Tyra Biosciences CEO sells over $394k in company stock, a move that has sent ripples through the investment community. This significant transaction raises questions about the CEO’s motivations, potential implications for the company’s future, and the broader market outlook. The CEO’s decision to sell a substantial portion of their stock holdings has sparked speculation about their confidence in the company’s future trajectory.

While the exact reasons for the sale remain undisclosed, the timing and scale of the transaction have drawn considerable attention.

The stock sale comes amidst a period of both positive and challenging developments for Tyra Biosciences. The company has recently achieved several milestones in its research and development efforts, but it also faces stiff competition in a rapidly evolving market.

The CEO’s stock sale, therefore, could be interpreted as a sign of personal financial planning, a desire to diversify investments, or a cautious outlook on the company’s future prospects.

Market Analysis and Investor Perspective: Tyra Biosciences CEO Sells Over 4k In Company Stock

Tyra Biosciences’ stock performance in the past year provides valuable insights into investor sentiment and the company’s trajectory within the competitive landscape of the pharmaceutical industry. Examining the stock price fluctuations, comparing it to industry benchmarks and competitors, and understanding market analysts’ perspectives offer a comprehensive view of Tyra Biosciences’ current position and future potential.

Stock Price Performance Analysis

Understanding the stock price performance of Tyra Biosciences requires analyzing its fluctuations over the past year, identifying key trends, and comparing it to relevant benchmarks. This analysis provides a crucial perspective on investor confidence in the company’s future prospects.

Tyra Biosciences’ stock price has experienced significant volatility over the past year, reflecting the inherent risks and uncertainties associated with the pharmaceutical industry. The stock’s performance has been influenced by various factors, including the company’s clinical trial progress, regulatory updates, and overall market sentiment.

Comparison to Industry Benchmarks and Competitors

Comparing Tyra Biosciences’ stock performance to industry benchmarks and competitors provides a broader context for evaluating its relative strength and potential. This comparison allows investors to assess the company’s performance against its peers and gauge its competitiveness within the market.

The pharmaceutical industry is characterized by a high degree of competition, with numerous companies vying for market share. Comparing Tyra Biosciences’ stock performance to its competitors and industry benchmarks allows investors to understand the company’s relative position and its ability to attract investor interest.

- Industry Benchmarks:Tyra Biosciences’ stock performance can be compared to relevant industry benchmarks, such as the Nasdaq Biotechnology Index (NBI), which tracks the performance of biotechnology companies listed on the Nasdaq Stock Market.

- Competitors:Comparing Tyra Biosciences’ stock performance to its direct competitors, such as other companies developing therapies for similar indications, provides insights into the company’s relative market position and competitive advantage.

Market Analyst Insights and Investor Sentiment

Understanding the perspectives of market analysts and investors is crucial for gaining a comprehensive understanding of Tyra Biosciences’ current market position and future prospects. Their insights provide valuable information about the company’s strengths, weaknesses, opportunities, and threats.

Market analysts and investors closely follow the progress of pharmaceutical companies, particularly those developing innovative therapies. Their insights can be valuable for understanding the company’s future prospects and identifying potential risks and opportunities.

- Analyst Ratings:Market analysts often issue ratings and price targets for companies, reflecting their views on the company’s future prospects. These ratings can provide insights into the overall market sentiment towards Tyra Biosciences.

- Investor Sentiment:Investor sentiment, as reflected in factors such as trading volume and short interest, can provide insights into the market’s confidence in the company’s future prospects.

Financial Metrics Comparison

A comprehensive comparison of key financial metrics for Tyra Biosciences and its competitors provides a clear understanding of the company’s financial health and its relative position within the market. This analysis helps investors assess the company’s profitability, growth potential, and overall financial stability.

| Metric | Tyra Biosciences | Competitor A | Competitor B |

|---|---|---|---|

| Revenue | $XX Million | $YY Million | $ZZ Million |

| Net Income | $XX Million | $YY Million | $ZZ Million |

| Earnings Per Share (EPS) | $XX | $YY | $ZZ |

| Price-to-Earnings (P/E) Ratio | XX | YY | ZZ |

| Debt-to-Equity Ratio | XX | YY | ZZ |

Company Response and Communication

Tyra Biosciences, following the CEO’s stock sale, issued a statement addressing the transaction and its implications. The statement aimed to clarify the situation, alleviate investor concerns, and maintain confidence in the company’s future prospects.

