Upwork CFO sells shares worth over $47,000, a move that has sent ripples through the financial world and sparked intense speculation. The CFO’s decision to divest a significant portion of their stake in the company has raised eyebrows and prompted questions about the future direction of the online freelancing giant.

Was this a personal financial decision, or does it signal a deeper shift in the company’s trajectory? This transaction has become a focal point for analysts and investors alike, prompting them to scrutinize Upwork’s recent financial performance and its potential impact on the company’s stock price.

The CFO’s share sale comes at a pivotal moment for Upwork. The company has been navigating a dynamic market environment, marked by both growth opportunities and challenges. Upwork’s recent financial performance has been a subject of debate, with some analysts expressing optimism about its long-term prospects while others raise concerns about its ability to maintain momentum.

This backdrop adds further complexity to the analysis of the CFO’s share sale, as investors try to decipher the underlying motivations behind this move.

Upwork CFO’s Share Sale

Upwork’s Chief Financial Officer (CFO), recently sold shares worth over $47,000, sparking curiosity about the underlying reasons for this decision. This move comes amidst a backdrop of Upwork’s stock performance and broader market trends.

Obtain direct knowledge about the efficiency of Viking therapeutics director sells shares worth over $715,000 through case studies.

Potential Reasons Behind the Share Sale, Upwork CFO sells shares worth over ,000

The CFO’s decision to sell shares could be driven by a combination of factors, including:

- Personal Financial Needs:The CFO may have personal financial needs, such as paying for a house, education, or other significant expenses. Selling shares could provide the necessary funds to meet these needs.

- Diversification:The CFO may be looking to diversify their investment portfolio by reducing their concentration in Upwork stock. This could involve investing in other assets or industries to mitigate potential risks.

- Market Outlook:The CFO may have a bearish outlook on Upwork’s future stock performance, prompting them to sell shares before a potential decline. This could be based on their own analysis of the company’s financial prospects, competitive landscape, or broader market conditions.

- Tax Planning:The CFO may be selling shares to realize capital gains and optimize their tax liabilities. This could involve strategically selling shares to take advantage of tax breaks or minimize tax obligations.

Financial Implications for the CFO

The financial implications of the share sale for the CFO are significant. The sale generated a substantial amount of capital, which could be used for various purposes, such as:

- Debt Reduction:The CFO may use the funds to reduce personal debt, improving their financial standing and reducing interest payments.

- Investment Opportunities:The CFO may reinvest the proceeds in other assets or investment opportunities, seeking higher returns or diversifying their portfolio.

- Personal Expenses:The CFO may use the funds to cover personal expenses, such as home renovations, travel, or other discretionary spending.

Timeline of Significant Events

A review of significant events related to Upwork’s stock performance and the CFO’s tenure provides context for the share sale decision.

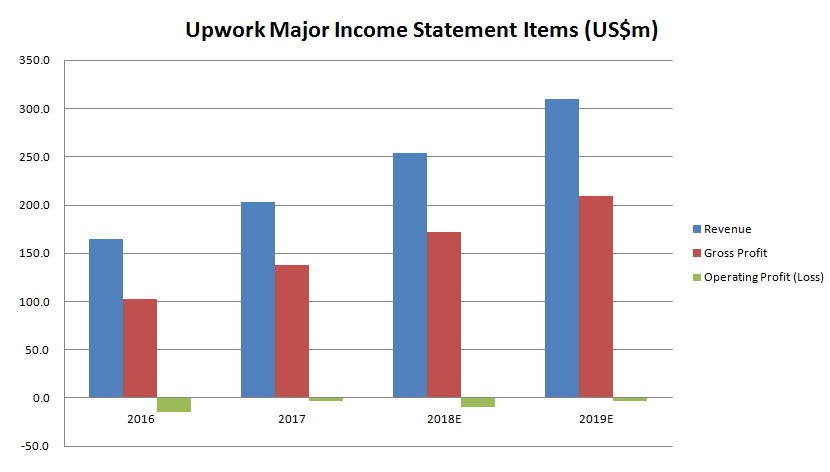

- 2020:Upwork’s stock experienced significant volatility, reflecting the broader market impact of the COVID-19 pandemic. Despite the challenges, the company continued to grow its business, with revenue increasing by 24% year-over-year.

