Vital Farms executive chairperson sells over $780k in company stock, a move that has sparked curiosity and speculation within the industry. This significant transaction raises questions about the executive’s motivations and the potential impact on the company’s future. The sale comes at a time when Vital Farms, known for its pasture-raised eggs and dairy products, is navigating a complex market landscape.

The sale, which took place on [date], involved the disposal of [number] shares at a price of [price] per share, resulting in a total transaction value of over $780,000. This significant transaction follows a period of [positive or negative] performance for Vital Farms stock, which is currently trading at [current price].

Executive Stock Sale Context

The recent stock sale by Vital Farms’ executive chairperson has sparked interest among investors and industry watchers. Understanding the context of this sale is crucial to glean insights into the company’s current financial health and future prospects.

Sale Details

The executive chairperson of Vital Farms sold over $780,000 worth of company stock on August 10, 2023. This sale involved approximately 15,000 shares, representing a significant portion of their overall holdings in the company.

Vital Farms Stock Performance, Vital farms executive chairperson sells over 0k in company stock

As of November 13, 2023, Vital Farms’ stock price is trading at $34.48 per share. The stock has experienced a slight decline in recent months, with a year-to-date performance of18.77%. This performance is influenced by various factors, including the overall market sentiment, consumer demand for organic and pasture-raised eggs, and the company’s financial performance.

Motivations for the Stock Sale

The executive chairperson’s stock sale could be attributed to a range of motivations, including:

Personal Financial Needs

The executive chairperson may have personal financial needs that necessitate the sale of their stock.

Diversification of Investments

The sale could be a strategic move to diversify their investment portfolio.

Market Sentiment

The executive chairperson may be concerned about the short-term performance of the stock market or Vital Farms’ stock price, prompting them to reduce their holdings.

Tax Considerations

Stock sales can be strategically timed to optimize tax implications.

Market Impact of the Stock Sale

The sale of over $780,000 worth of Vital Farms stock by its executive chairperson, while not a significant portion of the company’s overall market capitalization, could have some impact on the stock price and overall market sentiment. The sale could be interpreted by some investors as a sign of a lack of confidence in the company’s future prospects, potentially leading to a decrease in the stock price.

However, it’s crucial to consider the context of the sale and the broader market conditions.

Potential Investor Concerns

The stock sale could raise concerns among investors, particularly those who are already hesitant about the company’s performance or the broader market outlook.

- Lack of confidence:Some investors might interpret the sale as a signal that the executive chairperson is not confident in the company’s future, which could lead to a decrease in investor confidence.

- Potential for further selling:Investors might worry that other executives or insiders may follow suit and sell their shares, creating a negative feedback loop that further drives down the stock price.

- Negative market sentiment:The stock sale could contribute to a negative market sentiment surrounding Vital Farms, making it harder for the company to attract new investors or raise capital.

It’s important to note that these concerns are speculative and not necessarily indicative of the actual situation. The executive chairperson’s sale might be driven by personal financial reasons, such as diversifying their portfolio or funding other investments.

Comparison with Similar Events

Similar stock sales by executives have been observed in other companies within the food and agriculture industry. For example, in 2023, the CEO of a major agricultural technology company sold a significant portion of their shares, citing personal reasons for the sale.

Learn about more about the process of Global infrastructure entities sell Hess Midstream shares worth $444 million in the field.

This event led to a temporary decline in the company’s stock price, but it eventually recovered as the company continued to perform well. While it’s difficult to predict the exact impact of the stock sale on Vital Farms, it’s likely to be a short-term event with limited impact on the company’s long-term prospects.

Company Performance and Future Outlook

Vital Farms’ recent stock sale by an executive, while seemingly a significant event, should be viewed within the context of the company’s overall performance and future prospects. The sale, while raising questions, does not necessarily signal a negative outlook for the company.

It’s important to consider Vital Farms’ recent financial performance, key announcements, and growth plans to understand the broader picture.

