Onemain Holdings EVP & COO sells shares worth $44,300 – a move that has sent ripples through the financial world. This transaction, while seemingly small in dollar value, carries significant weight, prompting investors and analysts alike to dissect the motivations behind this decision.

Was it a personal financial move, a reflection of the company’s performance, or perhaps a signal of things to come? The sale has sparked a flurry of questions, inviting us to delve into the intricacies of executive stock transactions, company performance, and the delicate dance between market sentiment and insider trading.

The recent sale of shares by Onemain Holdings’ EVP & COO has raised eyebrows, prompting investors to examine the company’s financial health and market position. While the exact reasons behind the sale remain shrouded in speculation, it’s crucial to consider the broader context.

OneMain Holdings, a prominent player in the financial services industry, has been navigating a dynamic landscape marked by shifting consumer behavior, evolving regulatory frameworks, and economic uncertainties. The EVP & COO’s decision to sell shares, however, could be influenced by a range of factors, including personal financial needs, company performance, or a cautious outlook on the market.

This transaction has triggered a ripple effect, sparking questions about the company’s future direction and potential implications for investors.

Executive Stock Transactions

The recent sale of shares worth $44,300 by OneMain Holdings’ EVP & COO, while seemingly a minor transaction, can offer valuable insights into the company’s internal dynamics and potential market trends. This transaction raises questions about the executive’s motivations and its potential implications for investors.

Potential Motivations for the Sale

Understanding the reasoning behind an executive’s stock sale is crucial for investors. The sale could stem from various factors, including personal financial needs, strategic realignment, or a change in market outlook.

- Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as paying for education, a mortgage, or other expenses. This is particularly relevant if the executive has a significant personal stake in the company.

- Strategic Realignment:Executives may sell shares as part of a broader strategic realignment, potentially indicating a shift in their long-term outlook for the company. This could involve diversifying their investment portfolio or reducing their exposure to OneMain Holdings.

- Market Outlook:Executives may sell shares due to concerns about the company’s future performance or the broader market outlook. This could reflect a belief that the stock is overvalued or that the company faces challenges in the near future.

Potential Implications for Investors

The sale of shares by an executive, particularly a high-ranking one, can impact investor sentiment and potentially influence the stock price.

- Market Sentiment:Investors may interpret the sale as a signal of waning confidence in the company’s future prospects, leading to a decrease in demand for the stock and potentially impacting its price.

- Stock Price Impact:While the sale of a relatively small number of shares may not have a significant immediate impact on the stock price, it could contribute to a broader downward trend if other investors follow suit. Conversely, if the sale is seen as a purely personal decision, it may have minimal impact on the stock price.

