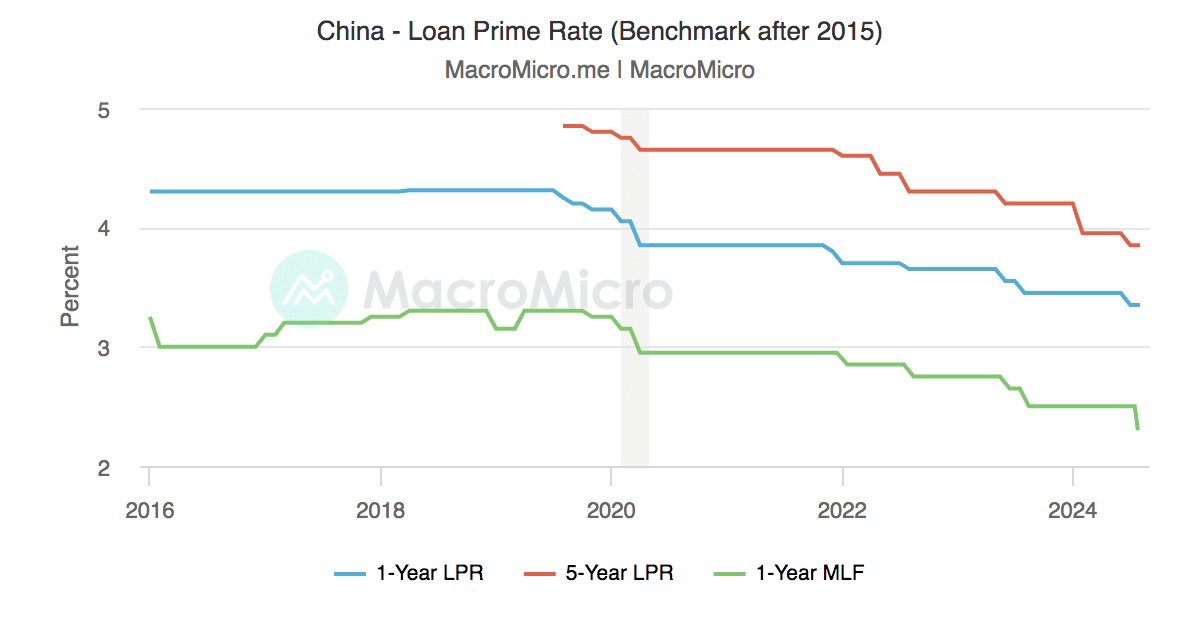

China keeps loan prime rate unchanged in September, signaling a cautious approach by the central bank amidst global economic uncertainties. The Loan Prime Rate (LPR), a benchmark lending rate, plays a pivotal role in shaping borrowing costs for businesses and consumers in China.

This decision comes at a time when the Chinese economy is navigating a complex landscape, balancing the need for stability with the desire for sustained growth.

The LPR is a key indicator of monetary policy in China, reflecting the central bank’s stance on interest rates. Several factors influence the LPR, including inflation, economic growth, and the overall direction of monetary policy. Recent LPR adjustments have been closely watched, as they provide insights into the Chinese government’s efforts to manage economic performance and navigate global economic headwinds.

Context of the Decision

The Loan Prime Rate (LPR) is a crucial benchmark interest rate in China’s financial system, influencing the borrowing costs for businesses and individuals. Understanding the LPR’s role and the factors driving its movements is key to comprehending the implications of its recent stability.

Significance of the LPR

The LPR is the reference rate for banks to set their loan interest rates. It plays a pivotal role in steering the flow of credit in the economy, impacting both investment and consumption. When the LPR is lowered, borrowing becomes cheaper, encouraging businesses to invest and individuals to spend.

Conversely, a higher LPR makes borrowing more expensive, potentially slowing down economic activity.

Factors Influencing the LPR

The LPR is influenced by a complex interplay of economic indicators and monetary policy decisions.

- Inflation:When inflation is high, the central bank may raise the LPR to curb borrowing and dampen demand, helping to control price increases. Conversely, during periods of low inflation, the central bank might lower the LPR to stimulate economic growth.

Enhance your insight with the methods and methods of Privet fund LP sells over $13 million in Ascent Industries stock.

- Economic Growth:The central bank typically lowers the LPR during economic slowdowns to encourage investment and consumption, boosting growth. However, if growth is robust, the central bank may raise the LPR to prevent overheating and potential asset bubbles.

