Walmart executive Jim Walton sells over $170 million in company stock, a move that has sent ripples through the retail giant’s financial landscape. The sale, announced earlier this week, has sparked a wave of speculation and analysis among investors and industry experts alike.

This significant transaction raises questions about Walmart’s financial health, the Walton family’s control over the company, and the broader implications for the retail sector.

Jim Walton, the son of Walmart founder Sam Walton, has long been a prominent figure in the company’s leadership. His decision to divest a portion of his substantial stake in Walmart has triggered a flurry of inquiries about the motivations behind the move and its potential impact on the company’s future.

The timing of the sale, coming amidst a period of heightened competition and economic uncertainty, has only added to the intrigue surrounding the transaction.

Jim Walton’s Stock Sale

Jim Walton, the son of Walmart founder Sam Walton, recently sold over $170 million worth of Walmart stock. This significant transaction has sparked curiosity about its implications for both Jim Walton’s personal finances and Walmart’s overall financial health.

The Significance of Jim Walton’s Stock Sale

Jim Walton’s stock sale represents a substantial divestment from Walmart, a company he has been closely associated with throughout his life. While the sale may seem large in absolute terms, it is important to consider its context within Walmart’s overall financial picture.

Walmart is a massive corporation with a complex financial structure, and the sale of a portion of Jim Walton’s stock is unlikely to have a significant impact on the company’s overall financial performance.

The Timing of the Sale

The timing of Jim Walton’s stock sale coincides with a period of market volatility and economic uncertainty. While it is impossible to definitively state the reasons behind his decision, it is plausible that he may have chosen to sell some of his shares to diversify his portfolio or to take advantage of favorable market conditions.

Jim Walton’s Current Stake in Walmart

Despite the recent sale, Jim Walton remains a significant shareholder in Walmart. He currently owns a substantial amount of stock, making him one of the largest individual shareholders in the company. This ownership stake demonstrates his continued belief in Walmart’s long-term prospects and his commitment to the company’s success.

Jim Walton’s Historical Involvement with Walmart

Jim Walton has been involved with Walmart since its early days, working alongside his father in various capacities. His experience and knowledge of the company’s operations have undoubtedly shaped his investment decisions over the years.

Market Impact and Analysis

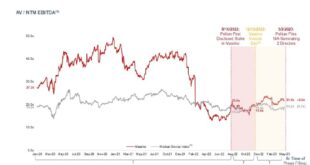

Jim Walton’s recent sale of over $170 million in Walmart stock raises questions about the potential impact on the company’s stock price and market valuation. This significant transaction could influence investor sentiment and market perceptions of the company’s future prospects.

Investor Sentiment and Market Perception

The sale of a substantial amount of stock by a major shareholder, especially a member of the founding family, can often be interpreted as a lack of confidence in the company’s future performance. Investors may view this as a signal that the company’s prospects are not as bright as they once seemed, potentially leading to a decrease in demand for Walmart stock.

This could result in a downward pressure on the stock price.

Comparison with Other Recent Stock Sales

To understand the potential impact of Jim Walton’s sale, it is essential to compare it to other recent stock sales by Walmart executives or major shareholders. For instance, in 2022, Doug McMillon, Walmart’s CEO, sold a significant amount of stock, which was attributed to diversification of his personal portfolio.

However, the scale of Jim Walton’s sale is considerably larger, potentially amplifying the impact on investor sentiment.

Potential Impact on Stock Price and Market Valuation

The market reaction to Jim Walton’s stock sale will depend on several factors, including the overall market conditions, the company’s recent performance, and the explanation provided for the sale. If the sale is perceived as a sign of declining confidence in the company’s future, it could lead to a decrease in stock price and market valuation.

However, if the sale is attributed to personal reasons or portfolio diversification, it may have a less significant impact.

Expand your understanding about Travelzoo general counsel sells over $176k in company stock with the sources we offer.

The potential impact of the stock sale on Walmart’s stock price and market valuation is uncertain and will depend on a complex interplay of factors.

Walmart’s Financial Performance

Walmart’s recent financial performance reflects a company navigating a complex economic landscape. While the retail giant continues to dominate the market, its growth trajectory has been impacted by factors like inflation, supply chain disruptions, and evolving consumer preferences.

Revenue Growth and Trends, Walmart executive Jim Walton sells over 0 million in company stock

Walmart’s revenue has consistently grown over the past few years, demonstrating its resilience and adaptability. The company’s ability to leverage its vast network of stores, e-commerce platform, and supply chain has been crucial in navigating economic challenges.

