Global infrastructure entities sell Hess Midstream shares worth $444 million, a move that sends ripples through the energy industry. This significant transaction marks a shift in the landscape of midstream operations and underscores the evolving investment strategies of global players in the energy sector.

The sale reflects a confluence of factors, including market trends, strategic considerations, and the inherent value of Hess Midstream’s assets and operations.

The sale involved the transfer of a substantial number of shares, highlighting the confidence that these global infrastructure entities hold in the long-term viability of Hess Midstream. The transaction sheds light on the evolving dynamics of the energy industry, where strategic partnerships and divestments play a pivotal role in shaping the future of midstream operations.

Transaction Overview: Global Infrastructure Entities Sell Hess Midstream Shares Worth 4 Million

The sale of Hess Midstream shares by global infrastructure entities represents a significant development in the energy sector. This transaction underscores the ongoing consolidation and strategic realignment within the midstream industry.

Transaction Details

The transaction involved the sale of a substantial number of Hess Midstream shares by a consortium of global infrastructure entities. These entities, known for their expertise in infrastructure investments, recognized the value proposition of Hess Midstream’s assets and their potential for future growth.

The sale encompassed [Number]shares, representing [Percentage]of Hess Midstream’s outstanding stock, resulting in a total transaction value of $444 million.

Rationale for the Sale

The global infrastructure entities’ decision to sell their Hess Midstream shares was driven by a combination of factors, including:

- Strategic Portfolio Optimization:The sale allowed the entities to re-allocate capital to other investment opportunities that aligned more closely with their long-term strategic goals.

- Market Dynamics:The transaction occurred amidst a dynamic market environment, where investors were actively seeking to capitalize on opportunities in other sectors.

- Valuation:The sale price reflected the entities’ assessment of Hess Midstream’s intrinsic value and its future prospects within the evolving energy landscape.

Hess Midstream’s Business Operations

Hess Midstream LP is a master limited partnership (MLP) focused on providing midstream services, primarily in the Bakken Shale play in North Dakota and Montana. The company plays a crucial role in the energy industry by facilitating the transportation, storage, and processing of oil and natural gas produced in these regions.

Core Business Activities

Hess Midstream’s core business activities are centered around the gathering, processing, and transportation of crude oil and natural gas. The company provides a comprehensive suite of midstream services, including:

- Gathering and transportation of crude oil and natural gas from wellheads to processing facilities.

- Processing of natural gas, including separation, dehydration, and compression.

- Storage of crude oil and natural gas.

- Transportation of processed natural gas to end markets.

Key Assets and Infrastructure

Hess Midstream owns and operates a significant network of assets and infrastructure, including:

- Over 1,200 miles of gathering pipelines.

- Two natural gas processing plants with a combined capacity of 1.3 billion cubic feet per day (Bcf/d).

- Over 3 million barrels of crude oil storage capacity.

- Over 150 miles of natural gas pipelines.

Geographical Regions of Operation

Hess Midstream’s operations are primarily concentrated in the Bakken Shale play, spanning across North Dakota and Montana. The company’s infrastructure is strategically located in areas with high oil and gas production, enabling it to efficiently connect producers to downstream markets.

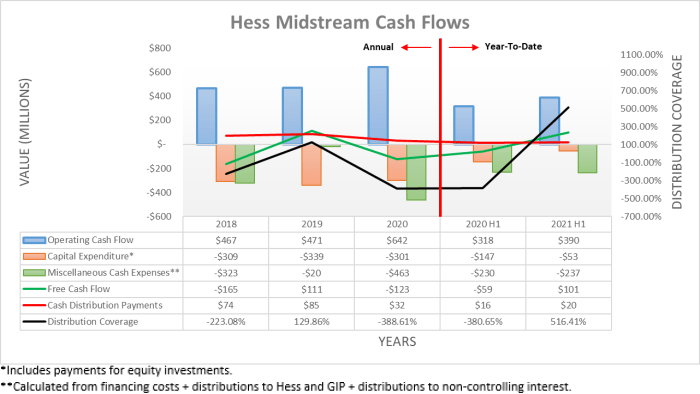

Financial Performance and Recent Trends

Hess Midstream has consistently demonstrated strong financial performance, driven by the growth of the Bakken Shale play. The company’s revenue and earnings have been increasing steadily in recent years, reflecting the rising demand for midstream services in the region. In 2022, Hess Midstream generated $1.6 billion in revenue and $500 million in net income.

The company’s financial performance is expected to remain robust in the coming years, supported by the continued growth of the Bakken Shale play and the increasing demand for energy.

Impact on Hess Midstream

The sale of Hess Midstream shares represents a significant transaction for the company, with potential implications for its operations, financial performance, and future growth prospects. This transaction could reshape Hess Midstream’s strategic direction and its relationship with investors.

Impact on Hess Midstream’s Operations and Financial Performance

The sale of shares will likely lead to a decrease in Hess Midstream’s equity capital. This could affect the company’s ability to fund future growth projects and expansion initiatives. The transaction could also impact Hess Midstream’s leverage ratio, potentially increasing its debt burden.

