Vera Therapeutics director sells over $696k in company stock, a move that has sent ripples through the financial world. This significant transaction has sparked a wave of questions and speculation about the company’s future prospects. While insider stock sales are a common occurrence, the magnitude of this particular transaction has caught the attention of investors and analysts alike.

The director’s decision to divest a substantial portion of their holdings in Vera Therapeutics raises eyebrows and begs for deeper analysis.

Vera Therapeutics is a biotechnology company focused on developing innovative therapies for patients suffering from autoimmune diseases. The company’s pipeline includes several promising drug candidates that have shown positive results in clinical trials. The recent stock sale by the director, however, has cast a shadow of doubt over the company’s trajectory, leaving investors wondering if there are underlying concerns about Vera Therapeutics’ future.

Executive Summary

A recent insider transaction involving Vera Therapeutics, a company specializing in the development of treatments for autoimmune diseases, has caught the attention of investors. A director of the company sold a significant amount of stock, raising concerns about the potential implications for the company’s future prospects.The director, whose identity has not been publicly disclosed, sold over $696,000 worth of Vera Therapeutics stock.

This transaction, while seemingly significant, must be viewed within the broader context of the company’s overall performance and market conditions.

Potential Implications of the Stock Sale

Insider stock sales can be interpreted in a variety of ways, and it’s crucial to consider the potential implications of this particular transaction. Here are some key factors to consider:

- Director’s Confidence in the Company’s Future:Insider stock sales can be perceived as a sign of a lack of confidence in the company’s future prospects. However, it’s important to note that there could be other reasons for the sale, such as personal financial needs or a desire to diversify their investment portfolio.

- Market Sentiment:The timing of the stock sale could be influenced by broader market sentiment. If the overall market is experiencing a downturn, insiders may choose to sell their stock to protect their investments. Conversely, if the market is bullish, insiders may be more likely to hold onto their shares.

- Company-Specific Factors:The stock sale could be a response to specific company-related developments. For instance, if the company is facing regulatory hurdles or financial challenges, insiders may decide to reduce their exposure.

Vera Therapeutics Overview

Vera Therapeutics is a clinical-stage biopharmaceutical company focused on developing novel therapies for patients with serious inflammatory and autoimmune diseases. The company’s mission is to deliver transformative therapies that address unmet medical needs in these areas. Vera Therapeutics’ key focus is on developing therapies that target the immune system’s signaling pathways, aiming to modulate the body’s inflammatory response and provide relief for patients suffering from debilitating diseases.

