3 reasons why US may slip into a recession over the next 12 months – 3 Reasons Why US May Slip Into a Recession in 2024 sets the stage for a chilling exploration of the economic storm clouds gathering on the horizon. The specter of recession, a word that sends shivers down the spines of investors and consumers alike, is becoming increasingly real, driven by a confluence of factors that threaten to derail the US economy.

This narrative delves into the heart of these concerns, revealing the three primary forces that could push the US into a recessionary abyss.

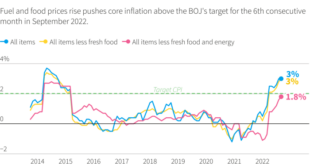

The first and perhaps most formidable force is the relentless grip of inflation. This insidious economic disease is eroding consumer purchasing power, making everyday necessities a luxury for many. Businesses, caught in the crossfire, are struggling to maintain profitability as input costs skyrocket, forcing them to make difficult decisions about investment and job security.

Meanwhile, the Federal Reserve, tasked with taming inflation, is walking a tightrope, attempting to cool the economy without triggering a full-blown recession. The delicate balance between controlling inflation and avoiding a recession is a precarious one, and the outcome remains uncertain.

Inflationary Pressures

The persistent rise in prices, known as inflation, is a significant economic headwind that could push the US economy into a recession. While inflation has been a concern for several months, its impact on consumers and businesses is becoming increasingly apparent.

Eroding Consumer Purchasing Power, 3 reasons why US may slip into a recession over the next 12 months

Inflation erodes the purchasing power of consumers, as their dollars buy less than they did in the past. This phenomenon, known as “inflationary erosion,” forces consumers to make difficult choices, often leading to a reduction in spending. For example, rising food and energy prices are squeezing household budgets, leaving less disposable income for other goods and services.

This decline in consumer spending can ripple through the economy, leading to reduced demand for goods and services, ultimately impacting businesses.

Federal Reserve’s Interest Rate Hikes

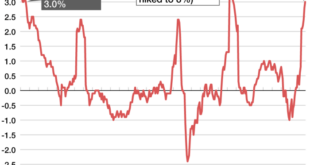

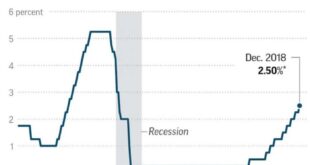

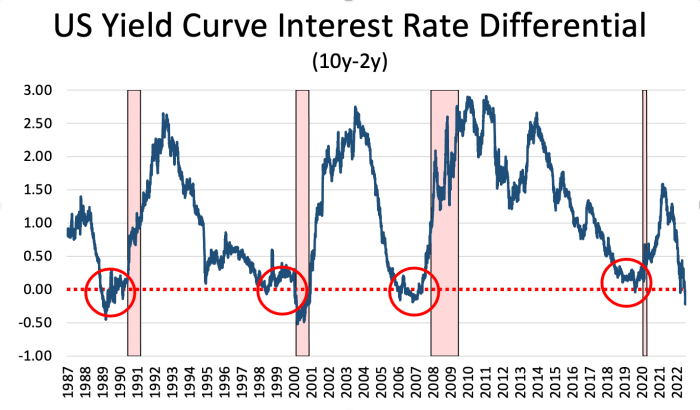

The Federal Reserve (Fed), in an attempt to curb inflation, has been aggressively raising interest rates. These rate hikes aim to slow down economic growth by making borrowing more expensive for businesses and consumers. However, there is a risk that the Fed’s aggressive stance could push the economy into a recession.

If interest rates rise too quickly, businesses may become hesitant to invest, leading to a decline in economic activity. This scenario is reminiscent of the 1980s, when the Fed’s aggressive interest rate hikes contributed to a recession.

Impact on Different Sectors

Inflation is impacting various sectors of the US economy differently. For example, the energy sector has benefited from higher oil and gas prices, while the housing market has been impacted by rising mortgage rates. The manufacturing sector is facing rising input costs, leading to increased prices for consumer goods.

The service sector is experiencing rising labor costs, as employers compete for a limited pool of workers. The current inflationary environment is a complex interplay of factors affecting different sectors of the economy in unique ways.

Historical Comparisons

The current inflationary environment is unique, but it shares similarities with past periods of high inflation. The 1970s, for instance, saw a surge in inflation driven by factors like the oil crisis and the Vietnam War. The current inflationary environment is driven by a combination of factors, including supply chain disruptions, strong consumer demand, and the war in Ukraine.

Understanding the historical context can provide insights into the potential consequences of inflation and how policymakers might respond.

Consumer Spending Slowdown: 3 Reasons Why US May Slip Into A Recession Over The Next 12 Months

The US economy relies heavily on consumer spending, which accounts for roughly 70% of GDP. A significant decline in consumer spending can therefore trigger a recession. Rising interest rates and inflation have been dampening consumer confidence and altering spending patterns, raising concerns about a potential slowdown in the US economy.

