Waller Defends Fed’s decision to cut by 50 bps sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset.

In a move that sent ripples through the financial world, the Federal Reserve announced a significant rate cut, sparking a wave of debate and analysis. At the heart of this discussion stood Federal Reserve Governor Christopher Waller, a key figure in the decision-making process.

Waller, a staunch advocate for the rate cut, stepped forward to defend the Fed’s actions, providing a compelling justification for the move.

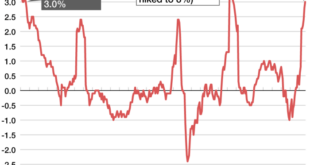

The rate cut was a response to a confluence of economic factors, including concerns about slowing global growth, trade tensions, and the potential for a recession. Waller, in his defense of the decision, cited a range of economic data points, including weakening consumer confidence, softening manufacturing activity, and a decline in business investment.

He argued that these indicators pointed to a need for a more accommodative monetary policy, a policy that would stimulate economic activity and prevent a downturn. Waller’s perspective aligned with the views of other Fed officials who believed that the rate cut was necessary to safeguard the US economy from potential headwinds.

The Context of the Rate Cut

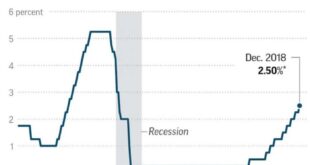

The Federal Reserve’s decision to cut interest rates by 50 basis points was a significant move, signaling a shift in the central bank’s stance on monetary policy. This decision was driven by a confluence of factors, including the global economic slowdown, trade tensions, and concerns about inflation.

Economic Conditions Leading to the Rate Cut

The US economy has been showing signs of weakness in recent months. Growth has slowed, and business investment has declined. Consumer spending, while still strong, has shown signs of moderation. This slowdown is partly due to the ongoing trade war with China, which has created uncertainty and disrupted global supply chains.

Additionally, the global economy is facing headwinds from weak growth in Europe and Japan. The Fed’s decision to cut rates was a response to these challenges, aiming to stimulate economic activity and prevent a recession.

Potential Risks and Uncertainties Facing the US Economy

The US economy faces a number of risks and uncertainties. The ongoing trade war with China is a major source of uncertainty, and it could further disrupt global trade and investment. The global economic slowdown is also a concern, as it could weaken demand for US goods and services.

Additionally, there are concerns about the impact of rising interest rates on the US economy, particularly on the housing market.

Rationale Behind the Fed’s Belief That a Rate Cut Was Necessary

The Fed believes that a rate cut was necessary to support economic growth and prevent a recession. The central bank argued that the slowdown in economic growth was due to “transitory factors” such as the trade war and the global economic slowdown.

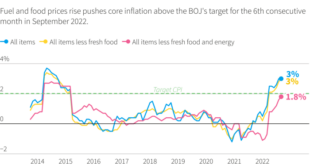

The Fed also believes that inflation is likely to remain below its 2% target in the near term. By cutting interest rates, the Fed aims to lower borrowing costs for businesses and consumers, stimulate investment and spending, and boost economic growth.

Waller’s Justification

Waller’s justification for the rate cut rests on his assessment of the economic landscape and the potential risks to future growth. He argues that while inflation remains elevated, there are signs of moderation, and the recent banking turmoil could further dampen economic activity.

This perspective aligns with the Fed’s dual mandate of achieving both price stability and maximum employment.

Waller’s Key Arguments

Waller emphasizes the need for a measured approach to interest rate adjustments, recognizing the potential lag effects of monetary policy. He cites several key economic data points to support his position:

- Inflation: Waller acknowledges that inflation remains above the Fed’s 2% target but highlights recent signs of moderation, particularly in core inflation, which excludes volatile food and energy prices. He suggests that the recent decline in core inflation indicates a potential easing of price pressures.

- Consumer Spending: Waller points to the resilience of consumer spending, which remains a crucial driver of economic growth. He acknowledges the impact of rising interest rates on consumer borrowing but suggests that the overall level of consumer spending remains healthy.