Financial Performance and Recent Developments

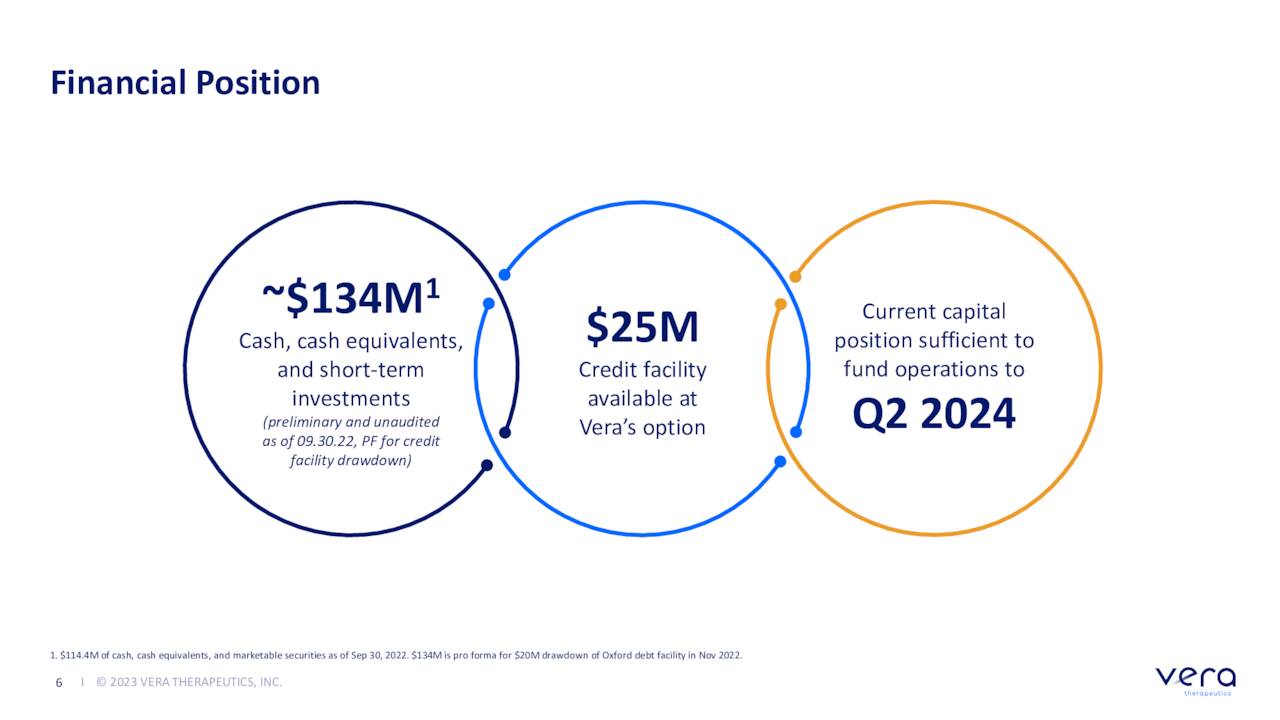

Vera Therapeutics’ financial performance is closely tied to its progress in clinical trials and the development of its pipeline. The company’s primary source of revenue is currently through collaborations and licensing agreements. However, Vera Therapeutics is actively pursuing strategic partnerships and potential acquisitions to enhance its financial position and accelerate the development of its therapies.The company’s recent developments include:

- Advancement of its lead candidate, VERA-111, in clinical trials for the treatment of Crohn’s disease. VERA-111 is an oral small molecule inhibitor of a key inflammatory signaling pathway, and initial clinical data has shown promising results in reducing disease activity and improving patient outcomes.

- Expansion of its clinical pipeline with the initiation of a Phase 2 clinical trial for VERA-111 in ulcerative colitis. This trial is expected to provide further data on the safety and efficacy of VERA-111 in another inflammatory bowel disease.

- Establishment of a strong intellectual property portfolio, securing patents for its innovative therapies. This portfolio provides Vera Therapeutics with a competitive advantage in the market and protects its investment in research and development.

Insider Trading Analysis

Insider trading, particularly by high-ranking executives, can provide valuable insights into a company’s prospects. While it is not a foolproof indicator, it can shed light on the management’s confidence in the company’s future. This analysis examines the recent sale of Vera Therapeutics stock by its director and explores potential motivations behind this decision.

Analysis of Vera Therapeutics Director’s Stock Sale

Insider stock sales, especially by executives, can be a signal of various factors, ranging from personal financial needs to concerns about the company’s future. The recent sale of over $696,000 worth of Vera Therapeutics stock by a director warrants scrutiny.

To understand the implications, it’s crucial to examine potential motivations behind the sale.

- Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as paying off debt or funding personal investments. This motivation doesn’t necessarily reflect a lack of confidence in the company’s future.

- Diversification:Executives might sell shares to diversify their investment portfolio. They may choose to invest in other assets, such as real estate or different stocks, to spread their risk.

- Confidence in the Company’s Future:While it may seem counterintuitive, insider stock sales can sometimes indicate confidence in the company’s future. Executives may believe the stock is currently overvalued and choose to sell at a favorable price, anticipating a future dip. They may then plan to repurchase shares at a lower price later on.

- Market Sentiment:Insider sales can also reflect broader market sentiment. If an executive believes the market is heading for a downturn, they may sell shares to protect their investments.

Historical Trends in Insider Trading at Vera Therapeutics

To gain a comprehensive understanding of the recent sale, it’s essential to compare it to historical trends in insider trading at Vera Therapeutics. Examining past insider transactions can provide valuable context and reveal any recurring patterns.

- Frequency of Insider Sales:Analyze the frequency of insider sales over a specified period, such as the past year or five years. This helps determine whether the recent sale is an outlier or a part of a recurring trend.

- Volume of Insider Sales:Compare the volume of the recent sale to previous insider transactions. A significant increase in the volume of insider sales may indicate a more pronounced change in sentiment.

- Timing of Insider Sales:Analyze the timing of past insider sales in relation to company announcements, market events, and financial performance. This can reveal whether insider sales tend to occur during specific periods or after particular events.

By carefully analyzing the motivations behind the recent stock sale and comparing it to historical trends in insider trading at Vera Therapeutics, investors can gain a more nuanced understanding of the company’s prospects.

Market Impact

The sale of over $696,000 worth of Vera Therapeutics stock by a director could have a significant impact on the company’s stock price and investor sentiment. This large transaction, especially from an insider, often raises concerns about the company’s future prospects, potentially leading to a sell-off and increased volatility.

Impact on Stock Price and Investor Sentiment

The director’s stock sale could trigger a decline in Vera Therapeutics’ stock price as investors interpret it as a sign of a lack of confidence in the company’s future. This perception could lead to a sell-off as investors rush to exit their positions, further driving down the stock price.

The impact on investor sentiment is likely to be negative, potentially affecting future fundraising efforts and overall market perception of Vera Therapeutics.

