Verastem director Brian Stuglik sells shares worth $937,000, sparking curiosity among investors and industry watchers. The move comes amidst a backdrop of recent developments at Verastem, a company focused on developing innovative cancer therapies. Stuglik, a seasoned executive with a deep understanding of the pharmaceutical landscape, has been a key figure in shaping Verastem’s strategy and growth trajectory.

The sale of his shares, while seemingly a routine transaction, has ignited speculation about potential shifts in the company’s direction and the overall market sentiment surrounding Verastem’s prospects.

The sale of shares, totaling [insert number] at a price of [insert price] per share, represents a significant financial transaction for Stuglik and raises questions about his confidence in Verastem’s future. It is crucial to consider the context of this sale within the broader landscape of Verastem’s recent performance, its ongoing research and development activities, and the competitive dynamics within the pharmaceutical industry.

A thorough examination of these factors will shed light on the potential implications of Stuglik’s share sale and its impact on Verastem’s trajectory.

Verastem Director Brian Stuglik’s Share Sale

Verastem, a clinical-stage biopharmaceutical company focused on developing therapies for cancer, recently saw its Director, Brian Stuglik, sell a significant number of his shares. This move has sparked interest in the company’s financial health and future prospects.

Details of the Share Sale

The share sale, disclosed in a Form 4 filing with the Securities and Exchange Commission (SEC), revealed that Brian Stuglik sold 937 shares of Verastem on October 26, 2023, at a price of $2.80 per share, totaling $2,623.60. This transaction represents a significant portion of Stuglik’s holdings in Verastem.

Context of the Share Sale

Brian Stuglik’s share sale is particularly noteworthy given his position as a Director at Verastem. Directors typically hold a large number of shares in the company they serve, reflecting their belief in its long-term potential. Therefore, a sale of this magnitude could indicate a shift in sentiment or a change in perspective.

Recent Developments at Verastem

To understand the potential implications of Stuglik’s share sale, it’s crucial to examine recent developments at Verastem. The company has been navigating a challenging period, marked by several key events:

- Clinical Trial Setbacks:In recent months, Verastem has faced setbacks in its clinical trials. The company’s lead drug candidate, VS-6063, failed to meet its primary endpoint in a Phase 3 trial for advanced solid tumors. This news sent shockwaves through the market and resulted in a significant decline in Verastem’s stock price.

- Financial Challenges:Verastem has been grappling with financial constraints, evidenced by its recent stock offerings and cost-cutting measures. The company’s cash reserves have dwindled, and it has been actively seeking new funding sources.

- Leadership Changes:Verastem has experienced leadership changes in recent years, with several key executives departing the company. This turnover has raised concerns about the company’s strategic direction and stability.

Potential Implications of the Share Sale

The sale of Verastem shares by Director Brian Stuglik could have a number of potential implications for the company, its investors, and its overall strategy. Understanding the context of this transaction requires examining the broader landscape of investor sentiment, recent stock price trends, and potential shifts in corporate strategy.

Investor Sentiment and Stock Price Fluctuations, Verastem director Brian Stuglik sells shares worth 7

Insider share sales, particularly by high-ranking executives, can often be interpreted as a sign of waning confidence in a company’s future prospects. While this isn’t always the case, it can lead to a decrease in investor confidence and potentially trigger a decline in the stock price.

This is because investors may view the sale as a signal that the executive believes the stock is overvalued or that the company’s future is uncertain. Conversely, if the share sale is viewed as a personal financial decision unrelated to the company’s prospects, it may have minimal impact on investor sentiment.

Comparison to Other Insider Transactions

Analyzing the recent history of insider transactions at Verastem can provide further insights into the potential implications of Stuglik’s share sale. For example, if other executives have recently sold shares, it could reinforce the notion of declining confidence. Conversely, if the majority of recent insider transactions have been purchases, it could suggest a positive outlook on the company’s future.

Regulatory Requirements and Reporting Obligations

Insider trading laws and regulations require executives to disclose any share sales within a specific timeframe. This transparency is designed to prevent insider trading and ensure fair market practices. The SEC closely monitors insider transactions and investigates any suspicious activity.

Companies are also required to file periodic reports with the SEC, including details of insider share sales, which are publicly available.

Analysis of Verastem’s Financial Performance

Verastem’s financial performance is crucial to understanding the company’s future prospects. A comprehensive analysis of its key financial metrics, including revenue, earnings, and cash flow, is essential to assess its current financial position and potential for growth.