Company Performance and Financial Health

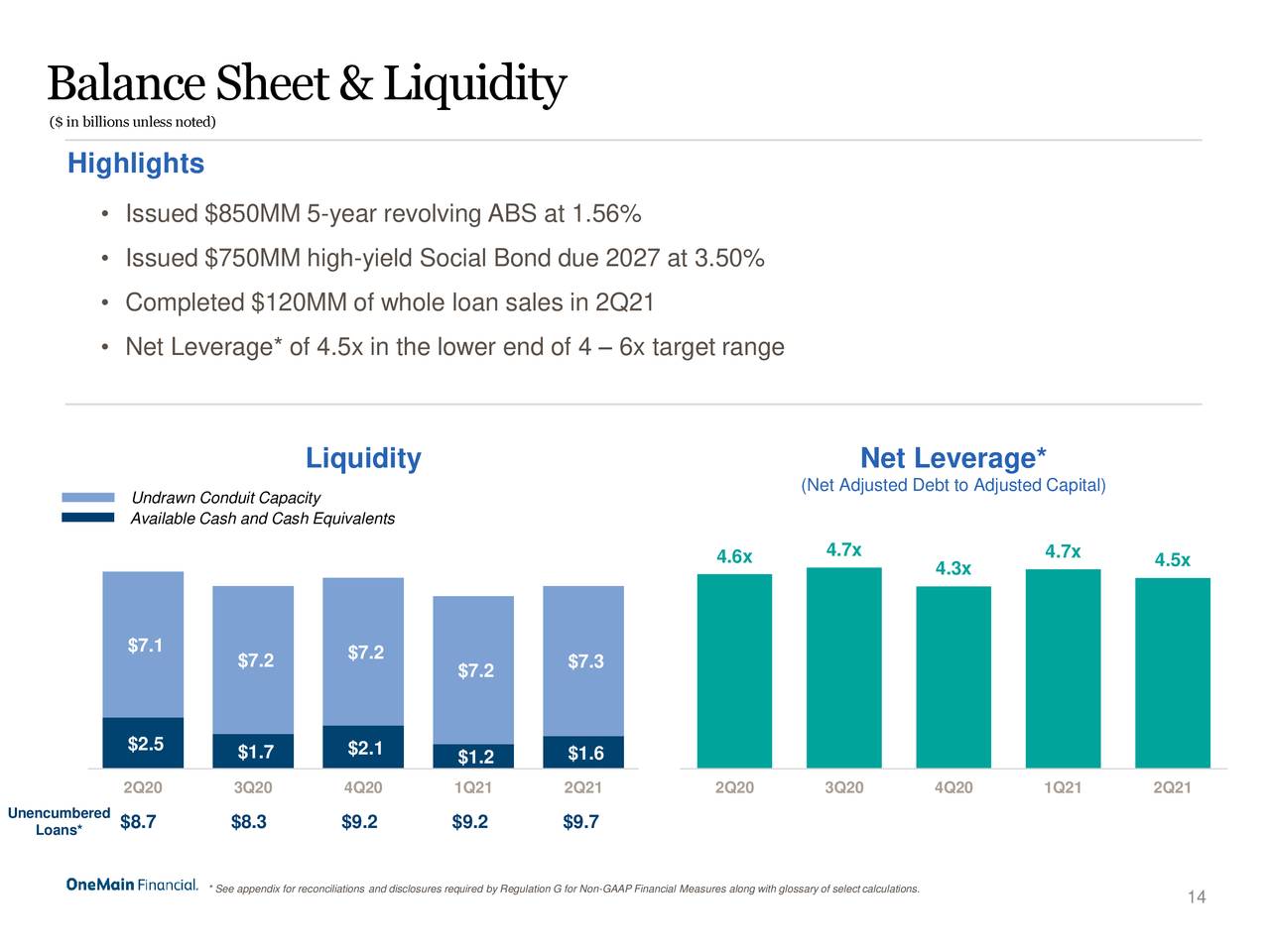

OneMain Holdings, a leading provider of personal loans and other financial products, has consistently delivered strong financial performance in recent years. The company’s recent stock transaction, involving the sale of shares by its EVP & COO, warrants a closer look at its financial health and market position.

Recent Financial Performance

OneMain Holdings’ recent financial performance has been positive, demonstrating consistent revenue growth and profitability. The company’s revenue has steadily increased over the past few years, driven by strong demand for personal loans and other financial products. For instance, in the second quarter of 2023, OneMain Holdings reported a revenue of $1.4 billion, a 9% increase from the same period in 2022.

The company’s earnings per share (EPS) have also shown positive trends, reflecting its ability to manage expenses and generate profits. In the second quarter of 2023, OneMain Holdings reported EPS of $2.60, a 12% increase from the same period in 2022.

Market Position and Competitive Landscape

OneMain Holdings operates in a competitive financial services industry, facing competition from traditional banks, online lenders, and other non-bank financial institutions. The company’s market position is strong, with a significant market share in the personal loan market.

OneMain Holdings’ competitive advantages include its extensive branch network, which provides convenient access to its services for customers, and its focus on serving borrowers with less-than-perfect credit.

Potential Factors Influencing Share Sale

Several factors could be influencing the EVP & COO’s decision to sell shares, including:

- Company-specific news:Recent announcements or developments within OneMain Holdings, such as a change in strategy or a potential acquisition, could impact the EVP & COO’s outlook on the company’s future prospects.

