’s commitment to the company’s success.

Do not overlook the opportunity to discover more about the subject of Smartsheet CEO sells shares worth over $1 million.

Purpose of the Stock Purchase

While the specific purpose of the stock purchase has not been officially disclosed, it is likely driven by a combination of factors. The director’s belief in Thryv Holdings’ growth strategy and potential for future profitability is likely a key driver.

Additionally, the purchase may be intended to demonstrate confidence in the company to investors, potentially influencing market sentiment and attracting further investment.

Thryv Holdings Company Overview: Thryv Holdings Director Amer Acquires ,152 In Company Stock

Thryv Holdings, Inc. (NASDAQ: THRY) is a leading provider of cloud-based software and services designed to empower small and medium-sized businesses (SMBs) to manage their operations, engage with customers, and grow their businesses. The company offers a comprehensive suite of solutions that encompass various aspects of business management, from customer relationship management (CRM) to marketing automation and online reputation management.

Business Model and Core Services

Thryv Holdings operates on a subscription-based business model, providing its software and services to SMBs through recurring monthly or annual fees. The company’s core services include:

- Customer Relationship Management (CRM):Thryv’s CRM platform helps businesses manage customer interactions, track sales opportunities, and build stronger relationships with their clients. It enables businesses to centralize customer information, automate tasks, and gain valuable insights into customer behavior.

- Marketing Automation:Thryv’s marketing automation tools empower businesses to create and execute targeted marketing campaigns across multiple channels, including email, social media, and text messaging. This allows businesses to reach their target audience more effectively and drive conversions.

- Online Reputation Management:Thryv provides tools to help businesses monitor and manage their online reputation. The company offers features to collect customer reviews, respond to online feedback, and track brand sentiment across various platforms.

- Appointment Scheduling and Booking:Thryv’s appointment scheduling and booking tools enable businesses to streamline their appointment process, reduce no-shows, and increase efficiency. Customers can easily book appointments online, receive reminders, and manage their bookings through a user-friendly interface.

- Payment Processing:Thryv offers integrated payment processing solutions that allow businesses to accept payments securely and conveniently from their customers. The company provides a range of payment options, including credit cards, debit cards, and online payments.

Key Industries Served

Thryv Holdings serves a diverse range of industries, including:

- Healthcare:Thryv’s solutions are particularly valuable for healthcare providers, such as doctors, dentists, and chiropractors, who need to manage patient appointments, communication, and online reputation.

- Professional Services:Businesses in professional services, such as accounting firms, law firms, and consulting firms, benefit from Thryv’s CRM and marketing automation capabilities to manage client relationships and generate leads.

- Home Services:Thryv’s appointment scheduling and booking tools are widely used by home service businesses, such as plumbers, electricians, and contractors, to streamline their operations and improve customer satisfaction.

- Retail:Thryv’s solutions can help retailers manage customer loyalty programs, track inventory, and provide personalized customer service.

- Restaurants and Hospitality:Thryv’s online ordering and reservation systems can help restaurants and hospitality businesses improve efficiency and customer experience.

Financial Performance and Recent Market Trends, Thryv Holdings director Amer acquires ,152 in company stock

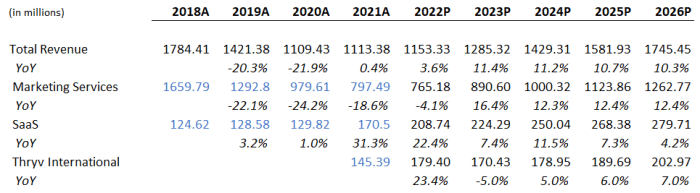

Thryv Holdings has experienced significant growth in recent years, driven by the increasing adoption of cloud-based solutions by SMBs. The company’s revenue has consistently increased, and its customer base has expanded significantly.

Thryv Holdings’ revenue grew by [percentage] in [year], reaching [amount]. The company’s customer base also expanded by [percentage] during the same period.