- Monetary Policy:The central bank’s monetary policy stance significantly impacts the LPR. When the central bank pursues a loose monetary policy, it typically lowers the LPR to stimulate borrowing and economic activity. Conversely, a tightening monetary policy often involves raising the LPR to control inflation and cool down the economy.

Recent LPR Adjustments, China keeps loan prime rate unchanged in Sept

China has implemented a series of LPR adjustments in recent years, reflecting the evolving economic landscape. In 2020, the central bank lowered the LPR multiple times to support economic recovery from the COVID-19 pandemic. However, as the economy stabilized and inflation pressures emerged, the LPR remained relatively stable in 2021 and 2022.

Economic Implications of Unchanged LPR

The decision by the People’s Bank of China (PBOC) to keep the Loan Prime Rate (LPR) unchanged in September has significant implications for the Chinese economy. This move, while seemingly subtle, sends a clear signal about the central bank’s stance on monetary policy and its impact on businesses and consumers.

Impact on Businesses and Consumers

The unchanged LPR maintains the current borrowing costs for businesses and consumers. This stability can be viewed as a positive for businesses, as it provides predictability and reduces uncertainty in their financial planning. However, it also means that businesses might not see a reduction in borrowing costs, potentially hindering their ability to invest and expand.

For consumers, the unchanged LPR means that mortgage rates and other loan rates remain at current levels. This can be beneficial for those with existing loans, as they continue to benefit from lower interest rates. However, it could also discourage new borrowers, particularly those seeking home loans, as they might not see a decrease in borrowing costs.

Monetary Policy Outlook

The People’s Bank of China (PBOC) has maintained a cautious and accommodative monetary policy stance in recent months, aiming to support economic growth while managing inflation risks. The unchanged LPR reflects this approach, signaling a continuation of the existing policy framework.

Factors Influencing Future LPR Adjustments

The PBOC’s future decisions on LPR adjustments will be influenced by a multitude of factors, including:

- Economic Growth:The pace of economic recovery and the strength of domestic demand will be crucial considerations. If growth momentum weakens, the PBOC may consider lowering the LPR to stimulate investment and consumption.

- Inflation:The PBOC will closely monitor inflation trends and ensure that monetary policy remains supportive of price stability. If inflation pressures rise significantly, the PBOC may consider tightening monetary policy, potentially leading to LPR increases.

- Global Economic Conditions:The global economic outlook and the impact of geopolitical events on China’s economy will also be important factors. A deterioration in global conditions could prompt the PBOC to adopt more accommodative measures, including LPR adjustments.

- Financial Stability:The PBOC will also prioritize financial stability, ensuring that credit growth remains sustainable and that risks in the financial system are contained. LPR adjustments may be used to manage credit growth and mitigate potential financial risks.

Current LPR Level in Relation to Historical Trends and Expectations

The current LPR level is relatively low compared to historical trends. The PBOC has been gradually lowering interest rates since the start of the pandemic, reflecting the accommodative stance of monetary policy. The market expects the PBOC to maintain a stable LPR in the near term, with potential adjustments depending on the economic outlook and inflation dynamics.

However, given the uncertainties surrounding the global economy and the domestic economic recovery, there is a range of possibilities for future LPR adjustments.

Global Economic Context

The decision to maintain the Loan Prime Rate (LPR) in September comes against a backdrop of a global economic landscape marked by both challenges and opportunities. Understanding the global economic environment is crucial to assess the potential impact on China’s monetary policy and its implications for international trade and investment.

Global Economic Environment and its Impact on China’s Monetary Policy

The global economic environment is characterized by a complex interplay of factors, including:

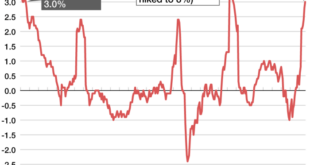

- Persistent Inflation:Inflation remains a major concern in many economies, driven by supply chain disruptions, energy price increases, and strong consumer demand. This poses a challenge for central banks globally, as they attempt to balance controlling inflation with supporting economic growth.

- Tightening Monetary Policies:Central banks around the world are tightening monetary policy to combat inflation. This includes raising interest rates and reducing asset purchases, which can slow economic growth and impact global financial markets.

- Geopolitical Uncertainties:The ongoing Russia-Ukraine war, escalating tensions between the US and China, and other geopolitical events create uncertainty and volatility in global markets. These factors can impact trade, investment, and global supply chains.

- Recession Risks:The combination of inflation, rising interest rates, and geopolitical uncertainties has increased the risk of recession in major economies. This could impact global demand for Chinese goods and services.