Recent Market Trends and Events

It’s crucial to consider recent market trends and events that might have influenced the director’s decision to sell shares. For instance, a recent disappointing clinical trial result or negative regulatory news could have prompted the sale. Conversely, the director might be selling shares to diversify their portfolio or meet personal financial obligations, unrelated to the company’s performance.

Analyzing these factors is essential to understand the true nature of the insider transaction.

Potential for Sell-off and Increased Volatility

The director’s stock sale could create a self-fulfilling prophecy, leading to a sell-off and increased volatility in Vera Therapeutics’ stock. Investors often follow the actions of insiders, and a large sale by a director can be interpreted as a signal to sell.

This behavior could trigger a cascade effect, further driving down the stock price and increasing volatility. The company’s response to the insider sale, including any public statements or actions taken, will also play a significant role in shaping market sentiment and influencing the stock’s trajectory.

Regulatory Considerations

Insider trading regulations aim to ensure a fair and level playing field in the stock market, preventing individuals with privileged information from gaining an unfair advantage. These regulations apply to both public and private companies, and they are enforced by the Securities and Exchange Commission (SEC).

Reporting Requirements and Potential Consequences of Insider Trading Violations

The SEC requires company insiders, including directors, officers, and major shareholders, to report their stock transactions within specific timeframes. These reporting requirements are Artikeld in Section 16(a) of the Securities Exchange Act of 1934 and are designed to provide transparency and deter insider trading.The potential consequences of insider trading violations can be severe.

The SEC can impose civil penalties, including fines and disgorgement of profits. Additionally, individuals involved in insider trading can face criminal charges, potentially leading to imprisonment and other sanctions.

Compliance with Applicable Rules and Regulations

The director’s stock sale must comply with all applicable rules and regulations, including the SEC’s insider trading regulations. This involves reporting the sale within the required timeframe and ensuring that the transaction is not based on material non-public information (MNPI).

To determine compliance, it’s essential to consider the following factors:

- The timing of the sale in relation to any material events or announcements by Vera Therapeutics.

- Whether the director had access to MNPI before the sale.

- Whether the director’s sale was consistent with their trading history and investment strategy.

If the director’s sale meets all applicable rules and regulations, it is likely considered a legitimate transaction. However, if there are any discrepancies or inconsistencies, the SEC could investigate further.

Obtain a comprehensive document about the application of Universal insurance exec sells $449k in stock that is effective.

Future Outlook

The recent stock sale by a Vera Therapeutics director, while raising eyebrows, doesn’t necessarily paint a bleak picture for the company’s future. Several factors, including Vera’s pipeline and market potential, offer a balanced perspective on the company’s prospects.

