All you need to know about Fed easing cycles – the phrase conjures images of economic fluctuations, interest rate adjustments, and the intricate dance between inflation and growth. But what exactly are Fed easing cycles, and how do they impact our daily lives?

The Federal Reserve, the central bank of the United States, wields immense power over the nation’s financial landscape. Through its monetary policy tools, it aims to steer the economy towards sustainable growth, stable prices, and full employment. One of the key strategies in the Fed’s arsenal is easing monetary policy, a process that involves lowering interest rates and increasing the money supply.

Understanding Fed easing cycles is crucial for anyone interested in navigating the complexities of the modern economy. This guide will delve into the intricacies of these cycles, exploring their historical context, underlying motivations, and potential consequences. We’ll examine the various tools the Fed employs to ease monetary policy, the impact of these actions on different sectors of the economy, and the risks associated with this approach.

Prepare to gain valuable insights into the intricate workings of the Federal Reserve and its profound influence on our financial well-being.

Understanding Fed Easing Cycles

Imagine the economy as a car. Sometimes, the car needs a little push to get going, and sometimes it needs to slow down to avoid a crash. The Federal Reserve (Fed), the central bank of the United States, acts like the driver of this car.

They use various tools to manage the economy’s speed, one of which is called “easing.”Fed easing cycles involve the Fed lowering interest rates and injecting money into the economy. This is done to stimulate economic growth, boost borrowing and spending, and encourage investment.

It’s like giving the economy a “gas pedal” to get it moving.

Historical Context of Fed Easing Cycles

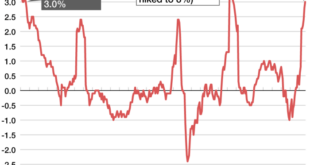

The Fed has been using easing cycles for decades to manage economic fluctuations. These cycles are a common response to economic downturns, recessions, or periods of slow growth.The Fed’s actions during these cycles have been crucial in shaping the economic landscape of the United States.

Here are some key examples:

- The Great Depression (1929-1939):The Fed’s inaction during the early stages of the Great Depression contributed to its severity. However, later easing measures helped to stabilize the economy and kickstart recovery.

- The 1970s Oil Crisis:The Fed’s easing cycles during the 1970s helped to mitigate the economic impact of the oil crisis, but they also contributed to high inflation.

- The 2008 Financial Crisis:The Fed implemented aggressive easing measures, including lowering interest rates to near zero and injecting trillions of dollars into the financial system, to prevent a complete collapse of the economy.

Examples of Past Fed Easing Cycles and Their Impact

The Fed’s easing cycles have had a significant impact on the economy, both positive and negative. Here are some examples:

- Lowering Interest Rates:When the Fed lowers interest rates, it becomes cheaper for businesses and individuals to borrow money. This can lead to increased investment, spending, and economic growth. However, it can also lead to inflation if borrowing and spending increase too rapidly.

- Quantitative Easing (QE):This involves the Fed buying government bonds and other assets to inject money into the financial system. QE can help to lower long-term interest rates and increase liquidity in the markets, but it can also lead to asset bubbles and inflation.

“The Fed’s easing cycles are a powerful tool for managing the economy, but they are not without risks. The Fed must carefully consider the potential consequences of its actions and adjust its policies as needed.”

Reasons for Fed Easing

The Federal Reserve (Fed) eases monetary policy to stimulate economic growth and combat deflationary pressures. The Fed employs various tools to achieve these goals, including lowering interest rates, buying government bonds, and injecting liquidity into the financial system. This process, known as easing, aims to increase the money supply and reduce borrowing costs, encouraging businesses and consumers to spend and invest more.

Economic Indicators Guiding Fed Decisions

The Fed closely monitors various economic indicators to assess the health of the economy and determine the appropriate course of action for monetary policy. These indicators provide insights into inflation, unemployment, economic growth, and financial market stability. The Fed’s decisions are guided by its dual mandate: to maintain price stability and maximize employment.

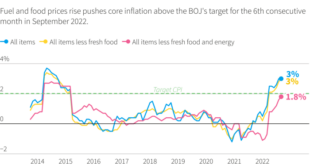

- Inflation: The Fed aims to keep inflation at a target rate of 2%. When inflation is below the target, it suggests weak demand and a risk of deflation. In such situations, the Fed may ease monetary policy to stimulate spending and increase inflation.

Conversely, when inflation is above the target, the Fed may tighten monetary policy to cool down the economy and prevent overheating.

- Unemployment: The Fed seeks to maintain a low unemployment rate, reflecting a healthy labor market. When unemployment is high, the Fed may ease monetary policy to encourage hiring and boost economic activity. Conversely, when unemployment is low, the Fed may tighten monetary policy to prevent inflationary pressures from rising.