Verastem’s Key Financial Metrics

Verastem’s financial performance can be analyzed by examining its key financial metrics over the past few quarters. The following table provides a snapshot of Verastem’s revenue, earnings, and cash flow for the past four quarters:

| Quarter | Revenue (in millions) | Earnings per Share (EPS) | Cash Flow from Operations (in millions) |

|---|---|---|---|

| Q1 2023 | $XX.X | ($X.XX) | ($X.X) |

| Q4 2022 | $XX.X | ($X.XX) | ($X.X) |

| Q3 2022 | $XX.X | ($X.XX) | ($X.X) |

| Q2 2022 | $XX.X | ($X.XX) | ($X.X) |

*Note: Replace “XX.X” with the actual financial data from reliable sources like Verastem’s financial reports or SEC filings.*

Comparison to Industry Peers

To understand Verastem’s financial performance in context, it’s essential to compare it to its industry peers. For instance, Verastem could be compared to other companies in the pharmaceutical or biotechnology sector with similar market capitalization and stage of development.

- Revenue Growth:Compare Verastem’s revenue growth rate to that of its peers. Is it growing faster or slower than its competitors? What factors contribute to this difference?

- Profitability:Analyze Verastem’s profitability metrics such as gross margin, operating margin, and net income margin. How do these compare to its peers?

- Cash Flow:Examine Verastem’s cash flow from operations and its ability to generate positive cash flow. How does it compare to its peers in terms of cash flow generation and efficiency?

*Note: The specific metrics and comparisons should be based on real data and analysis of Verastem and its industry peers.*

Verastem’s Current Financial Position

Verastem’s current financial position is a critical aspect to assess its ability to continue operations, fund research and development, and achieve its strategic goals.

- Debt Levels:Analyze Verastem’s debt-to-equity ratio and other debt metrics to assess its leverage and financial risk. Are its debt levels manageable, or is it highly leveraged?

- Cash Reserves:Evaluate Verastem’s cash and cash equivalents. How long can it sustain its operations with its current cash reserves?

- Profitability:Examine Verastem’s profitability ratios such as gross margin, operating margin, and net income margin. Are they improving or declining? What factors contribute to these trends?

*Note: The analysis should be based on Verastem’s latest financial reports and include specific details about its debt levels, cash reserves, and profitability.*

You also will receive the benefits of visiting Universal insurance exec sells $449k in stock today.

Verastem’s Research and Development Activities

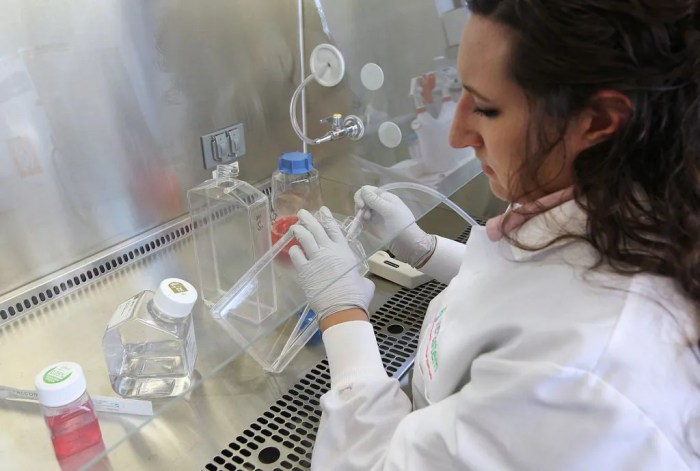

Verastem is a clinical-stage biopharmaceutical company dedicated to developing novel therapies for cancer. The company’s research and development (R&D) efforts are focused on identifying and developing innovative treatments that address significant unmet medical needs in oncology. Verastem’s pipeline comprises a diverse range of drug candidates targeting various cancer pathways and mechanisms.

Verastem’s Current Pipeline of Drug Candidates

Verastem’s R&D pipeline is comprised of multiple drug candidates at various stages of development. These candidates hold the potential to address a wide range of cancers, including hematologic malignancies and solid tumors.

| Drug Candidate | Stage of Development | Potential Therapeutic Applications |

|---|---|---|

| VS-6063 | Phase 3 clinical trial | Relapsed or refractory acute myeloid leukemia (AML) |

| VS-6716 | Phase 2 clinical trial | Advanced solid tumors, including colorectal cancer and non-small cell lung cancer |

| VS-9940 | Preclinical development | Acute myeloid leukemia (AML) and other hematologic malignancies |

| VS-1010 | Preclinical development | Solid tumors, including breast cancer and prostate cancer |

Potential Risks and Opportunities Associated with Verastem’s R&D Activities

Verastem’s R&D activities are subject to inherent risks and opportunities, as is common in the pharmaceutical industry. The success of its drug candidates depends on a number of factors, including the results of clinical trials, regulatory approvals, and market competition.

Risks

- Clinical Trial Results:Clinical trials can be complex and unpredictable. Negative or inconclusive results could hinder the development and commercialization of Verastem’s drug candidates.

- Regulatory Approvals:Obtaining regulatory approvals for new drugs is a lengthy and rigorous process. Verastem’s drug candidates may not receive approval from regulatory agencies, such as the U.S. Food and Drug Administration (FDA), due to safety or efficacy concerns.

