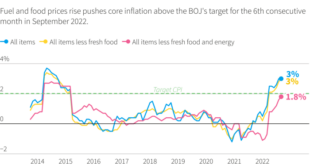

BOJ holds interest rates, flags steady growth in inflation, a decision that sends ripples through the global financial landscape. The Bank of Japan’s move to maintain interest rates at their current levels, despite rising inflation, signals a cautious approach to managing economic growth in the face of global uncertainties. This …

Read More »Asian Stocks Surge on Rate Cuts, Japan Lags After BOJ Move

Asian stocks rise on rate cut cheer; Japan trims gains after BOJ – Asian stocks rose on rate cut cheer; Japan trims gains after BOJ. A wave of optimism swept across Asian markets as central banks in the region, responding to softening inflation and slowing economic growth, implemented rate cuts. …

Read More »European Stocks Pause After Rally, Central Banks Hold the Spotlight

European stocks consolidate after sharp gains; central banks in focus as investors take a breather after a recent surge in markets. The continent’s economic landscape, now navigating a delicate balance between growth and inflation, finds itself under the watchful eye of policymakers. The recent gains, fueled by a combination of …

Read More »Barclays Doubts Fed Rate Cuts Match Market Expectations

Barclays doubts the Fed will cut as much as currently priced in, a bold statement that throws a wrench into the market’s optimistic outlook. While investors eagerly anticipate significant rate reductions, Barclays argues that the current economic environment doesn’t warrant such aggressive easing. This contrarian view sparks intrigue, prompting a …

Read More »PepsiCo Cut at Morgan Stanley: Fundamental Struggles Continue

PepsiCo cut at Morgan Stanley as ‘fundamental struggles continue’ signals a troubling trend for the beverage and snack giant. While PepsiCo has long been a household name synonymous with iconic brands like Pepsi, Lay’s, and Gatorade, recent financial performance and analyst sentiment paint a less optimistic picture. The company is …

Read More »3 Reasons Why US May Slip Into a Recession in 2024

3 reasons why US may slip into a recession over the next 12 months – 3 Reasons Why US May Slip Into a Recession in 2024 sets the stage for a chilling exploration of the economic storm clouds gathering on the horizon. The specter of recession, a word that sends …

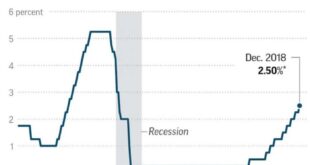

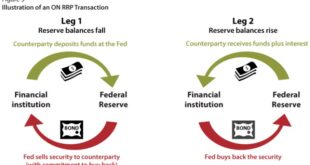

Read More »Fed Easing Cycles: A Guide to Understanding Monetary Policy

All you need to know about Fed easing cycles – the phrase conjures images of economic fluctuations, interest rate adjustments, and the intricate dance between inflation and growth. But what exactly are Fed easing cycles, and how do they impact our daily lives? The Federal Reserve, the central bank of …

Read More »Citi Urges Holding US Equities Despite High Valuations

Citi advises against ‘rushing to sell US equities’ despite high valuations, setting the stage for a compelling analysis of the current market conditions. While valuations may appear elevated, Citi’s stance highlights the nuanced factors supporting this bullish outlook. The firm believes that several key drivers, including robust economic fundamentals and …

Read More »Feds Bowman Opposed Jumbo Cut, Avoiding Premature Victory Claim on Inflation

Fed’s Bowman voted against jumbo cut to avoid signaling victory on inflation, a move that highlights the ongoing debate within the Federal Reserve about the appropriate pace of interest rate adjustments. While the majority of policymakers opted for a significant rate cut, Bowman’s dissenting vote underscores the complexities of navigating …

Read More » CentralPoint Latest News

CentralPoint Latest News