- Economic Growth: The Fed monitors GDP growth to gauge the overall health of the economy. When economic growth is sluggish, the Fed may ease monetary policy to stimulate spending and investment, leading to higher growth. Conversely, when economic growth is too rapid, the Fed may tighten monetary policy to prevent overheating and inflation.

- Financial Market Stability: The Fed also considers financial market stability, ensuring the smooth functioning of the financial system. During periods of financial instability, the Fed may ease monetary policy to provide liquidity to banks and financial institutions, preventing a crisis.

Relationship Between Inflation, Unemployment, and Fed Easing

The relationship between inflation, unemployment, and Fed easing cycles is complex and dynamic. The Fed’s decisions are influenced by the interplay of these factors.

The Phillips Curve, a theoretical framework, suggests an inverse relationship between inflation and unemployment. As unemployment falls, wages tend to rise, leading to higher inflation. Conversely, as unemployment rises, wages tend to fall, leading to lower inflation.

However, the Phillips Curve relationship is not always clear-cut in the real world. Other factors, such as supply shocks and expectations, can also influence inflation and unemployment.The Fed’s easing cycles are often influenced by the interplay of inflation and unemployment.

For instance, if inflation is low and unemployment is high, the Fed may ease monetary policy to stimulate demand and boost employment. Conversely, if inflation is high and unemployment is low, the Fed may tighten monetary policy to curb inflation.The Fed’s response to these economic indicators is not always straightforward.

The Fed may choose to ease monetary policy even if inflation is rising if unemployment is high and economic growth is weak. Conversely, the Fed may choose to tighten monetary policy even if inflation is low if unemployment is low and economic growth is strong.

The Fed’s decisions are ultimately based on a careful assessment of the economic outlook and the risks to price stability and employment.

Tools of Fed Easing

The Federal Reserve, the central bank of the United States, has a variety of tools at its disposal to ease monetary policy and stimulate economic growth. These tools work by influencing the cost and availability of credit in the economy, ultimately affecting interest rates and financial markets.

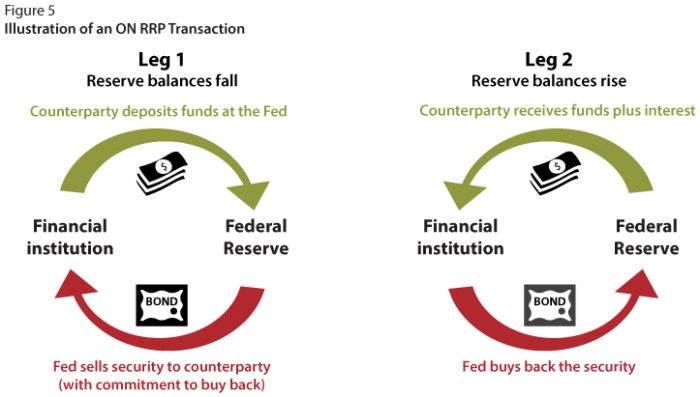

Open Market Operations

Open market operations are the most frequently used tool for adjusting the money supply. They involve the Fed buying or selling U.S. Treasury securities in the open market. When the Fed buys securities, it injects money into the banking system, increasing the money supply and lowering interest rates.

Conversely, when the Fed sells securities, it withdraws money from the banking system, reducing the money supply and raising interest rates.

The Fed’s actions in the open market directly impact the federal funds rate, the target rate at which banks lend reserves to each other overnight.

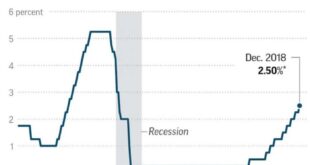

The Federal Funds Rate

The federal funds rate is the target rate at which banks lend reserves to each other overnight. The Fed influences this rate through open market operations, setting a target range for the rate and adjusting the money supply to keep it within that range.

The federal funds rate serves as a benchmark for other interest rates in the economy, including rates on loans, mortgages, and credit cards.

Discount Rate, All you need to know about Fed easing cycles

The discount rate is the interest rate at which commercial banks can borrow money directly from the Fed. It serves as a safety net for banks, providing a source of liquidity in times of stress. Lowering the discount rate encourages banks to borrow more, increasing the money supply and lowering interest rates.

Reserve Requirements

Reserve requirements are the percentage of deposits that banks are legally required to hold in reserve. Reducing reserve requirements allows banks to lend out more money, increasing the money supply and lowering interest rates. However, this tool is rarely used by the Fed, as it can have significant impacts on bank lending and stability.

Inflation Targets

The Fed’s commitment to maintaining price stability is crucial for long-term economic growth. The Fed sets an inflation target, typically around 2%, and adjusts its monetary policy to keep inflation close to this target. This approach helps to anchor inflation expectations and provides a clear signal to the public about the Fed’s commitment to price stability.