In this context, China’s monetary policy decisions are influenced by the need to balance domestic economic growth with the global economic environment. The decision to keep the LPR unchanged reflects a cautious approach, acknowledging the need to support growth while also managing inflation and external risks.

Relationship Between China’s LPR and Global Interest Rates

China’s LPR is not directly linked to global interest rates, but there is a relationship. The LPR is a benchmark lending rate determined by commercial banks in China, reflecting market conditions and the People’s Bank of China’s (PBOC) monetary policy stance.

“The LPR is a market-based rate, and its movements are influenced by a variety of factors, including global interest rates, domestic economic conditions, and the PBOC’s policy objectives.”

While China’s monetary policy is independent, it is not immune to global developments. If global interest rates rise significantly, it could put upward pressure on the LPR as banks adjust their lending rates to reflect the higher cost of borrowing.

Potential Implications for International Trade and Investment

China’s decision to maintain the LPR has implications for international trade and investment.

- Trade Competitiveness:Maintaining a relatively low LPR can support Chinese businesses and enhance their competitiveness in global markets. Lower borrowing costs can help businesses expand operations, invest in new technologies, and increase exports.

- Foreign Investment:A stable and predictable monetary policy environment can attract foreign investment to China. The LPR decision signals a commitment to supporting economic growth, which can make China an attractive destination for foreign investors.

- Currency Volatility:China’s monetary policy decisions can influence the value of the yuan. A stable LPR can help maintain a stable yuan, which is beneficial for international trade and investment.

The global economic environment is constantly evolving, and China’s monetary policy will need to adapt to these changes. The LPR decision is a reflection of China’s approach to balancing domestic economic growth with the challenges and opportunities presented by the global economy.

Impact on Specific Sectors: China Keeps Loan Prime Rate Unchanged In Sept

The decision to maintain the LPR has a significant impact on various sectors of the Chinese economy, influencing their growth prospects, investment patterns, and overall performance.

Real Estate

The unchanged LPR could have mixed implications for the real estate sector. While it might provide some relief to developers by keeping borrowing costs stable, it could also exacerbate existing challenges.

- Stable Borrowing Costs:The unchanged LPR ensures that developers continue to have access to relatively affordable financing, which can help them manage their debt burdens and potentially stimulate construction activity. However, the effectiveness of this measure might be limited if demand for new properties remains weak.

- Persistent Demand Weakness:Despite the stable borrowing costs, the real estate sector continues to grapple with weak demand. This is due to a combination of factors, including concerns about property prices, rising unemployment, and a shift in consumer preferences towards smaller and more affordable homes.

The unchanged LPR might not be sufficient to address these fundamental challenges.

- Potential for Price Stabilization:While the unchanged LPR might not lead to a surge in demand, it could contribute to price stabilization in the real estate market. By keeping borrowing costs stable, it could help to prevent further price declines, which could provide some confidence to buyers and investors.

Manufacturing

The unchanged LPR could offer some support to the manufacturing sector, particularly for export-oriented companies.

- Stable Financing Costs:The unchanged LPR ensures that manufacturers can continue to access affordable financing, which can help them manage their operating costs and invest in new technologies and equipment. This is particularly important for export-oriented companies, which are facing increased competition and global economic uncertainty.

- Potential for Increased Investment:With stable financing costs, manufacturers might be encouraged to invest in expanding their production capacity and exploring new markets. This could lead to job creation and economic growth, particularly in regions with strong manufacturing bases.

- Challenges of Global Demand:Despite the potential benefits of stable financing costs, the manufacturing sector is facing challenges from weak global demand and rising inflation. The unchanged LPR might not be sufficient to address these external factors, which could limit the sector’s growth prospects.

Services

The unchanged LPR could have a limited impact on the services sector, as it primarily focuses on domestic consumption.

- Limited Direct Impact:The unchanged LPR is unlikely to have a significant direct impact on the services sector, as it does not directly affect consumer spending. The sector’s performance will largely depend on factors such as employment levels, consumer confidence, and government policies.

- Indirect Impact through Real Estate:The unchanged LPR could have an indirect impact on the services sector through its influence on the real estate market. If the unchanged LPR helps to stabilize property prices, it could boost consumer confidence and potentially increase spending on services such as leisure, hospitality, and entertainment.

- Importance of Domestic Demand:The services sector’s growth prospects will largely depend on the strength of domestic demand. The government’s efforts to stimulate domestic consumption and support small and medium-sized enterprises will be crucial for the sector’s performance.

