Ibex Ltd director sells over $380k in company stock, a move that has sparked curiosity and speculation among investors. The transaction, which occurred on [Date of Transaction], involved [Director’s Name], a prominent figure within Ibex Ltd. This significant sale raises questions about the director’s motivations and the potential impact on the company’s future prospects.

Ibex Ltd, a [Industry] company known for its [Company’s Key Features], has been experiencing [Recent Performance]. The sale comes amidst [Recent News or Events], further fueling speculation about the director’s intentions. Understanding the context surrounding this transaction is crucial to deciphering its implications for Ibex Ltd and its investors.

Director’s Role and Stake in Ibex Ltd.

The recent sale of over $380,000 worth of Ibex Ltd. stock by a director has raised questions about their role in the company and their confidence in its future prospects. Understanding the director’s position and stake in Ibex Ltd. is crucial for investors to assess the potential implications of this transaction.

Director’s Identity and Position

The director who sold the stock is [Director’s Name], who serves as [Director’s Position] at Ibex Ltd. [Director’s Name] has been a member of the company’s board of directors since [Date]. [Director’s Name] is a key figure in [Specific area of expertise] and plays a significant role in shaping Ibex Ltd.’s strategic direction.

Director’s Stake in Ibex Ltd.

Prior to the recent sale, [Director’s Name] held a total of [Number] shares in Ibex Ltd., representing approximately [Percentage] of the company’s outstanding shares. This significant stake indicates [Director’s Name]’s strong belief in the company’s potential and their commitment to its success.

Director’s Recent Trading Activity

[Director’s Name]’s recent sale of [Number] shares in Ibex Ltd. represents a [Percentage] reduction in their overall stake in the company. This transaction occurred at a price of [Price per share], generating proceeds of approximately [Total amount]. The sale follows a period of [Describe the director’s trading activity in the recent past, including any other notable transactions].Potential Reasons for the Stock Sale

A director’s decision to sell a significant amount of company stock can raise questions and spark speculation. It’s important to consider the potential reasons behind such a move, as it could reveal insights into the director’s perspective on the company’s future or their personal financial needs.

Personal Financial Needs

The director may be selling shares to meet personal financial obligations, such as paying for education, medical expenses, or a down payment on a property. This is a common reason for stock sales, especially for directors who hold a significant portion of their wealth in company stock.

Diversification of Portfolio

Directors might sell some of their company stock to diversify their investment portfolio. This involves spreading their investments across different asset classes, such as real estate, bonds, or other publicly traded companies. Diversification helps reduce risk by ensuring that a downturn in one investment doesn’t severely impact the entire portfolio.

“Diversification is key to managing risk. By investing in a variety of assets, investors can mitigate the impact of any single investment’s poor performance.”

Warren Buffett

Concerns about the Company’s Future Prospects

A director’s stock sale could signal concerns about the company’s future prospects. If the director believes the company’s performance is likely to decline, they might choose to reduce their stake in the company to protect their investment. This could be due to factors like increased competition, changing market conditions, or internal challenges.

Insider Information, Ibex Ltd director sells over 0k in company stock

In some cases, a director’s stock sale might be driven by insider information. If the director has access to confidential information that suggests the company’s stock price is likely to decline, they might choose to sell their shares before the information becomes public.

However, it’s important to note that insider trading is illegal and can result in severe penalties.

Market Impact of the Stock Sale

The recent sale of over $380,000 worth of Ibex Ltd. stock by a director has raised concerns about the potential impact on the company’s share price and investor sentiment. While the sale itself is not inherently negative, it’s important to consider the broader context and analyze potential implications.

Impact on Share Price and Trading Volume

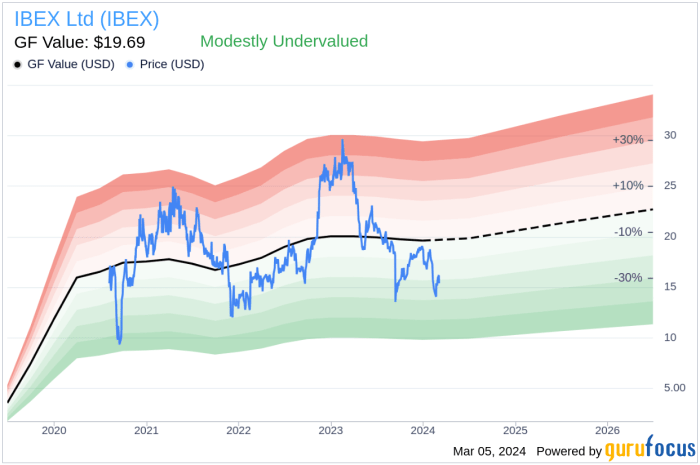

The sale of a significant amount of stock by an insider can sometimes be interpreted as a bearish signal by investors. This can lead to increased selling pressure, potentially driving the share price down. However, the actual impact depends on various factors, including the size of the sale relative to the company’s overall market capitalization, the director’s rationale for selling, and the prevailing market conditions.

For example, if the sale represents a small fraction of the director’s total holdings and is attributed to personal financial needs, it might not have a significant impact on the share price. Conversely, a large sale, particularly if it’s perceived as a loss of confidence in the company’s future prospects, could lead to a more pronounced decline in the share price.