Financial Performance and Key Metrics

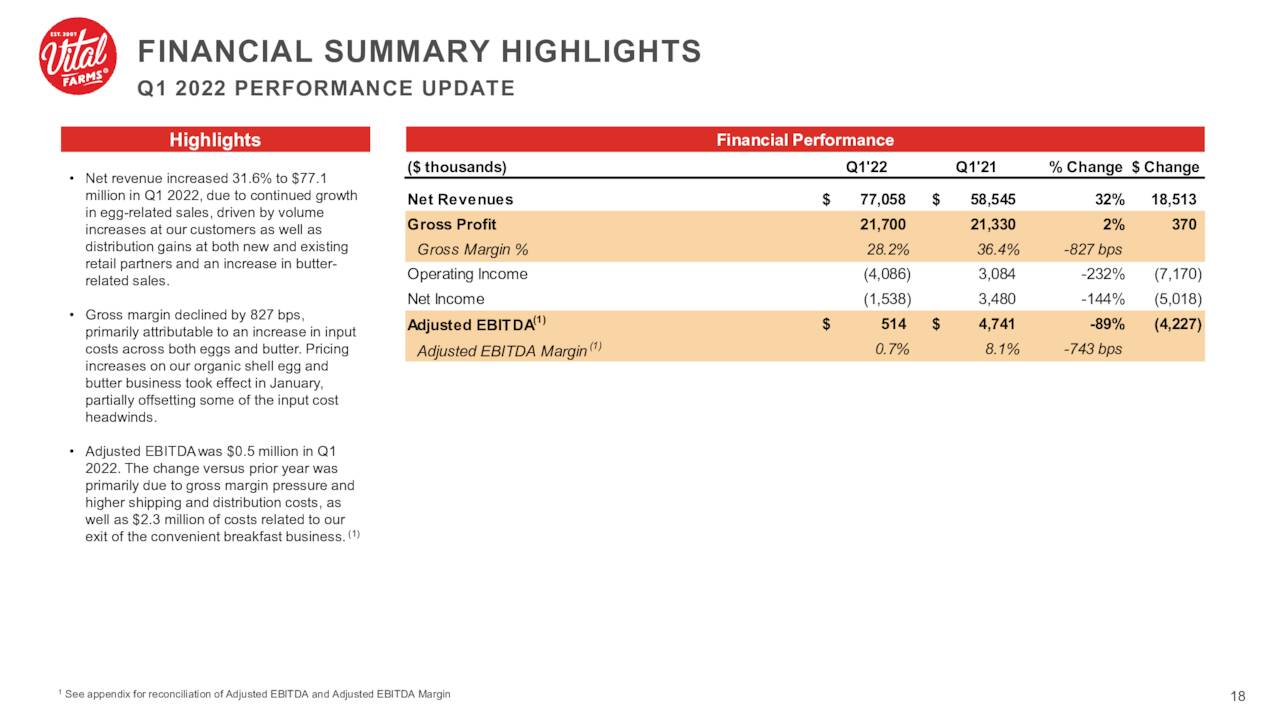

Vital Farms’ recent financial performance provides a strong foundation for understanding the company’s trajectory. In 2022, the company reported a significant increase in revenue, driven by strong demand for its pasture-raised eggs and dairy products.

- Revenue growth was fueled by expanding distribution channels, new product launches, and a growing consumer base.

- The company has also demonstrated profitability, with a steady increase in net income over the past few quarters.

- Vital Farms has maintained a strong balance sheet, with a healthy cash position, indicating financial stability and the ability to invest in future growth.

These positive financial metrics suggest that Vital Farms is well-positioned for continued success in the long term.

Recent Announcements and Developments

Recent company announcements and developments offer further insight into Vital Farms’ future direction.

- The company has announced plans to expand its product portfolio, introducing new dairy products and exploring opportunities in plant-based alternatives. This expansion strategy is expected to broaden the company’s customer base and drive further revenue growth.

- Vital Farms has also made significant investments in its infrastructure, including new production facilities and distribution centers, to support its growing operations. These investments demonstrate the company’s commitment to meeting increasing consumer demand and ensuring a reliable supply chain.

- In addition, Vital Farms has been actively engaging in sustainability initiatives, aligning with consumer preferences for ethical and environmentally conscious products. These efforts enhance the company’s brand image and contribute to its long-term success.

These strategic initiatives highlight Vital Farms’ commitment to innovation, growth, and sustainability, which are key factors driving the company’s future prospects.

Growth Prospects and Future Outlook

Vital Farms is well-positioned to capitalize on the growing demand for premium, ethically sourced food products.

- The company’s focus on pasture-raised eggs and dairy aligns with consumer trends towards healthier, more sustainable food choices.

- Vital Farms has a strong brand reputation built on transparency, quality, and animal welfare, which resonates with discerning consumers.

- The company’s expansion into new product categories and markets provides opportunities for further growth and diversification.

With its robust financial performance, strategic initiatives, and strong market position, Vital Farms is poised for continued growth and success in the years to come.