- Industry trends:Changes in the financial services industry, such as rising interest rates or increased regulatory scrutiny, could also influence the EVP & COO’s decision to sell shares.

- Personal financial needs:The EVP & COO may be selling shares to meet personal financial needs, such as paying for education expenses or making a significant investment.

Insider Trading Regulations and Disclosure Requirements

The recent stock sale by OneMain Holdings’ EVP & COO raises questions about the regulatory framework surrounding insider trading and the disclosure requirements for executive stock transactions. Understanding these regulations is crucial for assessing the potential implications of this sale on the company’s reputation and investor confidence.

SEC Rules on Insider Trading, Onemain Holdings EVP & COO sells shares worth ,300

The Securities and Exchange Commission (SEC) has established comprehensive rules to prevent insider trading, which is the illegal practice of trading securities based on non-public information. These rules are designed to ensure a fair and level playing field for all investors.

The SEC defines insider trading as the purchase or sale of a security, in breach of a duty or confidence, on the basis of material non-public information.The SEC’s rules on insider trading are multifaceted and include:

- Rule 10b-5 of the Securities Exchange Act of 1934: This rule prohibits the use of any deceptive device, scheme, or artifice to defraud in connection with the purchase or sale of any security. This rule applies to both insiders and outsiders who engage in insider trading.

- Regulation FD (Fair Disclosure): This regulation requires companies to disclose material non-public information to the public simultaneously with the disclosure to analysts, institutional investors, or other select groups. This ensures that all investors have access to the same information at the same time.

- Insider Trading Sanctions Act of 1988: This act increased penalties for insider trading, including fines and prison sentences. It also established the SEC’s ability to seek civil penalties from individuals who engage in insider trading.

Company Policies and Procedures for Executive Stock Transactions

In addition to SEC regulations, companies often have their own policies and procedures governing executive stock transactions. These policies typically address issues such as:

- Pre-clearance requirements: Many companies require executives to obtain pre-clearance from the company’s legal or compliance department before engaging in any stock transactions. This helps to ensure that transactions comply with all applicable laws and regulations.

- Trading windows: Companies may establish specific trading windows during which executives are permitted to buy or sell stock. This helps to minimize the potential for insider trading and to ensure that transactions are not based on non-public information.

- Disclosure requirements: Companies often require executives to disclose their stock transactions to the SEC and to the public. This disclosure helps to increase transparency and to build investor confidence.

Potential Impact of the EVP & COO’s Stock Sale

The EVP & COO’s stock sale, while seemingly insignificant in terms of dollar value, can have potential implications for the company’s reputation and investor confidence. Investors may question the timing and rationale behind the sale, particularly if it occurs shortly before the release of important company news or financial results.

If the sale is perceived as being based on non-public information, it could lead to:

- Increased scrutiny from regulators: The SEC may investigate the transaction to determine if it violated any insider trading rules.

- Damage to the company’s reputation: The company’s reputation could be tarnished if investors believe that executives are profiting from non-public information.

- Decreased investor confidence: Investors may lose confidence in the company’s management team if they believe that executives are not acting in the best interests of shareholders.

Market Analysis and Stock Price Impact

The sale of OneMain Holdings’ EVP & COO’s shares, while a relatively small amount, can be a significant event in the context of market analysis. It’s important to understand the recent stock price performance of OneMain Holdings and how this transaction might have impacted the company’s stock price.

Recent Stock Price Performance

The recent stock price performance of OneMain Holdings can be analyzed by considering its trends and anomalies. Examining the stock’s movement over the past few months, we can identify potential factors that might have contributed to its performance. For instance, if the stock price has been steadily increasing, it could indicate positive investor sentiment.

However, if the stock price has been fluctuating or declining, it could signal concerns about the company’s future prospects.

Impact of Stock Sale on Stock Price

The sale of shares by a high-ranking executive can be interpreted by investors in different ways. Some might see it as a sign of confidence in the company’s future, while others might perceive it as a signal that the executive is not optimistic about the company’s prospects.

This perception can significantly impact the stock price, depending on the overall market sentiment and investor psychology.