Impact of Rising Interest Rates and Inflation on Consumer Confidence and Spending Patterns

The Federal Reserve has been aggressively raising interest rates to combat inflation, which has reached a 40-year high. Higher interest rates make borrowing more expensive, impacting consumers’ ability to finance major purchases such as cars, homes, and appliances. Moreover, inflation erodes purchasing power, forcing consumers to spend more on essential goods and services, leaving less discretionary income for non-essential items.

This combination of rising interest rates and inflation has led to a decline in consumer confidence, as reflected in surveys such as the University of Michigan’s Consumer Sentiment Index. Consumers are becoming increasingly pessimistic about the future, leading to a pullback in spending.

Key Indicators of Consumer Spending

Several key indicators provide insights into consumer spending patterns:

- Retail Sales:This measure reflects the total value of sales at retail stores, offering a snapshot of consumer spending on goods. A decline in retail sales can signal a weakening economy.

- Personal Consumption Expenditures (PCE):This broader measure encompasses spending on both goods and services, providing a more comprehensive picture of consumer spending.

- Consumer Sentiment:Surveys like the University of Michigan’s Consumer Sentiment Index gauge consumer confidence and expectations about the economy. Declining sentiment can foreshadow a reduction in spending.

Potential for a Decline in Consumer Spending to Trigger a Recessionary Spiral

A significant decline in consumer spending can trigger a recessionary spiral. Reduced consumer spending can lead to lower sales for businesses, forcing them to cut production and lay off workers. Job losses further dampen consumer confidence and spending, creating a vicious cycle.

The decline in economic activity can also lead to a decrease in business investment, further exacerbating the downturn.

Role of Government Stimulus Measures in Mitigating a Consumer Spending Slowdown

Government stimulus measures, such as tax cuts or direct payments to consumers, can help mitigate a consumer spending slowdown. These measures can provide temporary relief to consumers by boosting their disposable income and encouraging spending. However, the effectiveness of stimulus measures depends on factors such as the size and duration of the program, as well as the overall economic climate.

Global Economic Uncertainty

The US economy is not an island. Its fate is inextricably linked to the global economic landscape, and the current climate is rife with uncertainty. Geopolitical tensions, supply chain disruptions, and a global economic slowdown are casting a long shadow over the US outlook.

The war in Ukraine, the energy crisis, and the potential for a recession in other major economies are all contributing to this sense of unease.

The War in Ukraine and the Energy Crisis

The war in Ukraine has unleashed a cascade of economic repercussions, disrupting global energy markets, driving up inflation, and jeopardizing supply chains. The conflict has exacerbated existing energy shortages, particularly in Europe, where Russia is a major supplier of natural gas.

You also can investigate more thoroughly about Nvidia CFO Colette Kress sells shares worth over $7.7 million to enhance your awareness in the field of Nvidia CFO Colette Kress sells shares worth over $7.7 million.

This has led to soaring energy prices, which are being felt around the world. For the US, the impact is twofold: higher energy costs for businesses and consumers, and a potential strain on its own energy supplies as it seeks to replace Russian imports.

Potential Spillover from Global Recessions

The war in Ukraine has further complicated an already precarious global economic situation. Many major economies are facing their own challenges, including rising inflation, supply chain bottlenecks, and weakening consumer demand. There is a growing concern that these factors could trigger a recession in some of these countries.

A recession in major economies like Europe or China could have a significant impact on the US economy. For example, a slowdown in Europe would likely lead to reduced demand for US exports, potentially impacting American businesses and jobs.

Similarly, a Chinese recession would disrupt global supply chains and dampen demand for US goods and services.

Implications for US Businesses and Consumers

A global recession would likely have a significant impact on US businesses and consumers. Businesses could face reduced demand for their products and services, leading to lower profits and potentially layoffs. Consumers could see higher prices for goods and services, further eroding their purchasing power.

In addition, a global recession could lead to a decline in investment and economic activity, ultimately hindering US economic growth.

Concluding Remarks

The US economy stands at a crossroads, facing the formidable challenges of inflation, consumer spending slowdown, and global economic uncertainty. These three intertwined forces are casting a long shadow over the economic landscape, threatening to push the US into a recession.

Whether the country can navigate these perilous waters and avoid a downturn remains to be seen. However, understanding the nature of these challenges is the first step towards finding solutions and mitigating the potential damage. The path ahead is uncertain, but by acknowledging the risks and preparing for potential contingencies, the US may be able to weather the storm and emerge stronger on the other side.

Common Queries

What are the potential consequences of a US recession?

A US recession could lead to job losses, decreased economic growth, lower consumer confidence, and a decline in investment. It could also strain government finances and potentially lead to social unrest.

How can the US government mitigate the risk of a recession?

The US government can implement fiscal policies, such as tax cuts or increased spending, to stimulate the economy. It can also use monetary policy, such as lowering interest rates, to encourage borrowing and investment. Additionally, government interventions to address inflation and stabilize the global economy can play a significant role in preventing a recession.

Is a recession inevitable?

While a recession is a possibility, it is not inevitable. The US economy has shown resilience in the past, and proactive measures can help mitigate the risk of a downturn. The effectiveness of these measures will depend on a range of factors, including the severity of the economic challenges and the government’s response.

CentralPoint Latest News

CentralPoint Latest News