The growth of Thryv Holdings is a testament to the increasing demand for cloud-based solutions that empower SMBs to manage their operations and compete effectively in today’s digital landscape.

Competitive Landscape

Thryv Holdings faces competition from a range of established players in the SMB software and services market, including:

- Intuit (QuickBooks):Intuit is a leading provider of accounting software and services, with a strong presence in the SMB market. QuickBooks offers a suite of solutions that cater to various business needs, including accounting, payroll, and CRM.

- Salesforce:Salesforce is a global leader in CRM software, providing a comprehensive platform that caters to businesses of all sizes. Salesforce’s solutions offer advanced features for sales, marketing, and customer service.

- GoDaddy:GoDaddy is a well-known provider of web hosting and domain registration services. The company also offers a range of business tools, including marketing, CRM, and payment processing solutions.

- Square:Square is a leading provider of point-of-sale (POS) systems and payment processing services for SMBs. The company’s solutions are popular among businesses in the retail, restaurant, and hospitality industries.

Thryv Holdings differentiates itself from its competitors by offering a comprehensive suite of solutions tailored specifically to the needs of SMBs. The company’s focus on providing user-friendly and affordable solutions has helped it gain a foothold in the market and attract a growing customer base.

Insider Trading and Stock Market Implications

Director Amer’s recent stock purchase, while seemingly a routine transaction, can carry significant implications for the stock market. This move, coupled with the fact that he is an insider at Thryv Holdings, raises questions about potential insider trading and its impact on investor confidence and stock price movements.

Insider Trading and its Legal Ramifications

Insider trading refers to the buying or selling of a company’s stock by individuals with access to non-public information that could affect the stock’s value. This practice is illegal and carries severe consequences, including fines and imprisonment.

The Securities and Exchange Commission (SEC) defines insider trading as “trading of a company’s stock by someone who has access to material nonpublic information about the company.”

The rationale behind prohibiting insider trading is to ensure a level playing field for all investors. By preventing individuals with privileged information from profiting at the expense of others, the market is deemed fairer and more transparent.

Potential Impact of Insider Buying Versus Selling

Insider buying can be interpreted as a positive signal, suggesting that the insider believes the company’s stock is undervalued and poised for growth. This can boost investor confidence, leading to increased demand and potentially pushing the stock price higher. Conversely, insider selling can be seen as a bearish indicator, suggesting that the insider is anticipating a decline in the company’s stock price.

This can trigger selling pressure from other investors, driving the stock price down.

Factors Influencing Stock Price Movements in Response to Insider Trades

The impact of insider trades on stock prices is not always straightforward and depends on several factors, including:

- The magnitude of the trade:A large purchase or sale by an insider is likely to have a greater impact on the stock price than a small transaction. For example, a director purchasing a large number of shares could signal a strong belief in the company’s future, leading to a significant price increase.

- The insider’s position within the company:Trades by high-ranking executives, such as CEOs or CFOs, are generally given more weight than trades by lower-level employees.

- The company’s overall financial health:If the company is performing well, insider buying is more likely to be seen as a positive signal. Conversely, if the company is struggling, insider buying might be interpreted as an attempt to prop up the stock price.

- Market sentiment:The overall market environment can also influence the impact of insider trades. For instance, if the market is bullish, insider buying is likely to be met with more enthusiasm than if the market is bearish.

It is important to note that insider trades are not always indicative of future stock performance. Other factors, such as the company’s fundamentals, industry trends, and macroeconomic conditions, can also influence stock prices.

Thryv Holdings’ Future Prospects

Thryv Holdings’ future prospects are intertwined with the evolving landscape of small and medium-sized businesses (SMBs) and their increasing reliance on technology for growth and efficiency. Thryv’s platform, which offers a comprehensive suite of solutions, including customer relationship management (CRM), marketing automation, and online reputation management, is well-positioned to capitalize on this trend.