- Labor Market: Waller acknowledges the strength of the labor market, characterized by low unemployment and robust job creation.

However, he also expresses concern about the potential for a slowdown in job growth due to the recent banking turmoil and rising interest rates.

- Banking Sector: Waller emphasizes the importance of financial stability and acknowledges the recent turmoil in the banking sector.

He suggests that the recent events could lead to a tightening of credit conditions, potentially dampening economic activity and slowing down growth.

Alignment with Other Fed Officials

Waller’s stance on the rate cut aligns with the views of other Fed officials who advocate for a cautious approach to monetary policy. Some Fed officials share Waller’s concern about the potential economic impact of the recent banking turmoil, while others prioritize the need to further reduce inflation.

The decision to cut rates by 50 basis points reflects a balancing act between these competing perspectives.

Market Reactions: Waller Defends Fed’s Decision To Cut By 50 Bps

The announcement of the 50 basis point rate cut sent shockwaves through the financial markets, triggering a flurry of activity and prompting investors to reassess their strategies. While the initial reaction was broadly positive, the long-term implications for various asset classes and investor sentiment remain a subject of ongoing debate.

Initial Market Response

The immediate reaction to the rate cut was largely positive, as evidenced by the surge in stock prices and the decline in bond yields. The S&P 500 index, a benchmark for US equities, experienced a sharp rally, gaining over 2% in the hours following the announcement.

This positive response can be attributed to the perceived easing of monetary policy, which is generally seen as favorable for businesses and economic growth. The decline in bond yields, which move inversely to prices, further indicated investor optimism about the economic outlook.

Implications for Asset Classes

The rate cut is expected to have significant implications for various asset classes, with some potentially benefiting more than others.

Stocks

The rate cut is generally seen as a positive development for stocks, as it lowers borrowing costs for companies and encourages investment. Lower interest rates can also boost consumer spending, leading to increased demand for goods and services, which can further drive stock prices higher.

Bonds

The rate cut is generally seen as a negative development for bonds, as it reduces their relative attractiveness compared to other investments. When interest rates fall, the value of existing bonds with higher yields declines, leading to losses for bondholders.

However, the rate cut could also lead to increased demand for bonds, as investors seek safe haven assets in a period of economic uncertainty.

Check Darden Restaurants: Bernstein sees limited upside, Evercore ISI bullish to inspect complete evaluations and testimonials from users.

Real Estate

The rate cut could have a mixed impact on the real estate market. On the one hand, it could make it easier for individuals to obtain mortgages and purchase homes, potentially leading to increased demand and higher prices. On the other hand, the rate cut could also lead to increased inflation, which could erode the purchasing power of buyers and dampen demand.

Changes in Investor Sentiment

The rate cut has led to a significant shift in investor sentiment, with many becoming more optimistic about the economic outlook. The positive market response suggests that investors are encouraged by the Fed’s willingness to act decisively to address economic challenges.

However, there are still concerns about the potential for a recession, and the rate cut alone may not be enough to completely alleviate these fears.

Alternative Perspectives

While Waller defended the Fed’s decision, many economists and analysts expressed skepticism and raised concerns about the potential drawbacks of the rate cut. Their arguments highlight the complexities surrounding monetary policy and the potential for unintended consequences.

Potential Drawbacks of the Rate Cut

The decision to cut rates by 50 basis points was met with mixed reactions, with some experts raising concerns about the potential drawbacks.

- Fueling Inflation:A significant concern is that the rate cut could further fuel inflation, which has already been a persistent issue. Lower interest rates can encourage borrowing and spending, potentially leading to increased demand and upward pressure on prices. This could create a vicious cycle, where inflation feeds on itself.

- Weakening the Dollar:A rate cut can weaken the dollar’s exchange rate, making imports more expensive and potentially contributing to inflation. A weaker dollar can also make it more expensive for U.S. businesses to borrow money from overseas, potentially hindering economic growth.