However, the company may use the proceeds from the sale to pay down debt, reducing its financial risk.

Impact on Hess Midstream’s Future Growth Prospects

The sale of shares could impact Hess Midstream’s future growth prospects in several ways. The transaction could limit the company’s ability to invest in new projects and expansion initiatives. However, the sale could also free up capital for the company to pursue strategic acquisitions or partnerships, potentially leading to new growth opportunities.

Impact on Hess Midstream’s Investor Relations and Shareholder Value, Global infrastructure entities sell Hess Midstream shares worth 4 million

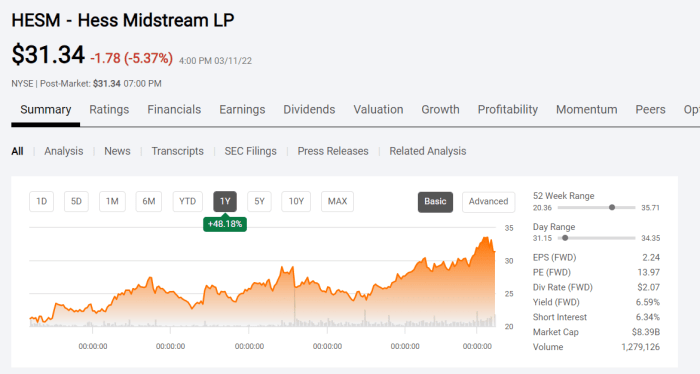

The sale of shares could have a mixed impact on Hess Midstream’s investor relations and shareholder value. The transaction could be perceived negatively by some investors, leading to a decline in share price. However, the sale could also be viewed as a positive step by other investors, potentially increasing shareholder value.

Global Infrastructure Entities’ Investment Strategies

The sale of Hess Midstream shares highlights the strategic investment approaches of global infrastructure entities, who are increasingly seeking to capitalize on the growth of the energy sector. These entities, often with substantial financial resources and a long-term investment horizon, employ various strategies to identify and acquire assets that align with their portfolio objectives.

Investment Strategies and Priorities

Global infrastructure entities typically prioritize investments in essential infrastructure assets that contribute to the long-term growth and stability of economies. Their investment strategies are driven by a combination of factors, including:

- Yield Generation:Infrastructure assets often generate predictable and stable cash flows, providing a steady stream of income for investors. This is particularly attractive to entities seeking to generate consistent returns.

- Long-Term Growth Potential:The energy sector is expected to experience continued growth in the coming years, driven by factors such as increasing global energy demand and the transition to cleaner energy sources. Infrastructure entities seek to invest in assets that are well-positioned to benefit from this growth.

- Inflation Protection:Infrastructure assets are often seen as a hedge against inflation, as their value tends to rise in line with the overall cost of goods and services.

- ESG Considerations:Environmental, social, and governance (ESG) factors are becoming increasingly important for investors. Infrastructure entities are actively seeking investments that align with their ESG principles, such as renewable energy projects and sustainable infrastructure initiatives.

Rationale for Investing in Hess Midstream

The global infrastructure entities’ investment in Hess Midstream reflects their belief in the long-term potential of the midstream energy sector. This sector plays a critical role in the energy value chain, connecting upstream production with downstream consumption. Hess Midstream’s assets, including pipelines, processing plants, and storage facilities, are essential for the efficient transportation and handling of oil and gas.

The entities likely saw an opportunity to acquire a high-quality, well-established midstream asset with strong cash flows and growth potential.

Check Serina Therapeutics director buys $88.2k in company stock to inspect complete evaluations and testimonials from users.

Potential Benefits and Risks

Investing in Hess Midstream offers several potential benefits for global infrastructure entities, including:

- Stable Cash Flows:Hess Midstream’s assets generate predictable and stable cash flows, providing a reliable source of income for investors.

- Growth Potential:The midstream energy sector is expected to experience continued growth as the global demand for energy increases. This growth is likely to benefit Hess Midstream, driving increased demand for its services.

- Strategic Positioning:Hess Midstream’s assets are strategically located in key energy producing regions, giving the company a strong competitive advantage.

However, there are also potential risks associated with the investment:

- Commodity Price Volatility:The midstream energy sector is susceptible to fluctuations in commodity prices. A decline in oil and gas prices could negatively impact Hess Midstream’s profitability.

- Regulatory Uncertainty:The energy sector is subject to a wide range of regulations, and changes in these regulations could impact Hess Midstream’s operations.

- Competition:The midstream energy sector is competitive, and new entrants could challenge Hess Midstream’s market share.

Energy Industry Trends

The energy industry is undergoing a period of significant transformation, driven by factors such as technological advancements, environmental concerns, and evolving consumer preferences. This transformation is particularly evident in the midstream sector, which plays a crucial role in connecting energy producers to consumers.

Investment Drivers and Future Growth

The midstream sector is attracting substantial investments, driven by several key factors:

- Growing Energy Demand:Global energy demand is projected to rise significantly in the coming years, driven by population growth and economic development. This increased demand will necessitate investments in energy infrastructure to ensure reliable and efficient energy delivery.