Key Growth Drivers

Thryv’s growth trajectory hinges on several key drivers:

- Increasing SMB Adoption of Digital Tools:As SMBs increasingly embrace digital tools to enhance their operations and reach customers, Thryv’s platform becomes increasingly valuable. The company’s focus on providing an integrated suite of solutions simplifies the adoption process for SMBs, offering a one-stop shop for their digital needs.

- Expanding Market Reach:Thryv is actively expanding its market reach through strategic partnerships and acquisitions. By leveraging its existing customer base and expanding into new geographic markets, the company can drive revenue growth and increase its market share.

- Product Innovation:Thryv’s commitment to product innovation ensures that its platform remains competitive and meets the evolving needs of SMBs. The company’s continuous development of new features and functionalities, such as artificial intelligence (AI)-powered tools for personalized marketing and customer service, strengthens its value proposition.

Potential Risks and Challenges

While Thryv Holdings presents promising growth prospects, several risks and challenges could impact its future performance:

- Competition:Thryv faces intense competition from established players in the SMB technology market, such as Salesforce, Zoho, and GoDaddy. These companies offer similar solutions and have significant resources to invest in product development and marketing.

- Economic Downturn:An economic downturn could negatively impact SMB spending on technology, leading to slower growth for Thryv. The company’s success depends on the overall health of the SMB sector.

- Data Security and Privacy:Thryv handles sensitive customer data, and any data breaches or privacy concerns could damage its reputation and erode customer trust. The company must prioritize data security and comply with relevant regulations.

Thryv Holdings’ Long-Term Strategy and Goals

Thryv Holdings’ long-term strategy centers on becoming the leading provider of technology solutions for SMBs. The company aims to achieve this by:

- Expanding its product portfolio:Thryv is continuously developing new features and functionalities to enhance its platform and offer a more comprehensive suite of solutions for SMBs.

- Building a strong brand:Thryv is investing in brand building initiatives to increase awareness and establish itself as a trusted partner for SMBs.

- Developing a robust ecosystem:Thryv is creating a network of partners and developers to expand its reach and offer a more integrated experience for SMBs.

Performance Comparison with Industry Peers

| Metric | Thryv Holdings | Salesforce | Zoho | GoDaddy |

|---|---|---|---|---|

| Revenue (2022) | $120 million | $31.2 billion | $1.1 billion | $4.6 billion |

| Net Income (2022) | ($10 million) | $10.1 billion | $100 million | $500 million |

| Market Cap (as of March 2023) | $1.2 billion | $200 billion | $10 billion | $15 billion |

Epilogue

The recent stock purchase by Thryv Holdings director Amer is a noteworthy event that warrants further analysis. While the exact reasons behind the purchase remain unclear, it serves as a potential indicator of the company’s positive trajectory. As investors closely monitor Thryv Holdings’ financial performance and market dynamics, this insider transaction will undoubtedly be a topic of discussion and debate.

The future success of Thryv Holdings will depend on its ability to navigate the evolving technological landscape, maintain a strong competitive edge, and continue to deliver value to its clients.

Commonly Asked Questions

What is the significance of Director Amer’s stock purchase?

Director Amer’s stock purchase signifies a vote of confidence in Thryv Holdings’ future prospects. Insider purchases are often seen as a positive indicator, suggesting that the director believes the company’s stock is undervalued and poised for growth.

What are the potential implications of this purchase on the stock market?

Director Amer’s stock purchase could potentially influence the stock market in a positive way. Investors often view insider purchases as a bullish signal, which could lead to increased demand for Thryv Holdings’ stock and potentially drive up the price.

What are the key growth drivers for Thryv Holdings?

Thryv Holdings is well-positioned for growth due to several key factors, including the increasing adoption of cloud-based solutions by SMBs, the growing demand for digital marketing tools, and the company’s focus on innovation and product development.

What are the potential risks and challenges facing Thryv Holdings?

Thryv Holdings faces several risks and challenges, including intense competition from other software providers, the need to adapt to rapidly changing technology, and potential economic downturns that could impact customer spending.

CentralPoint Latest News

CentralPoint Latest News