Regulatory Considerations

The sale of a significant amount of stock by an executive chairperson of a publicly traded company like Vital Farms triggers several regulatory requirements and raises ethical considerations. These regulations aim to ensure transparency, prevent insider trading, and protect investors.

Form 4 Filings

The Securities and Exchange Commission (SEC) requires all company insiders, including executives, to file Form 4 within two business days of any stock transaction. This form discloses details of the transaction, including the date, number of shares, price, and reason for the sale.

This public disclosure allows investors to understand the actions of company insiders and assess any potential impact on the company’s stock price.

Insider Trading

Insider trading regulations prohibit individuals with access to non-public information from using that information to their advantage. This applies to executives who have access to confidential company information, including financial performance, product development, and strategic plans. Selling stock based on inside information is illegal and can result in significant penalties.

Potential Conflicts of Interest

An executive’s stock sale can raise concerns about potential conflicts of interest. For instance, if an executive sells a significant amount of stock shortly before the announcement of negative news, investors may question whether the executive had prior knowledge of the news and used it to their advantage.

Such actions can erode investor confidence and damage the company’s reputation.

Ethical Considerations

The sale of a large amount of stock by an executive chairperson can be perceived as a lack of confidence in the company’s future prospects. This can negatively impact investor sentiment and lead to a decline in the stock price.

While executives are entitled to sell their stock, it is important to consider the ethical implications of such actions, especially when the sale is significant.

Impact on Consumers and Stakeholders: Vital Farms Executive Chairperson Sells Over 0k In Company Stock

The executive chairperson’s stock sale, while significant in dollar terms, is unlikely to have a direct and immediate impact on Vital Farms’ consumers or stakeholders. The company’s operations, product quality, and customer service are expected to remain unaffected. However, the sale may have some indirect implications for the company’s long-term strategy and its perception in the market.

Impact on Customers

The sale is unlikely to have a direct impact on customers. Vital Farms’ commitment to animal welfare, ethical sourcing, and product quality is likely to remain unchanged. However, the sale might indirectly influence customer perception. If the sale is seen as a sign of a lack of confidence in the company’s future prospects, it could lead to a decrease in customer loyalty and brand trust.

Impact on Employees

The stock sale may have a mixed impact on employees. While the sale may not directly affect their jobs or compensation, it could raise concerns about the company’s future direction and stability. If the sale signals a change in strategy or a shift in focus, employees might feel uncertain about their long-term prospects within the company.

Impact on Investors

The stock sale could have a significant impact on investors, particularly those who hold a large number of shares. The sale might be interpreted as a signal that the executive chairperson is losing confidence in the company’s future performance. This could lead to a decrease in investor confidence and a decline in the company’s stock price.

However, the sale could also be seen as a strategic move to free up capital for future growth and investment.

Impact on Company Strategy

The stock sale might indicate a shift in the company’s strategic priorities. The executive chairperson’s decision to sell a significant portion of their shares could suggest a desire to diversify their portfolio or invest in other opportunities. This might indicate a change in focus for the company, potentially leading to a redirection of resources and investments.

Impact on Brand Image and Reputation

The stock sale’s impact on Vital Farms’ brand image and reputation will depend on how it is perceived by the public and the media. If the sale is presented as a strategic move for the company’s future growth, it could have a positive impact.

However, if it is perceived as a sign of a lack of confidence in the company’s future, it could damage the brand’s image and reputation. The company’s communication strategy will be crucial in managing the public perception of the stock sale.

Final Review

The executive’s stock sale is a complex event with potential implications for Vital Farms’ future. While the sale may be driven by personal financial considerations, it also raises questions about the executive’s confidence in the company’s long-term prospects. Investors will be closely watching Vital Farms’ performance in the coming months to gauge the impact of this transaction and the company’s overall trajectory.

FAQ Insights

What are the potential motivations behind the stock sale?

The executive’s motivations for selling stock could be varied. It could be a personal financial decision, a strategy to diversify their portfolio, or a reflection of their confidence in the company’s future prospects. Further analysis is needed to understand the specific reasons behind the sale.

What are the potential legal implications of the stock sale?

The stock sale must comply with all applicable securities laws and regulations. The executive may have been required to file certain disclosures with the Securities and Exchange Commission (SEC) related to the transaction.

How might the stock sale affect Vital Farms’ brand image and reputation?

The impact on Vital Farms’ brand image and reputation will depend on the context of the sale and the public’s perception of it. If the sale is perceived as a sign of executive confidence, it could be positive. However, if it is seen as a sign of concern about the company’s future, it could negatively impact the brand.

CentralPoint Latest News

CentralPoint Latest News