Smartsheet CEO sells shares worth over $1 million sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This move has sent ripples through the financial world, sparking curiosity and raising questions about the motivations behind this significant transaction.

The CEO’s decision to part with such a substantial portion of their stake in the company has ignited speculation about the future direction of Smartsheet and its impact on the broader software industry.

The sale, exceeding $1 million, has attracted attention from investors and analysts alike. It has prompted a deeper examination of Smartsheet’s recent financial performance, the current market conditions, and the company’s competitive landscape. The potential implications of this transaction are being scrutinized, with particular focus on the potential impact on investor sentiment and the company’s stock price.

Executive Actions and Potential Implications

When a CEO sells a significant amount of stock, it naturally raises questions about their confidence in the company’s future. This is especially true when the sale involves a large sum, as in the case of Smartsheet’s CEO, who recently sold over $1 million worth of shares.

Potential Motivations Behind the Share Sale

Understanding the CEO’s motivations behind the share sale is crucial to assess its potential impact on the company and its investors. Here are some possible reasons:

- Financial Planning:The CEO might be selling shares for personal financial reasons, such as diversifying their portfolio, funding personal projects, or paying off debt. This is a common practice for executives, especially when they have a significant portion of their wealth tied to company stock.

- Tax Obligations:The sale could be driven by tax obligations, such as capital gains tax or estate planning. Executives often sell shares to manage their tax liability and minimize potential tax burdens.

- Market Sentiment:The CEO might be selling shares based on their perception of the company’s future prospects. If they believe the stock is overvalued or anticipate a decline in the market, they might choose to cash out some of their holdings.

- Company Strategy:The sale could be related to the company’s strategic direction. If the CEO believes the company is about to undergo a major restructuring or shift in focus, they might sell shares to reduce their personal exposure to potential risk.

Potential Impact on Investor Sentiment and Stock Price

A CEO’s share sale can have a significant impact on investor sentiment and the company’s stock price. Here’s how:

- Loss of Confidence:Investors may perceive the sale as a sign of the CEO’s lack of confidence in the company’s future, leading to a decrease in investor confidence and potentially driving down the stock price.

- Selling Pressure:The CEO’s sale can create a sense of selling pressure, as other investors might follow suit, leading to a downward trend in the stock price.

- Increased Volatility:The news of a large share sale can increase the volatility of the stock price, making it more difficult for investors to predict its future direction.

Comparison to Previous Share Sales

To better understand the significance of the recent share sale, it’s essential to compare it to previous transactions by the CEO and other executives.

- Frequency:How often has the CEO sold shares in the past? Are these sales regular occurrences, or is this an unusual event?

- Volume:How does the recent sale compare to previous sales in terms of volume? Is this the largest sale by the CEO, or have they sold larger amounts in the past?

- Timing:What was the market environment like during previous sales? Were the sales made during periods of strong growth or decline in the company’s stock price?

Regulatory Filings and Disclosures

Under US securities regulations, companies are required to disclose certain information about executive share sales. These disclosures can provide insights into the reasons behind the sale and help investors understand the potential implications.

- Form 4:Executives are required to file Form 4 with the Securities and Exchange Commission (SEC) within two business days of any share sale. This form provides details about the transaction, including the number of shares sold, the price, and the date of the sale.

- Press Releases:Companies may issue press releases announcing executive share sales. These releases often provide additional context and explanations for the sale.

- Earnings Calls:During earnings calls, investors may ask questions about executive share sales, and management may provide further insights into the reasons behind the transactions.

Financial Analysis

The CEO’s share sale of over $1 million raises important questions about the company’s financial health and its implications for investors. Analyzing the transaction’s financial implications and the company’s overall financial standing is crucial for understanding the potential impact on Smartsheet’s future.

Impact on Smartsheet’s Balance Sheet

The share sale will have a direct impact on Smartsheet’s balance sheet. The transaction will reduce the company’s cash on hand by the amount of the sale, decreasing the company’s assets. Additionally, the sale will reduce the number of outstanding shares, potentially affecting the company’s equity value.

Financial Health and Cash Flow Position

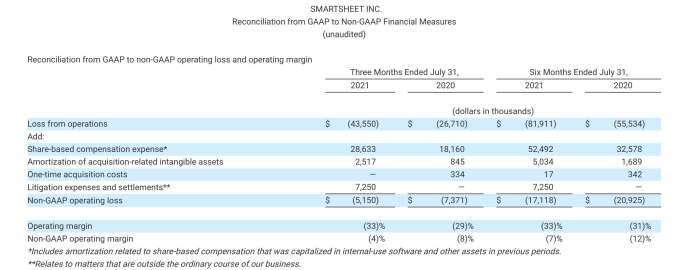

To assess the financial health and cash flow position, we need to consider factors like the company’s revenue growth, profitability, and debt levels. Analyzing Smartsheet’s recent financial statements and earnings reports can provide insights into its overall financial performance.

