Masimo gains as activist Politan wins two board seats – The medical device industry is abuzz with news of Masimo’s recent stock surge, driven by activist investor Politan’s successful campaign to secure two board seats. This unexpected turn of events has sparked intense speculation about the future of Masimo, a company known for its innovative pulse oximetry technology.

Politan, known for its aggressive approach to corporate governance, has made its intentions clear: to push Masimo towards a more shareholder-friendly path. But will this shake-up lead to a brighter future for Masimo, or will it create more turbulence for the company?

This strategic move by Politan has sent shockwaves through the industry, prompting investors and analysts alike to re-evaluate Masimo’s trajectory. With two of their board seats now filled by Politan’s representatives, Masimo finds itself navigating a new landscape, where the priorities of shareholder value and long-term growth take center stage.

This shift in power dynamics could have profound implications for Masimo’s strategic direction, its financial performance, and even its corporate culture.

Masimo’s Stock Performance

The activist investor Politan’s successful bid for two board seats at Masimo has sent ripples through the medical device company’s stock. The market is closely watching to see how this new dynamic will play out, particularly in terms of Masimo’s future stock performance.

Masimo’s Stock Price Fluctuations

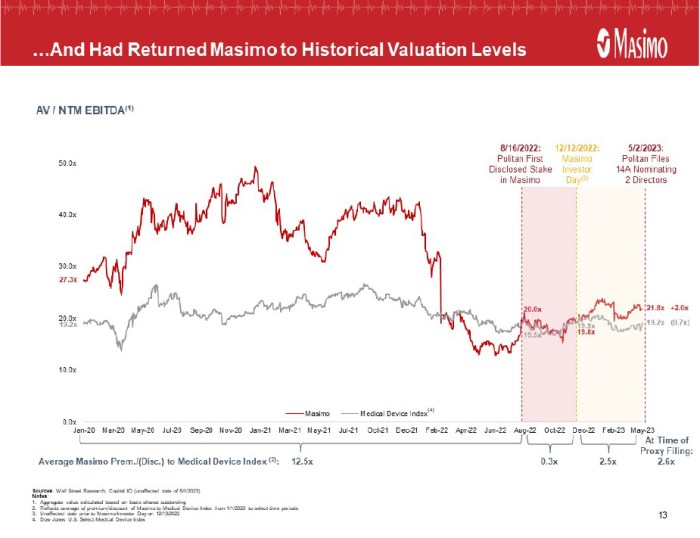

Following the announcement of Politan’s board seat win, Masimo’s stock price experienced a notable surge. This surge can be attributed to several factors, including the market’s anticipation of potential changes within the company’s management and strategy. However, it’s important to note that the stock price is influenced by a multitude of factors, and the impact of Politan’s influence remains to be fully understood.

Historical Stock Performance

Over the past year, Masimo’s stock performance has been volatile. The company’s stock price has experienced both significant gains and losses, reflecting the challenges and opportunities in the medical device market. This volatility has been further amplified by the ongoing global economic uncertainties.

Potential Impact of Politan’s Influence

The impact of Politan’s influence on Masimo’s future stock performance is a matter of speculation. However, some analysts believe that Politan’s activist approach could lead to positive changes within the company. This could include a focus on cost-cutting measures, strategic acquisitions, or a renewed emphasis on research and development.

These changes could potentially boost Masimo’s stock price, but it’s important to remember that the market is unpredictable, and any predictions are subject to change.

Politan’s Activist Campaign: Masimo Gains As Activist Politan Wins Two Board Seats

Politan’s activist campaign targeting Masimo was a strategic maneuver aimed at influencing the company’s direction and potentially unlocking shareholder value. The campaign, launched in 2023, involved a multifaceted approach that included public pressure, shareholder engagement, and ultimately, a bid for board representation.

Politan’s Objectives and Strategies

Politan’s objectives in its activist campaign were clear: to enhance shareholder value and improve Masimo’s operational performance. The firm believed that Masimo’s board lacked the necessary expertise and independence to effectively oversee the company’s strategic direction. Politan’s strategy involved a combination of tactics:

- Public Pressure:Politan publicly criticized Masimo’s board, highlighting concerns about its financial performance, corporate governance practices, and lack of innovation. The firm also released a detailed report outlining its case for change.

- Shareholder Engagement:Politan actively engaged with other Masimo shareholders, seeking their support for its proposed changes. The firm emphasized the potential for improved performance and shareholder value under a new board structure.