Pipeline Potential, Vera Therapeutics director sells over 6k in company stock

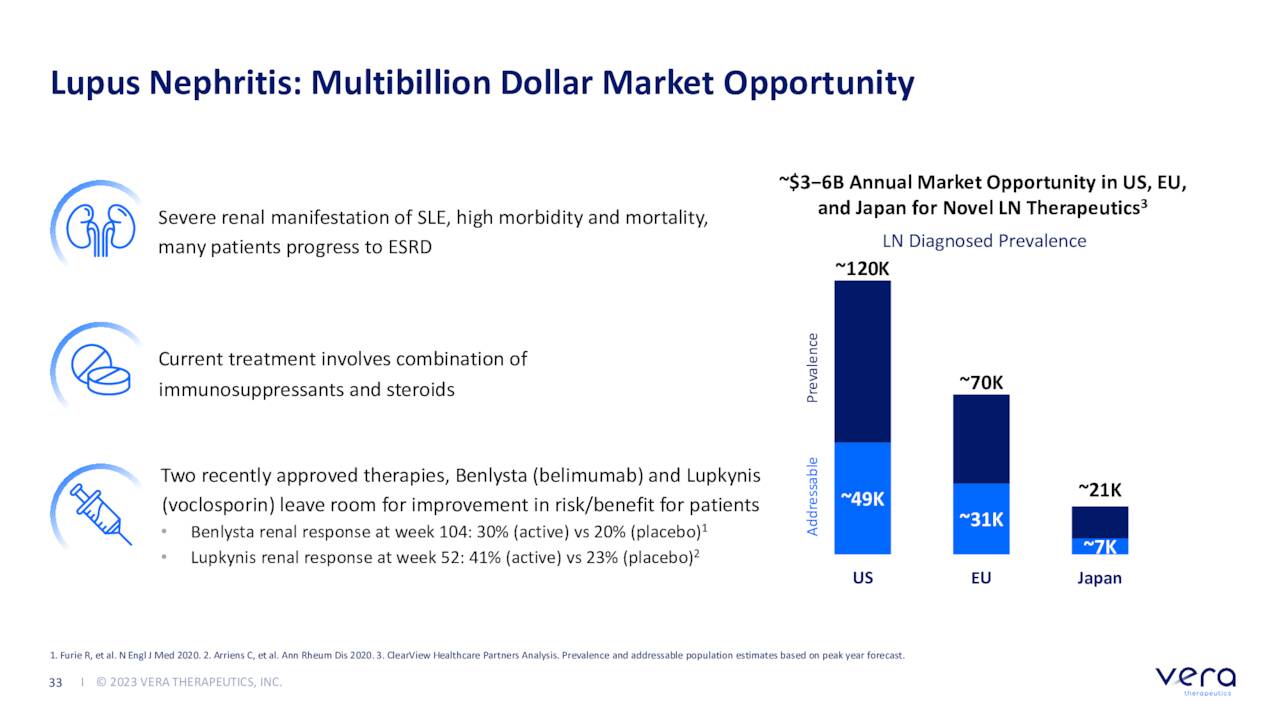

Vera Therapeutics’ pipeline holds promise, particularly with its lead candidate, enibtuzumab. This antibody targets the enzyme CD22, which is present on the surface of B cells, making it a potential treatment for autoimmune diseases like lupus. The company is currently conducting Phase 3 trials for enibtuzumab in lupus, and positive results could significantly impact the company’s future.

Market Opportunity

The market for lupus treatments is substantial and growing. The global lupus market is expected to reach \$12.8 billion by 2028, driven by increasing prevalence and the emergence of new treatment options. Vera Therapeutics’ enibtuzumab has the potential to become a significant player in this market if it proves effective and safe in clinical trials.

Challenges and Opportunities

While Vera Therapeutics faces several challenges, including the competitive landscape and the need to secure regulatory approval for its products, the company also has several opportunities for growth.

Challenges

- Competition:Vera Therapeutics faces competition from established pharmaceutical companies with existing lupus treatments. The company will need to differentiate its product and demonstrate its value proposition to physicians and patients.

- Regulatory Approval:Obtaining regulatory approval for new drugs is a complex and time-consuming process. Vera Therapeutics must navigate this process successfully to bring its products to market.

- Financial Resources:The company will need to secure adequate funding to support its clinical trials and commercialization efforts. The recent stock sale could be a sign of potential financial constraints, which could impact the company’s ability to pursue its growth plans.

Opportunities

- Expanding Pipeline:Vera Therapeutics has the opportunity to expand its pipeline with new drug candidates targeting other autoimmune diseases. This could diversify the company’s revenue streams and reduce its reliance on a single product.

- Strategic Partnerships:The company could enter into strategic partnerships with other pharmaceutical companies to leverage their expertise and resources. This could help accelerate the development and commercialization of its products.

- Emerging Technologies:Vera Therapeutics can explore opportunities to leverage emerging technologies, such as artificial intelligence and machine learning, to improve its drug discovery and development processes.

Last Recap

The director’s stock sale, while a significant event, is just one piece of the puzzle when it comes to understanding the future of Vera Therapeutics. The company’s financial performance, ongoing clinical trials, and the overall market landscape will play a crucial role in shaping its trajectory.

Only time will tell whether the director’s decision was a strategic move to diversify their portfolio or a sign of underlying concerns about the company’s future. Investors will be closely watching for further developments, hoping to gain clarity on the true implications of this significant transaction.

User Queries: Vera Therapeutics Director Sells Over 6k In Company Stock

What are the potential motivations behind the director’s stock sale?

The director’s motivations could range from personal financial needs to a desire to diversify their investment portfolio. It’s also possible that the director has a different outlook on the company’s future compared to other investors. Further investigation is needed to determine the specific reasons behind the sale.

How might this stock sale impact Vera Therapeutics’ stock price?

The impact on Vera Therapeutics’ stock price is uncertain. The sale could trigger a sell-off if investors perceive it as a sign of pessimism about the company’s future. However, the stock price could also remain stable or even rise if investors believe that the sale was driven by personal reasons or a desire to diversify.

What are the legal and regulatory implications of this stock sale?

The director’s stock sale must comply with all applicable rules and regulations regarding insider trading. The sale must be reported to the Securities and Exchange Commission (SEC), and the director may be subject to certain restrictions on future stock transactions.

How does this stock sale compare to historical trends in insider trading at Vera Therapeutics?

Analyzing historical insider trading activity at Vera Therapeutics can provide insights into the company’s past performance and the potential implications of the recent stock sale. Comparing this sale to previous transactions can help investors understand whether it is an isolated event or part of a broader trend.

CentralPoint Latest News

CentralPoint Latest News