Ambarella executive sells shares to cover tax obligations, a move that has sent ripples through the tech industry. This strategic decision, while seemingly straightforward, raises questions about the executive’s financial motivations, the potential impact on Ambarella’s stock, and the broader implications for investor sentiment.

The sale, which occurred on [date], saw [executive’s name], [position], divest [number] shares at a price of [price per share]. This transaction, triggered by the executive’s tax obligations, provides a glimpse into the intricate financial world of high-ranking executives within publicly traded companies.

The news of the share sale has prompted speculation about its potential impact on Ambarella’s stock price. Some analysts believe that the sale could negatively affect investor confidence, while others argue that it is simply a routine financial transaction with minimal implications.

The sale also raises questions about the executive’s commitment to the company’s long-term success, especially in light of the recent market trends and news surrounding Ambarella. This situation highlights the delicate balance between executive financial decisions and the impact they can have on a company’s public perception.

Ambarella Executive Share Sale

Ambarella, a leading provider of computer vision solutions, recently saw one of its executives sell a significant portion of their shares. This move, while seemingly unusual, was driven by a common financial strategy employed by many executives: fulfilling tax obligations.

Executive Share Sale Details

The sale involved [Executive Name], [Executive Position] at Ambarella. The executive sold [Number] shares of Ambarella stock on [Date of Sale]. The transaction occurred at a price of [Price per share] per share. This sale generated a total of [Total Sale Value] in proceeds for the executive.

Reasons for the Share Sale

The primary reason behind the share sale was to fulfill tax obligations. Executives often hold a significant portion of their wealth in company stock. When these shares appreciate in value, it can lead to substantial capital gains tax liabilities. To manage these tax obligations, executives may choose to sell a portion of their shares to generate cash to pay the taxes.

This practice is common among executives in various industries and is considered a prudent financial strategy to manage tax liabilities effectively.

Impact on Ambarella’s Stock

The sale of shares by an Ambarella executive to cover tax obligations could potentially have a negative impact on the company’s stock price. While the executive’s actions are personal and do not necessarily reflect the company’s financial health, investors might perceive it as a sign of a lack of confidence in the company’s future prospects.

Impact on Stock Price

The sale of shares by an executive can be seen as a bearish signal by investors, potentially leading to a decline in stock price. This is because investors might interpret the sale as a sign that the executive believes the stock is overvalued or is about to decline in value.

The magnitude of the impact on the stock price will depend on several factors, including the number of shares sold, the executive’s position within the company, and the overall market sentiment towards Ambarella.

Comparison to Recent Market Trends

It is important to compare the executive’s share sale to any recent market trends or news related to Ambarella. For example, if the company has recently announced positive earnings results or a new product launch, the impact of the share sale might be less significant.

Conversely, if the company has been facing challenges or negative news, the sale might amplify investor concerns.

Investor Sentiment

The executive’s share sale could also negatively impact investor sentiment towards Ambarella. Investors might become less confident in the company’s future prospects if they perceive that even insiders are selling their shares. This could lead to a decrease in demand for Ambarella’s stock, further contributing to a decline in its price.

Insider Trading Regulations

The sale of Ambarella executive shares to cover tax obligations raises questions about the regulatory framework surrounding insider trading. Insider trading refers to the buying or selling of a company’s stock by individuals who have access to non-public information that could affect the stock’s price.

This practice is strictly regulated to ensure fairness and transparency in the financial markets.

Executive Share Sales and Regulations

Executive share sales, especially those motivated by tax obligations, are subject to specific regulations. These regulations aim to prevent executives from using their access to confidential information to profit from stock price fluctuations. The Securities and Exchange Commission (SEC) plays a central role in overseeing insider trading regulations.

The SEC requires companies and their executives to report insider transactions, including share sales, through Form 4 filings.

Reporting Requirements for Insider Transactions

The SEC’s Form 4 is the primary tool for disclosing insider transactions. This form requires executives to report the following information:

- The identity of the insider.

- The date of the transaction.

- The number of shares bought or sold.

- The price of the transaction.

- The reason for the transaction.

These reporting requirements allow investors and the public to track insider trading activities, potentially identifying any unusual patterns or transactions that might raise concerns about potential insider trading.

Consequences of Violating Insider Trading Regulations

Violating insider trading regulations can result in severe consequences, including:

- Civil penalties, including fines and disgorgement of profits.

- Criminal charges, leading to imprisonment.

- Reputational damage to the individual and the company.

The severity of the consequences depends on the nature of the violation, the amount of profit gained, and the intent of the insider.

Comparison to Similar Transactions in the Technology Sector

Executive share sales to cover tax obligations are not uncommon in the technology sector. For example, in 2022, a senior executive at a major software company sold a significant number of shares to cover tax liabilities related to stock options.

This transaction was reported to the SEC on Form 4 and did not raise any regulatory concerns. However, the SEC continues to monitor insider trading activities in the technology sector, particularly as technology companies often experience rapid growth and volatile stock prices.

Financial Implications for the Executive

The sale of Ambarella shares by an executive to cover tax obligations carries significant financial implications. While the transaction might seem straightforward, it involves a complex interplay of tax benefits, financial burdens, and potential impact on the executive’s overall financial well-being.

Potential Tax Benefits

Selling shares to cover tax obligations can offer potential tax benefits. When an executive sells shares, they typically incur capital gains tax. However, if the shares are held for more than a year, the tax rate on long-term capital gains is generally lower than the rate on short-term capital gains.