- Board Representation:Politan ultimately sought to secure board representation, arguing that its nominees possessed the necessary experience and skills to drive positive change within Masimo.

Politan’s Arguments for Board Representation

Politan presented a compelling case for board representation, emphasizing the following key arguments:

- Financial Performance:Politan highlighted Masimo’s lagging financial performance compared to its peers, arguing that the current board had failed to deliver on its promises to shareholders.

- Corporate Governance:The firm raised concerns about Masimo’s corporate governance practices, including the lack of independent directors and the potential for conflicts of interest.

- Innovation:Politan asserted that Masimo had fallen behind in innovation and product development, leading to a decline in its competitive position.

- Expertise and Independence:Politan’s nominees possessed extensive experience in the healthcare industry, corporate governance, and financial management, skills deemed crucial for improving Masimo’s operations.

Implications of Politan’s Board Presence

The success of Politan’s activist campaign and its subsequent board representation could have significant implications for Masimo’s operations. The new board members are expected to bring a fresh perspective and a renewed focus on shareholder value. This could lead to:

- Enhanced Financial Performance:The new board could implement strategies to improve profitability and shareholder returns.

- Improved Corporate Governance:The board could strengthen corporate governance practices, ensuring greater transparency and accountability.

- Increased Innovation:The board could prioritize research and development, leading to new products and technologies.

- Strategic Review:The board might initiate a strategic review to assess Masimo’s existing business model and identify potential areas for growth and improvement.

Masimo’s Board Composition and Governance

The recent victory of activist investor Politan in securing two board seats at Masimo has ignited discussions about the company’s board composition and governance practices. This development marks a significant shift in the power dynamics within Masimo’s boardroom, potentially leading to changes in the company’s strategic direction and operational efficiency.

The Current Board Composition

Masimo’s board of directors comprises a mix of independent directors and executives. The current board members possess diverse backgrounds, including expertise in healthcare, finance, and law. However, the board’s composition has been subject to scrutiny, with some investors raising concerns about the lack of independent directors with experience in the medical device industry.

Impact of Politan’s Board Members

Politan’s successful campaign to secure two board seats signals a shift in the board’s dynamics. Politan’s board members are expected to bring fresh perspectives and a focus on shareholder value creation. Their presence could potentially lead to greater scrutiny of Masimo’s strategic decisions, financial performance, and corporate governance practices.

Perspectives of Politan and Masimo’s Board Members, Masimo gains as activist Politan wins two board seats

Politan’s campaign was driven by a desire to improve Masimo’s operational efficiency and shareholder value. The activist investor argued that Masimo’s board lacked the necessary expertise and oversight to drive growth and profitability. In contrast, Masimo’s existing board members have defended their record, highlighting the company’s innovation and leadership in the medical device sector.

Masimo’s Business Strategy and Future Outlook

Masimo, a leading medical device company specializing in non-invasive monitoring technologies, faces both challenges and opportunities in the dynamic landscape of the medical device industry. The company’s future trajectory will be shaped by its ability to navigate these factors effectively, particularly in light of Politan’s recent involvement.

Challenges and Opportunities

Masimo operates in a competitive market characterized by technological advancements, regulatory hurdles, and evolving healthcare trends. The company faces challenges in maintaining its market share, adapting to changing patient needs, and staying ahead of the innovation curve. However, it also benefits from several opportunities, including the growing demand for non-invasive monitoring solutions, the increasing adoption of telehealth, and the expansion of global healthcare markets.

Impact of Politan’s Involvement

Politan’s activist campaign has brought about significant changes to Masimo’s board composition and governance structure. The new board members, with their expertise in corporate strategy and finance, are expected to play a crucial role in shaping Masimo’s strategic direction. Their influence could lead to several changes, including:* Enhanced Financial Performance:Politan’s focus on maximizing shareholder value could lead to increased profitability and cost optimization initiatives.

Strategic Acquisitions and Partnerships

Politan’s expertise in mergers and acquisitions could result in strategic acquisitions or partnerships to expand Masimo’s product portfolio and market reach.

Focus on Innovation and Research

Politan’s emphasis on long-term growth could encourage investments in research and development to drive innovation and develop new technologies.

Potential Scenario for Masimo’s Future

Under Politan’s influence, Masimo could embark on a path of strategic growth and transformation. The company could leverage its existing strengths in non-invasive monitoring technologies to expand into new markets, such as home healthcare and wearable devices. This expansion could be facilitated through strategic acquisitions or partnerships with companies specializing in these areas.