- In the fiscal year 2023, Walmart reported total revenue of $572.8 billion, a 7.6% increase compared to the previous year. This growth was driven by strong performance across its various segments, including grocery, general merchandise, and international operations.

- Walmart’s e-commerce sales continue to be a key growth driver. In the same fiscal year, e-commerce sales surged by 16.4%, demonstrating the company’s success in capturing the growing online market share.

- Despite facing inflationary pressures, Walmart has been able to maintain its pricing strategy, attracting value-conscious consumers. This strategy has contributed to its strong revenue performance.

Profitability and Margins

While Walmart’s revenue has been robust, its profitability has faced some challenges in recent years. This is largely attributed to increased operating costs, particularly in areas like labor and logistics.

- Walmart’s operating income in fiscal year 2023 declined by 1.4% compared to the previous year. This decline was mainly due to higher expenses related to labor, supply chain disruptions, and inflation.

- The company’s gross margin, a measure of profitability on goods sold, has also been impacted by rising costs. Walmart has implemented strategies to mitigate these pressures, including price adjustments and cost-cutting measures.

- Despite these challenges, Walmart remains a highly profitable company. Its scale and efficiency allow it to operate with relatively low costs, providing a competitive advantage in the retail market.

Challenges and Opportunities

Walmart faces a number of challenges in the coming months and years. These include:

- Continued Inflation:High inflation continues to impact consumer spending patterns and put pressure on Walmart’s pricing strategies.

- Supply Chain Disruptions:Ongoing supply chain disruptions can affect product availability and increase costs.

- Competition:Walmart faces intense competition from other retailers, both online and brick-and-mortar, including Amazon, Target, and Costco.

- Evolving Consumer Preferences:Consumers are increasingly demanding convenience, personalization, and sustainable options, requiring Walmart to adapt its offerings and operations.

Despite these challenges, Walmart has significant opportunities for growth:

- Expanding E-commerce:Walmart can continue to grow its e-commerce presence, leveraging its vast network and logistics capabilities.

- Focus on Private Label Brands:Expanding its private label offerings can enhance profitability and provide a competitive edge.

- Investing in Technology:Investments in technology, such as artificial intelligence and data analytics, can improve efficiency and customer experience.

- Sustainability Initiatives:Embracing sustainability initiatives can attract environmentally conscious consumers and enhance brand reputation.

Family Ownership and Control: Walmart Executive Jim Walton Sells Over 0 Million In Company Stock

The Walton family’s ownership structure and control of Walmart have been a defining feature of the company’s history. The family’s substantial stake in the company has given them significant influence over its strategic direction and operations. Jim Walton’s recent stock sale, though substantial, is unlikely to significantly alter the family’s overall control of Walmart.

The Walton Family’s Ownership Structure

The Walton family’s ownership structure is characterized by a concentration of shares among its members, ensuring their continued dominance over the company. This structure, however, presents potential implications for the family’s influence and potential conflicts of interest.

- Concentrated Ownership:The Walton family collectively holds a significant portion of Walmart’s outstanding shares. This concentrated ownership provides them with a powerful voting bloc, allowing them to exert considerable influence on key decisions, including the appointment of directors and the approval of major strategic initiatives.

- Family Trust:A significant portion of the Walton family’s shares are held through a trust, the Walton Family Holdings Trust. This trust structure allows the family to maintain control over their shares while potentially limiting individual influence and providing a framework for succession planning.

- Publicly Traded Shares:While the Walton family’s ownership is substantial, a significant portion of Walmart’s shares are publicly traded. This public float provides some degree of shareholder oversight and accountability, potentially mitigating the potential for excessive family control.

Implications of Jim Walton’s Stock Sale

Jim Walton’s recent stock sale, while representing a significant portion of his personal holdings, is unlikely to substantially alter the Walton family’s overall control of Walmart. The family’s collective ownership remains substantial, and the sale does not diminish their voting power or influence over the company.

Potential Conflicts of Interest

The Walton family’s significant ownership of Walmart presents potential conflicts of interest. The family’s influence over the company’s decision-making processes could create a situation where their personal interests might conflict with the interests of other shareholders or stakeholders.

- Executive Compensation:The family’s ownership could potentially influence the setting of executive compensation levels, potentially leading to excessive compensation packages that may not be in line with shareholder interests.

- Strategic Decisions:The family’s control over the company’s strategic direction could lead to decisions that prioritize their own interests over those of other stakeholders, such as employees or customers.