Comparison with Competitors

A comparison of OneMain Holdings’ stock price performance with its competitors in the financial services industry can provide a broader context for understanding the impact of the EVP & COO’s stock sale.

| Company | Stock Price (as of [Date]) | Year-to-Date Performance | 52-Week High | 52-Week Low |

|---|---|---|---|---|

| OneMain Holdings | [Stock Price] | [Year-to-Date Performance] | [52-Week High] | [52-Week Low] |

| [Competitor 1] | [Stock Price] | [Year-to-Date Performance] | [52-Week High] | [52-Week Low] |

| [Competitor 2] | [Stock Price] | [Year-to-Date Performance] | [52-Week High] | [52-Week Low] |

| [Competitor 3] | [Stock Price] | [Year-to-Date Performance] | [52-Week High] | [52-Week Low] |

This table provides a snapshot of how OneMain Holdings’ stock price performance compares to its competitors. It’s important to note that this comparison is based on a specific date and may not reflect the overall long-term performance of these companies.

You also can understand valuable knowledge by exploring RH director Mark Demilio sells over $1 million in company stock.

Potential Implications for Future Company Strategy

The EVP & COO’s decision to sell shares, while seemingly a personal financial decision, can offer insights into potential future company strategies. Understanding the motivations behind this transaction and its potential impact on capital allocation, growth plans, and talent acquisition is crucial for investors and stakeholders.

Impact on Capital Allocation and Growth Plans

The EVP & COO’s stock sale might signal a shift in their perspective on the company’s future growth trajectory. If they anticipate a slowdown in growth or a change in the company’s strategic direction, selling shares could be a way to diversify their personal portfolio.

Alternatively, the sale could be driven by personal financial needs, such as funding a major life event, which might not directly reflect their outlook on the company’s future.

Impact on Talent Acquisition and Retention

Executive stock sales can sometimes influence the perception of a company’s attractiveness to potential employees. If the EVP & COO’s decision is seen as a lack of confidence in the company’s future, it could make it more challenging to attract and retain top talent, particularly within the executive ranks.

This is especially true if the sale is perceived as a sign of an impending change in leadership or a shift in strategic direction.

Potential Risks and Opportunities

The EVP & COO’s decision to sell shares should be considered within the broader economic and regulatory environment. A bearish economic outlook could influence the decision to sell shares, regardless of the company’s future prospects. Additionally, regulatory changes impacting the industry could also lead to a change in investment strategy.

On the other hand, the sale could represent an opportunity for the company to repurchase shares, boosting shareholder value and potentially increasing the stock price.

Wrap-Up: Onemain Holdings EVP & COO Sells Shares Worth ,300

The sale of shares by Onemain Holdings’ EVP & COO has undoubtedly sparked a conversation, highlighting the delicate balance between personal financial decisions, company performance, and market expectations. While the exact motivations behind this move may remain elusive, the transaction offers a glimpse into the inner workings of the company and its executives.

This event serves as a reminder that insider trading, market sentiment, and company performance are intertwined threads in the tapestry of the financial world. Investors, analysts, and industry observers will continue to scrutinize the situation, seeking to decipher the implications for OneMain Holdings’ future and the broader financial landscape.

Expert Answers

What is the significance of the EVP & COO’s stock sale?

The sale of shares by a high-ranking executive can be interpreted as a signal about the company’s future prospects, even if the sale is for personal reasons. It can also raise questions about the executive’s confidence in the company’s performance.

What are the potential implications of this transaction for investors?

Investors may interpret the sale as a negative sign, potentially leading to a decrease in stock price. However, the impact can vary depending on other factors, such as the company’s overall financial health and market conditions.

What are the regulatory requirements surrounding insider trading?

Insider trading regulations are designed to prevent executives from using non-public information to profit from stock transactions. These regulations often require executives to disclose their stock trades and may impose penalties for violating the rules.

How might this transaction impact OneMain Holdings’ future strategy?

The sale could potentially influence the company’s future capital allocation decisions or growth plans. It could also affect the company’s ability to attract and retain top talent, especially within the executive ranks.

CentralPoint Latest News

CentralPoint Latest News