Masimo’s future under Politan’s influence could see the company become a leading provider of comprehensive patient monitoring solutions, encompassing both traditional hospital settings and the rapidly growing home healthcare and telehealth markets.

Masimo’s commitment to innovation and its ability to adapt to evolving healthcare trends will be crucial to its success in this new era. The company’s ability to leverage its existing expertise and resources to navigate the challenges and capitalize on the opportunities in the medical device industry will determine its future trajectory.

The Impact of Activist Investors

Activist investors have become increasingly prominent in recent years, influencing corporate governance and performance across various industries. Their campaigns often target companies they believe are underperforming or mismanaged, aiming to unlock shareholder value through various strategies.

Examples of Activist Investor Campaigns

Activist investors have a history of influencing corporate decisions and driving change within companies. Here are some notable examples:

- Carl Icahn’s campaign at Apple (AAPL):In 2013, Icahn launched a campaign urging Apple to increase its share buyback program and return more cash to shareholders. This campaign resulted in Apple increasing its buyback program significantly, benefiting shareholders.

- Bill Ackman’s campaign at Herbalife (HLF):Ackman publicly accused Herbalife of being a pyramid scheme and launched a short-selling campaign against the company. While the campaign did not lead to Herbalife’s collapse, it significantly impacted its stock price and forced the company to defend itself against allegations.

- ValueAct Capital’s campaign at Microsoft (MSFT):In 2013, ValueAct Capital, a prominent activist investor, pushed Microsoft to improve its financial performance and return capital to shareholders. The campaign resulted in Microsoft restructuring its business and investing in areas like cloud computing, leading to a significant increase in its share price.

Do not overlook explore the latest data about Donnelley Financial Solutions director sells over $18 million in company stock.

Impact of Activist Investors on Corporate Governance and Performance

Activist investors can have a significant impact on corporate governance and performance, often leading to positive changes for shareholders. They can:

- Improve corporate governance:Activist investors often push for changes in corporate governance practices, such as board composition, executive compensation, and transparency. This can lead to more accountable and responsive management teams.

- Enhance financial performance:Activist investors can pressure companies to improve their financial performance by focusing on areas like cost reduction, operational efficiency, and strategic investments. This can lead to increased profitability and shareholder value.

- Drive strategic changes:Activist investors can influence a company’s strategic direction, pushing for changes in areas like mergers and acquisitions, divestitures, or new product development. This can lead to a more focused and competitive business strategy.

Approaches of Different Activist Investors

Activist investors can employ various approaches, ranging from collaborative engagement to confrontational tactics. Some common approaches include:

- Constructive engagement:Activist investors may engage with management in a constructive manner, providing input and recommendations for improving performance and governance.

- Shareholder activism:Activist investors may engage with other shareholders, building support for their proposals and pressuring management to make changes.

- Public pressure campaigns:Activist investors may use public pressure campaigns to raise awareness of their concerns and influence public opinion, putting pressure on management to address their demands.

- Legal action:Activist investors may resort to legal action to enforce their rights or challenge management decisions they believe are detrimental to shareholders.

Final Wrap-Up

The impact of Politan’s board presence on Masimo’s future remains to be seen. Will Politan’s influence lead to a more efficient and profitable Masimo, or will it disrupt the company’s operations? The coming months will be crucial for both Masimo and Politan, as they navigate the complex interplay of shareholder interests, corporate governance, and the ever-evolving landscape of the medical device industry.

One thing is certain: the battle for control of Masimo has just begun, and the stakes are high.

Q&A

What is Masimo’s main business?

Masimo is a leading medical device company that specializes in noninvasive monitoring technologies, particularly pulse oximetry. Their products are used in hospitals, clinics, and homes to monitor patients’ vital signs.

What are Politan’s objectives in taking board seats at Masimo?

Politan aims to improve Masimo’s financial performance and shareholder value by influencing the company’s strategic decisions and corporate governance practices.

How might Politan’s influence impact Masimo’s operations?

Politan’s presence on the board could lead to changes in Masimo’s product development, acquisitions, and overall business strategy. It could also result in increased scrutiny of Masimo’s financial performance and executive compensation.

What are the potential risks associated with Politan’s involvement?

Some potential risks include disruptions to Masimo’s operations, conflicts between Politan and existing board members, and a shift in focus away from long-term growth towards short-term profits.

CentralPoint Latest News

CentralPoint Latest News