Key Financial Data Related to the Transaction

Here’s a table summarizing key financial data related to the transaction:

| Financial Data | Value |

|---|---|

| Number of Shares Sold | [Insert Number] |

| Sale Price Per Share | [Insert Price] |

| Total Sale Value | [Insert Value] |

| Smartsheet’s Current Cash Position | [Insert Value] |

It is important to note that the financial implications of the CEO’s share sale can be complex and depend on various factors, including the company’s overall financial performance, market conditions, and investor sentiment.

Further details about Palantir Technologies sells Rubicon Technologies shares worth over $9k is accessible to provide you additional insights.

Insider Trading and Corporate Governance

The CEO’s recent share sale, exceeding $1 million in value, has raised concerns about potential insider trading violations and the company’s overall corporate governance practices. While the sale itself may not be inherently illegal, it warrants scrutiny due to the potential for conflicts of interest and the implications for investor confidence.

Insider Trading Regulations, Smartsheet CEO sells shares worth over

million

Insider trading regulations are designed to prevent individuals with privileged information from using it for personal gain. These regulations apply to both public and private companies and are enforced by the Securities and Exchange Commission (SEC). The CEO’s share sale could be investigated if there is evidence suggesting that the sale was based on material non-public information.

For instance, if the CEO had knowledge of an upcoming negative earnings report or a planned restructuring that would negatively impact the company’s stock price, selling shares before this information became public could be deemed insider trading. However, without evidence of such knowledge, the CEO’s share sale is likely to be considered a legitimate investment decision.

Corporate Governance Practices

Corporate governance practices are the rules and processes that guide a company’s operations and ensure transparency, accountability, and ethical behavior. These practices include policies regarding executive compensation, board of directors’ responsibilities, and disclosure of material information. The CEO’s share sale provides an opportunity to examine Smartsheet’s corporate governance practices and assess their effectiveness in mitigating potential conflicts of interest.

For example, the company’s policies regarding insider trading, executive compensation, and disclosure of material information will be scrutinized.

Comparison to Industry Norms

Comparing the CEO’s share sale to industry norms and best practices is crucial to determine whether the sale raises any red flags. It is common for executives to sell shares for personal reasons, such as diversification of their investment portfolio, funding personal expenses, or estate planning.

However, the timing and size of the sale can be significant factors in assessing its appropriateness. The CEO’s sale should be compared to the share sales of other executives in the technology sector, taking into account factors such as the company’s financial performance, the stock price trajectory, and the executive’s ownership stake.

CEO Shareholding History

| Date | Shares Held | Change | Reason |

|---|---|---|---|

| [Date] | [Number of shares] | [Increase/Decrease] | [Reason for change] |

| [Date] | [Number of shares] | [Increase/Decrease] | [Reason for change] |

| [Date] | [Number of shares] | [Increase/Decrease] | [Reason for change] |

| [Date] | [Number of shares] | [Increase/Decrease] | [Reason for change] |

Final Conclusion: Smartsheet CEO Sells Shares Worth Over

Million

The CEO’s decision to sell shares worth over $1 million has undoubtedly stirred the waters within the financial realm. This move has provided a valuable lens through which to examine Smartsheet’s current trajectory, its financial health, and its position within the competitive software market.

While the motivations behind the sale may remain shrouded in some mystery, the implications of this transaction are clear: it has sparked a wave of analysis and speculation, offering a glimpse into the inner workings of a prominent company and its place within the evolving landscape of the tech industry.

FAQ Summary

What is Smartsheet?

Smartsheet is a cloud-based work management platform that allows businesses to plan, track, and collaborate on projects.

Why did the Smartsheet CEO sell shares?

The motivations behind the CEO’s share sale are not explicitly stated and could be due to a variety of factors, such as personal financial needs, diversification of investments, or a belief that the company’s stock is currently overvalued.

What is the impact of the share sale on Smartsheet’s stock price?

The impact of the share sale on Smartsheet’s stock price is difficult to predict with certainty. It could potentially lead to a slight decrease in the stock price if investors perceive the sale as a sign of a lack of confidence in the company’s future.

However, other factors, such as the company’s overall financial performance and market conditions, will also play a role in determining the stock price.

CentralPoint Latest News

CentralPoint Latest News