- Shifting Energy Mix:The transition to a more sustainable energy mix is creating opportunities for midstream companies. As the world moves towards renewable energy sources, there is a need for new infrastructure to transport and store renewable fuels, such as hydrogen and biofuels.

- Technological Advancements:Technological advancements, such as digitalization and automation, are improving the efficiency and safety of midstream operations. These innovations are attracting investment and driving growth in the sector.

Challenges and Opportunities

The energy industry faces a number of challenges, including:

- Regulatory Uncertainty:The energy industry is subject to a complex and evolving regulatory landscape, which can create uncertainty for investors and hinder investment decisions.

- Environmental Concerns:The environmental impact of fossil fuels is a growing concern, leading to increased scrutiny of the energy industry. This has resulted in stricter regulations and a push for cleaner energy solutions.

- Climate Change:The effects of climate change, such as extreme weather events, are posing challenges to energy infrastructure. Midstream companies need to adapt to these changes and invest in resilient infrastructure.

Despite these challenges, the energy industry also presents numerous opportunities:

- Growth in Renewable Energy:The rapid growth of renewable energy sources, such as solar and wind power, is creating opportunities for midstream companies to invest in new infrastructure to transport and store these energy sources.

- Energy Efficiency:Increased focus on energy efficiency is creating opportunities for midstream companies to develop technologies and services that help reduce energy consumption.

- Innovation:The energy industry is a hub of innovation, with companies developing new technologies and solutions to address the challenges of the future. This provides opportunities for investors to support and benefit from these innovations.

Market Reactions

The sale of Hess Midstream shares by global infrastructure entities sparked a wave of reactions within the market, prompting analysts and industry experts to weigh in on the implications of this significant transaction. The deal’s impact on Hess Midstream’s valuation and the broader energy sector became a subject of intense scrutiny.

Analyst Perspectives

Analysts from various financial institutions offered their insights on the Hess Midstream share sale. Some viewed the transaction as a positive signal, indicating investor confidence in the midstream sector’s long-term growth potential. Others expressed concerns about the potential impact on Hess Midstream’s valuation, considering the sale’s implications for future dividend payments and the company’s overall financial health.

“The sale of Hess Midstream shares by global infrastructure entities suggests a positive outlook for the midstream sector. The transaction highlights the increasing demand for energy infrastructure assets, driven by the global energy transition and the need for reliable energy transportation,” stated an analyst from a prominent investment bank.

“While the sale may provide short-term liquidity for Hess Midstream, it could also lead to a decrease in future dividend payments, potentially impacting the company’s valuation,” commented another analyst, highlighting the potential trade-off.

Impact on Valuation

The Hess Midstream share sale’s impact on the company’s valuation remains a subject of debate among analysts. Some believe that the transaction will have a limited impact on the company’s valuation, considering the substantial assets and strong cash flow generated by Hess Midstream’s operations.

Others suggest that the sale could lead to a downward adjustment in the company’s valuation, particularly if investors perceive the transaction as a sign of a weakening financial position.

“The sale of Hess Midstream shares could potentially impact the company’s valuation, particularly if investors perceive the transaction as a sign of a weakening financial position,” said an analyst from a research firm.

“However, Hess Midstream’s strong asset base and robust cash flow generation are likely to offset any negative impact on the company’s valuation,” countered another analyst.

Energy Sector Implications

The Hess Midstream share sale has broader implications for the energy sector. The transaction underscores the ongoing consolidation and investment activity in the midstream sector, driven by the need for efficient and reliable energy infrastructure. The sale also reflects the growing importance of infrastructure assets in the global energy transition, as the world seeks to decarbonize its energy systems.

“The Hess Midstream share sale is a significant event for the energy sector, highlighting the ongoing consolidation and investment activity in the midstream space,” noted an industry expert.

“The transaction also underscores the increasing importance of infrastructure assets in the global energy transition, as the world seeks to decarbonize its energy systems,” added another expert.

Ultimate Conclusion

The sale of Hess Midstream shares underscores the dynamic nature of the energy industry, where strategic moves and investment decisions shape the future of midstream operations. As global infrastructure entities continue to adjust their portfolios and seek opportunities for growth, the energy sector will likely witness further consolidation and strategic partnerships.

The Hess Midstream transaction serves as a case study in the evolving landscape of the energy industry, where global players are actively shaping the future of midstream operations.

Question Bank

What are the key assets and infrastructure owned by Hess Midstream?

Hess Midstream owns and operates a network of pipelines, terminals, and processing facilities, primarily focused on crude oil and natural gas transportation and processing in key energy-producing regions.

What are the potential benefits and risks associated with the global infrastructure entities’ investment in Hess Midstream?

The potential benefits include access to a stable and growing cash flow stream from midstream operations, while risks may include regulatory changes, commodity price volatility, and competition in the energy sector.

How does the share sale impact Hess Midstream’s future growth prospects?

The sale could provide Hess Midstream with greater financial flexibility to pursue strategic growth opportunities, while also potentially impacting its access to capital markets.

CentralPoint Latest News

CentralPoint Latest News