The Fed’s inflation target serves as a guide for its monetary policy decisions, helping to ensure that inflation remains within a desirable range.

Forward Guidance

Forward guidance involves the Fed communicating its intentions regarding future monetary policy decisions. This helps to manage expectations and provide clarity to financial markets about the Fed’s outlook for the economy. For example, the Fed may indicate its intention to keep interest rates low for an extended period or signal its willingness to take further easing measures if economic conditions warrant it.

When investigating detailed guidance, check out Privet fund LP sells over $13 million in Ascent Industries stock now.

Forward guidance helps to anchor market expectations and reduce uncertainty, promoting stability in financial markets.

Impact of Fed Easing on the Economy

The Federal Reserve’s easing cycles, through various tools like lowering interest rates and quantitative easing, aim to stimulate economic growth. However, these actions can have both positive and negative impacts on the economy, affecting various sectors in complex ways.

Positive Impacts of Fed Easing

Fed easing can boost economic growth by making it cheaper for businesses to borrow money, encouraging investment and expansion. This can lead to job creation and increased consumer spending, further stimulating the economy. Additionally, easing can help stabilize financial markets during periods of uncertainty, boosting investor confidence.

Negative Impacts of Fed Easing

While Fed easing can stimulate economic growth, it can also lead to unintended consequences. One concern is inflation. When interest rates are low, borrowing becomes cheaper, potentially leading to excessive spending and increased demand, which can drive up prices. Another concern is asset bubbles.

Low interest rates can encourage speculative investment in assets like stocks and real estate, creating bubbles that can burst, causing economic instability.

Short-Term Impacts of Fed Easing

In the short term, Fed easing can have a quick and noticeable impact on the economy. Lower interest rates can lead to an immediate increase in borrowing and spending, boosting economic activity. However, these effects can be temporary, and the full impact of easing may take time to materialize.

Long-Term Impacts of Fed Easing

The long-term impacts of Fed easing are more complex and depend on various factors, including the severity of the economic downturn, the effectiveness of other policy measures, and the behavior of consumers and businesses. If easing is successful in stimulating growth, it can lead to a more sustainable economic expansion in the long run.

However, if easing leads to excessive inflation or asset bubbles, it can have negative long-term consequences for the economy.

Impact of Fed Easing on Different Sectors

| Sector | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Housing | Lower interest rates can make mortgages more affordable, increasing demand for housing and boosting construction activity. | Increased demand for housing can lead to higher prices, making it more difficult for first-time buyers to enter the market. |

| Manufacturing | Lower interest rates can encourage businesses to invest in new equipment and expand production, creating jobs and boosting economic growth. | Increased demand for manufactured goods can lead to higher prices, eroding consumer purchasing power. |

| Financial Services | Lower interest rates can increase profits for banks and other financial institutions, leading to higher dividends and stock prices. | Lower interest rates can reduce the profitability of banks and other financial institutions, leading to lower returns for investors. |

| Retail | Increased consumer spending due to lower interest rates and job growth can boost sales for retailers. | Higher inflation can lead to lower consumer spending, hurting retail sales. |

Risks Associated with Fed Easing: All You Need To Know About Fed Easing Cycles

While Fed easing can stimulate economic growth and create jobs, it also comes with potential risks that policymakers must carefully consider. These risks can arise from the very mechanisms that drive economic expansion through Fed easing, and they require a delicate balancing act to manage.

Inflation

Inflation is a key concern when the Fed eases monetary policy. When interest rates are lowered, it becomes cheaper for businesses to borrow money, leading to increased investment and spending. This can drive up demand for goods and services, putting upward pressure on prices.

If this demand growth outpaces supply growth, it can lead to inflation, eroding the purchasing power of consumers and potentially destabilizing the economy. For example, during the 2008 financial crisis, the Fed implemented a series of easing measures, including quantitative easing, which contributed to a surge in asset prices, including housing.

While this helped to stimulate the economy, it also contributed to concerns about potential inflation in the long run.

Asset Bubbles

Another risk associated with Fed easing is the formation of asset bubbles. When interest rates are low, investors often seek higher returns by investing in assets like stocks, bonds, and real estate. This increased demand can drive up prices, creating a bubble that may eventually burst, leading to financial instability and economic downturn.

For example, the dot-com bubble of the late 1990s and early 2000s was fueled by low interest rates and excessive investment in technology companies. When the bubble burst, it led to a significant economic recession.

Moral Hazard

Fed easing can also create moral hazard, which occurs when individuals or institutions take on excessive risk because they believe they will be bailed out if things go wrong. When the Fed provides liquidity and support to struggling institutions, it can create an expectation that such support will always be available, encouraging risky behavior.

