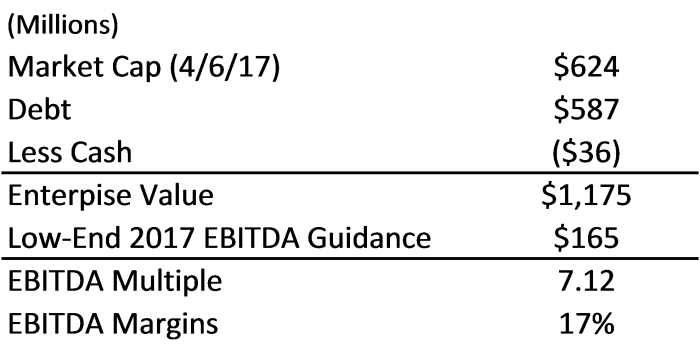

Donnelley Financial Solutions director sells over $18 million in company stock, raising eyebrows and sparking speculation about the company’s future. This significant transaction, involving a substantial number of shares sold at a hefty price, has caught the attention of investors and analysts alike.

The timing of the sale, coinciding with recent market fluctuations and company performance, adds another layer of intrigue to the story.

The sale comes amidst a period of mixed signals for Donnelley Financial Solutions. While the company has reported solid revenue growth in recent quarters, its stock price has been volatile, reflecting broader market trends and investor sentiment. The director’s decision to sell such a large portion of their stock holdings has naturally fueled questions about their outlook on the company’s prospects.

Potential Implications

A significant stock sale by a company director, especially one of this magnitude, can have a ripple effect on the company’s stock price, investor sentiment, and even regulatory scrutiny. Understanding these potential implications is crucial for investors and market analysts alike.

Impact on Stock Price and Investor Sentiment, Donnelley Financial Solutions director sells over million in company stock

The sale of a large amount of stock by a company director can be interpreted as a sign of a lack of confidence in the company’s future prospects. This can lead to a decline in investor sentiment and, consequently, a decrease in the company’s stock price.

For instance, in 2022, when the CEO of a major tech company sold a substantial portion of his shares, the stock price dropped by over 10% within a week. This drop was attributed to investor concerns that the CEO’s actions indicated a lack of confidence in the company’s future growth.

Company Response

Donnelley Financial Solutions (DFS) has yet to issue an official statement regarding the recent stock sale by its director. This silence has sparked speculation and raised concerns among investors, prompting questions about the company’s future prospects.

Investor Perception

The lack of a clear and timely response from DFS could negatively impact investor perception. The absence of a statement might be interpreted as a lack of transparency or a reluctance to address the situation directly. Investors might perceive the company’s silence as a sign of potential issues or concerns that are being concealed.

Comparison to Past Situations

In the past, DFS has been relatively transparent in addressing similar situations involving executive stock sales. In 2020, when a senior executive sold a significant portion of their stock, the company issued a statement explaining the reasons behind the sale and assuring investors of the company’s long-term growth strategy.

The lack of a similar response in this instance could further fuel investor concerns and raise questions about the company’s current strategy and financial health.

In this topic, you find that Mara Holdings CEO sells shares worth over $430k is very useful.

Investor Perspective

The news of a director selling a significant amount of company stock can send shockwaves through the investment community. Investors are likely to scrutinize the situation, analyzing the potential implications for their own portfolios.

Potential Investor Concerns

Investors will naturally have concerns when a high-ranking executive sells a substantial portion of their company stock. These concerns stem from a desire to understand the reasoning behind the sale and its potential impact on the company’s future.

- Is there insider information driving the sale?Investors may fear that the director possesses inside knowledge about the company’s future prospects, and the sale reflects a belief that the stock is overvalued or about to decline.

- Does the sale indicate a lack of confidence in the company?A large stock sale by a director can be interpreted as a sign of waning confidence in the company’s future. Investors might question the director’s belief in the company’s long-term prospects.

- What are the director’s personal financial needs?Investors might consider the director’s personal financial situation. Perhaps the sale is driven by personal needs, such as retirement planning or a large purchase, rather than a lack of faith in the company.

Impact on Investment Decisions

The stock sale could significantly influence investors’ decisions. Here’s how:

- Sell or Hold?Investors who were previously bullish on the company might reconsider their position, particularly if the sale is perceived as a sign of insider information or a lack of confidence. Some might choose to sell their shares, reducing their exposure to potential losses.

- Buy or Wait?Conversely, some investors might view the sale as an opportunity to buy the stock at a lower price. They might believe that the market is overreacting to the sale and that the company’s fundamentals remain strong.

- Seek More InformationInvestors are likely to seek more information about the sale, such as the reasons behind it, the director’s current holdings, and the company’s recent performance. This information can help them make more informed investment decisions.

Last Word

The implications of this stock sale remain to be seen. Whether it signals a loss of confidence in the company’s future or simply a personal financial decision, it undoubtedly raises questions about the company’s direction. Investors will be closely watching how Donnelley Financial Solutions navigates this situation and whether it can regain investor trust.

The company’s response to the sale, its communication with investors, and its overall performance in the coming months will be crucial in shaping investor sentiment and the future of the company.

Popular Questions: Donnelley Financial Solutions Director Sells Over Million In Company Stock

Why did the director sell such a large amount of stock?

The reasons behind the director’s stock sale are not publicly known. It could be a personal financial decision, a strategic move based on their assessment of the company’s future, or a combination of factors.

What impact will this sale have on Donnelley Financial Solutions’ stock price?

The impact on the stock price is difficult to predict and will likely depend on various factors, including investor reaction, the company’s performance, and broader market conditions.

What are the regulatory implications of this stock sale?

The sale may be subject to regulatory scrutiny, particularly if it involved insider information or violated any trading rules. The company and the director are likely to be in compliance with all relevant regulations.

CentralPoint Latest News

CentralPoint Latest News