- Corporate Governance:The family’s ownership structure could potentially impact the company’s corporate governance practices, potentially leading to a lack of transparency or accountability.

Corporate Governance and Transparency

Jim Walton’s recent stock sale, while significant in its scale, raises questions about Walmart’s corporate governance practices and its transparency regarding executive compensation and stock transactions. This event prompts a deeper examination of the regulatory environment surrounding insider trading and the implications for shareholder confidence.

Transparency in Executive Compensation and Stock Transactions

Walmart’s approach to transparency in executive compensation and stock transactions is a complex issue with multiple facets. The company discloses executive compensation details in its annual proxy statement, adhering to Securities and Exchange Commission (SEC) regulations. However, the sheer volume of information and the technical language used can make it challenging for ordinary investors to fully understand the intricacies of executive pay packages.

- Public Disclosure:Walmart’s annual proxy statement Artikels the compensation structure for its top executives, including base salaries, bonuses, stock options, and other benefits. This information is available on the company’s investor relations website and through the SEC’s EDGAR database.

- Stock Transaction Reporting:Walmart executives, like Jim Walton, are subject to SEC regulations requiring them to report any stock transactions they make. These reports, known as Form 4 filings, are publicly available and provide details about the transaction, including the date, number of shares traded, and the price.

- Transparency Concerns:Despite these disclosures, some critics argue that Walmart’s transparency could be improved. They point to the complexity of executive compensation packages, which can be difficult for average investors to fully grasp. Additionally, the timing of stock sales, particularly by members of the Walton family, can raise concerns about potential insider trading.

Regulatory Environment Surrounding Insider Trading

The regulatory environment surrounding insider trading is designed to prevent executives from using non-public information to gain an unfair advantage in the stock market. The SEC closely monitors insider trading activities, and violations can result in significant penalties, including fines and imprisonment.

- Insider Trading Laws:The Securities Exchange Act of 1934 prohibits insider trading, which is defined as the purchase or sale of a security based on material non-public information. This law applies to corporate insiders, including executives, directors, and employees, as well as individuals who receive confidential information from insiders.

- SEC Enforcement:The SEC actively investigates and prosecutes insider trading cases. In recent years, the agency has pursued numerous high-profile cases involving executives and other individuals who have illegally profited from insider information.

- Public Scrutiny:The public is increasingly scrutinizing executive stock transactions, particularly in cases where insiders sell large amounts of stock. This scrutiny can put pressure on companies to be more transparent about their executive compensation and stock trading practices.

Implications for Corporate Governance

Jim Walton’s stock sale highlights the importance of corporate governance practices that promote transparency, accountability, and fairness. While the sale itself may not be illegal, it raises questions about the company’s commitment to these principles.

- Shareholder Confidence:Large stock sales by executives can erode shareholder confidence, particularly if they are perceived as opportunistic or lacking transparency. Investors may question the company’s long-term strategy and the alignment of executive interests with those of shareholders.

- Corporate Governance Practices:Strong corporate governance practices are essential for maintaining shareholder trust and ensuring that companies operate in a responsible and ethical manner. This includes transparent disclosure of executive compensation, clear guidelines for stock transactions, and independent oversight of corporate activities.

- Regulatory Scrutiny:Companies with weak corporate governance practices are more likely to face regulatory scrutiny and legal challenges. The SEC and other regulatory agencies are increasingly focusing on corporate governance issues, and companies that fail to meet these standards can face significant penalties.

Last Recap

Jim Walton’s stock sale serves as a stark reminder of the complexities and dynamics within the world of corporate finance. It highlights the intricate interplay between family ownership, market forces, and corporate governance. As analysts dissect the implications of this transaction, the spotlight remains firmly fixed on Walmart’s future trajectory and the evolving role of the Walton family in its success.

Clarifying Questions

Why did Jim Walton sell his Walmart stock?

The exact reasons for Jim Walton’s stock sale are not publicly disclosed. However, it’s speculated that the sale could be motivated by a desire to diversify his investment portfolio, estate planning, or a personal financial decision.

What impact will this sale have on Walmart’s stock price?

The impact on Walmart’s stock price is difficult to predict definitively. Some analysts believe the sale could put downward pressure on the stock, while others argue that the market will likely absorb the transaction without significant impact.

What is the current ownership structure of Walmart?

The Walton family holds a significant majority stake in Walmart, with the majority of their holdings inherited from Sam Walton. The family’s influence on the company’s strategic direction and governance is substantial.

CentralPoint Latest News

CentralPoint Latest News