This can lead to a weakening of financial institutions and an increase in systemic risk, making the financial system more vulnerable to shocks. For example, the 2008 financial crisis was exacerbated by the belief among some financial institutions that they were too big to fail and would be rescued by the government.

This belief encouraged risky lending practices that ultimately contributed to the crisis.

Trade-offs

The Fed faces a difficult trade-off when considering easing monetary policy. While easing can stimulate economic growth, it also carries the risk of inflation, asset bubbles, and moral hazard. The Fed must carefully weigh these risks against the potential benefits of easing, making decisions based on the current economic conditions and the outlook for the future.

Potential Risks and Benefits of Fed Easing

| Risk | Benefit |

|---|---|

| Inflation | Economic growth |

| Asset bubbles | Job creation |

| Moral hazard | Financial stability |

Fed Easing Cycles in the Current Economic Context

The Federal Reserve (Fed) is navigating a complex economic landscape, marked by persistent inflation, slowing growth, and geopolitical uncertainties. The Fed’s easing cycles, historically employed to stimulate economic activity, are now under scrutiny as policymakers grapple with the delicate balance between controlling inflation and supporting growth.

The Current Economic Situation and Its Potential Implications for Fed Easing Cycles

The US economy is facing a confluence of challenges. Inflation remains stubbornly high, fueled by supply chain disruptions, strong consumer demand, and the lingering effects of the pandemic. The Fed’s aggressive rate hikes have slowed economic growth, raising concerns about a potential recession.

Moreover, the war in Ukraine, global energy price volatility, and ongoing supply chain disruptions continue to cast a shadow over the economic outlook.These factors significantly influence the Fed’s approach to easing cycles. The central bank faces a dilemma: easing too quickly could reignite inflation, while tightening too aggressively could tip the economy into recession.

The Fed’s actions will be closely watched, as they will have a profound impact on financial markets, businesses, and consumers.

Factors Influencing the Fed’s Decision-Making Process

The Fed’s decision-making process is guided by a complex interplay of factors. Key considerations include:

- Inflation Data:The Fed closely monitors inflation indicators, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, to assess the persistence and trajectory of inflation.

- Economic Growth:The Fed evaluates economic growth indicators, such as GDP growth, employment data, and consumer spending, to gauge the health of the economy and the potential impact of monetary policy.

- Financial Market Conditions:The Fed monitors financial market conditions, including interest rates, stock prices, and credit spreads, to assess the impact of its policies on financial stability and the availability of credit.

- Global Economic Developments:The Fed considers global economic developments, such as economic growth in major trading partners and geopolitical risks, as these factors can influence domestic economic conditions.

Potential Trajectory of Future Fed Easing Cycles

The trajectory of future Fed easing cycles is uncertain and will depend on the evolution of economic conditions. However, several factors could influence the Fed’s decisions:

- Inflation Trends:If inflation shows signs of cooling, the Fed might be more inclined to ease monetary policy. However, if inflation remains stubbornly high, the Fed may continue to tighten policy or maintain a restrictive stance.

- Economic Growth Outlook:If economic growth weakens significantly, the Fed may be more likely to ease policy to stimulate activity. However, if growth remains relatively robust, the Fed may continue to focus on controlling inflation.

- Financial Market Volatility:If financial markets experience significant volatility, the Fed may be more cautious in easing policy to avoid exacerbating market instability.

- Geopolitical Developments:Geopolitical events, such as the war in Ukraine or trade tensions, could influence the Fed’s decisions by impacting economic growth, inflation, or financial market stability.

Ultimate Conclusion

The Fed’s easing cycles are a powerful instrument in the economic toolkit, capable of influencing growth, inflation, and employment. While these cycles can offer valuable support during challenging economic times, they also carry inherent risks that must be carefully considered.

By understanding the motivations, mechanics, and potential consequences of Fed easing, we can navigate the complexities of the modern economy with greater awareness and informed decision-making. The journey through the world of Fed easing cycles may seem intricate, but with a grasp of the fundamental principles, we can unlock a deeper understanding of the forces that shape our financial future.

FAQ Overview

How often do Fed easing cycles occur?

The frequency of Fed easing cycles varies depending on economic conditions. They can occur multiple times a year or only once every few years. The Fed’s decision-making process is data-driven, and it responds to changes in economic indicators such as inflation, unemployment, and GDP growth.

What are the long-term effects of Fed easing?

The long-term effects of Fed easing can be complex and multifaceted. While easing can stimulate economic growth in the short term, it can also lead to higher inflation and asset bubbles in the long run. The Fed carefully monitors these potential consequences and adjusts its policies accordingly.

CentralPoint Latest News

CentralPoint Latest News