- Eroding Confidence in the Fed:Some critics argue that the rate cut could undermine confidence in the Fed’s commitment to controlling inflation. Frequent rate cuts, especially in the face of persistent inflation, might signal a lack of resolve and lead to market uncertainty.

Comparison of Arguments

The arguments for and against the rate cut reflect a fundamental debate about the appropriate course of action in a complex economic environment.

| For the Rate Cut | Against the Rate Cut |

|---|---|

| Stimulates economic growth by lowering borrowing costs for businesses and consumers. | Could exacerbate inflation, potentially leading to a spiral of rising prices. |

| Provides a buffer against potential economic shocks and uncertainties. | Might weaken the dollar, making imports more expensive and potentially contributing to inflation. |

| Supports the housing market and encourages investment. | Could erode confidence in the Fed’s commitment to controlling inflation. |

“The Fed’s decision to cut rates is a gamble, and it remains to be seen whether it will pay off. The potential for unintended consequences is real, and the long-term impact of this decision remains uncertain.”

[Name of Economist], [Affiliation]

Future Implications

The 50 basis point rate cut by the Federal Reserve, while a significant move, raises crucial questions about the trajectory of future monetary policy decisions. The impact of this rate cut on inflation and economic growth will influence the Fed’s next steps, and the market is keenly observing for any hints about the future direction of interest rates.

Impact on Future Monetary Policy, Waller defends Fed’s decision to cut by 50 bps

The 50 basis point rate cut signals a shift in the Fed’s stance, indicating a greater willingness to combat economic slowdown. This could suggest further rate cuts in the near future, especially if economic indicators continue to point toward weakening growth.

However, the Fed’s decision will also be influenced by the inflation outlook. If inflation remains stubbornly high, the Fed may be forced to prioritize price stability over economic growth, potentially limiting future rate cuts.

Impact on Inflation and Economic Growth

The rate cut aims to stimulate economic activity by lowering borrowing costs for businesses and consumers. This could boost investment and spending, leading to higher economic growth. However, the effectiveness of this measure depends on various factors, including consumer confidence, business sentiment, and the overall economic environment.

The rate cut could also contribute to higher inflation, as it could increase demand for goods and services.

Likelihood of Further Rate Cuts

The likelihood of further rate cuts depends on the evolving economic landscape. If economic growth slows down significantly, the Fed may be more likely to cut rates further. However, if inflation remains high, the Fed may prioritize price stability and hold off on additional cuts.

The Fed’s decision will be driven by a careful balancing act between supporting economic growth and controlling inflation.

Final Review

The Fed’s decision to cut rates by 50 bps sparked a lively debate, with economists and analysts offering a spectrum of opinions on the move. Some hailed the rate cut as a necessary step to bolster economic growth, while others expressed concerns about the potential consequences of loosening monetary policy.

Waller’s defense of the rate cut, based on his analysis of economic data and his belief in the need for a proactive approach, provided a valuable perspective on the Fed’s decision-making process. The rate cut’s impact on the economy, financial markets, and investor sentiment will continue to unfold in the months to come, offering a compelling narrative of the interplay between monetary policy and economic forces.

Commonly Asked Questions

What were the main economic concerns that led to the Fed’s rate cut?

The Fed’s decision to cut rates was driven by concerns about slowing global growth, trade tensions, and the potential for a recession. The Fed was seeking to stimulate economic activity and prevent a downturn.

What specific economic data points did Waller cite to support his position?

Waller cited weakening consumer confidence, softening manufacturing activity, and a decline in business investment as evidence that a rate cut was necessary.

What were the potential implications of the rate cut for different asset classes?

The rate cut could lead to increased investment in stocks and other assets, as investors seek higher returns in a low-interest-rate environment. However, it could also lead to a decline in bond prices as investors seek higher-yielding investments.

CentralPoint Latest News

CentralPoint Latest News