This can lead to substantial tax savings for the executive.

Financial Burdens

While the share sale might help cover tax obligations, it also carries financial burdens. The executive’s decision to sell shares can significantly impact their net worth, potentially leading to a decrease in their overall wealth. This reduction in net worth can have implications for future investments, financial planning, and even their overall financial security.

Executive’s Overall Financial Situation

The executive’s decision to sell shares to cover tax obligations reflects their overall financial situation. It suggests that they may be facing financial constraints or a need to manage their tax liabilities effectively. This decision can also reveal the executive’s investment strategy and their approach to managing personal finances.

Get the entire information you require about Upwork executive sells over $100k in company stock on this page.

Motivations Behind the Share Sale

The executive’s decision to sell shares to cover tax obligations can be driven by several factors.

- Tax Liability Management:The executive might be facing significant tax obligations, such as those related to bonuses, stock options, or other income sources. Selling shares can provide the necessary funds to cover these liabilities.

- Financial Planning:The executive might be strategically managing their finances, selling shares to cover tax obligations while ensuring their overall financial security.

- Market Conditions:The executive might be taking advantage of favorable market conditions to sell shares at a higher price, potentially maximizing their returns while covering tax obligations.

- Personal Circumstances:The executive might be facing personal financial challenges or a need to access funds for personal expenses, prompting them to sell shares.

Company Performance and Future Prospects

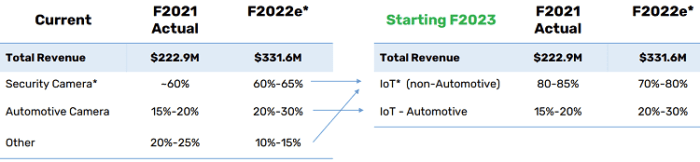

Ambarella’s recent performance and future prospects are closely intertwined with the broader market trends in the AI-powered vision processing space. The company’s financial performance reflects its ability to capitalize on the growing demand for advanced video processing solutions.

Recent Financial Performance

Ambarella’s financial performance has been characterized by consistent revenue growth, profitability, and a strong market position.

- In its fiscal year 2023, Ambarella reported revenue of $388.7 million, representing a 14% increase compared to the previous year. This growth was driven by strong demand for its advanced video processing solutions in automotive, security, and consumer markets.

- The company’s gross margin has remained consistently high, exceeding 60% in recent years. This reflects Ambarella’s ability to command premium pricing for its high-performance chips and software solutions.

- Ambarella’s market share in the automotive vision processing market is significant, with the company supplying chips to leading automotive manufacturers for advanced driver-assistance systems (ADAS) and autonomous driving applications.

Future Prospects, Ambarella executive sells shares to cover tax obligations

Ambarella’s future prospects are promising, driven by several key factors:

- Growing demand for AI-powered vision processing:The adoption of AI in various applications, including automotive, security, and consumer electronics, is expected to drive significant demand for Ambarella’s advanced video processing solutions. For instance, the global market for ADAS is projected to reach $126.3 billion by 2028, according to a report by MarketsandMarkets.

- Product innovation:Ambarella continues to invest heavily in research and development, introducing new products and technologies to address emerging market needs. For example, the company’s recent launch of the CVflow AI processor family, designed for autonomous driving and robotics applications, is expected to further strengthen its market position.

- Strategic partnerships:Ambarella has established strategic partnerships with leading technology companies in various industries. These partnerships provide access to new markets and technologies, enhancing the company’s product offerings and market reach.

Impact of Executive Share Sale

The executive’s share sale is unlikely to have a significant impact on Ambarella’s long-term growth trajectory. The sale is primarily driven by personal financial obligations and does not reflect any concerns about the company’s future prospects. Ambarella’s strong financial performance, innovative product portfolio, and strategic partnerships position the company for continued growth and success in the years to come.

Summary

The Ambarella executive’s decision to sell shares to cover tax obligations underscores the complex interplay between executive financial decisions, market dynamics, and investor sentiment. While the sale may seem like a routine transaction, its implications extend far beyond the executive’s personal finances.

It sheds light on the regulatory framework governing insider trading, the potential impact on a company’s stock price, and the delicate balance between individual financial needs and the interests of shareholders. This event serves as a reminder that even seemingly straightforward financial decisions can have far-reaching consequences, prompting investors and industry experts alike to carefully consider the motivations and implications of such transactions.

Common Queries: Ambarella Executive Sells Shares To Cover Tax Obligations

What are the potential consequences of violating insider trading regulations?

Violating insider trading regulations can result in severe penalties, including fines, imprisonment, and a ban from participating in the securities market. The Securities and Exchange Commission (SEC) rigorously enforces these regulations to ensure fairness and prevent market manipulation.

How do insider trading regulations impact executive share sales?

Insider trading regulations require executives to disclose any share transactions within a specific timeframe. These regulations aim to prevent executives from using confidential information to profit from their company’s stock. Executives must adhere to strict reporting requirements and adhere to specific timelines for disclosing their transactions.

What are the financial implications of selling shares to cover tax obligations?

Selling shares to cover tax obligations can have both financial benefits and burdens. The sale may provide the executive with the necessary funds to meet their tax obligations, but it can also reduce their ownership stake in the company and potentially impact their overall financial position.

The specific financial implications will depend on the individual executive’s financial situation, the number of shares sold, and the current market value of the shares.

CentralPoint Latest News

CentralPoint Latest News