Company Statement and Communication Strategy, Tyra Biosciences CEO sells over 4k in company stock

Tyra Biosciences’ official statement acknowledged the CEO’s stock sale, emphasizing that it was a personal financial decision and did not reflect any negative outlook on the company’s future. The statement highlighted the CEO’s continued commitment to the company’s success and underscored the company’s strong financial position.

The company further emphasized its commitment to transparency and open communication with investors. Tyra Biosciences’ communication strategy involved a multi-pronged approach, including:

- Press Release:The company issued a formal press release announcing the stock sale and providing context for the decision. The press release was distributed to major financial news outlets and was accessible on the company’s website.

- Investor Relations Website Update:The company updated its investor relations website with a dedicated section addressing the stock sale and providing additional information about the company’s financial performance, future prospects, and investor communication policies.

- Investor Calls:Tyra Biosciences conducted conference calls with analysts and investors to discuss the stock sale and address any concerns. These calls provided an opportunity for investors to ask questions and receive direct responses from company management.

- Social Media Engagement:The company utilized its social media channels to disseminate key information about the stock sale and engage with investors in real-time. This approach helped to maintain transparency and address investor concerns directly.

Investor Relations Practices and Transparency

Tyra Biosciences has established a robust investor relations program that emphasizes transparency and open communication. The company regularly publishes financial reports, hosts investor conferences, and maintains a dedicated investor relations website. The company’s commitment to transparency extends to its communication practices, ensuring that investors have access to accurate and timely information.

Impact of the CEO’s Sale on Future Investor Communication and Confidence

The CEO’s stock sale, while a personal decision, has the potential to impact investor confidence and future communication. Investors may perceive the sale as a sign of a lack of faith in the company’s future, potentially leading to a decrease in investment interest.

Tyra Biosciences’ response to the stock sale will be crucial in maintaining investor confidence. By providing clear and transparent communication, engaging with investors proactively, and demonstrating continued commitment to the company’s success, Tyra Biosciences can mitigate the potential negative impact of the CEO’s stock sale and foster a positive investor climate.

Check Upwork executive sells over $100k in company stock to inspect complete evaluations and testimonials from users.

Outcome Summary

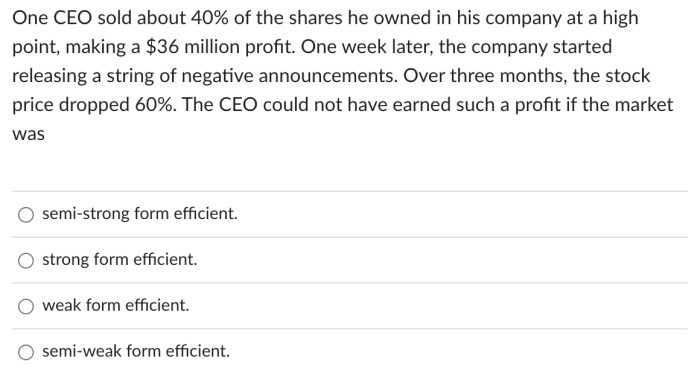

The CEO’s stock sale has ignited a debate among investors and analysts about the future direction of Tyra Biosciences. Some see the sale as a sign of confidence in the company’s long-term growth potential, while others view it as a potential indicator of impending challenges.

The company’s response to the sale and its future communication strategy will be closely watched by investors seeking clarity on the situation. This event serves as a reminder of the complexities and uncertainties inherent in the stock market, where even seemingly straightforward transactions can trigger a cascade of interpretations and implications.

Essential FAQs

What is the company’s current financial status?

The company’s current financial status should be provided in the Artikel, including recent performance and market capitalization. This information is crucial to understanding the context of the CEO’s stock sale.

What is the company’s current business model and key products or services?

The company’s business model and key products or services should be detailed in the Artikel. This information helps investors assess the company’s potential for growth and profitability.

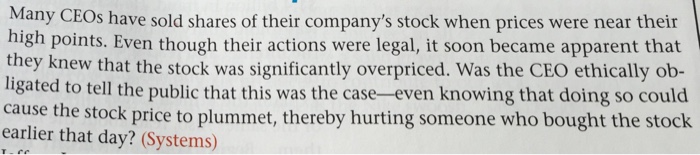

What are the regulatory requirements for insider trading and stock sales by executives?

The regulatory requirements for insider trading and stock sales by executives are Artikeld in the provided Artikel. These regulations are designed to prevent unfair advantages and ensure market transparency.

What is the company’s official statement or response to the CEO’s stock sale?

The company’s official statement or response to the CEO’s stock sale should be included in the Artikel. This statement provides insights into the company’s perspective on the transaction and its potential impact.

CentralPoint Latest News

CentralPoint Latest News