Comparison with Other Major Economies

China’s decision to keep the LPR unchanged stands in contrast to the recent monetary policy tightening actions taken by several other major economies. This divergence in policy approaches reflects the unique economic circumstances faced by each country and the differing priorities of their central banks.

Divergent Monetary Policy Approaches

The decision to keep the LPR unchanged highlights the diverging paths taken by major economies in navigating the post-pandemic economic landscape. While China has opted for a more accommodative stance, other major economies, particularly in the West, have embarked on a path of monetary tightening to combat rising inflation.

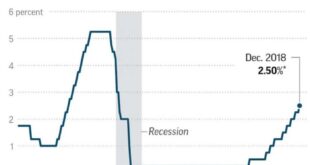

- The US Federal Reserve has aggressively raised interest rates multiple times this year, with further hikes anticipated in the coming months. This aggressive approach aims to curb inflation, which has reached multi-decade highs.

- The European Central Bank (ECB) has also begun to raise interest rates, albeit at a slower pace than the Fed. The ECB faces a complex balancing act, trying to tame inflation while supporting a eurozone economy already grappling with the fallout from the Ukraine war.

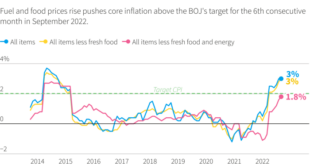

- Japan, on the other hand, has maintained an ultra-loose monetary policy, with interest rates remaining near zero. This approach reflects Japan’s unique economic challenges, including persistent deflation and a shrinking population.

Potential Impact on Global Financial Markets and Exchange Rates

The diverging monetary policy approaches across major economies have significant implications for global financial markets and exchange rates.

- The widening interest rate differentials between China and other major economies could lead to capital outflows from China as investors seek higher returns elsewhere. This could put downward pressure on the Chinese yuan.

- The global financial markets could experience increased volatility as investors navigate the complex interplay of differing monetary policies. This could lead to heightened uncertainty and risk aversion.

- The diverging monetary policy approaches could also exacerbate global trade tensions, as countries with tighter monetary policies might see their exports become more expensive relative to those from countries with looser policies.

Future Prospects

The decision to maintain the LPR unchanged in September provides insights into the current stance of China’s monetary policy and offers clues about its future direction. The stability of the LPR reflects the policymakers’ focus on maintaining a balanced approach to economic growth and financial stability.

Potential for Future LPR Adjustments

The potential for future LPR adjustments hinges on a complex interplay of economic indicators and policy objectives. The People’s Bank of China (PBOC) will likely consider several key factors when determining future adjustments to the LPR:

- Inflation:The PBOC closely monitors inflation levels. If inflation pressures rise significantly, the PBOC might consider raising the LPR to curb excessive price increases. The recent slowdown in consumer inflation suggests that the PBOC is likely to remain cautious about raising rates.

- Economic Growth:The PBOC aims to maintain a healthy pace of economic growth. If growth weakens significantly, the PBOC could lower the LPR to stimulate borrowing and investment. The recent economic data, which indicates a slight slowdown in growth, might prompt the PBOC to consider easing monetary policy.

- Financial Stability:The PBOC is committed to maintaining financial stability. If excessive credit growth or asset bubbles emerge, the PBOC could raise the LPR to cool down the financial system. The current financial stability concerns are relatively muted, suggesting that the PBOC might not prioritize raising rates for this purpose.

Final Review

The decision to keep the LPR unchanged in September highlights the balancing act facing China’s central bank. While the economy continues to recover, global uncertainties and domestic challenges remain. The LPR, as a key instrument of monetary policy, will likely be closely monitored in the coming months.

The central bank’s actions will provide valuable insights into the direction of China’s economic strategy and its ability to navigate the complexities of the global economic landscape.

FAQ Corner

What is the significance of the Loan Prime Rate (LPR) in China?

The LPR is a benchmark lending rate that serves as a reference point for banks when setting interest rates on loans for businesses and consumers. It plays a crucial role in shaping borrowing costs and influencing investment decisions.

What are the potential implications of an unchanged LPR on the Chinese economy?

An unchanged LPR could indicate a desire to maintain stability in borrowing costs and encourage continued economic activity. However, it could also suggest that the central bank is hesitant to stimulate growth aggressively due to concerns about inflation or other economic risks.

CentralPoint Latest News

CentralPoint Latest News