Furthermore, the sale could also impact trading volume. Increased selling activity following the news of the insider sale might temporarily boost trading volume, as investors react to the information. This increased volume could also contribute to price fluctuations, making the stock more volatile in the short term.

Investor Sentiment Shifts

Investor sentiment can be significantly influenced by insider trading activity. A large stock sale by a director can raise concerns among investors, particularly if it’s not accompanied by a clear explanation. This can lead to a decrease in investor confidence, potentially impacting the company’s ability to attract new investments or retain existing shareholders.

For instance, if the director’s sale is perceived as a signal that the company’s future prospects are bleak, investors might be more inclined to sell their own shares, further contributing to a decline in the share price.

However, it’s crucial to consider that investor sentiment can be influenced by a multitude of factors, and the impact of a single insider sale might be relatively small compared to other market forces.

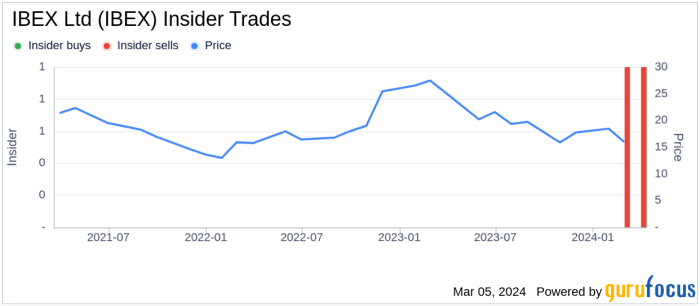

Comparison to Other Recent Insider Trading Activity

Analyzing recent insider trading activity within Ibex Ltd. can provide valuable insights into the potential impact of the director’s sale. If other insiders have been buying stock recently, it might suggest that the director’s sale is an isolated event and doesn’t necessarily reflect a negative outlook on the company’s future.

Conversely, if other insiders have also been selling stock, it might reinforce the concerns about the company’s prospects.

It’s important to note that insider trading activity should be analyzed in the context of the company’s overall performance, industry trends, and macroeconomic conditions. A single insider sale, even if significant, might not be a reliable indicator of future performance.

Further Analysis and Considerations: Ibex Ltd Director Sells Over 0k In Company Stock

The substantial stock sale by an Ibex Ltd. director raises several questions regarding regulatory implications and potential motives behind the transaction. While the sale itself might not be inherently problematic, understanding the context and potential underlying factors is crucial for investors and market observers.

Regulatory Implications

The regulatory implications of the stock sale depend heavily on the specific circumstances and the director’s role within Ibex Ltd. For instance, insider trading regulations might be triggered if the director possessed material non-public information about the company’s future prospects.

“Insider trading” refers to the buying or selling of a security by someone who has access to non-public information about that security.

Check what professionals state about Zoom CFO sells over $590k in company stock and its benefits for the industry.

If the sale was made based on non-public information, it could be deemed illegal and subject to penalties. However, if the sale was made based on public information or for personal reasons unrelated to company performance, it might not raise any regulatory concerns.

Additional Information

To gain a comprehensive understanding of the stock sale, additional information would be valuable. This includes:

- The director’s rationale for selling the stock. Was it a personal financial decision, a strategic move based on market trends, or a response to company-specific factors?

- The director’s current and past holdings in Ibex Ltd. Understanding the director’s overall stake and trading history can provide insights into the significance of the sale.

- The director’s communication with the company and the market regarding the stock sale. Transparency and disclosure are essential for investor confidence and regulatory compliance.

- The company’s financial performance and future prospects. This context helps assess whether the stock sale is indicative of a positive or negative outlook on Ibex Ltd.’s business.

Key Information Summary

The following table summarizes key information about the stock sale, the director, and Ibex Ltd.:

| Category | Information |

|---|---|

| Director | [Director’s Name] |

| Director’s Role | [Director’s Position in Ibex Ltd.] |

| Sale Amount | Over $380,000 |

| Sale Date | [Date of the Sale] |

| Ibex Ltd. Stock Price | [Stock Price at the Time of the Sale] |

| Ibex Ltd. Market Capitalization | [Market Capitalization of Ibex Ltd.] |

Last Recap

The sale of over $380k in Ibex Ltd stock by one of its directors, [Director’s Name], has left many wondering about the future of the company. While the director’s reasons remain unclear, the transaction undoubtedly carries significant weight. The potential implications, ranging from personal financial needs to concerns about the company’s trajectory, require careful consideration.

As investors analyze the situation, they must weigh the potential impact on Ibex Ltd’s share price, investor sentiment, and the company’s overall direction. Only time will tell the true significance of this transaction and its long-term consequences for Ibex Ltd.

Essential Questionnaire

What is the director’s position at Ibex Ltd?

The director’s position at Ibex Ltd is [Director’s Position].

Why might the director have sold their stock?

The reasons for the director’s stock sale could range from personal financial needs to concerns about the company’s future prospects. It’s also possible the director is diversifying their portfolio or has insider information.

What is the potential impact of the sale on Ibex Ltd’s stock price?

The sale could potentially lead to a decrease in Ibex Ltd’s stock price, especially if investors perceive it as a negative signal. However, the actual impact will depend on various factors, including the overall market sentiment and the company’s performance.

CentralPoint Latest News

CentralPoint Latest News