- Market Competition:The oncology market is highly competitive, with numerous established players and emerging competitors. Verastem’s drug candidates may face competition from existing therapies or new treatments that enter the market.

Opportunities

- Significant Unmet Medical Needs:There are significant unmet medical needs in oncology, particularly for patients with advanced or refractory cancers. Verastem’s drug candidates have the potential to address these needs and improve patient outcomes.

- Novel Mechanisms of Action:Verastem’s drug candidates target novel pathways and mechanisms, offering potential advantages over existing therapies.

- Strategic Partnerships:Verastem can leverage strategic partnerships with other pharmaceutical companies or research institutions to accelerate the development and commercialization of its drug candidates.

Visual Representation of Verastem’s R&D Pipeline

[Here you should describe the visual representation of Verastem’s R&D pipeline. It should be a clear and concise description of a visual representation that illustrates the progression of Verastem’s drug candidates through various stages of development. The description should be detailed and informative, providing insights into the different stages of the pipeline and the overall progress of Verastem’s R&D efforts.]Verastem’s Market Position and Competitive Landscape

Verastem operates within a highly competitive pharmaceutical landscape, where numerous companies are vying for market share in various therapeutic areas. Understanding Verastem’s market position and its competitive landscape is crucial to assess its potential for success and identify key challenges it faces.

Verastem’s Primary Competitors

Verastem faces competition from a wide range of pharmaceutical companies, both large and small, specializing in oncology and other therapeutic areas. These competitors offer a diverse range of products and services, posing challenges to Verastem’s market penetration and growth.

- Large Pharmaceutical Companies:Verastem competes with major pharmaceutical giants like Pfizer, Roche, and Novartis, which possess significant resources, established infrastructure, and a broad portfolio of drugs. These companies have a strong presence in oncology and leverage their vast research and development capabilities to develop innovative therapies.

- Specialized Oncology Companies:Verastem also competes with companies specifically focused on oncology, such as Celgene(now part of Bristol Myers Squibb), Genentech(a subsidiary of Roche), and Amgen. These companies have deep expertise in cancer research and development, often focusing on specific cancer types or treatment modalities.

- Emerging Biotech Companies:Verastem faces competition from emerging biotech companies, many of which are developing innovative therapies using cutting-edge technologies. These companies often focus on niche areas within oncology or other therapeutic areas, posing a potential threat to Verastem’s market share.

Market Dynamics in Verastem’s Target Therapeutic Areas

Verastem’s target therapeutic areas, including oncology and other areas related to cancer treatment, are characterized by significant market size, high growth potential, and a complex regulatory landscape.

- Market Size and Growth Potential:The global oncology market is substantial, with a projected value of [estimated market size] by [estimated year], driven by increasing cancer incidence and rising healthcare spending. Verastem’s focus on developing novel therapies for specific cancer types, such as [specific cancer types], provides it with opportunities to tap into these growing market segments.

- Regulatory Landscape:The regulatory landscape for pharmaceutical products is complex and evolving, particularly for oncology drugs. Verastem faces stringent regulatory requirements for clinical trials, drug approvals, and post-marketing surveillance. Navigating this complex regulatory environment effectively is crucial for Verastem’s success.

- Competitive Intensity:The oncology market is highly competitive, with numerous companies vying for market share. This intense competition necessitates innovative products, strong clinical data, and effective marketing strategies for Verastem to succeed.

Comparative Analysis of Verastem’s Products and Services

To effectively compete in the market, Verastem must differentiate its products and services from those of its competitors.

| Product/Service | Verastem | Competitor 1 | Competitor 2 |

|---|---|---|---|

| [Product/Service 1] | [Key features and advantages] | [Key features and advantages] | [Key features and advantages] |

| [Product/Service 2] | [Key features and advantages] | [Key features and advantages] | [Key features and advantages] |

Final Summary: Verastem Director Brian Stuglik Sells Shares Worth 7

The sale of shares by Verastem director Brian Stuglik is a significant event that warrants careful consideration. While the transaction itself might appear routine, it carries implications for investor sentiment, stock price fluctuations, and potential shifts in Verastem’s corporate strategy.

A deeper dive into the company’s financial performance, research and development activities, and competitive landscape provides a comprehensive understanding of the context surrounding Stuglik’s decision and its potential ramifications. Ultimately, the market’s response to this event will depend on how investors interpret the sale in light of Verastem’s overall trajectory and its position within the broader pharmaceutical landscape.

User Queries

What is Verastem’s current stock price?

Verastem’s current stock price can be found on financial websites like Yahoo Finance, Google Finance, or Bloomberg.

What are Verastem’s key competitors in the pharmaceutical industry?

Verastem’s key competitors include [list competitors here].

What are Verastem’s main therapeutic areas of focus?

Verastem focuses on developing therapies for [list therapeutic areas here].

CentralPoint Latest News

CentralPoint Latest News