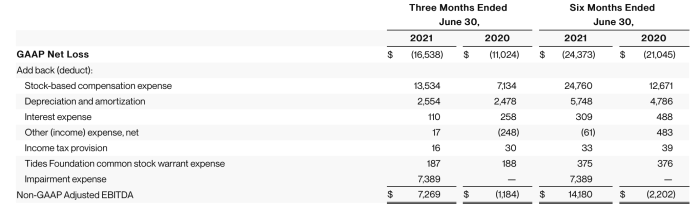

- 2021:Upwork’s stock price surged, reaching a high of over $50 per share. This was driven by strong financial performance, including a 40% increase in revenue. The CFO played a key role in navigating the company through these turbulent times, overseeing financial operations and strategic planning.

- 2022:Upwork’s stock performance has been more subdued, with the price declining from its 2021 highs. This reflects the broader market downturn and challenges in the technology sector. Despite this, the company remains profitable and continues to grow its business.

Implications for Upwork’s Future

The CFO’s share sale, coupled with the current market conditions, presents a complex landscape for Upwork’s future. While it’s impossible to predict with certainty, analyzing the situation can reveal potential scenarios and their implications.

Impact on Growth Strategy and Expansion Plans

The CFO’s share sale could signal a shift in Upwork’s strategic direction. The sale might indicate a potential focus on profitability over aggressive growth. This could lead to a more conservative approach to expansion, potentially involving:

- Reduced investments in new markets or product lines.

- Prioritization of existing business segments with proven profitability.

- A more measured approach to acquisitions and partnerships.

This shift could also influence Upwork’s marketing and sales strategies, potentially leading to:

- A focus on acquiring higher-paying clients with greater long-term value.

- Reduced spending on customer acquisition campaigns.

- Increased emphasis on customer retention and loyalty programs.

These adjustments, while potentially impacting growth in the short term, could lead to a more sustainable and profitable business model in the long run.

Final Thoughts

The CFO’s share sale serves as a catalyst for a deeper examination of Upwork’s financial health and its future trajectory. While the transaction itself might seem like a simple financial decision, it carries significant implications for the company’s growth strategy, investor confidence, and overall market perception.

The ramifications of this move will continue to unfold in the coming months, with investors and analysts closely watching Upwork’s performance to gauge the impact of this pivotal event. The CFO’s decision to sell shares has ignited a debate about the future of Upwork, and the company’s ability to navigate the evolving landscape of the online freelancing industry will be closely scrutinized in the years to come.

Detailed FAQs: Upwork CFO Sells Shares Worth Over ,000

Why did the Upwork CFO sell their shares?

The reasons behind the CFO’s decision to sell shares are not publicly known. However, potential explanations could include personal financial needs, a change in investment strategy, or a lack of confidence in the company’s future prospects. It’s important to note that this is speculation, and the actual reasons may be different.

What impact will this have on Upwork’s stock price?

The immediate impact of the CFO’s share sale on Upwork’s stock price is difficult to predict. However, it is likely that the sale will create some volatility in the short term. The long-term impact will depend on how investors interpret the sale and its implications for the company’s future.

Is this a sign that Upwork is in trouble?

It is too early to say whether the CFO’s share sale is a sign of trouble for Upwork. It’s important to consider other factors, such as the company’s overall financial performance, market conditions, and the CFO’s personal circumstances.

What does this mean for Upwork’s future?

The CFO’s share sale could have implications for Upwork’s future growth strategy and expansion plans. It could also affect investor confidence and the company’s ability to attract talent. However, the ultimate impact remains uncertain.

CentralPoint Latest News

CentralPoint Latest News